Dear Valued Clients and Friends,

I have done my very best to herald the virtues of normalization as much as I can since the pandemic struck a year ago. There was a period of time last spring where clearly normalization was not possible or even advisable, but even then, I didn’t want to lose track of what we all wanted on the other side of this awful event – to get to a position where we could safely resume the activities and events that we enjoy in our lives.

Many people love the rhetoric of “things will never be the same again” or “it is time we realize that [fill in the blank] has been permanently altered by [fill in the blank].” There are times where those sentences may have cogent utility, but I actually those times that are far less frequent than people realize. But regardless, those attracted to such rhetoric usually have a certain affection for the melodrama that comes with it. Do I think it is true that “we may never see a full capacity sold-out football game inside a stadium again”? Ummmm, no, I do not. In fact, I don’t think that statement will stay true for five more months. But I do understand why some people love talking that way.

Yes, I do love the idea of normalization – especially when people are using the term correctly. I consider it “normal” for the sandwich shop in Brooklyn to be open, with customers lined up out the door, and employees coming to work to serve those customers, both drawing a paycheck for themselves in the process, and inextricably linked to such, serving people a hot pastrami sandwich in the meantime. I want that blue-collar worker being paid, and I want that customer eating his delicious sandwich. I want the landlord getting paid rent, and I want the proprietor of that sandwich shop feeding his family via his business’s profits. All of those things, at full capacity, with people in and out of the restaurant talking to each other, yelling at each other, bumping into each other while they grab napkins or extra dressing – all of that is what I mean by “normalization.” To not want such a thing strikes me as sadistic.

But I want you all to notice something I have done, and not actually done consciously or purposefully, both above and throughout the last nine months or so. I have created a very romantic notion of normalization, whereby the universally loved and appreciated and missed aspects of our lives are what I want to be normal again. Any decent human being wants the Brooklyn sandwich shop owner to get his livelihood back. All of us want midtown offices full again. No one is rooting for those who lost their jobs in the pandemic to stay unemployed (I suppose you could say some policymakers don’t mind it, but hopefully, even they don’t actually “root” for it just because of the consequences of their policy decisions). And aside from a truly unfathomable form of shortcoming, we all want our Broadway theaters full again, our football stadiums packed, and public events to resume their place in society. We all want our seminars, conferences, and symposiums to be in person – not electronic – so we can resume the time-tested experience of, wait for it, real human interaction.

These are not controversial aspirations, and I will add – they are all inevitable. They are all coming. They will all bring joy and relief when they do. The sooner, the better (for reasons economic and existential, as I have said countless times).

But if normalization means a return to the conditions and circumstances we enjoyed pre-pandemic, doesn’t that carry with it a sort of implied assertion that there will be the “normal” challenges and concerns we had pre-pandemic, as well? Shifting to the economic category specific to the pandemic that I have devoted multiple hours per day to studying every single day for over a year now, what exactly are we rooting for when we root for “normalization”?

This week’s Dividend Cafe is going to dive into the “abnormalcy” of the economic contraction during COVID, the abnormalcy of the economic recovery we are currently in (and will be in for months to come), but then also the “normalcy” of pre-pandemic economic life, and what that means on the other side of this. I will humbly suggest that despite the changes in the economic landscape brought about by the fiscal and monetary monstrosities of the last year, “normalization” will mean “resuming our obsession with the question of _____”

That ______ is what I will fill in for you in today’s Dividend Cafe.

Partying like it’s 1999 2019

It is pretty difficult to go back and think about economic life pre-pandemic. Everything right now is so understandably understood in the context of pandemic recovery. It is almost impossible to re-imagine economic conditions, goals, circumstances, and challenges before the pandemic.

And of course, “normalization” is not going to mean that what happened from February 2020 through (let’s say September 2021) didn’t happen … Yes, there will be an outlier contraction in the history books. And yes, that will mean there will be an outlier recovery in the history books. But post-recovery economic realities are going to reflect many new realities – not the silly statements like “people are going to think twice about flying again” (nonsense). Rather, the $5 trillion of new national debt, the totally re-constituted balance sheet of the Federal Reserve, the various failed businesses out of the pandemic, the new technologies and medical innovations out of the pandemic, etc. – these things all have staying power in the way we view the post-recovery economic landscape.

But I believe the sheer force of jobs lost and jobs re-gained, the collapse in manufacturing and violent restoration of manufacturing, the deflation of commodity prices and the reflation of commodity prices – all of these things and more help to skew our view of where things were before the huge drop, and before the huge move back up.

A blast from the past (or two)

I found these chart in my research for this piece in my digital archives from late 2019 – so going into 2020, before we knew anything about the pandemic:

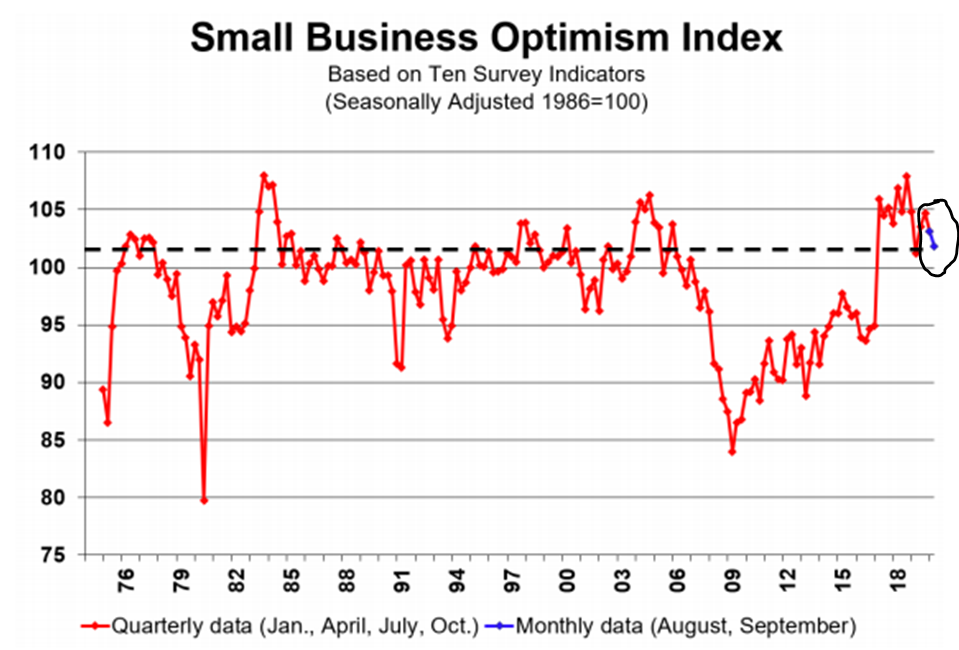

*Strategas Research, Investment Outlook, December 2019

The general optimism of small business that drives so, so much of our economic activity, productivity, and growth, had substantially collapsed in the financial crisis and really, really struggled to recover. In 2017 it finally recovered to its long-term average, with deregulation, tax reform, and easy credit, all providing supply-side boosts. The trade war of 2018 pulled back some of the momentum, but where the camera stopped at the end of 2019 was this big question – not knowing anything about the COVID reality to come – were we going to build on 2017-2019 momentum or head back to post-crisis “muted” conditions?

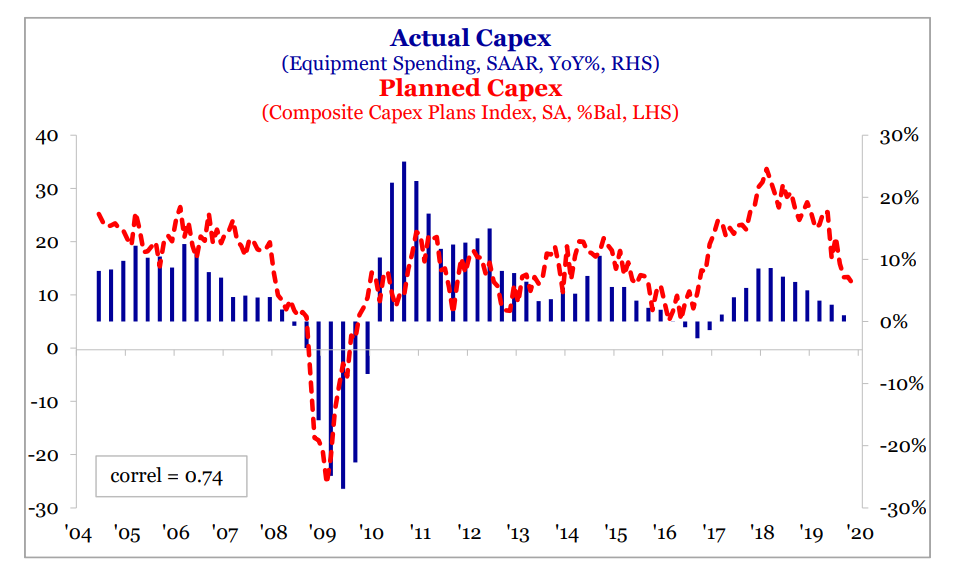

Note this chart from December 2019, clearly showing a resurgence of business capital expenditures in 2017 and 2018, but a muting of planned business investment as companies pondered what tax, trade, policy, and growth conditions would be in store for the future.

*Strategas Research, Investment Outlook, December 2019

It is my position that going into 2020, before COVID, the number one question facing the economy was whether or not business confidence and business optimism would warrant the business investment necessary to drive further economic growth. There were tailwinds (fully inviting credit markets), and there were headwinds (large budget deficits and uncertainty around trade policy). Still, that crux was the major issue determining the extension or expiration of this post-crisis economic era.

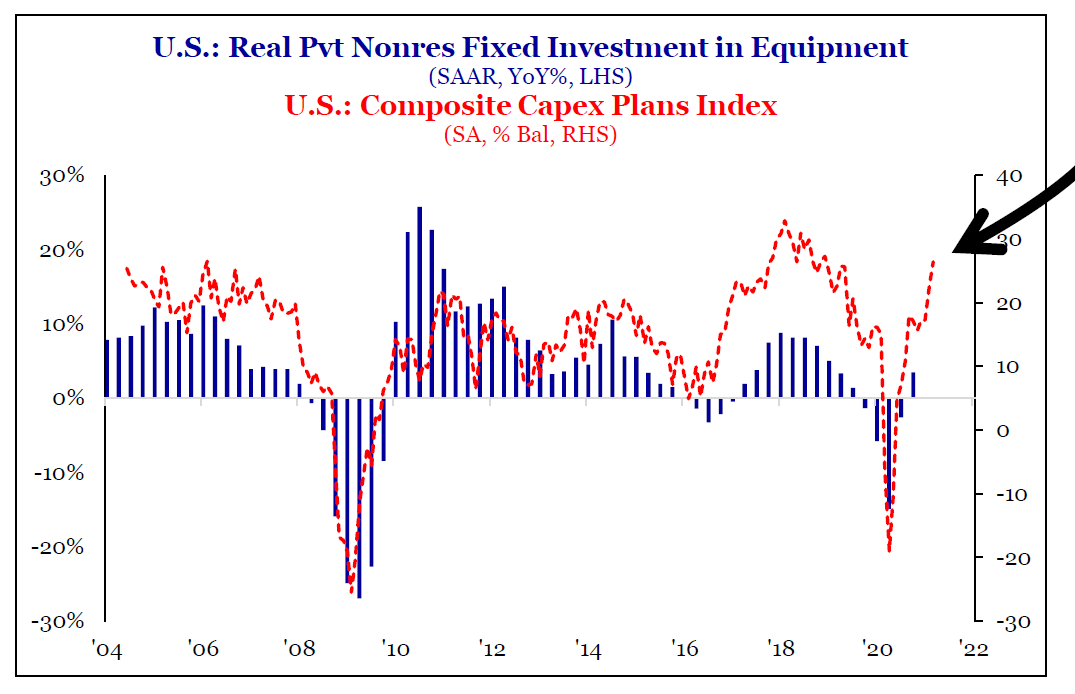

Now, the updated and more modern charts show promise. Capex plans are on the rise. Sure, they dipped significantly with the COVID contraction, but the overall indicators are picking up. So why am I not full throttle optimistic here?

A glimpse into the future

*Strategas Research, Policy Outlook, April 9, p. 15

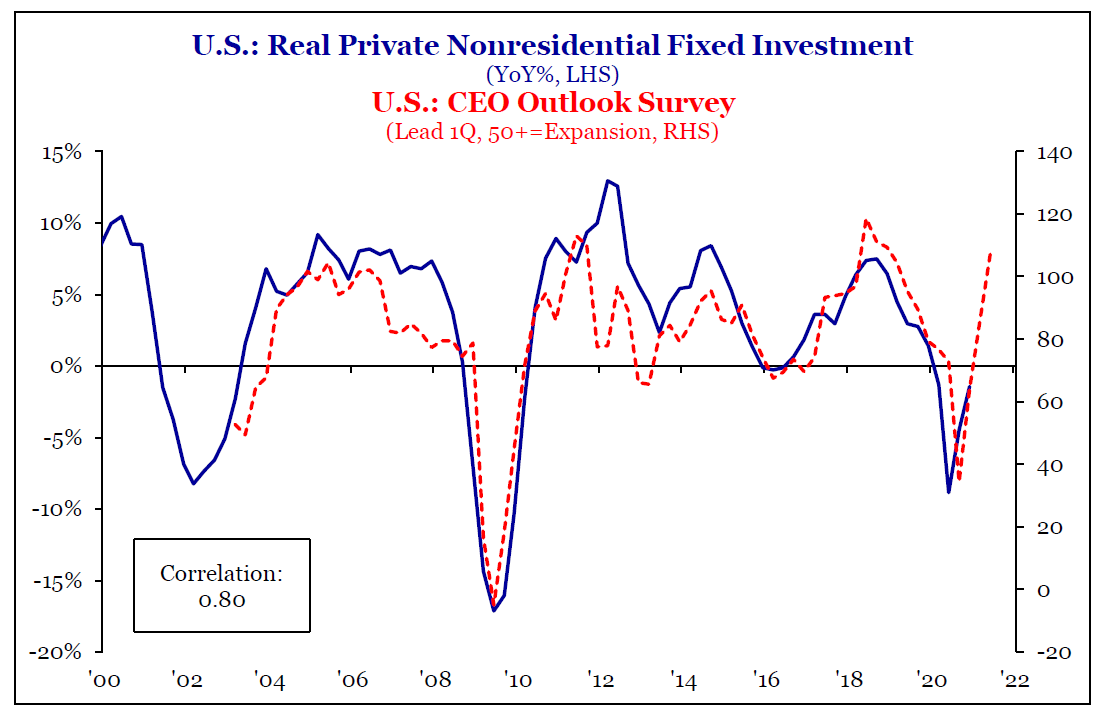

The CAPEX plans look good (above). And note (below) – after a horrific dip in CEO optimism, it has skyrocketed back in anticipation of this vaccine-fueled post-COVID economy recovery.

Also, note right below the simply undeniable correlation between CEO confidence and business investment. This is hardly confusing – business operators invest more in their business when confident and optimistic about future conditions.

*Strategas Research, Policy Outlook, April 9, p. 15

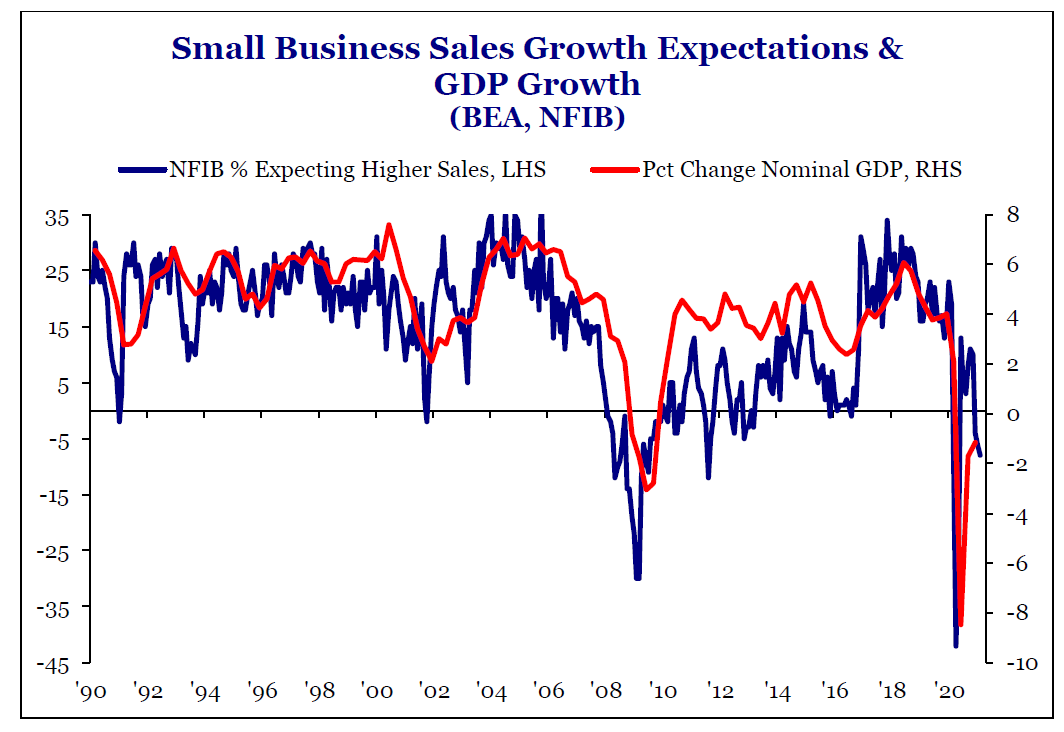

These correlations don’t only work with Fortune 500 companies. Note the historical correlation (below) with small business optimism and nominal GDP growth. Also, note growth expectations from small businesses collapsing during COVID, then recovering dramatically, and now pausing …

*Strategas Research, Policy Outlook, April 9, p. 31

What’s the concern?

As business confidence and optimism goes, so will go the next phase of America’s economic progress. It is that simple. I am not talking about the 2021 Q1, Q2, Q3 era – this era of day by day increasing “normalization” in restaurants, airports, and eventually offices (I’ll bet anyone who wants to bet on the last one – get back to work America!).

I am writing to you, not about COVID or COVID recovery, but the concerns in post-recovery, post-COVID America economic reality …

I repeat, what’s the concern?

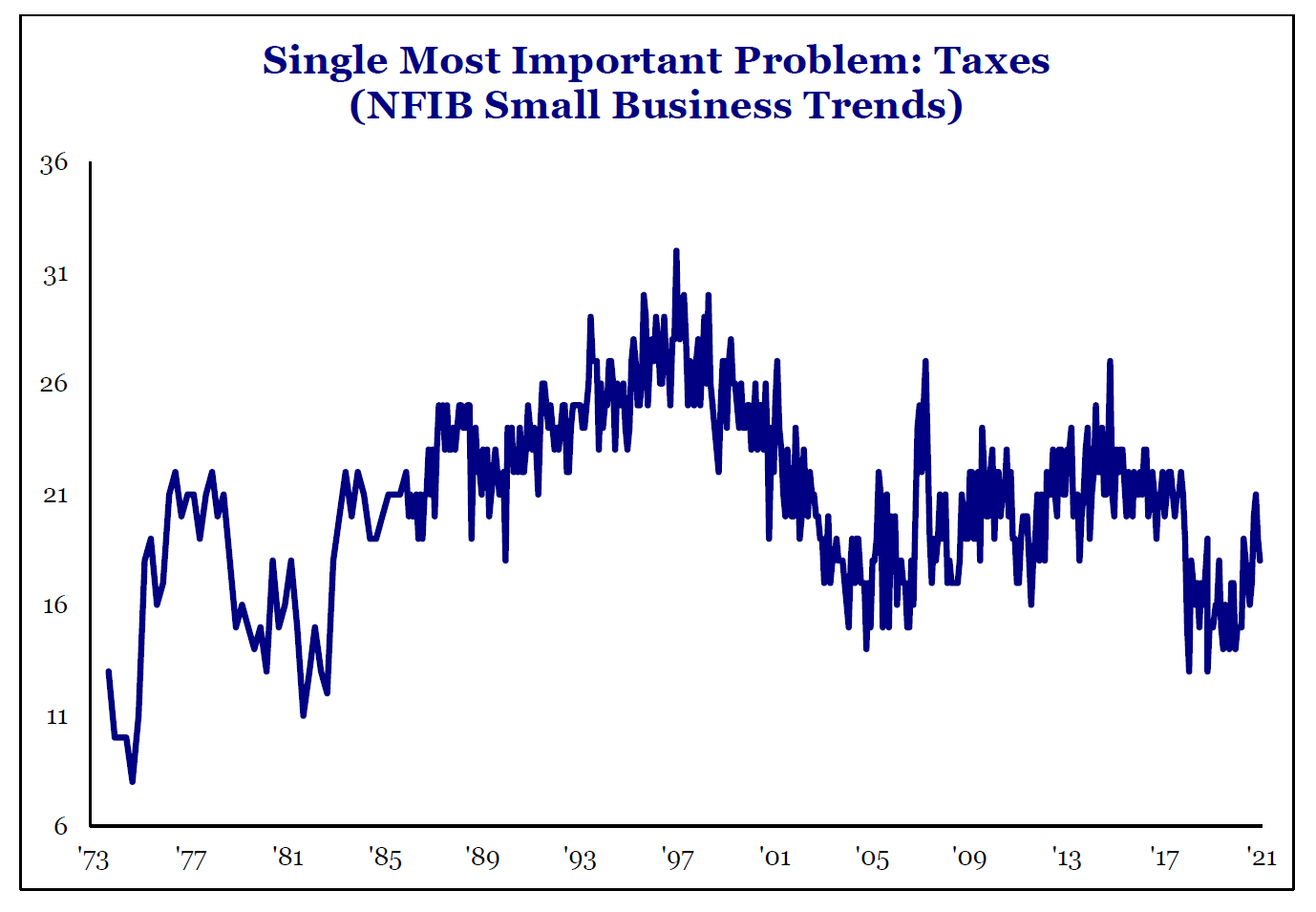

Small business owners always have anxieties and concerns about business conditions. But one thing has moved up more than anything else as of late …

The biggest move higher in concerns for small businesses has been taxes (in terms of how many more businesses state that fear of tax change is a huge cause of concern for their business growth). It is important to understand: this only partially reflects fears of a higher corporate tax rate; a substantial number – the majority, in fact – are LLCs or S-corps – pass-through entities where the profits pass through to the owners. THIS is the area where potential tax changes are the most threatening to small business optimism and growth.

*Strategas Research, Policy Outlook, April 9, p. 32

Net income from pass-through entities is well over $1 trillion per year – a simply massive part of our national income. To equalize the benefit of the corporate tax cut in 2017 (when the top marginal tax rate of C-corps was cut from 35% to 21%), the 2017 tax bill offered a 20% deduction on certain pass-through income (when actively earned). If this deduction for LLC and S-corp owners is taken away, it represents hundreds of billions of dollars moved from the small business private economy to government coffers. It is a big, big deal.

Section 199A applied only to certain business sectors (because you know, why shouldn’t the government pick which ones qualify and which ones don’t … Financial Services did not qualify, in case you were wondering). But even after filtering for various crony criteria and qualifiers and adjustments, this tax deduction which was originally offered only to equalize treatment with more traditional corporate income being repealed, is a needle-moving headwind for business optimism.

I would add that I am not convinced that all small business owners are aware of the potential change to their own tax treatment. A substantial amount of LLCs and S-corps and partnerships and sole proprietorships are mom & pop businesses focused on their customers and their inventory, not their tax planning. The move up in articulated fear around these issues likely understates what a fully informed fear and trepidation would look like.

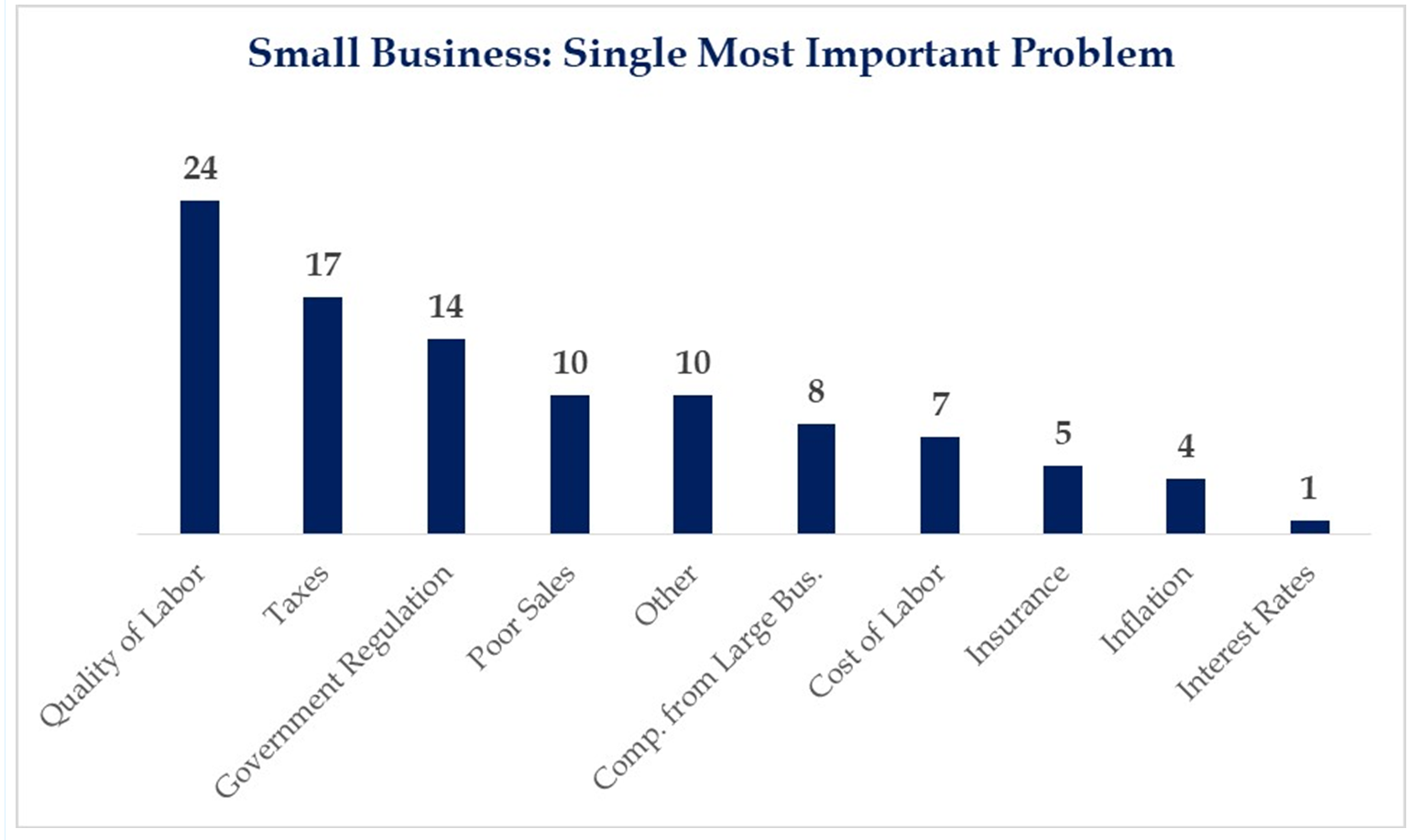

But fear of changes in tax policy is only the second biggest fear or problem presently being cited. Access to the quality labor needed to drive productivity is, far and away, the biggest concern facing businesses in our country (according to them).

*Strategas Research, Daily Macro Brief, April 16, 2021

Business surveyed right now speak of two issues that are actually quite distinct from one another. First, the challenge of finding low-skill workers for more remedial jobs when they are competing against unemployment benefits that, combining federal and state benefits at the moment, can equal very close to $20 per hour. Finding labor for remedial work when they are being paid $17-20/hour not to work is very difficult (and that hourly subsidized amount does NOT include recent direct payments like the $1,400 of March or $600 of January).

But outside of the lower skill labor shortages, we also have a truly overwhelming challenge finding properly skilled and trained labor for where the millions of job openings exist right now. I will never, ever forget the CFO of Chevron telling me at a conference some years back that they put out job postings for hundreds of jobs paying six-figures that required a certain specialized certification, offering to pay people to get the training and certification for this position, and ultimately had to expand their job search out of the country because of lack of applicants. That dynamic weighed heavily on the economy from 2012-2015, and it appears to be coming back. Finding bodies is not always what a company needs; finding the right skills and particulars is a whole different ball game.

So wrap it all together

(1) Pre-COVID, we had a strong economy, but a “fork in the road” coming that I believe was going to be determined by business investment (or lack of business investment) – the necessary extension mechanism for economic productivity, growth, and prosperity.

(2) COVID became a very unfortunate interruption to, well, everything

(3) COVID RECOVERY has and is a welcome end to the interruption and represents the second part of the “skewed” data economically (skewed bad going down, skewed good coming back up)

(4) Now we “normalize” right back to where we were at the end of 2019 – with questions about business confidence and business investment again determining the fate of economic expansion

(5) And yet, as we go into #4, unlike back in the good old days of #1, we face the possibility of disruptive tax changes that dis-incent business investment and capital expenditures. And, of course, we face trillions of dollars of new national debt that contracts from the U.S. economy and compresses growth.

Sooooo … We wait and see if the engines of prosperity that have dumbfounded critics and skeptics and doubters and haters more times than I can count will overcome headwinds, or if a combination of policy decisions and difficult circumstances get the next word.

This is no time for passivity in one’s outlook or one’s portfolio.

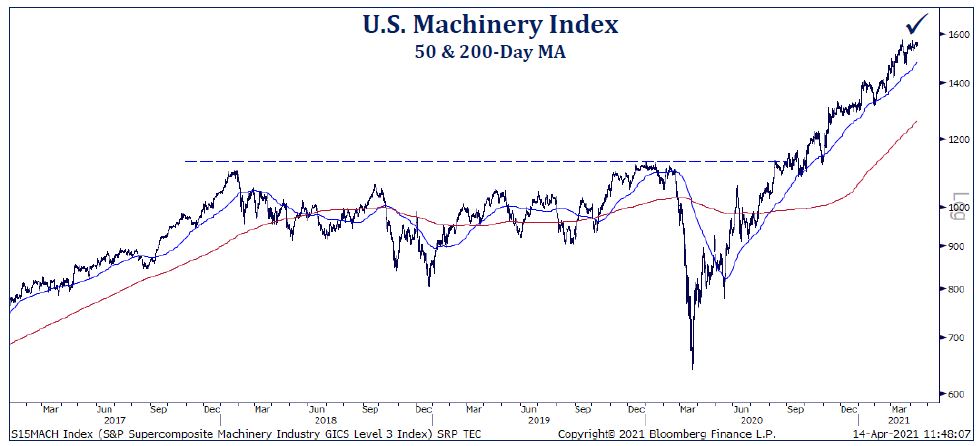

Chart of the Week

It sure looks like manufacturing and industrial production wants to fire right past pre-COVID levels, doesn’t it?

*Strategas Research, Daily Macro Brief, April 13, 2021

Quote of the Week

“The central principle in choosing financial structures is the rule of Ecclesiastes: ‘For every thing there is a season, and a time for every purpose under heaven.’As time and seasons change, companies must seek different means of financing to meet their needs.”

~ Michael Milken

* * *

I thoroughly enjoyed writing this week’s Dividend Cafe. I thoroughly enjoy being here in New York City. I am thoroughly enjoying watching the economic recovery and normalization. And I am pleading with everyone to move forward, to be safe, and be free.

Have a wonderful weekend.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet