Dear Valued Clients and Friends,

It does you no good for me to talk about valuation without some kind of application or advice attached to it. I don’t have to do that in this communique with clients – they already receive our advice in action, every day. But what does it mean to comment on market index valuation for those of you who do not have the embedded investment philosophy, direction, and guidance of TBG as your fiduciary advisor? We’ll unpack some of that and a few other odds and ends in this week’s Dividend Cafe.

Before we jump into the Dividend Cafe this week, I wanted to invite you to be a part of next week’s Dividend Cafe. After all of the positive feedback I received on the annual election issue and the vast array of follow-up questions it has provoked, I have decided to devote next week’s Dividend Cafe to answering any and all questions you have on the election, its ramifications on markets and the economy, and anything adjacent to this [admittedly over-saturated] topic. So many questions are lingering, and I want to get as granular as you want me to get, so fire away with questions here and be a part of the Q&A edition election 2024 Dividend Cafe.

And with next week now teed up, let’s get into this week’s Dividend Cafe … Jump on in!

|

Subscribe on |

Practically dealing with the valuation question

At the annual Forbes Symposium in Las Vegas this week, one of the panelists said that “valuations may seem high, but you have to look at valuations relative to one another.” This is, of course, true. 21x or 22x for U.S. stock indices may be well above their historical average, but if bonds, and international, and real estate, and [fill in the blank asset class] are all even more expensive relative to their historical valuations, then the relative picture is a lot different, and practical application likely different, too. Let me summarize a few practical suggestions for how investors ought to think about this right now:

- For index-based investors committed to a strategic buy-and-hold allocation, it makes no sense to do anything about it (besides annual re-balancing along the way). The reason you committed to index-based, strategic asset allocation is that you didn’t want to think about or worry about valuation, timing, decisions, etc. Let your automated process play out, and keep the compounding machine going. While there are inevitable periods of downside volatility to contend with, that is part of the life you choose. History has been kind to you regarding results, provided you behaved in periods of downside volatility (i.e., stayed the course).

- For those who do worry about excessive valuation resulting in years of no growth when mean reversion rears its ugly head, understand what you own. You may have bought an index that was 15-20% “big cap tech” when you bought it and is 40% or more “big cap tech” now. It doesn’t need to be you changing; you may be responding to how the nature of cap-weighted indices has changed. You own heavy leverage to tech cyclicality and valuation, and you may not have meant to do that. There is no shame in that game – just really re-think what your goals are and the best way to achieve them in a disciplined, non-emotional manner.

- For those who want a heavy compounding of dividends that will not go down in market corrections or live off of the withdrawals of dividends that will not go down in market corrections, you may not be part of this conversation, to begin with. The S&P 500 ex-the expensive tech/Mag7/semiconductor/etc. stuff is trading about 17x – far less than the 30-50x the Mag7 is. Some dividend growth portfolios I am familiar with are trading at 16x, not at all in excess of historical sensibility. And your total return in compounding reinvested dividends increases from market volatility, so you almost embrace it, anyway (other than those of you who need to sell your whole portfolio on a given imminent day to pay off your bookie or buy a boat or something like that).

I have my own opinions about applying portfolio management to investor needs and goals. Still, I write this for the betterment of all – even those not within the universe of our investment philosophy: Discipline and behavior drive returns more than anything else, period. No one like myself who talks about valuation is trying to get you to time the market. My beliefs on this subject are the exact same when markets are not in the valuation range they are now, and the biggest ten companies are not >30x earnings. As long as one knows what they own and why (as a cap-weighted index investor) when valuations are “median,” they should be perfectly prepared for what it means when they are “stretched.”

The follow-up question is … does everyone know the what and why of that question?

Another point – for all of us

This is probably as important a point for TBG clients as it is for others … valuation talk right now can not/should not be limited to just merely the S&P 500 as an index. While it is true that within U.S. equities, the concentration of premium valuation is largely in the tech/AI/semi space, with many equity sectors at far more reasonable valuations, it is absolutely not true that high valuations are exclusively in the stock market. Credit spreads are so tight that many S&P companies are borrowing money at a lower cost than the United States government (a more accurate way of saying that is that the cost of insuring that debt is less than it is for Treasuries, but the point is the same). High-yield credit spreads are less than 3%. All sorts of credit instruments are at “very tight” spreads. And if you don’t know that real estate valuations are high, I don’t know what to say. Across all asset classes, there is room for prudence, reasonable expectations, and some sense of awareness.

But here is the thing – the behavioral mistake most often made here is not that people stay invested when they shouldn’t – if their portfolio was constructed right to begin with, they most certainly should not stop the compounding of that capital – but rather, it is the opposite. It is the euphoria that kicks in where people alter their allocations, not to be fearful or time the market, but rather to “press” on risk, to increase leverage, to “play” on momentum. It is a level of insanity I lack the words to explain. And it is on the same coin, just a different side, of that human nature thing we talk about all the time.

Responding to signals without noise

I read a report this week (h/t Callum Thomas) that suggested a framework for how we think about signals in the marketplace – the indicators that inform our beliefs and responses. There is, first, the explainable, those things that work for a reason, and we can explain why. There is the reliable, those thing that have additionally stood the test of time. There are the sensible things that not only have stood the test of time and have some plausibility and explainability to them but also have useful applications. I consider these discernments vital, and I believe far too many people invest without any capacity to explain why they are doing what they are doing or the basis for believing it is reliable, let alone sensible. There is no need to hold this process up to a standard of infallibility, but there is a need to have some standard.

By what standard do we believe our portfolio will take us from point A to point B? It seems like a good question to answer. To that end, we work.

One final confusion

I am very clearly talking about valuation as a relevant factor for investors in the expected rate of return and general portfolio understanding. I am not talking about volatility, which is what I think most people end up getting confused by. We actually have a very robust market right now, with multiple expansions, but hardly at low volatility. The VIX is sitting around 19, quite elevated from the 12 to 15 range at which it hung out most of the year. Regardless of what up and down movements have been this year (truth be told, they’ve been totally innocuous, not just because all volatility is ultimately innocuous, but by real historical standards, it’s been a nothing-burger), my comment is that any increase in up and down movements is not how I define risk, and not what I am talking about in terms of the need to formulate a portfolio fundamentally.

I do not fear over-valued shiny objects because I think they will go “up and down” in price. I fear them because I think they will go down in price. And stay there. Forever. Asking Peloton, Beanie Babies, Juniper Networks, and Pets.com if they remember what their favorite song was in 1999.

The moment it matters

People ask me all the time (a) When I think the excessive spending and debt of the U.S. federal government will cause a problem and (b) Why I think interest rates face downward pressure when generally increasing credit risk is supposed to put upward pressure on rates.

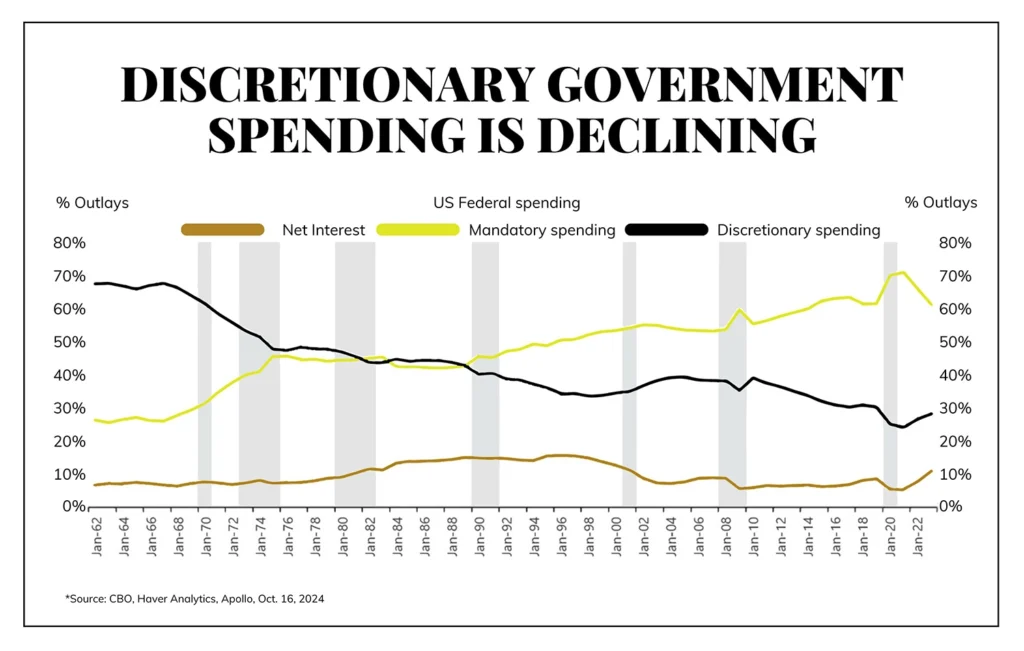

This chart is helpful for both questions. 70% of federal spending is now mandatory – not up for grabs – not able to be cut – not useful to discuss in the context of fiscal discipline, That number used to be 30%. Inversely (as this chart shows), so-called “discretionary” spending is now 30% – from a previous level of 70%.

Net interest expense going down may soon be the only lever they have to leave room for precious discretionary spending. But we do not merely need to note the increased spending levels, increased debt balances, and increased annual addition to the debt (i.e., budget deficits) – we also need to note the increased portion of that debt for which there is no flexibility. It’s not pretty. And the Fed knows this.

Chart of the Week

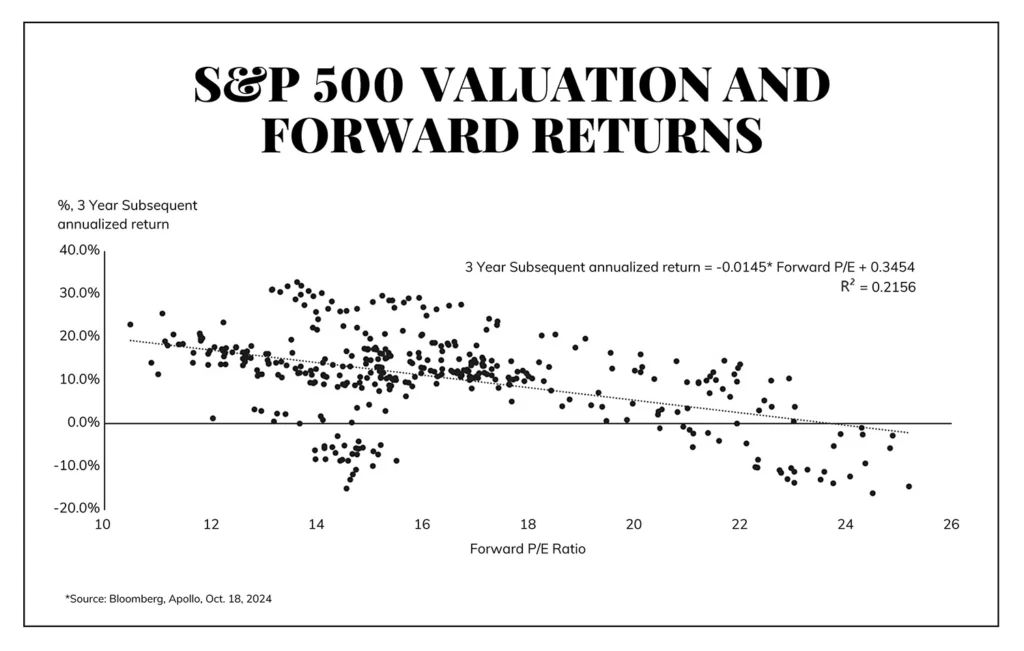

There is no way anyone knows what the market will do over one year, two years, or three years in terms of broad market index action. I dedicated several paragraphs above to the options investors have in a valuation moment like this. I have dedicated nearly 25 years, with hopefully decades more to go with what we believe and do in these periods. But as for history and all that jazz, well, valuation is noteworthy. A 21.8x multiple implies a +2.9% three-year annualized return going forward. But there are periods where it is worse and periods where it is better, so do with it what you think is best. I don’t share this for the benefit of our clients, for whom our investment philosophy and guidance are the ends to which we work; I share it for the informational value alone of those who may be in the wilderness, thinking things through.

Quote of the Week

“There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.“

~ John Kenneth Galbraith

* * *

So as a reminder, shoot any questions you have about election 2024 to us in the days ahead. Next week’s Dividend Cafe will take them on with all the grace of a Christian, the civility of a grown-up, and the level-headedness of an era that is not the one we are apparently in now. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet.