Dear Valued Clients and Friends,

I have said many times that the goal of Dividend Cafe is for its message to be aligned with what I believe our clients most need to hear. If that message is a benefit to non-clients, even better. But the mission here is to deliver evergreen, timeless, valuable messages about markets and investing and the economic backdrop to both that aligns with client interest and need. Sometimes that message is connected to the events of the week, but not often. This week, it is.

I only have a few comments about the election itself as a matter of politics and the nation because I have too many other comments about market reaction and various investing ramifications. Plus, it is a delicate time with a lot of folks still processing things (some very disappointed, some concerned, some jubilant, and perhaps many just shocked), and I don’t wish to create any additional feels on the matter. But I do have to address it, and then align the events of this week with what is practical and necessary for investors to understand in the aftermath.

So, to that end, I work – empathetic, civil, objective, and most of all, aligned with what is important for our clients. Jump on into the Dividend Cafe…

|

Subscribe on |

Politics redux

I write in other venues about my personal political beliefs. I do not hide my personal political beliefs in this venue, and in fact am quite transparent about what I believe and why, but the Dividend Cafe does not exist to promote the Burkean political vision and Tocquevillian cultural vision I believe in. Avoidance of politics is impossible for one truly dissecting markets and economics, but it is not the primary objective.

Still, it is obvious that this was a controversial election, a divisive one, and there exists many strong opinions about both candidates and the outcome. My generally negative views about “all of the above” made me less partisan in this cycle than many of my friends, less emotionally connected to the outcome, but also at risk of not empathizing with those who felt very strongly (one way or the other) about various outcomes. I have worked very hard the last 8-9 years to understand why people feel the way they do. I often disagree with folks in the current political environment, but I understand (usually) where they are coming from.

So it is not without sympathy for those who don’t want to hear it right now that whether the candidate you supported won or lost, I am confident the American experiment will continue. And I absolutely promise you from the bottom of my heart that had the other candidate won, I would be saying the exact same thing.

Growth by any other name

We know by now that markets responded to the election outcome by rallying > 1,500 points in the Dow the next day. Bond yields flew higher. All risk assets rallied. And it felt rather clear that markets were taking a Trump victory a a hugely bullish sign. Four comments are in order here to further unpack:

- Not all, but some, some, of the rally was related to the elimination of uncertainty. Simply put, there was a quick outcome, there was a non-controversial outcome (in terms of election results and clarity), and there was a consensus (between White House and Senate). Not having 2-3 days, 2-3 weeks, or 2-3 months of ambiguity created relief and relief creates rallies.

- Taxes are a cost that come from profits. All profits are after-tax profits; they don’t count as profits when they are pre-tax; the term “pre-tax” profits just means “I have one more step of math to do.” So in a very basic sense, without considering any new legislation at all, “profits” are presumed to have already gone up after the election because even apart from new legislation, there were a good portion of 2017 tax cuts set to expire at the end of 2025 that markets now (wisely) believe are not going to go away. In other words, a bunch of “profits” went up, so markets discounted that in.

- The market believes there will be additional boost to profits in the form of additional tax relief. I do not know the details, and neither do markets, but with the new Presidential administration and the composition of the Senate, markets expect reduced corporate income rates, combined with some hodgepodge of other benefits (in a budget reconciliation package). Details to follow (for me, and for markets).

- And this is the final one, though not totally unrelated to #2 and #3: Markets clearly expect a more favorable nominal growth outcome as a result of this election. Less tax burden, yes, but less regulatory burden, as well. Again, without a comprehensive feel for details, markets believe that the general policy portfolio is a recipe for higher growth, and that boosted bond yields and cyclicals and the dollar in a meaningful way this week.

A tariff by any other name

I now have to do the “special tariff issue” I teased up a couple weeks ago. I have a lot to say on the subject, most of it quite critical, and yet I want to objectively make the case for what tariffs are, what reactions they create, and what I expect out of this situation. It is an area where I have been moved to the minority position in today’s economic right, but that is because they changed, not because I did. But as you will see when I do this special edition Dividend Cafe, many more than just myself are still holding the line on the benefits of free trade and comparative advantages – some are just more vocal than others.

What you will not hear me say is that the U.S. should be ignorant or naive about supply chain dependencies on other countries. Where there is a need to have contingencies, to protect national security, and to avoid significant economic disruption, I vehemently favor domestic solutions. But that has nothing to do with tariffs! We don’t say, “we need this and this on-shored for U.S. safety, but if we collect a tariff it can still be offshored and keep us unsafe.” That is incoherent. So the need for coherent plans to protect us from supply chain disruptions or national security threats are not related to the tariff question.

I offered other caveats in pre-election Dividend Cafe issues about the ambiguity around tariffs as policy and tariffs as negotiating tactics. This is not the end of this subject.

Drill baby drill?

The broad narrative about a Trump administration posture on U.S. energy production is essentially an accurate one: He does value U.S. energy independence, he does believe in increased U.S. production (which follows more drilling), and he is supportive of the U.S. becoming an exporter of oil and especially gas to the world. And there are investment components to this that matter – namely, approval of more LNG export terminals, as well as broad support for more pipelines where federal approval is needed.

But should we really be expecting that something happens day one that pushes our 13.5 million daily oil barrel production up another one million barrels? Is it really, right now, a governmental factor that has oil at 13.5 million barrels (which is an all-time record)? Would $70-72 oil incentivize something that much larger than what is already an all-time high – with OPEC+ lingering in the shadows having held their own production down? I have to tell you to level-set the expectation – that is not going to happen. More approvals, less red tape, more favorable backdrop, and in more granular aspects of the energy ecosystem (LNG terminals), yes, the administration is going to be pro-energy. But the reason crude production is where it is and not higher right now is entirely related to the producers themselves. Capital discipline has been the post-COVID name of the game in the oil patch, both in the midstream and upstream. The President is not going to change that.

So does that mean no benefit to the bottom line of upstream energy companies? Not so fast. Deregulation is about more than just more production and volume! Lower regulatory cost and burden equals higher profits, too. This can’t be forgotten! I expect higher margins within status quo production to be a likely outcome from the new administration.

A post-war re-build?

Is President-elect Trump serious that the war in Ukraine is going to come to a resolution before he even takes office, or within 24 hours of him coming to office? Let’s do our best to do two things at once here: (1) Accept that the 47th President of the United States is fond of hyperbole and exaggeration; and (2) Understand that there is a not-slim chance that there will now be a brokered end to the war. I am not saying this with any assumed acceptance of or agreement with what will come to be, but merely descriptively stating that the posture Trump is likely to take seems more likely to force Ukraine, NATO, and even Russia to find some off-ramp. The way this comes to be may or may not be something I like in the end, but (a) who cares what I think, and (b) that is not my point. My point is that if some concession is given by Ukraine to the country that unlawfully invaded them to stop the invasion, I suspect most are going to feel the need to take the off-ramp.

So why do I bring this up? I do not believe Ukraine is getting re-built on the cheap. The elements involved in a re-build of a nation are not billions of dollars but hundreds of billions if not trillions. I can’t comment on who is going to pay for it, but I can begin to think about who is going to get paid.

How to think about the results?

There is much that can be said about President Biden’s decision to run again, the way the media handled his physical and cognitive condition, the way things shook out for the Democrats this summer, and the appointment of Vice President Harris as the replacement candidate without a primary process. I have political opinions about it all and you likely have political opinions about it all. What I would say is that anti-incumbency is the major theme of this year’s election, and that is true not just in the United States but in Japan, the UK, the European Union, and more. Call it a belated COVID reaction, the aftermath of inflation, the aftermath of immigration decisions, or call it a response to any of the issues that most frustrate you. Reasonable men and women can disagree on what caused an anti-incumbency wave but the fact that one is at the heart of this year’s global election results does not seem controversial.

Personnel is Policy

We know that President Trump has appointed his campaign chairwoman, Susie Wiles, as his new White House Chief-of-Staff. I take this as a very solid pick of a person with significant experience leading very difficult people. In the weeks ahead we are going to hear more about key staff positions, advisory positions, and cabinet positions. And yes, we are going to hear more about the new Senate Majority Leader (one would think the pick between Sen. John Thune and Sen. John Cornyn would come down to who Trump chooses to back). In the meantime, a few thoughts:

- I do not believe some of the chatter about Robert Lighthizer, the U.S. Trade Representative for Trump’s first term, as a potential Treasury Secretary now. I do understand his name to be in contention for Commerce Secretary, and we shall see where this goes in the days ahead. It will have a lot to do with President-elect Trump’s seriousness about certain protectionist tariff proposals.

- I was interviewed by Pension & Investments magazine yesterday about the Treasury Secretary opening and rather than re-invent the wheel I will just quote exactly what I said there:

David Bahnsen, chief investment officer of The Bahnsen Group, which has more than $6 billion in assets, thinks Trump will pick hedge-fund manager Scott Bessent as his Treasury Secretary. Bessent, Bahnsen noted, is “ideologically grounded, smart, experienced, and suited for the job.”

Trump has praised Bessent, the founder, chief executive officer and chief investment officet of macro investment firm Key Square Capital Management and a top fundraiser for the president, as “one of the most brilliant men on Wall Street, respected by everybody.”

Bessent was formerly a supporter of Democrat Al Gore and was long associated with billionaire investor George Soros, serving as Soros Fund Management’s chief investment officer from 2011 to 2015.

“I do not believe Jamie Dimon will get consideration but I would love to see that (happen),” Bahnsen added. “I pray it will not be (Robert) Lighthizer, and hear through my sources he is more in conversation for (the) Commerce Secretary (role). (Lighthizer’s) protectionism would be undesirable in the Treasury Department.”

Lighthizer, who served as U.S. trade representative during Trump’s first term, is reportedly telling money managers on Wall Street that Trump will implement his aggressive tariff regime immediately after taking office.

As for billionaire hedge fund manager Paulson, Bahnsen said “he was quite supportive of (Trump), but I do not see him as one having the political chops for this position.”

- Chairman Powell reiterated yesterday that he will not resign if the President-elect asked him to and his term ends in May 2026. So in 18 months, the President will be in a position to nominate a new Fed chair. Kevin Warsh is both who I would most like to see in this role, and who I expect to see him appoint. I also would love to see Judy Shelton re-surface for a Fed governorship (she lost her bid in 2020 when Sen. Grassley contracted COVID and the vote failed by one vote). But fed appointments are not going to be on the table in the next sixty days, so we can move on.

- The National Economic Council Director was an important and empowered role in Trump’s first administration. Gary Cohn served in it for a year and did a lot of the driving on the high-profile Trump tax cuts of 2017. Larry Kudlow served in the role the final three years and was a remarkable counter-balance to some of the more nationalistic and protectionist voices, and worked closely with Secretary Mnuchin to drive policy coordination. I am looking at Kevin Hassett as a possible name this time around, but there are no less than six other names being circulated, so I will sit tight while this resolves itself.

- The current SEC chair, Gary Gensler, is most certainly going to be gone. Who he would bring in as the replacement is unclear.

Some other odds and ends

- I don’t think any TikTok ban is happening any time soon

- Those who view crypto as an “asset class” are going to like the newer approach to “regulation”

- I do believe he will jawbone the Fed if he feels he needs to, and I do not say that as a good thing. However, because I believe the Fed is in the early innings of an easing cycle with monetary policy, my guess is that he is going to coincidentally like Fed policy for some time into the future.

- This list will be even longer next week, I assure you, but it is press time!

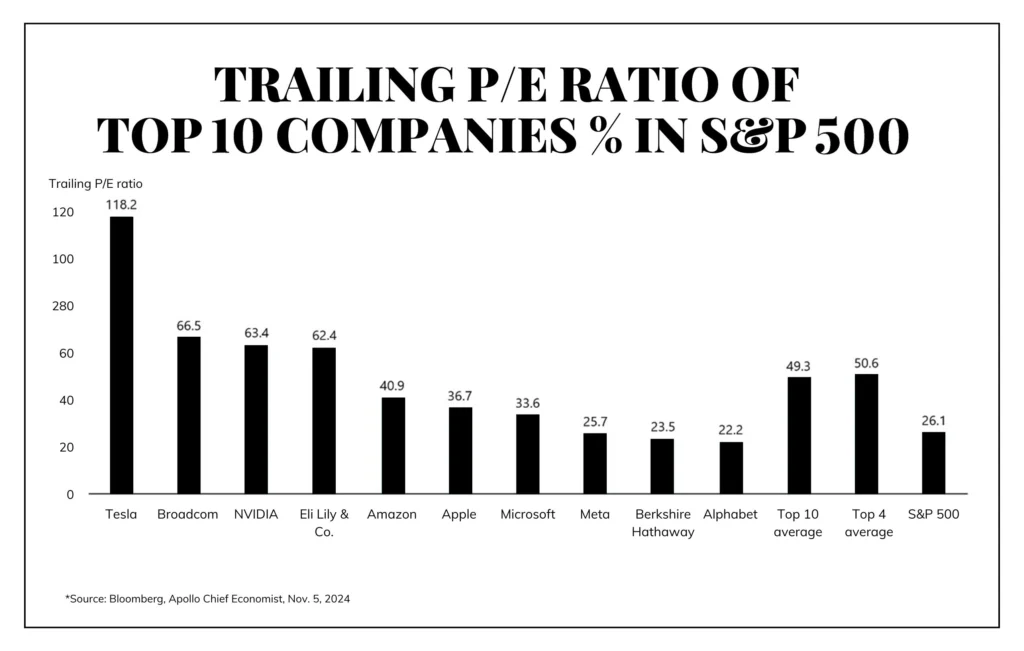

Chart of the Week

Despite all the election talk this week, we still have this going on. Note: This was BEFORE this week’s +2,000 point move higher in markets!

Quote of the Week

“[Economics] has a humble but all the more useful mission. Amidst the passions and self-interest of politics, it must assert the logic of things, it must bring to light all the inconvenient facts and relationships, must put them in their proper place with dispassionate justice, must prick all the soap bubbles, must unmask illusion and confusion, and must defend before all the world the proposition that two and two make four. It should be the one science par excellence which disillusions, which is anti-visionary, anti-Utopian, and anti-ideological. Thus, it can render society the priceless service of cooling off political passion, of combating mass superstition, of making life hard for all demagogues, financial wizards, and economic prestidigitators.”

~ Wilhelm Ropke

* * *

I am very likely picking up next week where I left off this week. I have a dozen more papers to read on various aspects of policy in the aftermath of the election, and I am participating in multiple conference calls per day related to the new administration. There is just more to say than could be fit in this week’s Dividend Cafe, so expect a Part 2 next week. In the meantime, reach out with questions, and by all means, enjoy this weekend with your loved ones. USC has no chance of losing a game in the final minutes this week (they don’t play). The weather is positively gorgeous. And we are going to have a peaceful transition of power. We do remain the best country on God’s green earth.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet