Dear Valued Clients and Friends –

Last Friday, December 11, marked year number 25 since December 11, 1995, when my father passed away. His name was Greg Bahnsen, he was 47 years old (the age I will be next year), and he was my hero and my best friend. I have to imagine many of you have experienced things (including losses) that do not feel like they were as long ago as they actually were. I know those cliches are tired, but it just simply does not feel like it has been 25 years since my dad died. Yet it has been, and I imagine when another 25 years go by, I will be saying and feeling the same thing.

Time becomes a weirder thing as we get older, I suppose (some of you will have more expertise in this than I do), and I am sure that time dynamics get even muddier when we are talking about a loss. Last weekend as I was isolated away working on a project, I spent abundant amounts of time reflecting on this and many other things. Regardless of what it feels like, 25 years has gone by since dad died, and my entire life being upended and forever changed. Over these last 25 years, not just in my own personal life, but across society, the news, the world, the culture, and yes, the economy and markets, there are a whole lot of things that have barely changed or haven’t changed at all. But, there also are certain things that reflect substantial change. Not just “evolutionary” change, but real paradigmatic change.

And the biggest of those changes is the subject of this week’s Dividend Cafe …

Jump on in and find out what represents the single paradigmatic change for investors since 1995 – what the number one most significant thing is that would be categorically different if someone were sitting down preparing to invest money in December 1995, versus sitting down preparing to invest money in December 2020. I believe it is a powerful message, an actionable one, and certainly one that will refute the cliche about “time standing still.”

Back to the Past

It is hard for some of us to think back to 1995. For some of you (yes, we do have some young readers), you were not yet alive then, or right in the midst of grammar school or middle school – hardly focused on world events and the like. And some of you have so much experience with world events you would just as soon reminisce about 1955 as you would 1995, and I love that! But as much as possible, let’s try to put ourselves back into 1995. There was a Democrat President, a Republican Congress, very fast-moving technology, and the very early stages of the internet (i.e., Netscape went public in August that year, and the “web browser” was changing the world).

The stock market was up big, and there was talk of “irrational exuberance” and how long it could last (note: it lasted a lot longer, as the S&P 500 would go up +34%, +20%, +31%, +27%, and 20% from 1995-1999). Housing prices were stable but not boom-territory, and pretty affluent people were buying homes for $500,000. Though 1994 had been a sketchy year, the economy was expanding, and Orange County, California, had actually declared bankruptcy.

I will spare you the various pop culture remembrances. Let’s just say that I don’t think Coolio, TLC, Blues Traveler, or Boyz II Men are still atop the charts (though I think Mariah Carey still is).

Dad, what do you think?

I used to play the game of what my dad would think if he suddenly came back and opened up a modern newspaper or turned on a current cable news show. Certainly, the social media realm of 2020 would be a shock to him (and probably make him wish he could go right back to where he had been), and it is almost funny to picture the look on his face if he were to hear that Donald Trump was the President (think back to the last Donald Trump my dad would have seen in public life in the early 1990s). But let’s be serious here … what would be abundantly clear to anyone who took a 25-year nap from 1995 to 2020 is the following:

- We have an extremely divided government in America

- There are pockets of instability in the world geopolitically, concentrated in the Middle East, Russia, and a few other spots

- Global debt is going higher

- Many people (and cities, and countries) live above their means

- Technology and Health Care are experiencing rapid and radical increases in efficiency, capability, and reach

- Free markets are working to build more wealth and expand the economic pie

What on that list was untrue in 1995? Not a single thing. What on the list is untrue in 2020? Not a single thing. Different music, movies, cultural sensibilities, mediums of communication, and in only a few cases, some different politicians (and frankly, not too many of those) – but really, the same major themes and realities, just advanced 25 years further.

Any hints from across the pond?

One thing more globally-minded investors may point to when distinguishing 1995 from 2020 is the existence of a shared currency in Europe, and that is far enough. Here in 2020 the European Union lives under the Euro currency (with a few holdout exceptions), and in 1995 they did not. Most would view the experiment as having failed to deliver on its promises, and many would look to the challenges the EU bloc has dealt with since 2010 as part of the forecasts Euro-skeptics offered up in the 1990s. But first of all, we must remember that the Maastricht Treaty, which effectively created the Euro currency and monetary union, was passed in 1993 (as we know, the UK stayed out of it, as did Denmark). The currency did not launch until 1999, but it was well in motion before 1995.

I could actually argue that there is a lot of Deja Vu between 1990’s Europe/UK and 2020 Europe/UK. Every single day my feed of research is overwhelmed by stories of negotiations between British and EU authorities trying to work out Brexit details, and in the mid-90’s the same was true as Britain negotiated its carve-out from the shared currency notion that would become the Euro. Extreme continuity.

Are you forgetting 9/11?

I thought about including the day that, in my mind, changed everything in this discussion, but I am not sure that 2020 as a result of 9/11 would seem much different to my dad than the world he left in 1995. There is not a daily fear in America right now of terrorist attack, and it wasn’t like the 9/11 attack was the first time radical jihadists hit us (my dad was still alive for the 1993 attack, which didn’t even have a different building as a target, let alone a different city or country). Yes, I do believe the 9/11 atrocity profoundly consummated the reality of nation-state conflict vs. rogue terrorist actor threats, and I do believe there were both transitory and evergreen impacts from this baked into the cake post-9/11, but it would be a hard sell to argue that most Americans lives are profoundly different in 2020 than they were in 1995 as a result of 9/11 (though I can’t even imagine my dad’s annoyance at the 2020 version of airport security, based on how annoyed he was at the pre-9/11 airport security he did experience) … =)

Money and Change

I have written for my entire career of the most constant reality in investing being the reality of human nature. Most extrinsic circumstances remain comparable to 25 years ago, and all intrinsic circumstances remain the same because human nature is immutable. Left to our own devices, human nature is a failed investor. It chases euphorically. It panics irrationally. And it believes against all hope what it wants to believe. Discipline, principle, conviction, patience, and planning were the antidotes in 1995 and remain so in 2020, as they will be in 2050.

Nothing new under this sun

The growth investing dynamic very popular right now is hardly new. It may be the element most reminiscent of 1995, in fact (though we are a few years into it, whereas in 1995, it was the beginning of the run). This excerpt from the book, Wall Street Meat, by venture capitalist and markets extraordinaire, Andy Kessler, caught my attention. Here he is writing ~20 years ago about the dynamic of 20-25 years ago, replaying a story of an actual research conversation he had at his old big Wall Street firm:

At the end of our meeting I sheepishly asked, 'Wouldn't you want to find stocks that are about to go up, rather than ones that are already going up?" "We don't have the patience for that," he answered. There it was in a nutshell. Momentum funds needed performance NOW and couldn't wait for a stock to work. Instead they bought stocks that were "proven," even if they had already doubled. This struck me as more like gambling than investing. Blackjack cards or a craps table gets hot and gamblers at the surreal Caesar's Palace flock to it and bet more. Wall Street as a casino is an overused metaphor, but an apt one. **************

I think that transcript could be put on top of a 2020 portfolio conversation as much as it is here on a 1999 conversation. “What has been working” vs. “what will be working” is not a new phenomenon, and though it goes in and out of favor, that 2020 dynamic has far more in common with 1995 than it does differential.

So what has changed???????

The one thing that I believe stands out as the truly paradigmatic difference in economic life from 1995 to 2020 is the nature of the Federal Reserve. The function, behavior, actions, approach, mentality, burdens, vision, expectations, and the Fed’s entire relationship to the economy, to financial markets, and to daily life, is categorically different from it was in 1995. And this is the real subject of today’s Dividend Cafe.

It was 1998 when we saw some significant disruptions in financial markets in the middle of the year. Russia defaulted on its debt and devalued its currency in August. Emerging markets were pummeled behind currency crises in Thailand, Indonesia, and Korea. Major hedge fund, Long Term Capital Management, blew up. These were profound events, but U.S. GDP growth was on fire regardless (+4.5% net of inflation). Unemployment was extremely low. And yet, the Fed cut rates three times in the fall of 1998 in response to some of these negative events in financial markets. The stock market loved it. Real Estate loved it. And the “Greenspan put” would become a key part of the financial lexicon driving American policy.

The idea of the central bank backstopping risk assets did not start in 1998 (though it was an unprecedented level of escalation, no doubt, and frankly, many pre-1998 examples of Fed support to financial markets are really weak comparisons by degree and kind to what they actually began doing in 1998). And really in hindsight, what they did in 1998 is small ball compared to the world we live in now.

Hurrying over History

This commentary will run on far too long, especially for the weekend before the Christmas holiday, if I give you the full play by play of every Fed event since 1998. A true codifying into the expectations of markets took place around the idea of the Fed as a protector of risk assets. The rationale is almost always articulated as defending financial stability or ensuring smooth operations in our financial markets, and there is absolutely truth and sincerity in that. But whether it is the primary driver or a secondary driver or a totally coincidental benefit, risk assets have been the beneficiary of these policy steps for 20-25 years now.

When Greenspan cut rates and flooded the money supply in anticipation of bank stress around the nothing-burger that was Y2K, my point is not whether or not he meant it when he said bank stability around Y2k was driving him. I frankly believe him. But it still had the net impact of expanding asset valuations.

After 9/11, when rates were cut substantially, and mortgage rates collapsed, and home-buying and re-financing skyrocketed, I have no doubt the intent was not to help the stock market but rather to offset concerns of economic softness. But motives aside, we know the boom effect it had in speculative real estate.

The grand-daddy of them all

And no doubt, when the great financial crisis (GFC) happened, and rates were brought to 0%, and the Fed’s balance sheet policies began (QE as a stimulative policy tool), we know the Fed was trying it’s very best to stabilize a financial system that had de-railed. Everything was thrown against the wall, a conscious and probably appropriate prioritization on the short-term was placed over longer-term side effects, and a new chapter of monetary policy creativity was invited into American life.

The $4 trillion of bond buying and seven years of a zero interest rate policy are not the GFC era’s biggest policy decisions. That is a pretty stunning thing to say, actually. But out of 2008 and 2009 came an expansion of the Fed’s emergency lending capabilities (Section 13.3) that, through coordination with Congress, the Treasury Department, and a slew of rather audacious policymakers, has totally recalibrated what we believe our Fed can and cannot do.

From residential mortgages to commercial mortgages to auto loans to credit card loans to Bear Stearns paper to Fannie and Freddie paper to syndicated loans to municipal securities to commercial paper to student loans, some form of all these assets has found its way into a Fed facility of sorts between the post-GFC decisions and the post-COVID decisions. TALF and TALF 2.0 and Maiden Lane and Maiden Lane 2.0 and a whole slew of alphabet soup both 12 years ago and today may not be commonly understood in American households, but they were revolutionary and precedent-setting actions that have totally re-programmed economic expectations in American life.

To unwind or not unwind, that is not the question

One thing I do know about the Fed’s current accommodations is that the Fed doesn’t know how they will disentangle themselves from them. Leaving aside the issue of zero interest rates, the heavy levels of bond-buying during this period (still going at $120 billion per month) puts two distinct issues out into the future: (1) When and how will the Fed decrease or cease this additional quantitative easing?, and (2) When and how will the Fed reduce the level of bonds that have been added to their balance sheet through this period?

To answer this question, let’s look at very recent history. From 2009 through 2014, the Fed added $4 trillion to its balance sheet through three rounds of quantitative easing. From 2015-2018 they more or less left that in place, reinvesting proceeds as some bonds matured but not adding new bonds to their balance sheet (leaving their asset levels in place). In 2018 they began “tightening” by not reinvesting some matured bonds ($10 billion here, $20 billion there). At no time did they actually sell bonds (real tightening) – they merely did “run-off” where bonds matured and were not replenished, which had the effect of a very slow reduction in their balance sheet.

By the end of 2018, in concert with their periodic 25 basis point rate hikes, credit markets were throwing up. Equities dropped. Credit tightened (I won’t say froze). Spreads widened. And by January 2019, the Fed had completely and totally capitulated to risk asset markets and put a kibosh on any additional normalization. And of course, by 2020, they had reversed course all together, re-reducing rates to zero percent and firing up the bond purchases like never before.

I do not merely mean to say that I do not know how they will unwind from this; I mean to say that they do not know how they will unwind from this. The Fed has said that they want to see “substantial further progress” in employment and inflation before they think about extrication (by the way, you will be shocked to know that here, “progress” in inflation means “more of it”). They have admitted they do not have numerical or measurable goalposts for what that progress in labor or money markets will mean. There may be a purposeful desire to maintain policy flexibility here, but vagueness and ambiguity also enable an avoidance of the real elephant in the room – they don’t really know when, how, or if they will be able to unwind this.

Elephant in the room

A central bank that has been exponentially more interventionist for the last 25 years is an easy choice for a desired savior in the greatest economic concern the country faces – skyrocketing national debt. The Fed’s ability to creatively raise its balance sheet and provide liquidity to capital markets has only reinforced its ability to be a monetizer of the U.S. government’s need to run gigantic deficits. This part of the playbook is not new – Japan has been doing it for, well, 25 years, and if anything, our country’s laws make it harder for the Fed to do or at least require more creativity. Even as our Fed functions under a dual mandate from Congress (full employment and stable money), they have a lot of wiggle room to re-define what that means or “supplement” it from time to time. But the policy tools are still limited – the Fed cannot literally monetize the debt. Their asset (a bond) remains the government’s liability. The burden of the liability has not been extinguished away, which is what real monetization would be. So they buy government bonds en masse, and keep rates down, and talk about economic stability (it is important), even as the government desperately needs both their bond-buying and their low cost of funds to keep the debt expansion going. Rinse and repeat.

Locking your rate in, for $20 trillion

The decision for the U.S. Treasury to issue more short-term debt vs. locking in these phenomenally low rates for long periods of time (I mean even one hundred years) is not the Fed’s to make – it really is the Treasury’s. One of the most economically productive things the Treasury could do is just that – in so much as the “tail risk” of the country’s very short term liabilities could be addressed once and for all by securing long term low rates. The Fed would be a “partner” in this endeavor, yet it has not materialized, and I remain at a loss as to why it has not happened.

So where are we?

The biggest change in financial markets since 1995 is that monetary policy is now driving everything else. It is the “instrument of choice for all crises,” as William White says. And what that means is a feedback loop now exists in financial markets that few understand or care to understand. Most of our crises have been debt crises (I wonder if you know of any other kind in the world of finance). Monetary policy as a tool to address debt crises is generally effective (short term), yet necessarily leads to the accumulation of more debt and more misallocation of capital that in turn creates more crisis that in turn necessitates more central bank intervention. Each time this happens, there are fewer bullets in the gun, and each Fed action’s efficacy is diminished. Dropping rates from 5% to 3% is a lot bigger of a policy step than dropping from 0.5% to 0.25%. I hope you see my point.

We have found ourselves in a situation over the last 25 years that my father (who was no economist) never lived through – we address instability with more actions that promote instability. And we don’t have a lot of options but to keep doubling down on the same track.

This is your holiday message?

None of this is to say that we have a terrible and immediately bad ending to all this; quite the contrary. Central banks carry big guns, and their ability to move, maneuver, delay, suspend, distort, and so forth is not an ability that we have yet seen reach its limit. What we know is this – bond yields and money markets pay essentially zero percent now. Corporations and credit-oriented borrowers have unlimited access to capital (at dirt cheap cost). And the cost of money for home buying is as cheap as can be.

You can derive real negatives from all this, and you can derive real positives. But what you can’t do is ignore the paradigm shift in 2020 economic life. The Fed is driving, and there are innumerable vulnerabilities, questions, and tough realities in what they are driving on. The government has no intention of decreasing the debt burden that complicates the Fed’s life (and if we are being very honest, the people who elect the government have no intention of decreasing the debt burden, either).

Inflation cannot be magically engineered, or a central bank would have done it by now. The vicious cycle of a debt-deflation feedback loop is here, and the Fed is doing all it can to deal with it. When my dad passed, we were coming up on balanced budgets, a Fed with almost no balance sheet, and savers that could earn 5% risk-free. All of that is gone, and it is never coming back.

Conclusion

We do not know more now than we did 25 years ago; we know even less. We just require others who also do not know more to do a lot more about the things they know less about. Call it a crisis of responsibility. It is not the Fed’s fault. But here we are.

2020 and beyond – the Fed is in charge. And fundamental logic, discipline, and stability in investment decisions have never been more important.

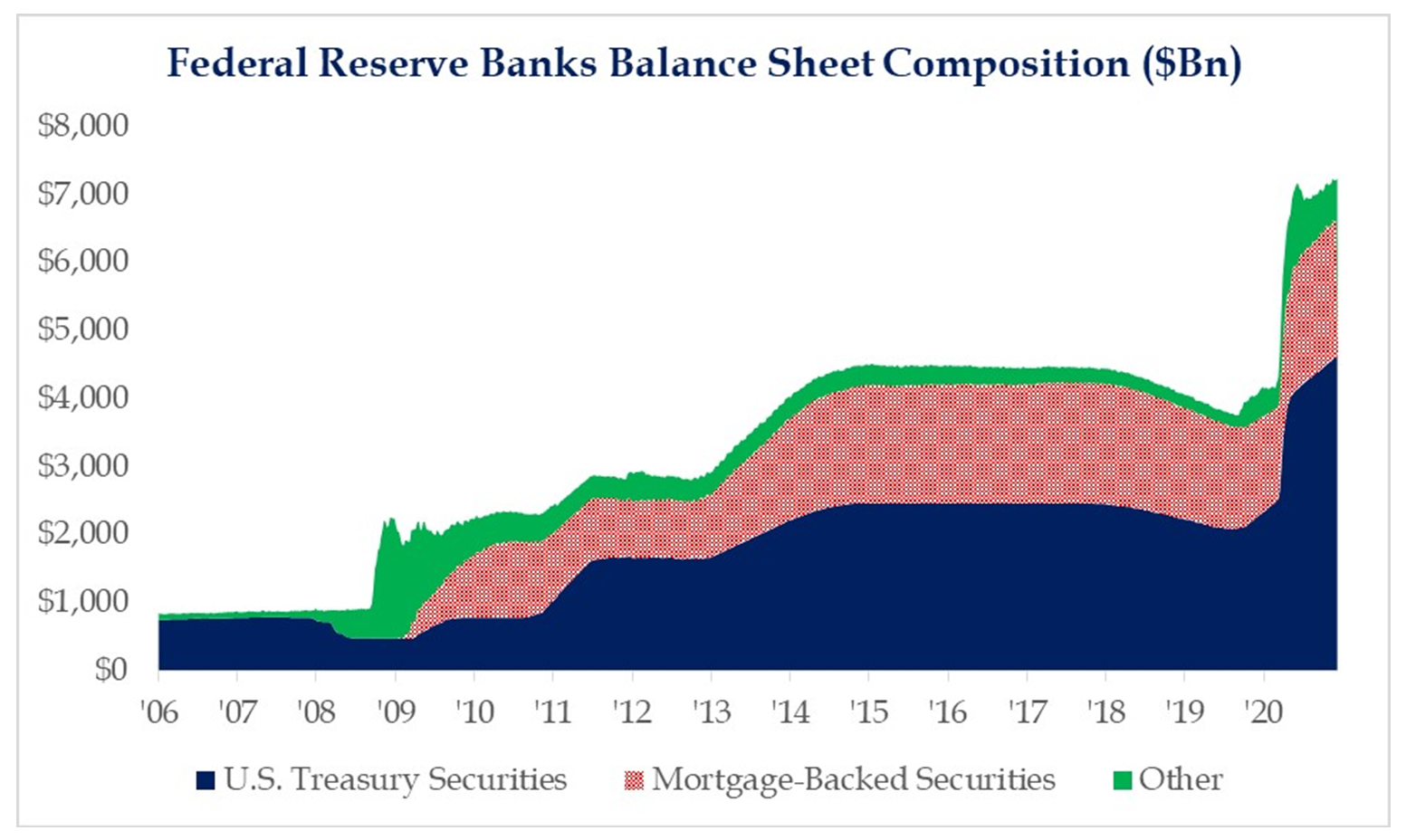

Chart of the Week

I would note here the big elevation with QE1 in 2009, the bigger elevation with QE3 in 2013, and then, of course, the hockey stick elevation with COVID QE of 2020. Also, note the introduction of mortgage-backed securities to the Fed’s balance sheet, something that began in 2009 out of the financial crisis, and whose innovation and novelty has apparently stuck.

*Strategas Research, Daily Macro Brief, Dec. 18, 2020

Quote of the Week

“Amid all the changes since I first went to Wall Street 40 years ago, basic investing principles have not changed at all. Attractive opportunities still await those who do careful research; capital structure still matters; and the best investor is a social scientist who analyses markets from both macro and micro views. The macro view sees the 21st century defined by global competition for the world’s most valuable asset, human capital.”

~ Michael Milken

* * *

I sincerely hope this has been a useful method of communicating the stark reality of where we are as an economy and how the central bank became such an important part of it. Please reach out with any questions – unpacking this more would be my pleasure.

In the meantime, this will be the last Dividend Cafe of 2020, with next Friday being Christmas Day and the following Friday being New Years Day. The first week of January will feature a very special annual Dividend Cafe edition – the recap of 2020 and our perspectives for 2021.

DC Today will continue Monday, Tuesday, and Wednesday next week, and the beginning of the week following. But in the meantime, my sincere wishes for a very Merry Christmas to you and yours. May this holiday time be filled with family and friends, the reason for the season, and abundant levels of joy and gratitude. We do not need a central bank for that.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet