Dear Valued Clients and Friends,

If you are sick of hearing about tariffs, imagine how I feel. In fact, imagine how a company buying steel right now feels. But as much as I want to write a Dividend Cafe saying, “this week massive tax reform was signed into law by the President,” and as much as I still see a path to such a Dividend Cafe coming in the future, right now the major economic story continues to be plans for tariffs. This week, I will try to take on some of the recent developments, unpack expectations for the week ahead, and make sense where I can of the economic and market impact. Some of it will feel critical, and some will not, but all of it is presented with all the objectivity, integrity, and candor I can muster.

And I hope it is informative in a way that is useful.

So, jump on into the Dividend Cafe and get ready for a wild week ahead.

|

Subscribe on |

Just Setting the Table

- Copper hit a record all-time high this week.

- Steel prices are up +30% since the inauguration.

- Lumber prices are up +18% since the inauguration.

All of these things matter to everything I am going to be talking about in Dividend Cafe today.

Will They, Won’t They?

I want to point out a quote that caught my attention a couple of days ago:

“I’ll probably be more lenient than reciprocal [regarding tariffs], because if I was reciprocal, that would be very tough for people.”

– President Trump, Tuesday, this week (March 25)

I’ll first acknowledge the politics of framing tariffs around “reciprocity” and “fairness” – the language of “they do it to us, so it is only fair we do it to them” has a political wisdom to it; it sounds good.

But mechanically, there is some reversal of agency here. A foreign country does not charge tariffs to us – they charge tariffs to their importers. So how would it sound politically if we accurately described it this way: “Because [some country] is taxing their importers and citizens on XYZ product, we are going to charge our importers and citizens on ABC product.” It has a different ring to it, doesn’t it?

The President continued:

“I know there are some exceptions, and it’s an ongoing discussion, but not too many exceptions, not too many.”

Markets rallied Monday on the belief and hope that some sort of fold was in motion and that the worst-case expectations were improving. Then, on Wednesday night, the President announced his plans for the auto sector.

Used Cars En Vogue Again

President Trump’s announcement Wednesday night that there would be a 25% tariff on all automobiles and auto parts not made in the United States was a shock to some and a nothing-burger to markets.

Volvo, Mazda, and Volkswagen make less than 20% of their combined vehicles in the United States.

This is supposed to hurt foreign automakers but help U.S. automakers, right? General Motors was down by over -6.5% on the news, and Ford was down by -3.2%. Ferrari announced a 10% increase in their prices to offset the tariffs. Some foreign automakers were down; some were up, but the broad market indices in the U.S. shrugged it off. Why?

Here is the thing: Will these tariffs bring back auto parts manufacturing onshore? And wasn’t there, presumably, some cost savings in why at least some part of the manufacturing was offshore, to begin with? It would seem as a matter of basic economics that there are two possibilities here: One is that the tariffs hit, the same manufacturing in the same places continues as is, and the cost of the tariffs has to be added to the price of the car; or secondly, perhaps the tariff impact incentivizes more onshoring of production – and then, the cost adjustment in that gets added to the price of the car. In option one and option two, there is a cost increase to the purchaser of the car, who is a U.S. economic actor.

How can you avoid these cost adjustments as a car purchaser? Well, I guess one could buy a used car! Did anyone notice what car stock did well on Thursday?

Visible and Invisible Effects

Will some new jobs be created in the United States if we use a tariff policy to manufacture more auto parts in the United States? I am skeptical, but I do not believe it is impossible. With the stars lining up the right way, it could happen that some new jobs are created out of it. But what else happens? Are other jobs, and even more jobs, lost? As Peter Boockvar pointed out, we employ 17 million people in our country in travel, leisure, and hospitality. What is the effect to their jobs from declining foreign tourism? What export manufacturing jobs are lost at the expense of these other jobs? What is the trickle-down effect in other sectors from changes in purchasing power as these cost adjustments are priced in?

And then this one. What exactly do we expect manufacturers to do, knowing that the stroke of an executive pen does these policies, and a new President comes every four years? How do capex manufacturing decisions get made around policies that might change in four weeks, and certainly in four years? What is the lasting impact on productivity in such a scenario? Some of the onshoring investment will take 4-5 years and certainly cost many billions of dollars. Is it realistic to expect immediate action?

Slowdown Fears

This week, the media made a lot of hay around the consumer confidence number hitting a 12-year low. I am not suggesting there is nothing there or that there is no connection to the tariffs at all, but I simply don’t accept at face value that the consumer is “pulling back” (yet). That U.S. consumers frequently say “we have bad sentiment” or “we have low confidence” right before they run to the mall and max out their credit card is not new. That consumers may feel sentiment pressure around other factors besides tariff threats is also quite possible. It is hard to know how many consumers are (a) Paying attention to tariff news, and (b) Understanding it enough to let it impact their decisions, and (c) Actually having it impact their spending … But even if you look beyond my low regard for consumer sentiment surveys, here is what we do know this week:

Non-defense capital goods orders fell -0.3% in February (month-over-month) when a +0.2% gain had been expected, and when orders had been up +0.9% in January. Is one month’s disappointment and contraction a clear and present danger? No, there are always outliers and anomalies in data sets that can not be identified as such without hindsight. But here is the part that feels like some prima facie affirmation … The Dallas Fed this week provided a lot of commentary from banking customers in their region – and yes, we are talking about oil and gas/exploration and production – a sector in a favorable place in the new administration’s priorities if ever there was one. I had to edit a lot of what was in the report for length, but the following are verbatim comments from survey respondents:

- The key word to describe 2025 so far is “uncertainty” and as a public company, our investors hate uncertainty. This has led to a marked increase in the implied cost of capital of our business, with public energy stocks down significantly more than oil prices over the last two months. This uncertainty is being caused by the conflicting messages coming from the new administration. There cannot be “U.S. energy dominance” and $50 per barrel oil; those two statements are contradictory. At $50-per-barrel oil, we will see U.S. oil production start to decline immediately and likely significantly (1 million barrels per day plus within a couple quarters). This is not “energy dominance.” The U.S. oil cost curve is in a different place than it was five years ago; $70 per barrel is the new $50 per barrel.

- First, trade and tariff uncertainty are making planning difficult. Second, I urge the administration to engage with U.S. steel executives to boost domestic production and introduce new steel specs. This will help lower domestic steel prices, which have risen over 30 percent in one month in anticipation of tariffs.

- The administration’s chaos is a disaster for the commodity markets. “Drill, baby, drill” is nothing short of a myth and populist rallying cry. Tariff policy is impossible for us to predict and doesn’t have a clear goal. We want more stability.

- The administration’s tariffs immediately increased the cost of our casing and tubing by 25 percent even though inventory costs our pipe brokers less. U.S. tubular manufacturers immediately raised their prices to reflect the anticipated tariffs on steel. The threat of $50 oil prices by the administration has caused our firm to reduce its 2025 and 2026 capital expenditures.

- I have never felt more uncertainty about our business in my entire 40-plus-year career.

- Uncertainty around everything has sharply risen during the past quarter. Planning for new development is extremely difficult right now due to the uncertainty around steel-based products.

- The only certainty right now is uncertainty. With that in mind, we are approaching this economic cycle with heightened capital discipline and a focus on long-term resilience. I don’t believe the tariffs will have a significant effect on drilling and completion plans for 2025, although I would imagine most managers are developing contingency plans for the potential effects of deals (Russia-Ukraine deal, Gaza-Israel-Iran deal) on global crude or natural gas flows. Now these contingency plans probably have more downside price risk baked in than initial drilling plans did for 2025.

- Steel prices and overall labor and drilling costs are up relative to the price of oil in 2021 (the same pricing regime but costs are up).

- Geopolitical risk and economic uncertainty continue to cloud our picture looking forward.

- Unstable capital markets are affecting oil prices. The political climate caused by the new presidential administration appears to be creating instability. Energy markets are not exempt from the loss of public faith in all markets.

- Global geopolitical unrest and the uncertain economic outcomes of the administration’s tariff policies suggest the need to hit the pause button on spending.

- The 2025 steel is already purchased; tariffs are most likely to impact 2026 investment decisions.

- Uncertainty around tariffs and trade policy continues to negatively impact our business, both for mid- to long-term planning and near-term costs. Because of trade tension, especially with Canada, a large operator requested we look to potentially move manufacturing out of the U.S. to support their work in Canada and other international markets.

- Washington’s tariff policy is injecting uncertainty into the supply chain.

- Bias is to lower oil prices due to geopolitical factors and the current administration. The potential tariff impact is creating uncertainty around costs for capital items. We have seen price increases already. Also, we have supply chain problems with a handful of specialty items out of the EU, particularly lower explosive limit sensors for monitors needed by employees.

Now, it has to be said that much of the uncertainty in the Dallas Fed Survey was not related to tariffs but particular to issues in oil markets. The survey respondents were not universal in pinning uncertainty concerns on tariff policy or this administration, and I am certainly not doing so, either. And in fact, as I have highlighted many times, much of the administration’s posture towards energy independence stands to unlock substantial growth opportunities for the economy. I bring this up and provide the above information because of the fact that in the most non-partisan context possible (you can guess who you think these E&P executives voted for), there is a broad consensus that tariff threats are adding to uncertainty and diminishing their willingness to invest in capital projects right now.

Where is it Going Next Week?

I do not know.

Neither do you.

Neither does anyone else who says they do.

And by the way – neither does anyone who works in the White House – possibly including the person in charge of it all.

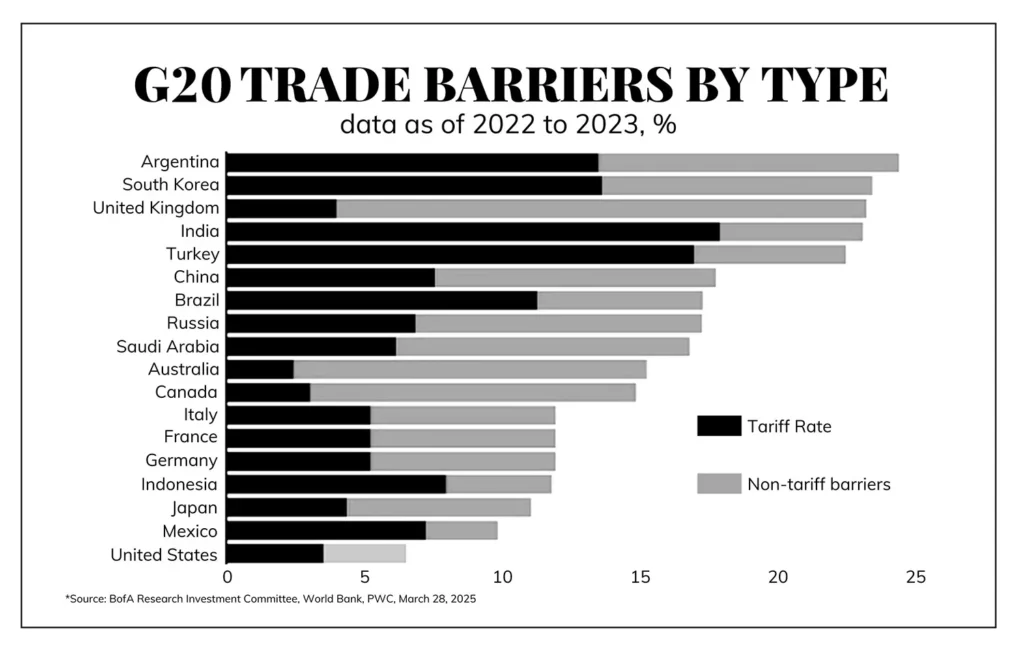

Are reciprocal tariffs equal to the current level of tariffs on the books? If so, that is a grand total of 1.5% above the current rate (per the good folks at Strategas Research). However, the EU commissioner is expecting a 20% tariff across all 27 European Union countries to be announced next week. That would mean the administration is incorporating VAT and “non-tariff barriers” in their calculus. And if that is the case, I am telling you that there is no possible way the line items are complete – sector by sector – country by country – product by product – to have calculated all of that.

That would mean another $160 billion of taxes if a “reciprocal VAT” was imposed, bringing the total cost to $300 billion (i.e., 1% of GDP).

But will that really happen? Will the administration try to assess a different rate for each European country on their own level of VAT and NTBs? Will they do a flat 20%? Will they do something else entirely?

Oh. And this one. Will they announce something on April 2, only to announce something else on April 9?

How reliable is everything you will hear between now and April 2 (or after April 2, for that matter)? The WSJ ran a story Wednesday afternoon that Trump officials had told them that auto parts were being exempted from the President’s auto tariff announcement that evening. Three hours later, the announcement came that automobiles and auto parts were part of the 25% tariff assessment. The news changes by the hour. And yes, this impacts business decisions – particularly capital spending decisions – from economic actors.

Is This All Permanent?

Some people I respect a great deal have said that they believe the President is very clear this will be a permanent change in U.S. trade policy, that he wants a headline of a reduced (or eliminated) trade deficit, and that the American economy must buckle down for a multi-year substantial re-ordering of trade relationships. And I think it is entirely possible that that is true. But no, I do not believe it is clear, and I do not believe he has said it (other than the times he said it, but not counting the times he said something different), and even if he has said it, and meant it, I do not know that he will say it and mean it in a week or a year.

I am very sympathetic to those who have concluded that the President’s economic agenda has changed – that he is less interested in tax, deregulation, and energy now than he used to be – and that his new legacy will center around tariffs, for good or for bad. The administration has said and done plenty to make economic actors believe that in the last two months.

The trade deficit is not likely to come down much from tariffs because tariffs decrease exports after they are done decreasing imports. Currency impact offsets the impact and is not captured in a declining trade deficit. The President’s optical victories are more likely to come from headline announcements around investment in the U.S. The path many think he is on (which he has said is his path) is less likely to create the results envisioned. That matters.

All I can tell you is that I believe there is a voice (or voices) on one shoulder of the President saying something very different, even as there are voices on the other shoulder offering a competing message.

I believe headlines matter, optics matter, and providing a “win for America” matters to the pathology of the President. When I hear the President of the United States say that he lowered tariffs on China a few percentage points to get a TikTok sale done, I do not hear a President who seems hyper-committed to a given trade and tariff path. I think everything is negotiable. And I am not saying that as a good thing. I am just explaining why I do not believe the outcomes on any of this are all that certain and why taking people at their word is the last thing I intend to do at this moment.

Enough about Tax Increases. What about Tax Cuts?

I came away from my time in Washington last week very convinced that I (and many others) were underappreciating the efforts playing out behind the scenes to drive extension of the Trump tax cuts, as well as pass additional tax relief (and to do so sooner than later). Do I believe there are some involved in the effort who would be cut to just “punt” an extension of the 2017 tax rates (and not make them permanent)? Yes, I do. But are Secretary Bessent and President Trump on that list? No, they are not.

Two things to watch in the days and weeks ahead:

- Whether or not a policy baseline is used on current policy for setting a budget and deficit impact – potentially $2.5 trillion of impact to what can be done in tax reform

- Everything and anything Sen. Mike Crapo of Idaho is doing. But you won’t see much because he is a behind-the-scenes player here. But his work is pivotal to what is happening and what will happen.

Conclusion

We are in for a very interesting week ahead. Have markets priced in all the downside events? Are there further downside surprises? Are there upside surprises to consider? Are both distinct possibilities (answer: yes) …

If markets were to drop enough, is there a point at which President Trump would reverse course and seek an off-ramp? If so, what is that point? And at that point, will whatever is done be too late to avoid the 2025 economic pain? I believe the answers are yes, I don’t know, and probably.

I suspect a point is coming where markets will accept that there is no cohesive, coherent, and clear trade and tariff policy. Whether or not economic damage is already done by then will be irreversible this year and will likely depend on a tax bill. And that tax bill’s future, timing, composition, and magnitude are all unknowable at this point (but not, by my reporting, the seriousness of intent of the key people in the administration).

There are so many moving parts that it is literally impossible to predict. And thank God you don’t have to. You really don’t. In fact, you really shouldn’t. I wish there was less chaos. But if we have to have some, I at least wish investors didn’t think they could trade it.

Chart of the Week

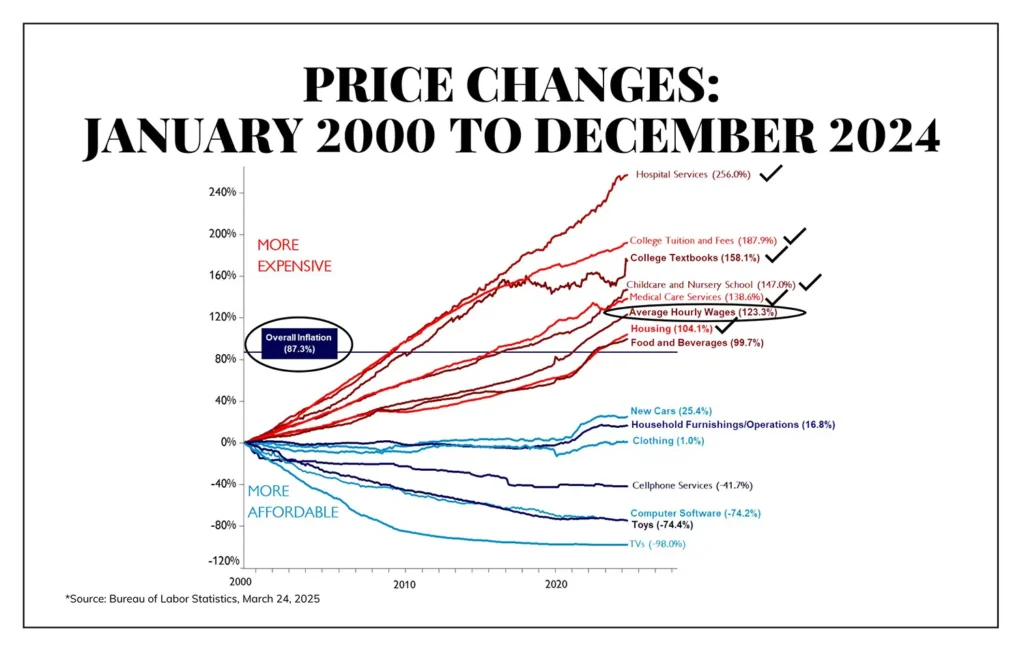

Over the last 25 years, wages grew higher than the price level (by quite a bit). Now, what were the only three areas where prices grew more than the price level??? Oh, the three areas subsidized by government – health care, higher education, and housing. I am detecting a theme …

Quote of the Week

“Talk less. Do more.”

~ Gov. Mitch Daniels

* * *

I landed in Southern California in the middle of the night and have a couple weeks in the Newport Beach office ahead of me besides 24 hours in our Oregon office. Over the last six weeks, I have been to Phoenix, Orlando, Nashville, Palm Beach, and Washington D.C., and I am ready for some time at the home base.

We will be celebrating a big anniversary next week at The Bahnsen Group, and I can’t wait to tell you more. In fact, I already know what next week’s Dividend Cafe will be about. And it won’t be about tariffs!

Have a wonderful weekend, and happy March Madnessing!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet