Dear Valued Clients and Friends,

Greetings from New York City, where I am two hedge fund meetings away today from being done with a week of extraordinary meetings, insights, and collaboration with our portfolio management partners. Some key takeaways are being summarized for next week, and a deliverable will be made available. More importantly, some really actionable decisions are in process as our Investment Committee downloads some of the major themes. It has been everything I hoped it would be this week, and more.

It is a shorter than normal Dividend Cafe this week because of the meeting load (and post-meeting download time). But I think what I do today you will find useful and valuable, as I use a Q&A format to answer a few key questions about the current investing state of affairs.

Let’s jump into the Dividend Cafe …

|

Subscribe on |

What is your general take on the market?

I do believe that both the short-term and intermediate-term are likely to be choppy and “range-bound” (in terms of broad market indices. I simply believe that in the short term, the key dynamic is uncertainty – that is, uncertainty about the impact of Fed policy on economic conditions, uncertainty about economic conditions themselves, and uncertainty about the impact on the earnings environment. The downside uncertainty is all about earnings, economic growth, and Fed interactions; the upside uncertainty is all about what has been priced in and when markets began to pre-price a turn (ahead of the actual inevitable turn). It will not be an easy needle to thread, and anyone trying to time and anticipate is simply trying to guess lucky …

But note that I said intermediate as well. Why do I see a more prolonged period of a more flattish market beyond the current short-term bear market?

Simply put, math.

For the last ten years, earnings per share grew +116%. That is really good (8% per year, in fact). But stock prices were up +279% (S&P 500). You got sales growth of 49%. You got margin expansion of 45%. And you got a dividend yield of a whopping 2% per year. So how do you get a 300% return (over 16% per year) in a period when earnings are up 8% per year and sales are up 4% per year?

Multiple expansion was up 76% over the last ten years. That was the primary story of the market. Now, it was not the only story. Had multiples not grown at all, earnings were still up nicely (more than revenues were, as profit margins grew nicely, too).

Do I see revenues growing in the decade ahead? Sure, though not like last decade. Do I see profit margins expanding from current levels? Probably not, and in fact, I imagine they contract some. But I am happy to pretend. Will earnings grow this decade? Sure, but no way at the pace of the last decade. So, will P/E ratios (multiples) grow?

Let’s just say that our answer is “no” – and that you if your investment thesis relies on believing that a 17.5x multiple will go up to 20x or higher, you are in very risky terrain.

So how will that play out?

It will not be a straight line down for index investors, and it will not be a straight line up; there will be periods of up-and-down movement for the index (largely sentiment-driven, but also around the particulars of earnings, margins, and resultant multiples. A more active approach and tactical judiciousness will be wise unless one believes the risk-free rate is going from 4% to 0% (and staying there).

And by the way, would a 4% to 0% move in the bond yield (Fed Funds rate) automatically mean the good times are back? Well, it would certainly re-rate stocks a bit and theoretically juice valuations. And anything that stops yields from going higher (even apart from them going lower) at least is a prerequisite to equity market stabilization, I reckon. But, what drives the risk-free rate from 4% to 0%? Something really, really bad. Right? A tail-risk (black swan) event? A complete collapse of risk assets? A fully baked-in expectation of no economic growth for a decade?

In other words, if God forbid the risk-free rate moved down like that, I imagine what is gained in valuations is lost in revenue growth (and then some).

But …

If bond yields level (not collapsing under bad circumstances but not going higher still), you do get range-bound, flattish markets for a sustained period, unless revenue and profit growth just somehow blows us out of the water. But in a period like that the lower-valued parts of the market with CURRENT sales and earnings growth (versus expectations of FUTURE sales and earnings growth) do quite well. It was what we mean by “short duration” vs. “long duration” stocks, and the more popular parlance is “value” versus “growth.”

The non-indexable solution

Indexing the entire market when multiples are not expanding becomes tough. A more active focus on individual companies of a shorter duration sticks out, and yes, I obviously am going to say now, “doing this with those companies who reaffirm their CURRENT revenues and earnings at a reasonable valuation by PAYING YOU makes the most sense.” That is not me talking my book (well, maybe a little) – it is me speaking the truth (I don’t speak it because it is my book; it is my book because it is the truth).

But dividend growth can’t be indexed. It is dynamic. It is subject to fundamental change. Why am I anti-indexing for the years ahead?

- It presupposes multiple expansion that is almost certainly not in the cards

- It requires other mathematical inputs after this last decade that may be way too pollyannish to build an investment policy around

- It fails to pursue what is most important – proactive procurement of and protective monitoring of particular fundamentals (cash flow growth, valuation, capital return, etc.)

What side dishes with the main course?

Very few people have a 100% equity allocation, and very few people should. The needed asset allocation overview to holistically design a suitable portfolio is specific to one’s timeline, liquidity profile, risk appetite, income needs, tax status, and all sorts of specifics that drive an optimal portfolio construction. I will argue that coming out of the last decade has not left things rosy for index equity investors, but it is hard to argue that some of the side dishes have become more appetizing.

Small cap – more beaten up than the S&P and Nasdaq, with a historical precedent of leading out of recessions

Emerging markets -with a dollar back to early 2000’s levels, when the decade that followed so, emerging markets more than doubled, even as all other equity categories run in place for a decade

Boring bonds – yields that now pay you, and either offer capital appreciation on modestly declining yields or at least an improved risk-reward trade-off, as any capital depreciation now has to offset a much higher coupon to create any net losses

Credit – a volatility profile that has enhanced the expected rate of return

Alternatives – a world of improved options in the private wealth space

Chart of the Week

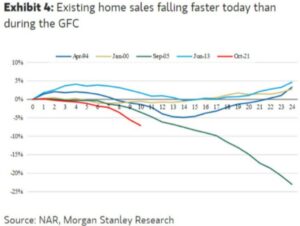

Maybe this time, it’s different, and a collapse in volume will not lead to a drop in prices. But intuitive logic might suggest some price recalibration is inevitable with this kind of transaction decline.

Quote of the Week

“You can’t live a perfect day without doing something for someone who will never be able to repay you.”

~ John Wooden

* * *

I need to really elaborate on all these side dishes and the main course in the weeks and months ahead, but I am not sure I have ever been more excited for an investing period ahead. Why would I be so excited when my call is for choppy and flattish broad markets?

Because we don’t invest in broad markets, we invest in companies. And this environment favors the selective. It favors the disciplined. And it favors the proactive. To those ends, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet