Dear Valued Clients and Friends,

I wanted to use this week’s Dividend Cafe to give long-term, patient, disciplined, and successful investors a refresher course in the art and science of surviving (and thriving) in bad markets. It is a topic for which I have strong opinions, 25 years of practical experience, and have studied a century’s worth of history. However, the week was just crazy enough to necessitate a lot of coverage across a host of topics and adjacent matters, so this is going to cover all of that and more. It is a heavy read because we are in heavy times, and I hope this will be among the most practical and useful Dividend Cafes I have ever written.

We need to get right into it this week, so jump on in to the Dividend Cafe (though some political commentary does work its way into the conclusion).

|

Subscribe on |

Why the Change of Heart?

Markets were pummeled last Thursday and Friday (April 3 and 4), down a fair amount Monday, down a fair amount Tuesday, and then set for a thousand-point drop pre-market Wednesday. And then mid-day Wednesday, we saw a 3,400 point switch in the middle of the day (from down -700 to up +2,700) as the President announced a 90-day pause on his tariff threats against all nations not named China (see the section titled “The question in front of us” in last week’s Dividend Cafe). Now, we dropped over 2,200 points on Thursday though “only” closed down 1,000, and then as of press time on Friday we have gone up and down a few hundred points about six times but are up over +700 points (so I have no idea how we close today), It has been a roller-coaster, but the question today is not about the market action but rather the Presidential reversal that took place on Wednesday. It is less important for our purposes for the 3,400 points it represented on Wednesday and more important for what it tells us about where we go from here.

The few things I will say with complete and total certainty:

- The change was not planned and was not part of a master strategy

- Financial markets were a huge factor, but not the only one

- Key advisors were pushing for a more orderly approach that more isolated China and differentiated them from allies and other trading partners. The President initially resisted this approach at the advice of Pete Navarro and Secretary Lutnick and ended up deciding that the other view had been the correct one

- The President himself referred to how “yippy” and “queasy” people had gotten as a reason to change course (versus claiming it was part of a master strategic plan)

- See above about financial markets, but don’t see the word “stock” where you see “financial” – see “bond”

My friend, Louis Gave, put it this way:

“For the U.S. dollar to go down in a global risk-off move is unusual. For bonds and equities to collapse at the same time is even more rare. This is a combination typically seen in emerging markets rather than developed markets.

So did this come about because the U.S. is now overly dependent on foreign investors to fund its twin deficits? Or because policymaking in the U.S. has started to look more like policymaking in an emerging market, with a powerful executive making arbitrary decisions in defiance of precedent?

Of course, Wednesday’s decision is good news; Trump walking back his global trade war has helped avert catastrophe.”

Lay of the Land

Both in terms of the advisors the President is most listening to and who will be driving public messaging, a big indication this week I am hesitant to celebrate yet but reasonably confident what is playing out is the following:

- An escalation of the profile, trust, and regard with POTUS for Treasury Secretary, Scott Bessent

- A marginalization if not outright sidelining of Trade Advisor, Pete Navarro

- Some adjustment in the role of Commerce Secretary, Howard Lutnick

I cannot say with certainty that any of this will last, and I do not say it to suggest that everything guys I know and like in the administration (Bessent and Hassett) say will be stuff I agree with. They have both said things through this period that I find myself shaking my head at (since I know what they used to think, about three weeks ago), but I fully understand the finesse needed to do this job and have to give them some grace. I consider Navarro an extreme liability to our nation’s economy and financial markets, and I consider Bessent a competent and worthy advocate for public policy around capital. The competence with which Lutnick/Navarro drove last week’s announcement would be a terminable offense in Dave-land, and I believe that financial markets are at least expecting more from Secretary Bessent. What concerns me, though, is that the media seems to have already adopted this narrative that Bessent is in and Navarro is out. While I hope it is true, I have followed the inner workings of the Trump administration since the 2015 campaign. I am not convinced that whoever’s stock is rising or falling in his personnel is ever all that sustainable (no pun intended on the metaphor there).

What About This Bond Market?

A massive amount of treasury bond selling was happening Tuesday and going into Wednesday, causing the long-bond yields to spike higher. This was, of course, an inconvenient development for the tin-hat crew that was sure this whole trade war was a genius plot to “bring down bond yields and thereby lower the deficit” … But it also begged the question as to why bond yields had collapsed the week before as expectations for economic growth plummeted in the aftermath of the Rose Garden trade war announcement, but then were spiking a few days later with economic and market indicators also plummeting.

I am an Occam’s razor guy. I generally believe the simplest explanation for something is nearly always (but not always) the correct one. Risk assets got taken to the woodshed from April 3-8 in a way rarely seen, and that came after a six-week period where a lot of other risk assets (Nasdaq, big tech, etc.) were already beaten up a bit. Seeing selling pressure come to defensive sectors (health care, utilities, consumer staples) after the violence of the risk sell-off was very consistent with the common practice of leveraged financial actors moving from targeted selling to indiscriminate selling (“when you can no longer sell what you want to sell you then sell what you can sell”). This same concept bled into Treasury bonds, no doubt. Asset allocators needing cash (primarily for de-levering but also for opportunistic buys, etc.) had ready access from Treasuries, and this was an asset class that had been up, not down, over the prior week. So Occam’s razor says – bonds got caught up as a sellable asset in a two-day “margin call.”

That said, supplementing Occam’s razor more than contradicting it, there was a troubled Treasury auction for new issuance on Tuesday, as well. I have no doubt hedge funds were selling Treasuries, but I am entirely open to the idea that foreign investors were selling, too. Speculation circulated that Japan was a forced seller, and it’s entirely possible. It is a little melodramatic to call it a “bond rout” (the yield went to 4.4% or so, where it had been just two weeks earlier, and much lower than it had been just a couple of months ago). But it did raise eyebrows, and any big move in the world’s most important financial asset is, indeed, newsworthy.

Seeing the yield back above 4.5% on Friday puts the issue more front and center: Are we still seeing forced selling and deleveraging driving yields higher (i.e., bond prices lower), or are some foreign owners laying off U.S. Treasury exposure (and if so, will that be sustained)? This is not the story of the week we just had that people think it was, but it may become a story next week.

My bottom line: The bond market activity this week was part of a de-levering activity that was taking place globally. However, the risk had picked up with some preliminary indicators to affirm that something deeper was stewing, and with growth expectations clearly dropping, but bond yields rising, we will want more clarity next week as to what selling anomaly is causing that contradiction.

P.S. – With the dollar dropping as it has against the Yen, Euro, and Canadian dollar, foreigners selling Treasuries is increasingly likely. So is an unwinding of the basis trade amongst hedge funds – something too complex to get into now but not making any of this any easier

Ninety Days to Do Three Years of Work

You will forgive me that I don’t really believe we are going to negotiate 70+ bilateral deals in the next three months. I do believe that we are talking to all these countries (or a bunch of them), and that a lot of announcements are coming. I do believe we will end up with some improvements in our trade deals. I also believe we will exaggerate to a point of absurdity what gets done, but that is not a uniquely Trumpian criticism (okay, maybe it is a little) but rather a statement about all political discourse. I think whatever happens will be exaggerated because the political world lives off of exaggeration. But forget all of that for our investment and market purposes: What matters is that the President is unlikely to go backwards with any of these countries, seeing the terror it unleashed in the economy this last week (and note, I did not merely say “markets” – I said “economy” because that is what I meant). I am sure there could be some volatility around certain countries pushing back and all that, but for the most part, I expect the administration to turn this into a massive PR victory of various deals – some substantive and some cosmetic.

Why be skeptical about the substantive progress opportunities here for bilateral reduction of tariffs and other deal terms? Simply because I believe they take longer than 90 days to do in 70 countries. Therefore, I expect “easier” things to be done than “harder” things. It is just a comment about logistics.

The sooner deals are completed and announced and certain normalcy is re-discovered with ally nations, the sooner markets can price in some restoration of normalcy. The rhetoric (from Navarro and others) that “no matter what, we are here to blow up trading relationships and leave tariffs on” was always insane, and that the President wanted deals more than he actually wanted America moving its coffee source from South America to Abilene, Texas is not news to markets.

So here’s the takeaway: the markets put 3,400 points on Wednesday because that fold by President Trump is not being seen as “now we have 70 tricky negotiations to do” but rather, “okay, it isn’t really serious with these 70 other countries; the carnage was too severe.” Markets are now focused on something else, the downside of impeding trade with 70 other countries now somewhat removed from the risk premia.

It’s All About China

And that something else is China. As I type, I believe we are now at a 145% tariff charge on Chinese imports (20% for a fentanyl dispute, then 125% in the current trade war), and China is at 125% on our exports. We export $144 billion of products to them (largely agricultural, so I expect farmer subsidies to come next). They export $450 billion of products to us (iPhones are a big thing you may be familiar with, and might be using to read this) … Suffice it to say, 125% and 145% and even if we said 30 gazillion% – they are all the same number – 0% – because trade is not going to get done at those levels. So the issue will not really be cost, but just a total lack of activity.

There will be a lag until it matters, but let’s just say there will be a visible effect on shelves if this continues. Both countries have dug in their heels, and I think a very complicated process lies ahead.

Some have said that markets reversed Thursday as “people thought about the fact that actually the tariffs with China are still really high,” and I just want to say that this is not the most intelligent thing you might have heard all week. In fairness, the people that say stuff like this are not markets people and they have every right to think that some adorable guy named Mr. Market hears big news Wednesday, starts buying, then wakes up Thursday, rubs his eyes, and says, “oh no – I forgot about the second largest economic superpower in the world – better start selling.” It is adorable and imbecilic.

What happened was a lot of sellers who were short or unexposed Tuesday/Wednesday had to get long or get exposed in light of the removal of one left tail risk (the trade war against seventy countries). On Thursday, various different actors in the market took advantage of the rally on Wednesday to curtail their exposure in light of the relief they felt from Wednesday. It was psychology. It reflected different actors in the market playing out different objectives. And it was math. There were more buyers offsides Wednesday and then more sellers Thursday. But the “market” does not “forget about China and re-remember the next day.” Different actors had different objectives with different needs on different days.

So is China Coming Along?

President Trump expressed confidence on Wednesday that a deal would get done. The current policy is “MAD” (mutually assured destruction). The U.S. cannot go without imports from China, and China cannot go without selling us their exports. I do believe we should be incrementally de-coupling in a lot of ways, and the adverb “incrementally” is an important one there. But economically, these current tariff levels are intended to force discussions quickly.

The chatter that “China has more to lose” is somewhat unhelpful. Both have a lot to lose, and one country has a Democratic form of government with Congressional elections every two years.

The best ending would be one in which China offers more market access, and I am confident that, for all the bluster and pretextual rationales up until now, the administration would take this in a heartbeat. I am not at all certain this will happen, but I do know it is what I would do if I were Xi (but, you know, I am not a Communist).

I see increasing our commercial relationship as unlikely, but getting to a detente in the current state of the relationship as the most pragmatic resolution from here. I still expect this to cost U.S. GDP a minimum of 1%, and possibly more. A mild recession by Q3 is very possible, even if already priced in.

There really is so much more than needs to be said about the future of the U.S.-China relationship, but this week is not the week for it. I promise it is coming.

A Contrarian Consistency

The VIX got to $52 on Tuesday of this week. The VIX is the ticker for the Volatility Index on the Chicago Board Options Exchange. When it is going higher, fear in the market is rising; when it is going lower, fear is dropping; when it is stable, fear is level. One year after the VIX has closed a week at $45 or higher, the S&P 500 return has never been less than 18%, and it has averaged 39%. The return five years later (cumulative) has never been less than 100%, and it has averaged 139%. Much of this is math – a very high VIX frequently (always?) coincides with a drop in the stock market, so the entry level in the market is, by definition, lower, if not outright low. But a lot of it speaks to a behavioral reality of investing – fear is often highest at the most opportune time, and fear is often lowest when there is reason for caution. I would offer no prediction about where markets will be in a year or five years. I will only say that when markets are dropping and the VIX is flying higher, history has had something to say.

Tariffs and Dividends

I am quite resolute that dividend growth investing is the big winner in market moments like this. Withdrawers of capital continue receiving their needed cash flow, uninterrupted, unthreatened by market volatility, and even get a raise year-over-year as dividends grow despite market conditions. Accumulators of capital take advantage of reinvesting dividends at lower prices, enhancing the compounding of their capital (in this case, compounding it into more and more shares of dividend-paying securities – compounding within compounding). Dividend growth provides both defense and offense, and it is rarely more beneficial than in times of market declines (despite the reality of declining stock prices, a decline that is itself, much less than high beta markets).

But of course, this all begs the question: What if tariffs threaten the dividends themselves? It is a fair question, and why we do not believe dividend growth investing can be done passively. A fundamental research process is vital to not merely see backward-looking dividend habits but forward-looking dividend capacity. Free Cash Flow, a stress test of that free cash flow, an intimate familiarity with the company’s balance sheet, a strong comfort with the culture and propensity of management, and so much more are needed.

And I will say this about Trump’s trade war: It is not going to do more damage than the global financial crisis of 2008. So if your dividend growth strategy sustained (and grew) income, then you should be feeling pretty good about your dividend growth sustainability. If you have seen total dividends grow for 25+ years through the four major disruptions of this so far rather unsettling new century, then I would suggest that you are in a good position.

Remember the tax bill?

Back on the side of reality, where Republicans still like tax cuts and not the largest tax increase in nearly sixty years, there is a conversation worth having on the shocking news that Speaker Johnson got the next step of a budget reconciliation bill accomplished this week. In any other week besides one where the markets were down the way they have been and where trade and tariff policy is so explosive, this would be the biggest story in the country, but instead, it feels like it is barely being mentioned. Now, in fairness, it is hardly done. The House passed a FRAMEWORK to work with the Senate on reconciliation, and so while the framework’s passage (by a two-vote margin – razor, razor thin) was necessary to keep the patient’s heart beating, there is still a lot of wood to chop. I will unpack all of this more in the Monday Dividend Cafe.

Conclusion

We are not out of the woods yet. We are in a better place today than we were a week ago. But the China resolution is a complete unknown right now. I have not moved one inch on what I believe are the sociological and psychological factors that drive the president’s decision-making. All I suggest is aligning one’s investment thoughts with those factors versus one’s ideological and philosophical beliefs. Candidly, we are not in a very ideological or philosophical era. We are in a volatile one. No one has to like it. Very few are likely to do so, as a matter of fact. But what one can and must do is not allow their investment behavior to make it all worse.

Chart of the Week

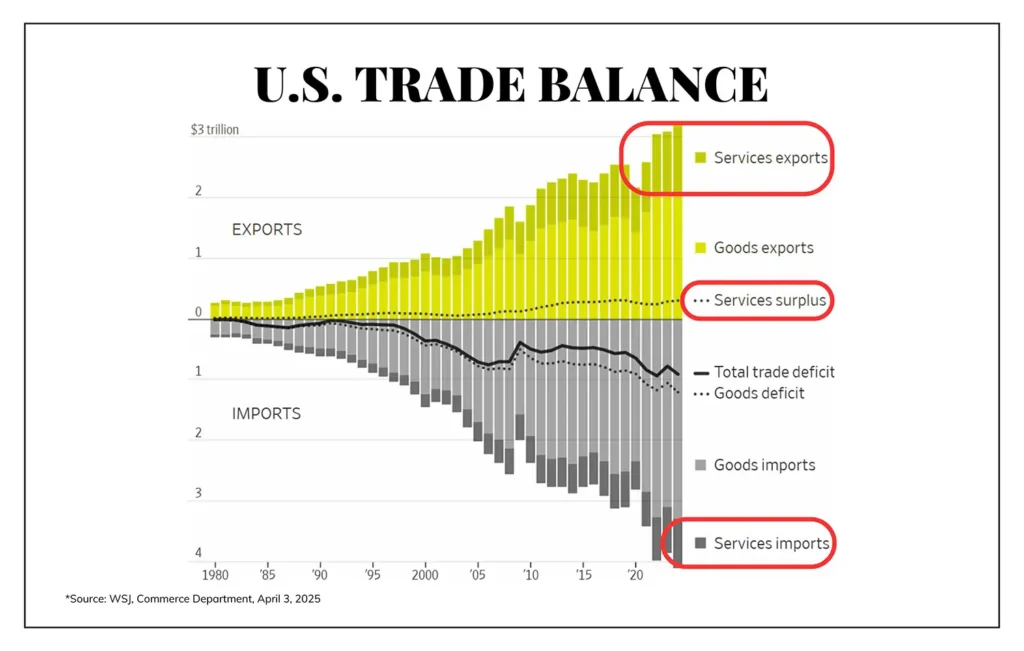

The talk of trade deficits in this whole ordeal has consistently missed the fact that we export trillions of dollars of goods and services in America, a rather large part of our economy (don’t you think?). Of those exports, we are exporting over $1 trillion of services per year, $300 billion more than we are importing (a very large trade surplus).

Quote of the Week

“Education makes the wise slightly wiser, but it makes the fool vastly more dangerous.”

~ Nassim Taleb

* * *

I am a little exhausted by my political disclaimers each week and increasingly aware that they are worthless. I find this particular policy decision of the President outrageous, and especially find the way it has been carried out mind-boggling (even if I was more supportive of the desired ends). But I also am supportive of a significant amount of other policy aims of the President, and I also have stated repeatedly (including, ummmm, a week ago) that I did not believe the President would hold the line on the mistakes he was making for long. Somehow, none of this is good enough for some because the only thing that will work is holistic opposition or else holistic support. My duty is to tell the truth, and that is what I will do. I spend exactly zero seconds thinking about how to “make everyone happy” with this messaging. It just can’t be done. I am a movement center-right conservative who finds much of this self-induced error utterly bizarre, and so I have to say things in my assessment for investors that are critical. Those things do not negate my support for corporate tax reform, for opposing wokeness in the government and corporate sector, for deregulation, for energy independence, or for anything else that I have addressed in countless places.

In fact, I would say that my support for the Constitutional order, the separation of powers, Article I responsibilities about taxation being with the Congress, aversion to central planning, an understanding that tariffs are taxes, and an economic philosophy that acknowledges all actors and not just easily visible ones, are all by-products of a belief system that is consistent with the principles I have long advocated. In other words, I am not the one who has changed here.

Enough of all that. I am here to answer any questions, any time, and to work 18 hours per day if need be, making the best decisions I can for the best interests of my clients. To those ends, we all work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet