Dear Valued Clients and Friends –

I spent a lot of time this week talking about last week’s Dividend Cafe which was dedicated to the subject of the Election and its impact on the markets. The follow-up to the white paper I wrote was this video / podcast on the same subject which also sparked more questions and comments. Overall I have been really grateful for the feedback I have gotten on the paper and the call, and I am happy to report that (thus far) my prediction that it would work just enough to make both sides upset with me has not proven true (at least not judging by the feedback I have received directly).

I think a part of me wanted to write the paper and be done talking about the election as a portfolio issue until November. That is obviously not going to work as it just won’t be avoidable for the next 46 days (but who’s counting). Not only is it front and center in the national civic conversation, but it is at least in the top five of things that will impact markets in the next two months.

But even saying that is likely to re-provoke the risk that I may offend both sides. The idea that it is not the number one issue driving markets at the moment is incomprehensible to many because it sure seems to be the number one issue driving the daily and nightly news, so many dinner time conversations, and so much of national life. And besides, what could possibly be ahead of the election in driving markets, let alone what three or four things could be?

Well that will be the subject of this week’s Dividend Cafe – the actual drivers of markets right now. It may surprise you. It may uplift you. But it will not bore you.

So thank you to all who offered such gracious feedback to the election white paper issue of Dividend Cafe. I am in no position to lecture anyone about an obsession with politics. I have been a political junkie since childhood and will never get the hours back I have spent playing with different versions of the electoral college map to try and figure out possible scenarios in the Presidential election (by the way, ask me sometime for the 2 or 3 not-totally-impossible ways in which this thing could end up being a TIE – seriously!). But I am exhausted by the politics right now. I have very strong ideological opinions and a fully-formed worldview of political philosophy, but I am exhausted by the lack of empathy, exhausted by the extremism, exhausted by the nut-picking, exhausted by the misrepresentations, exhausted by the lack of grace, and generally exhausted by the corrosion an obsession with Washington D.C. creates in our culture. And you know what? I have a strong feeling many of you might be trying to guess which side I am accusing of these things right now. See my point?

But I am not accusing anyone in this writing of anything. I am making a broad and not at all veiled or manipulative comment that the less focus we have on local communities, our families, churches, civic organizations, mediating institutions, sports, philanthropy, exercise, and so forth and so on, the more drawn we are to the tribal war of national politics. You can decide without my input if you think that is going well. But to apply this to my world of investment management, the less focused one is on corporate profits, on central banking and monetary policy, on sentiment and investor behavior, on valuations and risk/reward, on cash flows and organic growth – the less of a role all those things play in one’s understanding of the investment world, well yes indeed, the more tempted one may be to assume that a given election will make or break their financial success.

It’s contagious, indeed.

So I will do my best to put politics underneath bowling with my son and going to church in my personal life, and I will absolutely put politics underneath the big movers and shakers of our portfolios as well. You’ll see all of this and more as …

… in this week’s Dividend Cafe we will be looking at …

- The big unknown of corporate profits in the here and now and future

- Impact of perpetual quasi-COVID lockdowns

- The ambiguity of the present economic condition

- Operation Magnify

- Why financial services are under-valued, but not for the reason many think

- A sober assessment of the state of stock buybacks

- Why corporate bond yields matter so much to stocks, and everything else

- Night trading more important than day trading?

- Politics and Money: A new poll you haven’t seen in the news

- Chart of the Week: Small Cap Bizarro Land

So let’s jump in, yet again, to the Dividend Cafe!

Prophesying about Profits

I will argue that in a granular sense, the state of corporate profitability will drive markets for the next 4-6 months – as cost-cutting, margin expansion, and getting more clarity on outlook as the fog of forfeited guidance comes off. This is the beauty of companies saying they couldn’t provide forward guidance in Q2 and Q3 around the uncertainty of COVID – it gave us an actual chance for surprises in the markets (upside and downside).

A huge portion of positive market action for the last five months (since the COVID swoon of March) has been about valuations flying higher in the big technology sector. Yes, some tech companies that have a particular “stay at home” benefit saw real life revenues climb higher for now (home video technology, food delivery, exercise, etc.), but even in those cases the “E” went up a little (earnings), while the “P” went up a lot (price). Multiple expansion – valuations – have skyrocketed, but paying more for the same earnings can not drive markets forever.

This represents a great risk and a great opportunity for investors, especially bottom-up, company-focused ones in the next two or three quarters. Where are positive earnings stories pent up? And does this have to mean “really good earnings growth compared to 2019”? No, in fact, some of the most profitable stories from here may have real profit struggles versus the trajectory they were on pre-COVID, but simply outperform the woeful expectations that have been priced into their stocks.

More than anything else one can think of, company profitability outlook, case by case, bottom-up, will drive stock prices in the months and quarters ahead.

Yes COVID, but not COVID

But will the story of corporate profits just simply be a manner of companies telling us what we don’t now right now but they do? Or is there even a fog over exactly how healthy various companies are in various sectors of the economy? I believe we have more awareness, information, and understanding about COVID now than we have had in six months (which is not to say we know everything), but we have less clarity and understanding about the policy response to COVID in particular cities, counties, and states. The national lock-down of March/April is behind us, but there remains tremendous uncertainty about the specifics behind re-openings, normalization, and all the things that go therewith. We may know, now, that the surge in new positive tests in Florida, Arizona, and Texas (and other states) from June/July did not push us back to the brink of March/April fears, but even as New York sits with a positivity rate far below 1% (no typo), and California’s has sunk below 4%, if two of the largest states in the country have significant restrictions around travel, events, dining, and activity, does it really matter (economically) how improved things are health-wise? And just so I am crystal clear, everyone can form their own opinions on the propriety or impropriety of various particular policies and restrictions, and for my purposes here I am not commenting one way or the other – I am merely making the point that as it pertains to economic impact, the vastly improved COVID dynamic is not the only material fact; the tightening or loosening of restrictions around economic activity, is.

Magnifying the problem

We are in the midst of what we have deemed Operation Magnify at The Bahnsen Group, where we are overhauling present portfolio strategies, re-visiting risk and reward assumptions about each asset class, and most importantly, addressing the significance of low (no?) interest rates on each client’s needs and situation. This has cash flow ramifications, as well as portfolio ramifications.

Low interest rates as a policy response to various distress conditions are not new. But the United States being essentially at the zero-bound across its yield curve, is. Now in the U.S., only 16% of our population is (presently) over the age of 65. In Japan, it is 28% !!!!! The bulk of Europe is somewhere in between. A need for income drives the practical financial concerns of most investors, and the understanding that some form of cash flow need (present or future, lump sum or periodic) drove all investor objectives was the epiphany moment that produced my obsession with dividend growth investing.

But as we sit here at the zero-bound, with $15 trillion of global debt actually below the zero percent level (i.e. negative interest rates). A 60/40 stock-bond index portfolio yielded 3.5% in income ten years ago; it barely yields 1.5% today (and many may feel that even 60/40 is outside their risk appetite).

Magnifying the solution

Alternative Income Solutions are going to be needed to address the reality of this new interest rate regime. A different understanding of credit. A commitment to understanding the necessity of volatility in receiving dependable dividend levels. Private cash flow-generative investments (debt, equity, real estate).

I implore all readers, especially clients, to understand: 0% rates have made your borrowing easier, and your investing harder. We have to get this right. There is no free lunch. Our timeless principles will be magnified out of this period.

Banks are under-valued, but not for the reason you think

The yield curve does seem likely to steepen from here to some degree, and we know that banks are supposed to benefit from borrowing short and lending long. But I would be remiss if I did not point out – bank assets going into excess reserves are now > 14%, up from the 10% level of pre-COVID (thank you quantitative easing, and THAT is why QE does not equal automatic inflation). These excess reserves earn some yield from the Fed, but do not benefit from a steepening yield curve the way their own capital does.

So while some believe banks are just chomping at the bit to get the net interest margin that will come from a steeper curve than the flat as a pancake curve we have had for so long, I would argue it is the excessive loan loss reserves, and the increased M&A activity coming down the pike, that will prove opportunistic for some of the truly diversified behemoth financial institutions.

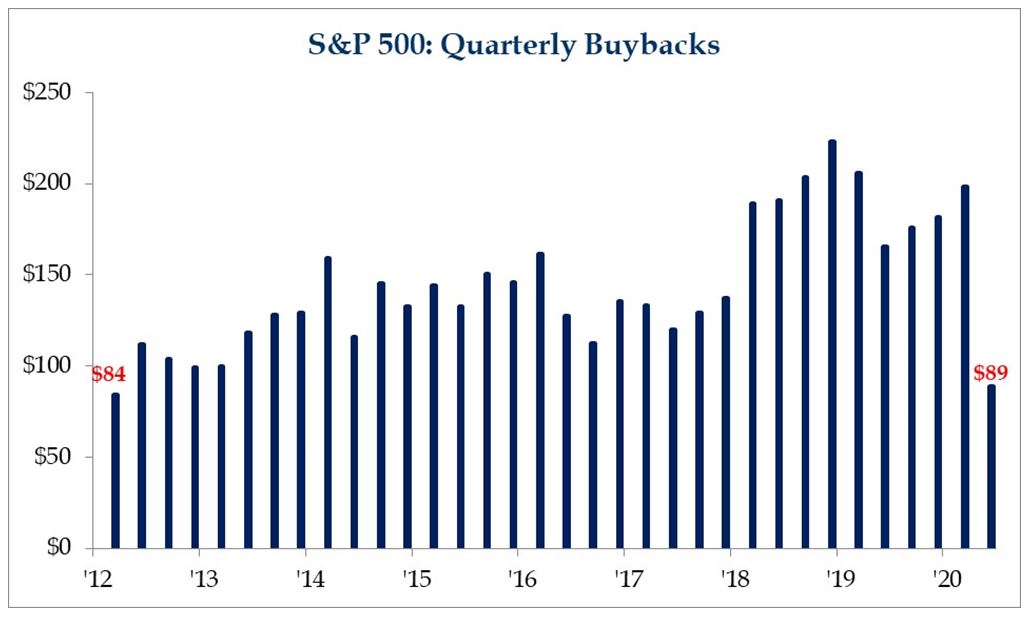

Buybacks did what?

The second quarter saw stock buybacks in the S&P 500 reach their lowest level since 2012, and less the half the level they have been averaging the last few years. This drop comes as firms sought to protect their liquidity amidst the uncertainty of a COVID-recession. There are two things that may happen here … One is that buybacks re-accelerate in Q4 or Q1 and provide an additional/potential tailwind to equities. The other, more likely in my book, is that buybacks face a prolonged season of being “out of favor,” with potential regulatory/governmental heat to boot.

*Strategas Research, Daily Macro Brief, Sept. 16, 2020

But switching gears …

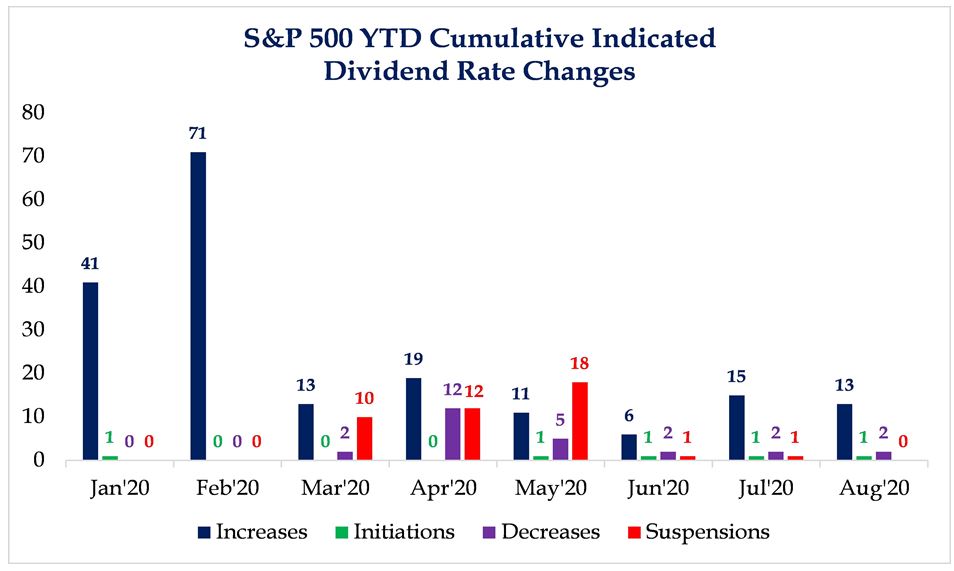

My view is that the proper stewardship of dividend reliability and dividend growth obviously cannot be done passively, or via an index. And yet, the very concept of dividend payments to shareholders vs. stock buybacks is itself more reliable, coherent, repeatable, and politically acceptable. Note below that while decreases and suspensions and dividends were elevating across the S&P 500 in March, April, and May, they have totally settled down now, dividend payments themselves will equal the same level as 2019 for the market overall, even as stock buybacks will end up at a 50% clip of their 2019 level. Bottom line: (1) Dividend growth trumps stock buybacks in a general sense as more reliable and consistent in capital return to shareholders, and (2) Even within dividend growth, active diligence trumps passive indexing to avoid cuts and suspensions.

*Strategas Research, Daily Macro Brief, Sept. 18, 2020

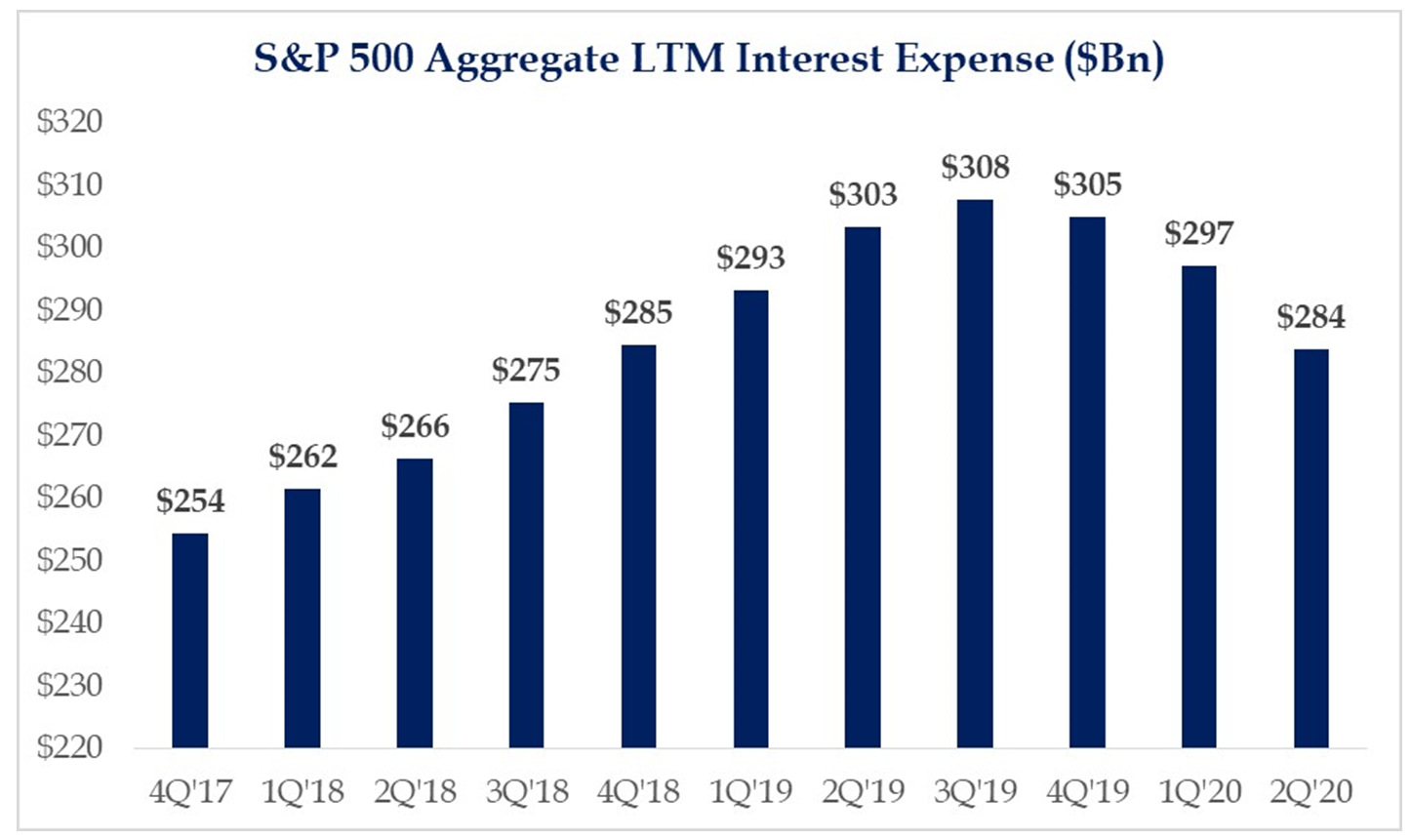

What do bonds have to do with stocks?

I have written abundantly how record levels of issuance of corporate debt this year, and yet, the total interest expense companies will incur is significantly lower. How could this be? Obviously, it is the decreased interest rate factor, driving the expense of borrowing money down. And how does this impact stocks? The primary factor is the productivity they can derive from presumably productive use of additional debt brought on by greater Fed-enabled liquidity. And secondarily, Fed efforts to drive rates down and intervene in corporate bond markets have created a record-low borrowing cost environment.

*Strategas Research, Daily Macro Brief, Sept. 15, 2020

Inflating the Inflation Metrics

When I refer to deflation or dis-inflation, am I implying that no prices inflate right now?

There certainly is inflation in housing costs – rent and mortgage as a percentage of take home income have absolutely gone up! Arguments can be made different metrics under-count health care costs as well (again, this is difficult because each household’s health care costs are a different percentage of that household’s total expenses).

Housing, Health Care, and Higher Education remain the three categories by which we have seen inflation. And in all three of those the impact is different depending on circumstances. The impact is different, but the cause is not.

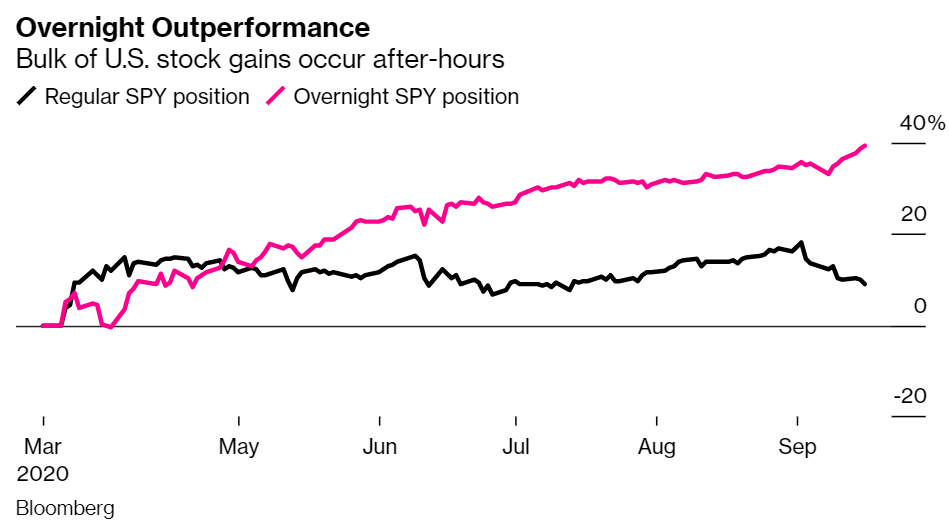

Night trading trumps day trading

I had written about this several times in past missives at COVID & Markets, but the percentage of stock market movement this year that has taken place after hours (meaning, after the market closes and before it opens the next day) is simply stunning. This applies to both the upside and downside, as basically, markets have opened up with a huge gap up or down, and then kind of held that move (more or less) throughout the actual trading day, more times than I can count. Buying the market right before the close every day, and selling it right at the open the next day, as generated almost 5x the return of buying it at the open every day and selling it at the close each day. Now, both ideas are absurd, of course – my point is to illustrate the percentage of price movement that is taking place overnight.

The major reason for this is in line with occam’s razor – because most of the market-moving news comes after hours. Announcements, policy changes, global events, earnings reports, etc. take place in non-market hours. That gives futures markets the ability to price things in before the cash trading markets open.

But is this new or unique to 2020? The Federal Reserve says no … This research paper I found from February of this year, written before the COVID mess began in March, argues that 100% of equity returns have been obtained after European markets open going back to 1998!

Consider this another reality of globalization. And consider it a pretty good argument for the folly of relying on intra-day market timing to drive an investment policy.

What will it take to attract midstream investors again?

One would think high distributions (cash flow) to investors would make the MLP/oil and gas pipeline attractive to investors. The growth of those cash flow distributions has certainly slowed down from the good ole’ days, and this slow-down in the rate of distribution growth began well before COVID, but the distributions still remain very high and very attractive. So why are investors not bidding up the price of these assets?

New projects were previously funded by unlimited amounts of equity capital. Those days are gone. Free Cash Flow is the name of the game now. Sustainable business models, prudent management of debt, and threading the needle between protect cash flow and the dividend now, while not starving growth for the future, will all be required to bring investor appetite back. The opportunity is in the strength of the sector, not the weakness of the sector.

Economic Check-In

Consumer auto purchases are now above pre-COVID levels. Stunning. Housing is still hot, especially with single-family, but multi-family has cooled off as of late. The weekly initial jobless claims hit their lowest number since March this week, and continuing claims are down ~50% since the COVID peak. Manufacturing and Business Confidence have outperformed expectations.

The two themes I have written about previously have yet to become obsolete. Many economic metrics are better than expected, but none are what we would call “good” (yet).

Politics & Money: Beltway Bulls and Bears

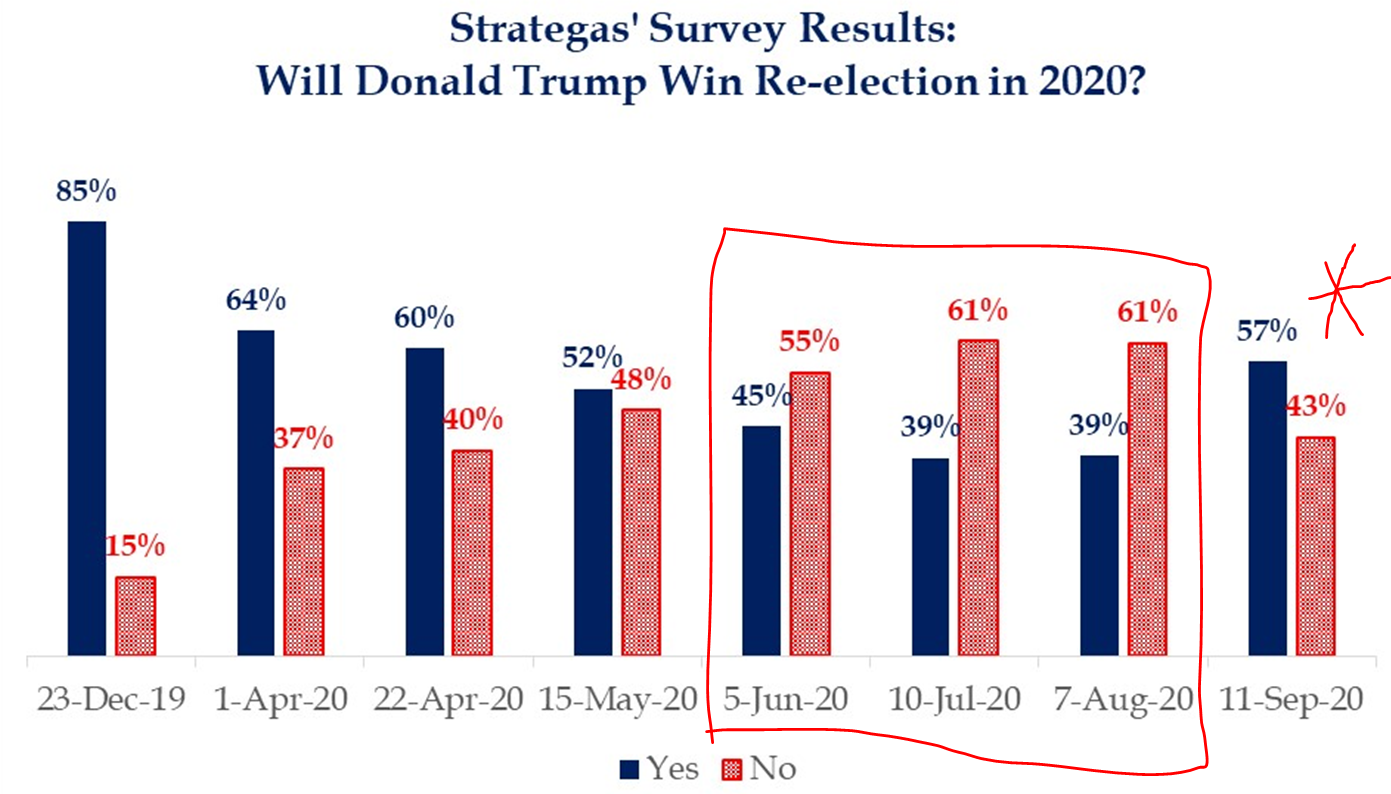

- Take it for what it’s worth, but for the first time since the middle of May, more institutional money managers in this survey are predicting a Trump win than a Biden win. What makes the import of this particular survey special or noteworthy? Nothing. It is what it is. But I am just sharing with you the results of a pretty significant sample of Wall Street portfolio managers on their predictive forecasts here …

*Strategas Research, Daily Macro Brief, Sept. 14, 2020

Chart of the Week

We really do believe that there is an opportunity in the small-cap space coming out of the COVID recession, and we are very happy with some of the present and future strategy exposures we are pursuing to execute on this opportunity. That said, I cannot emphasize enough how much the current environment screams for active management vs. indexing in the small cap space of the market. A record number 47% of the companies in the Russell 2000 small-cap index do not have any positive earnings at all. Things are just indiscriminate right now, and this is no time to lack discrimination.

*Strategas Research, Daily Macro Brief, Sept. 18, 2020

Quote of the Week

“Pain plus reflection equals progress.”

~ Ray Dalio

* * *

I hope this was a helpful Dividend Cafe commentary for you. Reach out with any questions, as always.

Congrats to fans of Big-10 football this week. Pac-12, we are waiting on you to do the right thing, and to restore the joy of my Trojan Saturdays!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet