Dear Valued Clients and Friends,

Recession. The dreaded word, “recession.” For those who have lost their job in one it can feel like a depression. For those who kept their own job in one but saw their portfolios drop, or saw neighbors or loved ones lose their jobs, or experienced a decline in income or business revenue, it may not have had the existential punch that it did for others, but it generates unpleasant memories of unpleasant times.

There is a lot of talk about a recession right now, some of it imbecilic, some of it overtly political, and some of it, quite substantive and important. But if the Dividend Cafe exists to bring simplicity and honesty to topics that are often spoken of with too much complexity and/or abundant dishonesty, the task at hand is readily apparent.

And so we will look at recession reality in current times, when, what, and why, and unpack the investment implications of all of it. I will always do my best at the simplicity part (I know I miss the mark there sometimes). I will be unrelenting in the honesty part. But as far as the pleasant part of it all, well, let’s just say my focus is on the honesty part.

Jump on into the Dividend Cafe …

|

Subscribe on |

Are we in a recession?

The answer is currently “no” – and candidly, we aren’t close to one (yet). But that is not the question, because for our purposes this is the type of subject wants to be “forward-looking” on. If the hallmarks of a recession are lost jobs, declining wages, lower revenues, and negative economic growth, knowing you are in it is not generally a question has to be asked – you just open your eyes. Economists and financial managers have to be focused on the future; the present is generally rather obvious. If a recession is like a negative weather event, one may really want to know if a storm is coming in three days; they don’t usually have to ask if there is a storm going on or not outside their window.

But why do I say we are not close to one, yet? Does that mean I do not believe we are going to have one? No, it does not. Does it mean I believe all is well on the home front? No, it does not. It is a purely descriptive and objective claim. The characteristics of a recession are not currently present. Let’s go deeper.

What is a recession?

We have generally accepted the “formal” definition as “two consecutive quarters of a decline in real GDP.” The National Bureau of Economic Research (NBER) is the governmental arbiter of such things, and they provide their own resources to help people with the definition. But as far as these things go, I think this is a fine definition:

“A significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

It’s a little general, a little imprecise, and a little lacking in time specifications, but good enough. And yes, “more than a few months” sounds to me like “two quarters” is the bare minimum. So good enough.

Didn’t the economy contract in Q1?

Actually, it looks like it might have as far as how GDP is measured. The market responded with one of its biggest days UP on the year. Huh? Well, the market knows what all other pundits and analysts know – that while the report was filled with both some positive and negative components, the formulaic items leading to the “negative -1.4%” print were temporary, and a return to positive growth is expected next quarter. What were these temporary factors that distorted the GDP reading for Q1?

3.6 million workers reported sick in January as Omicron was allowing the media (and workers) to play hooky. The average “sick from work” data in January pre-COVID for years was 1 million. So there was an additional shortage of domestic labor in January that was even higher than the already short labor supply we have been fighting since mid-2021. This pushed up demand for imports and diminished our export activity, widening the trade deficit despite the fact that consumption and business investment expanded.

Well, consumption and business investment ADD to GDP, while the wider trade deficit SUBTRACT from it. As it turns out, we may actually see the data HELP the GDP number next quarter even if it is BAD news. Huh? The current China lockdowns seem likely to at least marginally diminish imports, and we know that U.S. exports at least in the energy sector are on the rise. The way the numbers pull through will likely see the trade deficit data (which is about the change quarter-over-quarter – not in absolute terms) be a positive input to GDP next quarter, whereas this last quarter it was the factor in contraction.

But, but, but

Aren’t I presupposing the positive inputs now stay positive in the future? If the important elements are Consumption and Business Investment (it is called non-residential fixed investment in the GDP formula), don’t we need to know what they are going to do before we decide what the future holds?

Well, sure. But that was not the question. I was answering if we are in a recession now, and my point was that we are not. At 3.6% unemployment, there are not many who would say it feels like a recession, either. This has nothing to do with whether or not all aspects of the economy are good – they are not – it has to do only with whether or not we are in a recession. Words matter.

If I say, “it is not raining outside” – and someone else says, “who are you to say it is not raining? I am having a terrible day and I got stuck in traffic this morning!” – I am not the one missing the point. Someone can have a flu, get stuck in traffic, have McDonald’s forget to put the egg McMuffin in their bag at the drive-thru, and have this happen to them, but – it is not raining, unless it is raining.

I am a little exasperated that this even has to be said.

So, what about that future?

I can see a GOOD thing helping the export data next month (U.S. energy exports), a BAD thing bringing imports down (China lockdowns), a MIXED thing adding to the government expenditures component of GDP (i.e. beginning of deployment of the infrastructure bill), and CONSUMPTION keep plugging along (long-time readers will note that I have had this bias for most of my adult life, especially as I have more understood American consumption habits; I have found no evidence, ever, of a diminished appetite to consume – only a diminished capacity to do so from job loss or credit impairment).

And this leaves investment. Will investment levels contribute enough to keep some positive GDP growth going?

Why are we worried about this?

Why in the world is there recession talk when unemployment is 3.6%? Don’t employers see dark clouds ahead and start firing people way before they start cutting Capex, and before people stop going to their favorite restaurant? Well yes, that is generally the way it works. The key concern at the moment is the aforementioned credit markets. Put differently, both consumption and production depend to some degree on credit, and the concern is that the Fed’s new monetary agenda will require a slowdown of credit to a point that consumption or production slow down enough to usher in a recession.

It is, theoretically, an entirely rational proposition.

The good ole days

I used to write a Friday commentary at Morgan Stanley much like this, only without the name “Dividend Cafe,” and with 95% fewer readers. And I think perhaps my biggest theme in the initial phase of excess Fed accommodation post-GFC was the possibility of the Fed swinging the pendulum from one extreme to the other.

The Great Financial Crisis happened (we’ll ignore causation for our purposes today)

The Fed threw the kitchen sink at it (we’ll ignore what they did at that time that was good versus not good for our purposes today)

They kept the accommodation on way, way too long, in my humble opinion (we’ll ignore why they did that for our purposes today)

And my take was that Fed excess accommodation would create too much reflation, too much distortion, too much excess, and then force the Fed to hit the brakes too hard, creating too much contraction, too much pain, and too much discomfort, leading to the Fed having re-accelerate accommodation again, rinse and repeat.

I wrote about it a lot – that the Fed in its fear of normalization and seeing an economy properly “clear” actual price levels and market realities – was exacerbating the likelihood of a recession. And in fact, the more accommodation/distortion built up, the more draconian the efforts would have to be to contain the spill.

The worse the bender, the worse the hangover. It’s the way the world works.

Is this where we are now?

I am not in the mainstream view about what the primary concern is right now. The consensus view is that the Fed will raise interest rates so much that it makes people stop overpaying for overpriced houses. Yeah, I don’t really care about that, like, at all. I hope that happens, and I own a lot of houses. Pulling the punch bowl is a good thing when someone is going to drive home, and fear about a party ending that for damn sure needs to end is simply not something I spend any time worrying about. Sorry.

And I don’t care much about the Fed impacting consumption, either. Obviously, I understand how much consumption matters in the GDP print, but I don’t believe the Fed is the primary driver of consumption activity, and I never have. Yes, marginally. But it’s not the low-hanging fruit of what would tip us into a recession.

So I do believe Fed tightening could become recessionary, but my focus in that is not on housing prices or how many flat-screen TVs college students buy. My focus is on the impact of credit markets on business investment.

Capex like COVID never happened

All I cared about in 2019 (and really much before that) was seeing capital expenditures that indicated a healthy optimism in the supply side of the economy. Then COVID came, and all we cared about in 2020 was the economy not being shut down, and all we cared about in 2021 was the pace and magnitude of economic re-opening. 2022 has thus far focused on price inflation impact and what policymakers will do about that, as well as Russia/Ukraine, energy markets, and price excesses in the technology sector. But essentially, if we want to wipe out 2020/2021 (and I wish we could for a lot of reasons), and we can now look past the economic shutdowns and re-openings of the COVID era, we are back to the CAPEX question. We have been muddling through a sub-optimal economic growth era, with inadequate business investment driving inadequate productivity. And if CREDIT is now contracted to a point that it cuts off CAPEX, I strongly suspect that becomes recessionary.

Could it be sooner than I think? Yes. Could it be avoided? Sure. But my best guess is that we are looking at an 18-24 month period. I wouldn’t bet much on the timing here.

The bright side?

When the cost of capital exceeds the return on invested capital, recessions happen. Businesses compress activity when it is destroying capital. This is a tautology. But then, markets purge out inefficiencies, price distortions, and other viruses that permeate the economy, and we can launch from a healthier and better position. Capital performs best when it is most efficiently allocated, and recessions are, to a large degree, the process by which capital allocation gets repaired.

This is not helpful for people who lose their job in a recession. Much damage is done to the soul of society in a recession. I never take that lightly. I write only to the relevance of such for an investor. Some aspects of investment markets will benefit on the other side of a recession. The bright side is the opportunity. I hope that can be taken in the spirit with which it is written.

Regret

Timing one’s way around a recession – into it, out of it, ahead of it, behind it – is perhaps the most surefire way to guarantee REGRET. A timing mistake happens, and it inevitably begets another timing mistake. And then another. Regret messes with our emotions and puts us into a really painful period of reacting and overreacting, wrongly.

A recession is going to come, and maybe not in 3-6 months (I very much doubt it will), and maybe not in 18-24 months (I would suspect that is much more likely), but eventually. And I will argue that an asset allocation that does not account for the inevitability of recessions is a problem, but so is trying to throw out your asset allocation to anticipate one. We can do better.

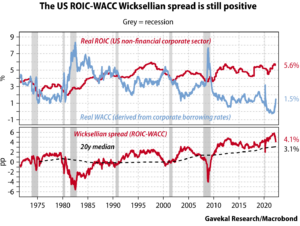

Chart of the Week

The ROIC here means “Return on Invested Capital.” Cost of capital is, right, less than ROIC. A recession comes when that inverts.

Quote of the Week

“He who knows only his own side of the case, knows little of that.”

~ John Stuart Mill

* * *

April is fait accompli. On to the month of May. Enjoy your weekends. Ask questions all you want. And avoid regret. Regret is the way to make a recession worse than it already is.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet