Dear Valued Clients and Friends,

I started writing this week’s Dividend Cafe with a vision of just covering anything and everything that came to mind this week in the markets, and it really did become yet another assessment of much of what is going on in this Presidential administration. It was another big week of appointment announcements across various economic positions, and a lot of material is front and center right now when it comes to tax, trade, tariffs, and energy. So that is what we are doing in the Dividend Cafe today, with a few bonus nuggets flowing out of my research inspiration.

It’s a fun one today in the Dividend Cafe, but really, is it ever not fun? Off we go …

|

Subscribe on |

Some administration updates

This week President-elect Trump named:

- Paul Atkins to lead the Securities and Exchange Commission. Besides being known as a cryptocurrency enthusiast, he also advocates a lighter and more efficient regulatory apparatus when it comes to financial services. He has been a SEC commissioner before (but not director) and has been widely heralded as a good pick by many financial market groups.

- Pete Navarro as a “White House trade advisor” … People can have different takes on this one. Some who are skeptical of Navarro both ideologically and personally might feel discouraged to see Navarro back in some orbit, but another interpretation is that Navarro’s role seems to be marginal and minimal and certainly beneath some of the more formal roles Navarro sought.

- Former Georgia Senator Kelly Loeffler, as head of the Small Business Administration (SBA). This is the position Linda McMahon held in his first term (the current nominee for Secretary of Education). SBA was the government agency that administered the high-profile PPP program during COVID.

- Frank Bisignano as the Social Security Administration commissioner. Frank is the chairman of Fiserv, a massive payment processing company, and has done time at several major Wall Street banks. He is a serious finance guy with a great reputation.

- David Sacks has been named the “White House AI and Crypto Czar.” … David is a major Venture Capital investor and one of the Paypal founders alongside Elon Musk and Peter Thiel back in the 1990s.

- David Perdue, former CEO of Reebok and Dollar General and later the U.S. Senator from the great state of Georgia, has been named the U.S. Ambassador to China. This was an interesting pick for me because although Perdue has been a Trump loyalist since 2020, he has also been a traditional pro-trade-with-China businessman.

Navarro and Lighthizer

There is always a risk of over-reading things, and there is near-certainty that some twists and turns in U.S. trade and tariff policy in the months ahead will catch some market actors offsides. I continue to believe that the right play is not to believe all the worst-case scenarios will happen (i.e., universal tariffs, a price tag in the hundreds of billions of dollars, multi-dimensional objectives that transcend national security objectives and broach into rank economic protectionism), and at the same time, to not believe the whole thing will go down without messiness. There seems to be a public school of thought that either wonders why everyone is not running for the hills with some inevitable and ghastly Smoot-Hawley coming and another public school of thought that there is nothing more than a few tweets and threats coming on our way to Canada and Mexico giving us all that we want, etc.

I sit in the middle of these two schools of thought, believing that there will be noise and threats closer to school of thought #1 above, while the final policy enactment will look closer to school of thought #2 above (but not exactly).

This brings me to Bob Lighthizer, the U.S. Trade Representative in Trump term #1 who has not received a job in Trump term #2. Now, his Chief-of-Staff from Trump term #1 has gotten the job in Trump term #2, and there is no reason to believe Trump has had a significant ideological parting with Lighthizer. But Lighthizer’s public advocacy of a universal tariff is no longer considered a baseline outcome, or even close to it, and market pricing reflects that. A much more likely scenario is the following:

- Threats of tariffs with allies like Canada and Mexico to obtain other policy objectives (border, crime, drugs, etc.)

- Actual modest tariff increases (or currency concessions) with China to pacify a political base and marginally move the needle on objectives without disrupting markets, while larger policy objectives are addressed via back channels

The possibility of retaliatory tariffs from China as that plays out is marginally lower now than it was in 2018 just due to increased vulnerability in China’s economy now vs. then. They have some leverage, no doubt, and will use it (rare earth minerals, currency exchange, etc.), but if the governor of how far Trump and team can push this time is financial market response (my long-held theory), he may get more room this time as financial markets price in differences in macro conditions vs. 5-7 years ago.

So with tariff hawk Lighthizer not around, a lower-level staffer now in his former position, and a Wall Street CEO in the commerce position (Howard Lutnick) who the President-elect has said will oversee the trade representative, what does this mean that Navarro is back in some form of unofficial advisory position? My view is that he will be there to advocate for a weaker dollar as a weapon and that it will create an intellectual tug-of-war between strong dollar guys like Bessent (Treasury) and Hassett (NEC) and those who believe China’s weaker currency has been weaponized against the U.S. (Navarro, and, ummmm, Navarro). And this whole setup is where the tariff matter is about to get a lot more complicated than I fear people understand. Tariffs can impact the dollars that trade hands in global trade, and they can modify the volume of goods that move one way (import) or the other (export). But the value of the currencies involved in these transactions can do the same and serve as a response mechanism to such.

President Trump has generally jawboned for a weaker currency over the years, being at least prima facie convinced of the position that a strong dollar and weak counter-party currency have been weaponized to hurt U.S. trade and capital flow objectives. Plus, it is easier to say, “We got China to buy more stuff from us.” than it is to say: “We got them to use a stronger currency to pay for what they buy.” – you may have heard that Americans do not exactly have Ph.D’s in economics. But why this matters is that, politics and messaging notwithstanding, multiple policy levers are on the table, and multiple advisors are in the President’s orbit who are much more nuanced and economically proficient than the two people whose names appear in the above sub-heading.

And markets are grateful.

Bessent Bond Rally

My friends at Strategas Research were wise enough to start codifying the language of a “Bessent Bond Rally” – something that works because of the alliteration around the new Treasury Secretary’s last name and the word “bonds,” but also because of the absolutely perfect correlation between his appointment to the role and a massive 30-basis point drop in the 10-year yield. As the 10-year now sits around 4.17% (well below concerns of a 4.5% level just a few weeks ago) with inflation expectations also 20 basis points lower than they were a month ago, a meaningful stage is set for (a) Greater liquidity in financial markets, (b) The end of quantitative tightening, (c) More appetite from foreign investors for U.S. bonds as the yield curve un-inverts and subsequently steepens, and (d) Better tax receipts than previ0usly anticipated.

All this to say – the conditions entering 2025 are favorably set for the budget reconciliation window needed to set up a massive tax bill.

An early tease

I am very excited to write my annual white paper analyzing the year soon to be behind us (2024) and offering commentary on the year ahead of us (2025) – along with the report card as to how the paper done at the beginning of this year has held up. I will say that one big area of focus, when I think about 2025 themes, is the expected changes in the tax code. There is no question that the most meaningful element of the first Trump term was the tax bill passed in late 2017 (effective for 2018 and thereafter). The various nuances of what to expect in 2025 around tax legislation are utterly fascinating to me, and the political stakes are very high (the campaign theme in 2024 around things like “no tax on tips” was much more significant than the theme in 2016 was about “lower corporate rates”) – again, this is a political comment, certainly not an economic one. So we have the nuances of how a budget reconciliation bill will work, what can be on the table to add revenue to keep it all deficit neutral, how to meet some (not all) campaign promises, and most importantly for investors – what it will all mean for investors.

And let’s just say that some of my research this week has caused me to believe that some of the possible outcomes here are more bullish for investors than I previously believed. But there is a lot – a lot – of wood to chop.

Parlez vous Francais

A no-confidence vote in France, massive division over what to do over a broken budget, and political dysfunction that makes Marjorie Taylor Green and AOC look like college roommates – there are plenty of reasons for the recent woes in the Euro than just the re-election of Donald Trump. Will Macron resign? Is the immigration and budget dysfunction so severe in France that a political realignment is on the way? And what will it mean for European markets, downtrodden and underwhelming as they have been for many years now?

Oh. You thought I was asking rhetorically and about to answer. No. I am actually asking. And I don’t think I or anyone else has those answers right now.

Drill Baby Drill

OPEC+ announced another delay in raising their oil production quotas, this time putting it off until April. Another way of saying this is that they are [allegedly] holding back on what they otherwise would be [allegedly] producing at the pump. The estimates are that they are holding back in supply about 6% of what is needed to meet global demand. Now, why am I skeptical that there is really another 6% need for supply to meet demand and that OPEC+ is refraining in order to boost the price they achieve on that other 94%? Because oil prices are sitting at $67/barrel, down from the low-80s, where it spent much of 2024, and down from the mid-70s, where its average was in 2024. I just don’t believe supply-demand imbalances like that are met with lower prices. The more reasonable assumption here is that if OPEC+ were producing 6% more than they are, oil prices might be $60-62, not $67-69.

All of this forces a great question: Is the new Trump administration really going to get a “drill baby drill” dynamic in immediate and current oil production? Do U.S. producers want to turn up the production spigot with prices in the 60s? I don’t believe they even can, let alone will. Increased production has to become a policy mantra around capacity and around control (serving as the marginal producer for global needs, not ceding that control to OPEC+). I should be clear – some analysts I think very highly of really do believe the new administration’s commitment is to a sub-$50 oil price. But immediate increases in daily supply and prices in the 50s or low 60s? I would be shocked, but I guess I am often shocked.

Chart of the Week

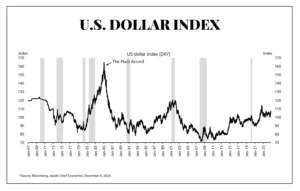

It is true that the dollar is way, way higher than it was ten and fifteen years ago (no greater way to make a fool of one’s self in financial markets than permanent dollar bearishness). But it also is true that we are hardly in the place we were when James Baker orchestrated the Plaza Accord in the 1980s. The dollar is in a reasonable place for trading partners, even a favorable one, yet also in a place where American policymakers (and certainly U.S. exporters) wouldn’t mind a little air coming out. See above.

Quote of the Week

“The dollar is fortunate in its alternatives. Europe is a museum; Japan is a nursing home; China is a jail; and bitcoin is an experiment. And that gives us the prospect of a certain robustness going forward.”

~ Lawrence Summers

* * *

I am excited to be in the Newport Beach office for the week ahead after a conference in San Francisco the next couple of days. I am also excited to take any questions you all have this weekend about all the things mentioned in this week’s Dividend Cafe. And if Pete Navarro has any questions for me, all I can say is, “It’s not personal; it’s business.”

Have a great weekend. This is a magical season of the year.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet