Dear Valued Clients and Friends –

It’s been another roller-coaster week in the markets, and we are ending the week with a sell-off after up and down days every day this week. Net on the week the market is basically down about 750 points, but that came about with two days down over 700 points (each), and three days that were up 600 points in aggregate. A high volatility, range-bound market is the lay of the land right now.

The COVID “era” is not over, and while I vehemently disagree with the portrayal of the current COVID realities (especially the economic implications of the current realities) being hoisted upon the American people, I am very grateful for the evolution towards normalcy we are experiencing. Two weeks ago it was the “hard” re-open of our Newport Beach office. A few weeks before that it was the “soft” re-open of the Newport office, whereby those who wanted to were able to get back in the office after eight weeks of quarantine. As I type this letter, I am 48 hours away from returning to New York City (with family in tow), where I have not been since March 13 just as the COVID moment was escalating to extraordinary levels.

I know I am returning to a city that is not itself anywhere near normalized. Restaurants are open for patio/outdoor dining, Broadway is closed, and all sorts of offices will wait until Labor Day or longer to re-open. The Bahnsen Group is re-opening its office in the city on July 6, and I am thrilled that my daughter will spend her 13th birthday with her friends in NYC this coming week.

But here is why I bring it up … The various market stages since March have been just that – stages. A violent sell-off. A sudden snap-back. And now, a “range-bound volatility” stage. I imagine all of you have experienced “stages” as well … Perhaps it was a hard quarantine, then it was a progressive easing of one, and maybe now you are back to normal – or getting there. Each state, each family, each dynamic – has surely experienced different types of stages through this process.

My family has gone through ups and downs through this, and experienced the COVID era in stages. The employees, advisors, and partners of The Bahnsen Group all have their tales to tell. And yet here we are, about four months since all of this began, and with uncertainty still in front of us, the worst surely behind us, and so many things that will define the next “stage.”

For me, I am beyond thrilled to be getting back to New York City. It is hot and humid right now, and it is not at full capacity, but I do not care. It is the greatest city in the world, and it has survived significant challenges over the years. Survived, and then thrived. It is going to again.

So has the market. Stages of challenge. Stages of survival. And stages of thriving. It’s inherent to markets.

I know not what markets will do for the next few weeks or few months, and neither does anyone else (the only people to be careful of are those who think or say they do). What I do know is what awaits those who persevere through their own “stages” of this: Perseverance, character, hope.

Markets and NYC are more aligned than just their cultural proximity and co-branding (New York as the land of Wall Street and such). Ups and downs. Resilience. Rewards.

It’s all part of the stages we have come to expect.

As for this week’s Dividend Cafe … The agenda includes:

- Some clarification on COVID and the current media coverage

- How the result of “financialization” is to ignore capital investment, and how starving the economy of capital spending deprives it of future productivity

- The stress of the stress tests!

- The lost decade of gold is a powerful antidote to the strange argument that central bank abuses are bullish for gold. If the last decade wasn’t the golden era of central bank libertinism, I don’t know what was. And yet gold is just now trying to get back within striking distance of where it was ten years ago??

- A refresher on our friend, Illiquidity, and why behavioral finance drives the return premium in private market assets – a section that should get its own dedicated Dividend Cafe!

- How good/bad is the economic “recovery” going?

- And the secret sauce on how politics works in conjunction with markets … what we expect out of the next few months as various political scenarios play themselves out

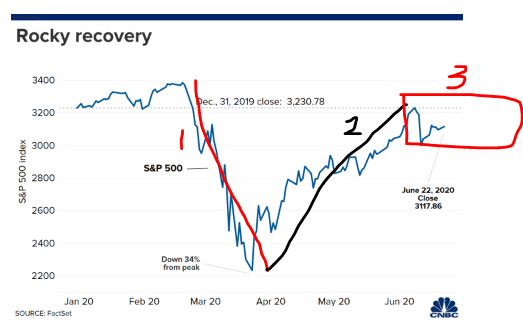

- The Chart of the Week looks at the three stages of the COVID era …

So join us for a trip to this week’s Dividend Cafe …

What to expect from here

As I have been writing all week in our daily COVID and Markets missives, there has been an undeniable increase in positive cases the last two weeks, in a few major states above and beyond the rate of increases in testing, and in some states in line with that testing growth. And in other states, there has been a decrease in positive cases adjusted for testing … There is no question that all the noise around this has heightened market volatility, and intensified societal nerves about what it all means and where we go from here.

I do not take the case increases lightly, and there are certainly some communities (not very many) where hospitalizations and equipment use have warranted extra monitoring this week.

There is no need to qualify, alter, or downplay any data. All of the empirical facts I bring to bear are what they are.

(1) There is an increase in positive COVID cases nationally the last two weeks.

(2) Re-openings began 52 days ago in many places (including the states of TX, FL, and AZ). Hospitalizations have followed positive cases by a rate of 11-14 days on average since the COVID pandemic began. To argue that the re-opening caused an increase in cases, or that Memorial Day weekend caused it, with some hospitalizations coming 30-40+ days later, seems rather unlikely.

(3) The protests may be a more logical explanation, but even those are now 21 days old, and there has been no detectable increase in the states that had highest profile/populous protests.

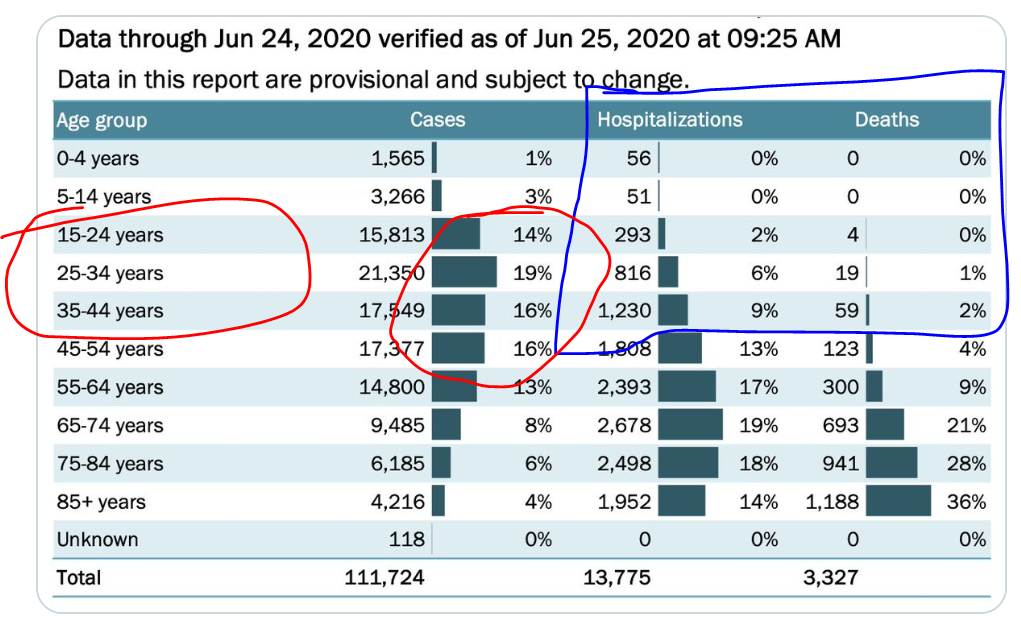

(4) The median age of those testing positive has collapsed, and they have a very low probability of mortality per all the data of the last four months. The younger demographics where more COVID positive cases are coming from right now have very low hospitalization, very quick discharges where there are hospitalizations, and very low mortalities. We don’t want anyone getting sick, and no one wants to get sick themselves. But the new data does not suggest systemic risk of over-burdening the U.S. medical system – not by a long shot.

The below chart is Florida data updated as of yesterday. Florida provides a lot of granularity in their reporting. The easiest takeaway is that in the age groups seeing the most positive cases the last two days, the total COVID hospitalizations and mortalities do not suggest anything close to a burden on hospital resources.

*Florida Health Department, June 26, 2020

There is significant improvement in Arizona hospital and equipment data in the last 24 hours. After more verification I will provide a full report in the next COVID and Markets missive.

All things being equal, it will be better for our country and better for markets to see case growth declining. I cannot control how the media will cover this, or what correlation it may or may not have to markets around economic activity. The narratives being formed do not match up to science or logic, and that is the sole reason I resist them. In the meantime, as if markets need an excuse for volatility and uncertainty, I anticipate this adding to, well, volatility and uncertainty.

And if that doesn’t cheer you up, consider that the daily death rate is down 80% since March. Down 80%.

Back to financialization

I wrote last week about the consequences of excessive government debt being excessive monetary accommodation, and the consequences of excessive monetary accommodation being “financialization.” Companies can succeed with financial engineering with distortions to the cost of capital and liquidity in the marketplace. Capital investment becomes “plan B,” if that. But capital investment is the lifeblood of an economy. We invest today to prosper tomorrow. But if we don’t invest today because financial engineering has made doing so less necessary, we prosper less tomorrow.

I can make the argument that many others have made, too – that this environment stokes class envy and expands the wealth divide. It surprises me more do not understand this or utilize it politically. But if one cannot get on board with that concern, the universality of the challenges of falling productivity should be ample motivation.

I ask because I sincerely want to know – does this all make sense? Am I adequately communicating my message here?

Reducing the Stress

The Fed released results from their annual stress tests of America’s major banks yesterday (CCAR – Comprehensive Capital Analysis & Review). While this was a major endeavor in the years immediately following the financial crisis, it has become a sleepy event the last few years, as the banking system became much less leveraged and much more capitalized post-crisis, and it was reasonably known that the Fed was going to allow (for the most part) the capital return plan of most banks. The COVID moment has changed that this year, with significant questions around what regulators would allow and would restrict in light of different potential economic scenarios.

As mentioned in yesterday’s COVID & Markets, the results was a sort of “split baby” approach. Big banks have been asked to suspend share buybacks (everyone of which had already done so). And big banks have been asked to not grow their dividends in the third quarter (not a single one of which was going to do so, I assure you). They were not, however, asked to reduce their dividend (and even the prohibition against increasing the dividend was, for now anyways, just for one quarter). In this sense, it was totally benign as for its shareholder-friendliness – no impact at all to what banks were doing already.

However, they are asking for banks to submit to stress tests again later in the year – and this was unexpected. And the dividends that are paid Q3 while not being elevated will be subject to a net income test (nothing too profound).

Bottom line: No blanket prohibition on dividend payments, and companies now submit their capital return plans early next week. The capitalization buffers of the big banks held up well in this year’s stress tests, even with COVID pressures factored in. I think the market has set the banks up for a relief rally when the median outcomes (or better) surface.

The Lost Decade of Gold

The expression, “everyone is entitled to their own opinions, but not their own facts,” is important here. Differing and even respectable views exist about the nature of inflation, about precious metals, about monetary insanity, and so forth. With gold, I can’t argue with those who say “gold will do X,” because that is a prophetic view about the future, and I am also unable to predict the future. But what I can do is at least try and set the record straight about the past, and do so without an argument, per se, about the future – just empirical factoidishness (I am committed to making up my own words more frequently going forward).

Fact #1 – I have often shared when people tell me that they buy gold as a hedge against inflation, that gold is currently down at least 50% in inflation-adjusted terms over the last forty years. Other arguments can be made about past periods of inflation (the 1970’s, for example), and arguments can be made about what gold will do in the future vs. inflation, but the empirical fact that gold went forty years under-performing inflation by half is troublesome for the inflation hedge argument.

Fact #2 – The most common thing I hear now is that “central banks have lost their mind” (I am listening), and

*Strategas Research, Daily Macro Brief, June 23, 2020

A refresher on our friend, illiquidity

One of the things investors can do to improve their portfolio is try (within reason) to limit the effect other investors can have on their results. In other words, we cannot escape the fact that asset prices are affected by sentiment, and that in times of distress other investors panicking out can cause a cascading effect into the way our assets are priced. It is part of investing, and I have long believed that smart investors exploit it, while not-smart investors become victimized by it.

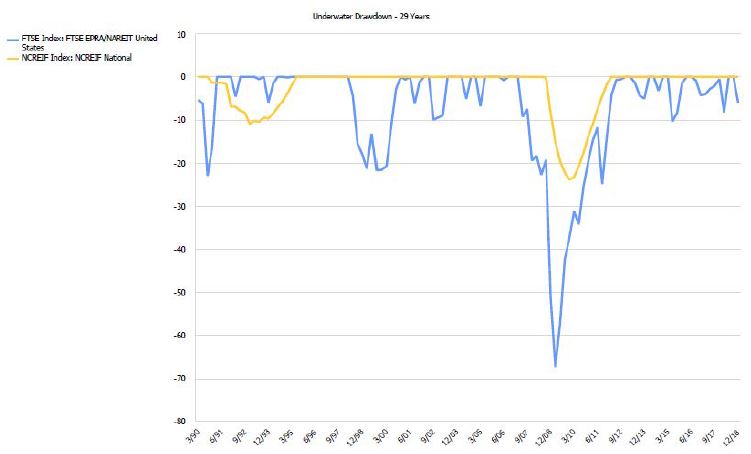

Public market dislocations cannot impact private market investments the same way, though. Behavioral finance realities do less damage to private market investments because illiquidity becomes your friend – other people can’t do damage to your portfolio. Private equity, private credit, and private real estate all possess this illiquidity benefit relative to public market counterparts.

You can see here how the index of private real estate funds experienced so much less volatility than the index of public real estate funds through a plethora of market downturns. Illiquidity has to be managed around an investor’s own need for, well, liquidity. But at whatever appropriate allocation level, the benefits may be much more than the obvious investment merits – the protection against other investor behavior matters, a lot.

* eVestment Alliance, LLC, PPB Capital Partners, June 2020

Economic check-in

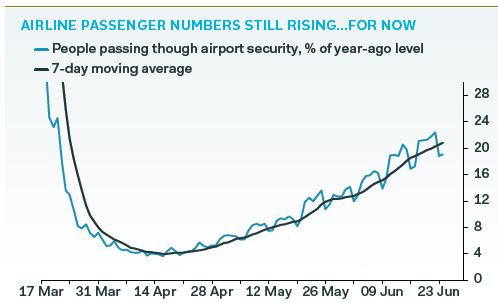

The slow re-build of normal economic activity continued this week …

* Pantheon Macroeconomics, U.S. Economic Monitor, June 25, 2020

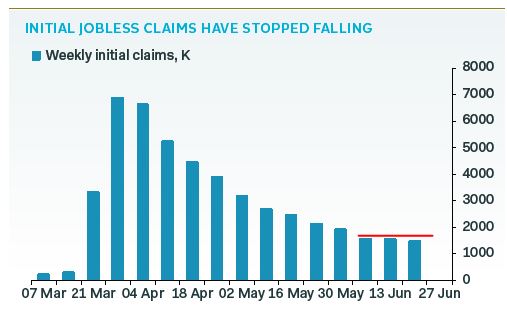

… but the flat-lining of initial jobless claims gives one the feeling of a pause in improved employment conditions (that, and it reveals the delay and back-log some states had in processing unemployment claims)

Politics & Money: Beltway Bulls and Bears

- An interesting thing to follow in the months ahead if the presumed election outcome becomes more pronounced in markets is if certain outcomes will be priced in ahead of time. For example, let’s say the markets decide Joe Biden is going to win, and let’s say the markets believe Joe Biden will sign legislation that increases the corporate tax cut (both of these things are big assumptions, for hypothetical purposes, and the latter assumption implies House and Senate support, too). Will companies perceived to particularly benefit from the reduced corporate tax rate suffer? More significantly, will we see companies themselves start to move money back onshore at a faster pace, fearing that their window is closing and that a return to higher double taxation is coming? (I should note, my friends at Strategas suggest this is already happening, with $124 billion coming home in Q1, more than 100% of total foreign profits; my own view is that there are other explanations for this, because in Q1 there was no election vulnerabilities to speak of evidenced in betting odds or polls). Regardless, I believe investment positioning has to account for what may take place in the election, and what may take place in advance of the election.

- But beyond all that, the basic trend taking place right now is unambiguously negative for the incumbent President, with the message of major national polls (both credible ones and less credible ones) indicating a 9-14% lead for Joe Biden, and also individual battleground state polls showing a growing lead for Biden over Trump (Michigan, Pennsylvania, Florida, Arizona, North Carolina). The President’s approval rating and polling vs. Biden on the economy is the one data point that sticks out in the President’s favor, and reinforces the idea that most of the negative results in the polling for POTUS are temperament-driven and style-driven. There is, of course, an eternity between now and November. I not only do not personally have the ability to forecast where this goes from here, but the market in aggregate does not either. However, the trajectory of momentum, and the magnitude of the lead, certainly give markets something to absorb here.

Chart of the Week

I believe in this week’s Chart of the Week you can see the phases of the market we are projecting playing out. Phase 1 was the COVID collapse, fastest of its kind in history. Phase 2 was the snapback rally, also the fastest of its kind in history. Phase 1 and 2 have happened – they are not speculations. Now, our view is that phase 3 will be “choppy,” and it will be “flattish” (not a huge breakout up or down), and it will extend out for several months/quarters. The up and down “range-bound” movements thus far fit exactly within this market narrative.

Quote of the Week

“It is difficult to get a man to understand something when his salary depends upon his not understanding it”

~ Upton Sinclair

* * *

Reach out over the weekend with any questions you would like to throw our way, and please join us for our national video call this Monday at 11am PT/2pm ET. Questions can be sent ahead of time as well and will definitely get covered on the call.

Enjoy your weekend, and here’s to a better second half of 2020 for our whole country!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet