Dear Valued Clients and Friends,

By the time you are reading this, the first half of 2023 will be complete. I can’t put exact market figures here because I am writing this middle of the market day, Thursday the 29th, so the precise finality is a day and a half away. But the general themes that made the first half of 2023 what it was are quite clear, and I think you will find this “2023 halftime report” Dividend Cafe to be quite provocative. And what else do you hope you find in the Dividend Cafe if not “provocative” …

So let’s jump into the Dividend Cafe and see what 2023 has delivered thus far and what might be on the horizon for the second half!

|

Subscribe on |

Not expected

I would say that the surprises of the first six months of 2023 were, in no particular order:

(1) The lack of economic punch out of China’s re-opening

(2) The regional bank failures created very little collateral damage

(3) The lack of strategic petroleum reserve activity

Allow me to tackle each one individually …

(1) The lack of economic punch out of China’s re-opening

China’s elimination of COVID lockdowns did come way too late, and there was ample precedent from other countries’ re-opening to believe a demand surge would follow. That normalization was widely assumed would lead to increased global activity economically and particularly add to global energy demand. What has constrained that scenario from playing out? My initial thesis was that before the normalization would happen on the other side of lockdowns, everyone would first have to get COVID, as has been routine and needed everywhere else. In other words, there would be a lag as the lockdowns delayed the inevitable herd immunity, but the first event would be a mass infection of people that would then give way to the economic activity predicted (so a delay but not a deferral).

I am now convinced by Louis Gave’s argument that on the other side of re-opening, the challenge China has faced is more macroeconomic – that is, the construction sector collapse has failed them more profoundly than we anticipated. We’re used to thinking about construction as a somewhat small part of total economic output, with relevance to materials, jobs, etc. But in China, construction is also necessary to provide capital for basic infrastructure spending. It is far weightier in their economic picture. And that sector has very little juice right now, creating a much bigger trickle-down effect than would be the case here in the States.

Now, China did not spend trillions to pay their laborers to not work during the lockdowns or pay their businesses to not do business during the lockdowns, so that represents less sugar-high now but less debt-drain on growth later.

I don’t have strong opinions on where China’s growth goes from here and am open to any number of outcomes from here. What I am more interested in now than 2023 growth in China is the fact that their money supply growth is skyrocketing, their velocity is collapsing, and I feel like I have seen this movie before. If China’s central bank heads to the zero-bound, we will be adding a significant new chapter to the global Japanification book.

(2) The regional bank failures created very little collateral damage

If you had “failure and insolvency of Silicon Valley Bank, First Republic Bank, and Signature Bank” on your bingo card at the beginning of the year, congratulations.

If you also had “such failures to be followed by positive market returns in the 90 days to follow,” I would say hold on to your strategy for bingo cards!

Ultimately, the AI surge, the lack of a recession, and market confidence in a Fed getting forced into future accommodation have kept markets healthy despite this big vulnerability in the banking sector. And, of course, the contagion of a run on dozens or hundreds of small/regional banks was largely curtailed by the FDIC intervention when Silicon Valley went down.

(3) The lack of strategic petroleum reserve activity

WTI Crude oil prices have stayed largely around $70/barrel (a few dollars lower and a few dollars higher) all year. That is not the surprise – rather, the surprise is that with such pricing level the SPR not coming into the market too aggressively has been a huge surprise. I think it is a very poor policy decision, but I am not surprised by things just because I disagree with them. Rather, it is genuinely surprising.

That, combined with the soft demand in China’s re-opening discussed above, the heavy amount of Russian oil going to Asia, and a better winter (globally) than had been expected, oil and gas needs (and price levels) have stayed rather contained despite OPEC+ aggressively curtailing production levels.

Top heavy much?

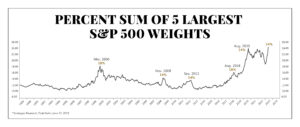

So far in 2023, the top ten stocks of the S&P 500 have accounted for 86% of the return, the highest in history that the top ten have ever accounted for. In second place was 2007, with 79%, and next was 2020, with 59%. After that was 1999 with 55%. 2021 saw 45%. So we know what all those other periods had in common – a few concentrated big tech companies representing a highly disproportionate amount of market return for a period, followed by a not-very-happy ending across the index (2008, 2022, and 2000, to be precise). There is an unsustainability to this, a historical precedent, and just general math. But timing it all is still impossible.

The top five stocks are currently 24% of the S&P 500, the highest in history.

Dividend Aristocrats

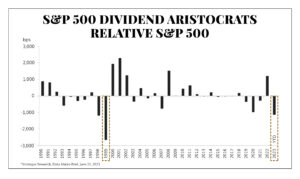

Even as the dividend growers smoked the S&P 500 at-large last year, the price performance of the tech-heavy S&P has not favored the dividend growers in the first half of this year, accentuated by the Artificial Intelligence (AI) and big tech play that lay behind the S&P’s move. Suffice it to say, this is something I love to see – and I mean love – for reasons I hope are clear on this chart.

In 12 of the last 23 years, dividend growers have performed better than the overall market. 10 of the last 23 years, the overall market has performed better than the dividend growers. In zero of the last 23 years, have I cared at all? Over 23 years, the market is up +305%, while the dividend growers are up +853%.

And the volatility taken on to achieve such? A 15.37% standard deviation for the S&P 500 but a 14.18% level for the dividend growers. So 10.3% per year versus 6.3% in return this new century, with less volatility and 10-20% improvement in downside performance each of the three great drops (tech crash, financial crisis, and last year).

Dividend growth. Always and forever. To that end, we work.

Defensives

Utilities have had a rough go this year (down -8%), Health Care is in the same boat (down -3.9%), and Consumer Staples have not had a great time either (down -1%, though we have better things to say about the Consumer Staples we own). Two things are true at once: We don’t believe in timing the weight of cyclicals vs. defensives, as if such a thing were predictable whatsoever, and there are a good portion of dividend growers in the world of defensives. But when it comes to the latter, we do not own those names because they are defensives, but rather because they are dividend growers. And it makes sense why more dividend growth names may be found in the defensives space than otherwise.

But the best practice is to let dividend growth and bottom-up analysis drive selection and to avoid the temptation of adding another layer of human fallibility to the mix.

The Fed – Always the Fed – Fed, Fed, Fed, Fed

The Fed is not a central bank. It is not a lender of last resort. It is an institutional celebrity and for most, an institutional messiah. It is viewed as a deity by politicians and media, and the institution itself has done a masterful job of leveraging the complexity and incomprehensibility of what it does to pedestrians as cover for an ever-growing domain of responsibility.

The current story is that they have “paused” (they didn’t hike rates last month) but that they will “resume tightening” in the next FOMC meeting, which presumes that a pause at these levels is not, itself, tightening. But it is.

Think of a Fed pause like getting your heart rate from 120 to 170 while exercising, and then you stay at 170 for a while. Does anyone want to say that the “pause” at a 6.0 speed on the treadmill is not “conditioning” just because your heart rate is done climbing on the way up? Sure, as you start going down to lower speeds, eventually walking, it is restful and a legitimate “slow down” activity. But the “pause” in one’s running speed at the high level where your max heart rate is reached and achieved is hardly restful or relaxing. Likewise, if the Fed were to just leave the rate where it is, it would still be “tightening” in every rational sense of the word.

I do not know when they stop, but I think there is a 51% chance they already have. Regardless, the questions around when they begin cutting are more media banter than market substance, as we have seen for some time.

The Debt Ceiling Debate and the End of Civilization

The first half of 2023 was supposed to lead to intransigent Republicans destroying the world’s financial system by causing the U.S. government to default on its debt. But you will be shocked, shocked, to hear that, ummmmm, the debt ceiling was lifted, some modest concessions achieved, and no such catastrophe took place, much to the chagrin of many whose business model love narratives of political drama.

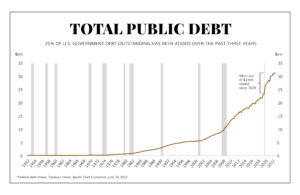

But is the ongoing drip of excessive debt going better? We are spending $2 billion per day in interest right now on the federal national debt. We were spending $1 billion per day just two years ago. So the cost of debt service is up by double in just a couple of years.

And we added 25% to the total national debt in just the last three years. To recap, we doubled the national debt from 2000 to 2009. Then over the next decade, it went up 150%. And now $8 trillion has increased in just three years.

So we took 232 years for our first $8 trillion of national debt and three years for our last $8 trillion.

Shiny Objects 101

A general rule of thumb for those who remember day trading commercials in 1999 and Super Bowl crypto commercials in 2022 … When the celebrities start jumping into funds and ventures and media noise etc., well, there is usually a very specific thing going on, and some may call it a “shiny object.”

*Wall Street Journal, June 7, 2023

From NFTs to now AI galore, pop culture has a way of feeding on shiny objects that helps separate the wheat from the chaff.

Did someone say recession?

The prospects of a recession have been discussed ad nauseum this year, and I am not sure we have any more clarity now than we did six months ago. I know the Fed wants a recession, and I know a lot of people believe one is needed to counter inflation (they are wrong on two counts there). And I know more people still want one for various political points. But what should we actually expect here apart from aspiration?

The unemployment rate and overall health of the job market have been the most cited counter to recessionary arguments, and I think it is legitimate. The counter to the counter has been that unemployment is always low before a recession starts but goes higher after one begins. All fair enough (but if one wants to be just a tad honest, the recessionistas were screaming that same thing 18 months ago – literally, a year and a half ago – and here we are).

But I think the metric that will ultimately tell me if we are having a recession and how deep it will provide to be is less obvious than joblessness. High-yield spreads right now are 415 basis points, and I have been obsessed with this metric since 2007 or so (I learned the hard way how problematic overly tight spreads could be). At 415 wide (that is, poor credit quality bonds are offering 4.15% more than Treasury bonds of the same maturity), we are neither at “tight” levels reflecting apathy about risk nor are we anywhere near recessionary spread levels. The last three recessions averaged a 590 basis point spread going into a recession.

If the spreads widen, I change my mind. If they don’t, I don’t. What do you do?

Opportunities

I do see a lot of factors converging in ways that indicate a delightful opportunity for emerging markets in the second half of the year. Lots of liquidity is building up in China. South America has strengthened fundamentally in numerous ways. The valuations are very low (absolutely) and record lows (relatively). A Ukraine rebuild will be coming one of these days.

Politics

Did you know next year is an election year? Have you heard a huge increase in the theme of “Bidenomics” from the Democrat Party in the last couple of weeks? Have you heard a big messaging focus on the economy from President Biden and his team? Should we believe the Fed is going to press harder on tightening as we go into the 18 months building up to the election? Just asking.

Second-half questions and comments:

By way of recap:

(1) The ongoing debate about a soft vs. hard landing from Fed tightening will remain. I am positing that credit spreads will predict and reflect the answer.

(2) The hand-wringing over commercial real estate is massively over-wrought, with defaults ending up being much less than people expect and recoveries being much higher than people expect.

(3) I don’t care if it prices itself in 2H 2023 or not, but emerging markets are generationally dislocated from fair value.

(4) A bet on the big getting bigger and expensive getting more expensive is not a bet we want to make.

(5) The risk that the Fed will break something and things many are currently complacent about will suddenly reverse is not minimal. The Fed is trying to break something. Maybe they will. No one should be arrogant here. On the other hand, see the “Politics” section above, too.

(6) I don’t see residential housing activity picking up just yet, but I do see us closer to the end of this “non-activity” cycle than we were six months ago (actually, we are six months closer than we were six months ago, to be precise). When mortgage rates come down, I expect more buyers and sellers to reach a price equilibrium.

Quote of the Week

“Just because we don’t understand doesn’t mean that the explanation doesn’t exist.”

~ Madeleine L’Engle

* * *

Not a bull, nor a bear, just a value-driven, short-term agnostic, dividend growth obsessive – that’s who we are. There is nothing happening right now we haven’t seen before, and yet some things are not what one might have expected six months ago. The same will be true in six months, I predict.

In the meantime, smart investors will focus on discipline and behavior. To those ends, we work!

Happy Birthday, America!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet