Dear Valued Clients and Friends,

Well yes indeed, this was a market week for the ages, even though that is hardly the story anyone is talking about today. As of press time, the market is up ~1,700 points on the week, which is a big enough feat on its own account, but even more so in the face of a truly painful week in American life and culture.

There have been both peaceful protests and reprehensible riots across our land this week, starting last weekend, and only now beginning to subside. The former are protected in the Constitution; the latter represents a descent into barbarism. Dividend Cafe concerns itself with the market and economic implications of events, but that doesn’t mean we can’t express genuine care for those who are hurting, and earnest hope for a future with greater peace and a more steadfast respect for human life and equality.

But beyond the human response that I know all readers share regarding all the matters at hand – we do have to ask, “how can markets go up so much with such disarray in the society around us?” The answers seem crass, impersonal, cold, and even offensive. But they are accurate descriptors – markets are pure discounters of future earnings – period. While the events of the week are chilling and provocative, there has been a great overhang on markets since March that we may face a prolonged period of American economic solitude in order to defeat COVID. The overwhelming belief is that the health data is proving that fear wrong. Substantial work lies ahead for our economy, but the worst-case scenarios feel obsolete (hint: they always are). Health aspects are modestly outperforming, and economic prospects are substantially outperforming – even though both were from very low baselines.

I find it inconceivable that we will not have up and down volatility at some point in the near future. But I am not surprised by this market’s resilience. The forward-looking capabilities of the market are powerful, even though they are consistently subject to excess. On the downside and the upside – no perfect equilibrium can ever be found. This is why market timing is the errand of a fool.

I hope and pray our society will find a forward-looking optimism, as well. That what is wrong in our country can be fixed by that which is right in our country. Believe it or not, even apart from all I care about on these pages regarding the markets and investment capital, it is to those greater ends that I work.

Now let’s jump into the Dividend Cafe. Rarely have we had more to cover.

The good news of the week

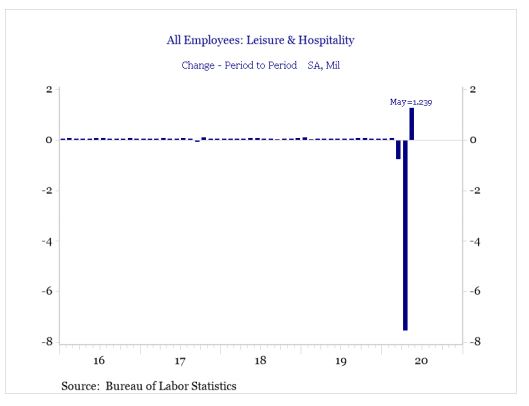

The jobs picture was supposed to reveal more than 8 million additional jobs lost in the month of May. Instead, we saw 2.5 million jobs added. Instead of reaching a 20% unemployment rate, it fell to 13.3%. Those “temporary layoffs” from COVID (especially in leisure and hospitality) came back with a vengeance, outperforming even the most optimistic of projections. The amount of new hirings in May is more or less exactly the same as those who had projected a temporary status in April. Economists doubted it, and perhaps for good reason. The description by terminated employees as “temporarily laid off” appears to have been accurate.

1.2 million hires were in leisure and hospitality. Bars and restaurants represented 1.4 million hires. And construction and also education/health services each added over 400,000.

This represents the biggest one-month job gain in American history. Nothing about it means our work is done. There are still a lot of unemployed people. But to not see this as a simply staggering move in the right direction for resilience and recovery requires a willful blindness.

Quick caveats

The U-6 rate which includes under-employment is still at 21.2% (better than last month, but very high). The April numbers were revised downward even more (by 642,000 jobs). “Permanent” job losses climbed by 295,000 to 2.3 million, even as the “temporary” losses saw so much notable improvement. There is a lot of ambiguity in the data because of the staggered re-openings of the economy. Some full-month, nationwide information will be very useful. I would have to stretch to find things negative in this data today relative to all that had been expected.

COVID moment spending or something else?

In the aftermath of the financial crisis, government tax receipts obviously dried up as we entered a severe and reasonably prolonged recession. The IOU’s from the Iraq and Afghanistan wars were still on the table. And then we added a kitchen sink of stimulus as well, providing the trifecta for deficit explosion (less revenue, more spending, big commitments for more spending). And yet in the aftermath of that, a political fight ensued (a pretty ideological one) that sought to “contain” that tolerance for deficits (which had exceeded $1 trillion on an annual basis), at least to within the context of that crisis moment. Don’t get me wrong – spending still exploded 2011-2019, and the national debt has seen many trillions added on to it post-crisis, and the country (both parties) has largely become desensitized to astronomical deficits … But I guess I would sum it up this way – we had a sort of “ad hoc” deficit explosion around the crisis, and then we had a sort of “normalized” deficit build-up post-crisis (contained, for lack of a better word).

Perhaps the single largest question facing the fiscal management of the United States in the next year or two is whether or not the COVID moment created another temporal spike (albeit one that trumps all the others many times over – $3 trillion and counting in a couple of months), or whether it represents the final chapter in a completely re-defined understanding of American fiscal policy. I strongly suspect it is the latter (I do not wish it to be so).

My comments, observations, and questions are not ideological – I am not so much talking about the COVID spending as I am the COVID mentality overhang – will the response to the spending be, “this is the new normal,” or will it be something like, “okay, we did that once, but we can’t possibly do that again.” You can formulate your own guess.

I think our expectations for interest rates, for monetary policy, for inflation/deflation, for the U.S. dollar, for economic growth, and for the relationship between the private sector and the state, has to be re-understood in the context of a strong appetite for government spending that is not particularly divisive anymore (the post-crisis spending was so divisive, it created the tea party movement; the COVID spending era is very different). We are talking right now about stimulus for the protests. Bailouts to states. Relief to cities. The fourth round of stimulus for COVID. An infrastructure bill. Tax credits for on-shoring. Besides the basic COVID elements already passed (a trillion here, a trillion there), we have pretty open conversations on the table right now for $5 trillion more – $10 trillion more – etc.?

My point is this. No central bank is going to push rates up to 3%, 5%, 7% at any spot on the yield curve when deficits are skyrocketing like this. We have the enabling of more spending that is needed out of the central bank. Generally, politics (ideological politics) becomes the headwind. I question if that will be the case in the months and years to come.

Low rates and eternal government stimulus spending. Is this the new framework for national economics, and what does it mean for investors? If you think this is the last you will see in Dividend Cafe about this subject, I have a trillion-dollar bridge to sell you.

The Looming China Overhang

I do believe that my three forecasts around the U.S./China relationship made in last week’s Dividend Cafe remain accurate:

(1) Increased rhetoric against China in the weeks and months ahead

(2) Muted actions against China in the weeks and months ahead (more bark than bite pre-election)

(3) A deteriorating relationship with China post-election that will last for many years, with broad popular American support.

The POTUS presser of last Friday reinforced both #1 and #2 in one shot. And I believe the rhetoric is foreshadowing for much of what will be on the table throughout the 2020 campaign season. My sources inside and outside the administration indicate that a further roll-out of U.S. agitation with China will come when there is more economic re-strengthening in the U.S., when there has been a greater implementation of fiscal and monetary efforts, and when the media cycle allows for it with less distractions.

The White House released a 16-page white paper on its strategic plans for dealing with the People’s Republic of China. I am very happy to send it to anyone who so requests.

I do see more announcements coming, Chinese soybean purchases halting, and the dollar at a high level to Yuan since last summer. None of this is good, and all of it is being monitored.

Outside of China …

While China has become very synonymous with most investor’s understanding of emerging markets, it is not connected to our approach. Ours is continually focused on domestic market strength and earnings power not reliant on global growth and export strength. The recent surge in commodity prices (our “reflation” thesis) is heavily correlated short-term with emerging markets pricing, and I am sure you will take it. However, all price improvement in EM notwithstanding, improved copper, iron ore, and other commodity pricing is not long-term correlated to our investment thesis – or at least not dependent on it.

King Dollar

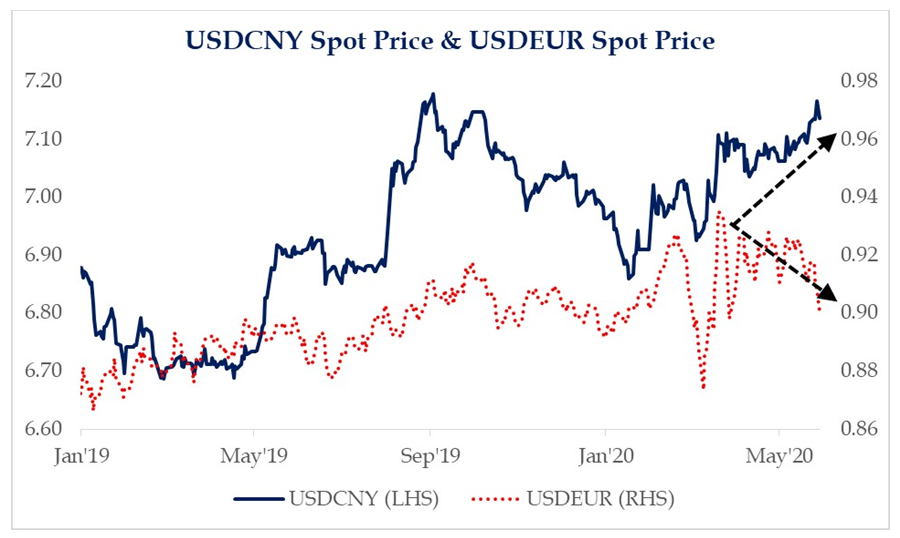

I find it fascinating that the U.S. dollar is continuing its ascension when compared to Asian currencies, but moving in the other direction against the Euro.

* Strategas Research, Daily Macro Brief, June 1, 2020

The reason it is harder for this to carry a lot of investment implications (in the short term) is that the correlation between the dollar and Gold, foreign stocks, emerging markets, U.S. stocks, small-cap stocks, high yield bonds, high-grade bonds, and pretty much everything else besides oil, has fallen by 50-70% over the last year. Risk assets have moved up and down based on a lot of things, but one of those things has not been the dollar.

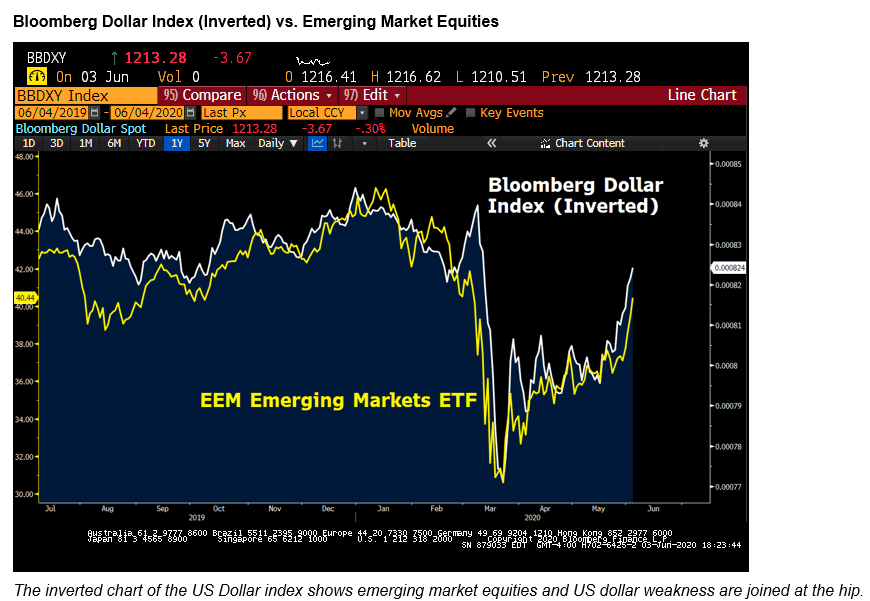

Dollar vs. EM

I have to think that low correlation will not hold with emerging markets if the dollar held a downward trend, but even that correlation has begun to separate a bit. Over the last year, it has been a rather reliable correlation, so this will be worth watching as a short term indicator in the months ahead.

Working our way around the globe

If I am going to talk China, and Emerging Markets, I may as well talk about what may be the world’s biggest global economic story right now, that as best I can tell, hasn’t gotten five minutes of media coverage …

The Euro is a structurally flawed currency no matter what happens out of this potential EU Recovery Fund, but it certainly becomes less structurally-flawed if a tighter fiscal union comes out of its efforts (to align with its already tight monetary union). The alignment of fiscal and monetary interests has always been the missing ingredient in the Euro as a solvent and normal currency, and yet the reasons for that lack of alignment are perfectly legitimate for those who care about national sovereignty more than continental allegiances – namely, that fiscal concerns cannot all favor every country at once. They inevitably will hurt some while helping others, and this seems like a pretty good reason to not have a fiscal union amongst independent countries, to begin with.

That said, the Euro is who they brought to the dance since 1999, and efforts to preserve the Euro as a shared currency and the European Union as a confederation are not fading. This debt mutualization proposal via a recovery fund backed by the collective (fiscal union) would be a large double-down on the structure of a Euro currency. And should it fail or flop or falter, one has to wonder (I do every single day) what keeps countries like Italy from walking away.

An unsustainable non-existent trend

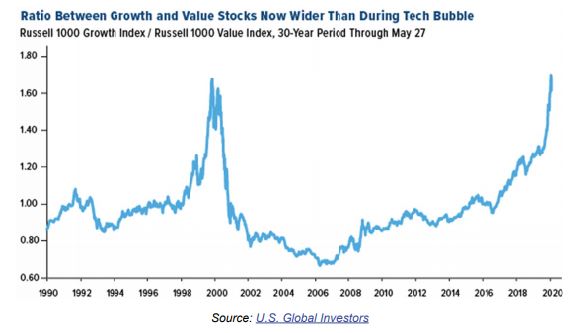

I will say it again. I don’t believe in the nomenclature of “growth” vs. “value” investing. I do not want to own companies that are not growing. And I do not want to buy companies at an excessive price. Every company a long-term investor buys ownership in is, hopefully, a growth AND a value company.

That said, I remain well-aware of what the indexing and nomenclature and methodology is that people use to allow for terms like this. And when I see this chart, I guess I have more of a question than a statement …

Do you think this is sustainable?

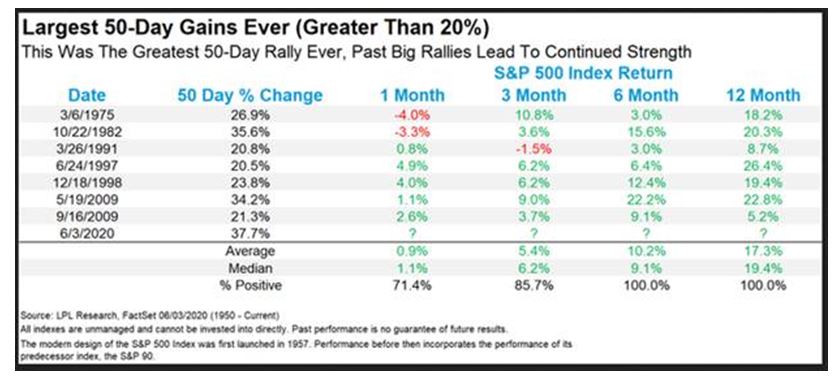

Market history

Now that markets have enjoyed the strongest 50-day run in history, let’s look at the historical precedent for post-rally performance:

A global oil demand story I hadn’t thought of

Do you believe demand for public transportation is going to be muted for a time, at least until much of the COVID fear is diluted? Does this lead to more people driving their own cars for their transportation needs, at least for a time? Road transportation is 51% of oil demand, whereas air travel is not even 8% … Could one post-COVID reality push oil demand much higher, even as another serves as a very modest headwind?

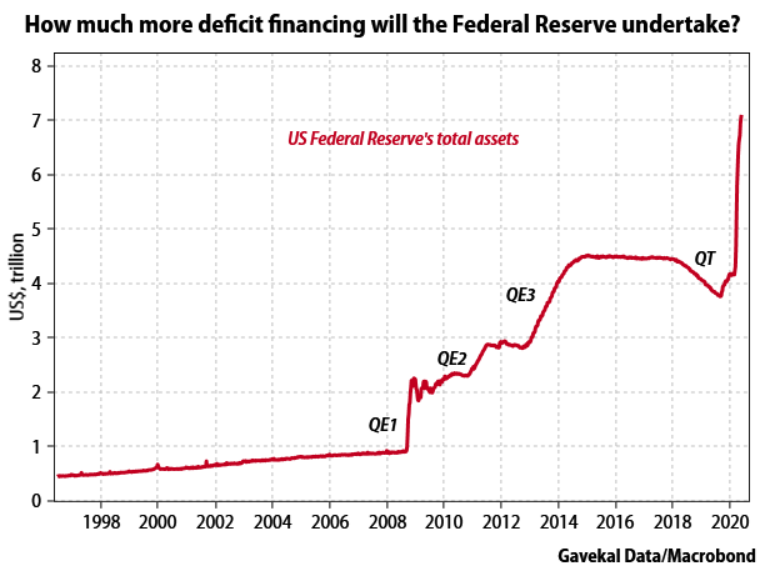

The Fed is Head

I am not sure why this chart and its subsequent adjustments should not be the Chart of the Week every week for months to come, but this is probably the best summary of why things are the way they are that you will find. The chart shows you the three things I believe you need to understand:

(1) What QE 1, 2, and 3 looked like post-crisis (just remember that the insatiable appetite from equity markets was for such during those periods)

(2) How shallow the Fed’s attempts ended up being to tighten back in 2018 If they had been able to decrease their balance sheet more pre-COVID, they’d have more firepower with less questions around such now)

And (3) The sheer gravity of what they have done in the last three months, adding $3 trillion to their balance sheet in three months, when $3 trillion took five years post-financial crisis.

So those three understandings are key, and the question becomes what their appetite is for ongoing assets on their balance sheet, as the need to fund greater government spending is nowhere near dissipating.

Economic Hope Part I

None of the charts and data points I am about to share can be interpreted as an exhaustive or conclusive data set. But more can they be ignored as irrelevant. These things in isolation and in aggregate help explain some of the hope and optimism embedded in markets right now.

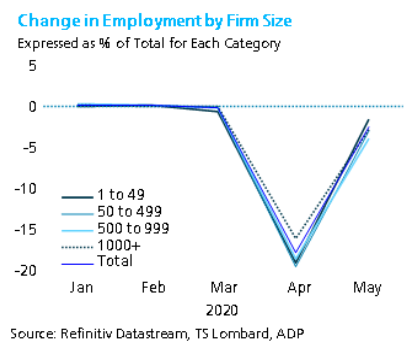

I will start with the jobs data, a classic case of “less bad” being a big deal to markets. The ADP number (private payrolls) from Wednesday was a big part of the 500-point rally in the market that day, as payrolls declined by 2.7 million, but where a decline of nearly 9 million had been expected. The plunge was almost 20 million in April, but then less than 3 million in May. Well, why would markets rally on a payroll decline in a month of 2.7 million people? Is that good news? Of course not. But it was way, way better than expected and feared, and pointed to a basis for confidence in an economic rebound.

I cannot emphasize this enough: The mere improvement of lost jobs is only phase one; the recovery of those lost jobs is now phase two, and the pace at which that recovery takes place will prove vital in the economic rebound.

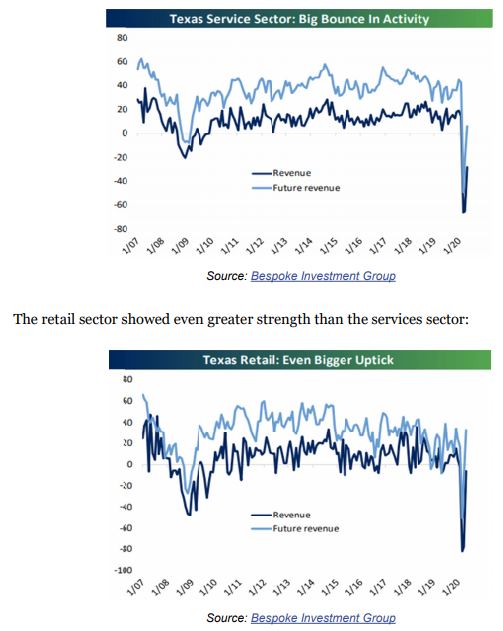

Economic Hope Part II

Texas began re-opening their economy in early May, and more aggressively in mid-May. The Federal Reserve of Dallas would suggest that things have moved in the right direction ever since.

Politics & Money: Beltway Bulls and Bears

- I have said before and I will say it again – I am not going to predict who is going to win the 2020 Presidential election. There are days I feel I have a better feel for where it is headed than others, but all of it is so volatile and subject to change, and all of it is so, so far away (in political time, that is). I do view the “predict it” data as more valuable than polls, especially individual polls (rolling average aggregate polls are much more reliable), but all of it – the polls, the averages, the betting odds – is subject to change, and is fallible. That said, Joe Biden and Donald Trump are now essentially locked in a nearly even place as far as the betting odds are concerned. You can see the history of the Trump v. Biden betting odds in this chart:

- Here are some predictions, though – (1) It will be a close election, (2) The “sentiment” around expectations will swing back and forth several times between now and then, and (3) Most people who offer you a prediction will be offering you their preference, not their analysis, whether they know it or not.

- My sources tell me that Kamala Harris almost certainly to be selected as Joe Biden’s VP running mate, and the PredictIt betting odds now have her nearly double the second place option. I doubt there are short-term market implications to the pick but obviously it will be a political story that gets a lot of noise. If he is serious that he will wait until August to announce his pick, it is entirely possible the news cycle will move around a bit between now and then and we may see different candidates come and go in the expected VP selection.

- My final political “wisdom” for the week: President Trump has a lot of things to overcome in order to get elected, and he has weeks where he makes it a lot harder in himself, and weeks where his opponents make it a lot easier for him. But here is what I believe the election will come down to: Among those who are actually enthusiastic about their candidate, Trump has a higher enthusiasm than does Biden amongst base supporters. Biden has ample enough current supporters to win the election, but a much higher percentage of his are “not enthusiastic” or only “somewhat enthusiastic,” where the enthusiasm factor for those who identify as Trump supporters is sizable. My view is that the election will come down to Biden preserving and even growing those folks, vs. Trump cutting into those folks. I think both candidates will try and run a “base” campaign (Trump always has run to his base support), and I think some addition to respective bases on the margin will be the difference maker in the 4-6 battleground states that will determine this election.

Chart of the Week

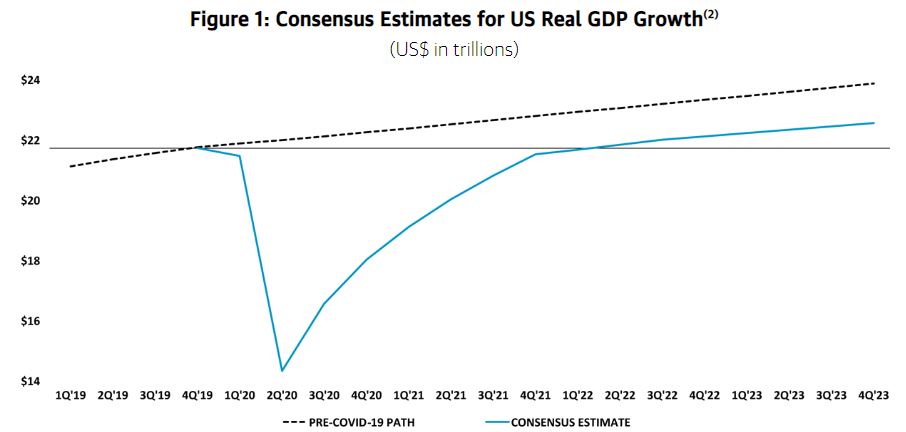

For all of the talk about the “shape” of the economic recovery, it is helpful to apply it to actual numbers and metrics. Now, even this application is conjecture – it is based on estimates – but this would be an example of a realistic look at the shape of economic recovery that has a “V” element to it (sharp bounce off the bottom), a little “square root” to it (the magnitude in the recovery is less severe than the drop), and a little “Nike swoosh” to it (the pace in recovery takes longer than the drop). All economic estimates are subject to change – most assuredly so – but I think this is a good encapsulation of our basic expectations. Note these elements that enable you to decide for yourself if it is “good” or “bad” –

(1) Strong forward-moving recovery effective immediately out of Q2 and hard into Q3 and Q4

(2) A slowing pace of the recovery beginning in Q4 and slowing more Q1 and Q2

(3) We don’t reach prior level of GDP until late 2021

(4) We stay below pre-COVID trendline growth for years

In other words, this captures some very good news and some very not-good-news all at once, hence the V, square root, and swoosh components.

* Blackstone Private Wealth Solutions, Waking Up from Slumber, Joe Zidle, May 27, 2020, p. 2

Quote of the Week

“In times of change and danger when there is a quicksand of fear under men’s reasoning, a sense of continuity with generations gone before can stretch like a lifeline across the scary present and get us past that idiot delusion of the exceptional Now that blocks good thinking.”

~ John Dos Passos

* * *

It has certainly been a week I will never forget, far more for the events of the news than even the events in the markets. Please do not lose sight of the fact that markets are very likely to trade up and down in the months to come, and while the base support for markets has moved powerfully off the COVID lows, there is a “grind” ahead for the economy, for corporate profits, and for the country. That “grind” got some good news this week – and we pray for more. But investors rarely get straight lines up, and that is okay. Investors don’t need straight lines up. If they ever existed, they’d destroy expected returns. But I don’t want to rain on the market parade. The risk environment in capital markets right now is substantially better than previously anticipated, and millions of people are getting their jobs back. So thank God, and everyone go enjoy your weekends, and if you’re up for it – patronize your favorite restaurant (I am sure your favorite waiters and waitresses would love to see you).

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet