Dear Valued Clients and Friends –

As I am typing this on Friday morning, about ninety minutes into trading, the Dow is down 230 points, which is less than six-tenths of one percent. If you stopped paying attention after last Friday’s close and started paying attention right now, you may be tempted to believe the biggest story in markets all week was this:

But alas, our unforgettable morning was not the biggest market event of the week for most people. In fact, Monday brought out some of the biggest media and political nailbiters I have seen in quite some time. And we are here about 0.5% later. The melodrama is exhausting, and I would say that if markets had actually had a real sell-off on the week.

Yet despite what ended up being a nothing-burger of a week in markets, there was some serious inspiration for today’s Dividend Cafe out of the events of Monday. Click on through for the Yen-carry trade, but stay for the lifelong lesson. Come on in, to the Dividend Cafe.

|

Subscribe on |

Japan and you, again?

I am sure I could very easily write a Dividend Cafe about the “yen carry trade.” I am not doing that this week, but I could. In this case, the “yen carry trade” (and, more specifically, the unwinding of it) was a big part of the story earlier this week. As I unpacked in Monday’s Dividend Cafe, the Nikkei was down an insane -12.4% Monday (so Sunday night for us in America). It became clear early Monday morning that the Nikkei was not down as a “follow-on” to Friday’s distress in American markets, but rather Monday’s distress in U.S. markets was a follow-on to the Sunday night drama in Japanese markets. Now, I believe the other two points I brought up Monday (#2 – tech over-valuation, and #3 – questions about economic strength) have hardly been rectified, and not only can but almost surely will stay relevant in the ebbs and flows of markets in the months ahead. But the issue in Japan that bled into American markets Monday clearly subsided this week, restoring the vast majority of what markets had retraced.

So what was that issue?

Just making it as simple as can be – the Yen was a very cheap currency, and had depreciated against the dollar (and other currencies) a fair amount this year. Yields on Japanese currency were microscopic. The reasonably anti-fragile currency (this is an ironic choice of words for a currency that had depreciated so much and is in a country that experiments with fiscal and monetary policy like Walter White in Breaking Bad experimenting with “chemistry,” but historically, it is true that the Yen had generally held up quite while in times of global turbulence) became a cheap and easy way to borrow and thereby apply leverage to other trades, ideas, and convictions. Borrow the Yen, use it to buy other currencies (Yuan, Dollar) and to buy assets with those other currencies (all funded by borrowed Yen).

The Bank of Japan last week defended against the Yen’s slide by raising rates from 0% to 0.25%. This is hardly a gargantuan move, but if $350 billion has been borrowed in Yen, it got the attention of borrowers. Panic-selling began, selling the assets bought in the carry (mostly at a profit, I would add) to pay back the borrowed Yen that shot up substantially against the dollar and the Yuan.

Given that the Nikkei had its worst day since Black Monday 1987 one day, and its best day of all time the next day, let’s just go out on a limb and say this was really screwed up stuff going on inside their financial markets whereby a lot, lot, lot of people were heavily, heavily, heavily on one side of a trade (borrowers of Yen that now had to be paid back in much more expensive Yen currency, with a carry cost that had gone up). And of course, if everyone borrowed Yen to buy Nvidia, and Nvidia was now down -25%, these financial actors could all sell Nvidia at once (many did), or they could look at other things in their portfolio not down -25%, and sell those things. And they did that, too.

But apparently, they did it for a day or so. Are we out of the woods now? Well, of course not. Something over $350 billion is still apparently in a Yen carry trade (based on short-term loans by Japanese banks to non-Japanese economic actors), and that does not include Japanese investors who have clearly done something very similar inside Japan.

Yet whatever it was, the initial panic has subsided, and we walk away with an opportunity to:

-

- Determine if our own risk appetite is properly set and

- Consider a much, much larger investment lesson than just the one specifically connected to the Yen carry trade.

If the salsa was too hot, you need a different salsa

The Nasdaq was down -13.5% from its high point to its recent low point. The S&P was down -8.5% from its recent high to low. The Dow was down a whopping -6.4%. The hottest stock in the land was down over -26%. Assume no outlook at all in what any of these strategies, indices, or positions will do from here. Pretend you have no view on my points #2 and #3 above (tech over-valuation and economic slowing). Just as a matter of what did happen, not would could have or what might, consider that if the reasonably benign events of recent times caused you any heartache at all, you may not have the right temperament for your portfolio. You may not have been honest with your advisor about your comfort level with inevitable volatility. And you may not have been honest with yourself!

I want to say this as humbly and softly and yet seriously as I can: That doesn’t even count as downside volatility. It was child’s play if the child was being really nice. The number of things that can create market moves like that go a lot further than a yen-carry trade, an election outcome, a bad jobs report, or, as I said to one of our economic advisors this week, it could have happened because he and I sneezed. The historical reality of downside volatility is much more than that with equity markets, and it usually lasts longer than 2-3 days (or 2-3 hours).

Use this minor, barely-worth-mentioning moment to question your own temperament and the portfolio you have. Surveys, questions, and hypotheticals can’t tell you how high your tolerance is. Only tasting the salsa can.

That brings us to this

Here is a permanent reality that I believe investors need to understand: unrelated (in some ways) to the yen carry trade and unrelated to your own risk comfort levels. I wrote about this over and over and over again in late March 2020, describing those events then as a “national margin call.” Multiple events in the decade between the financial crisis and COVID also painted the picture I am about to describe. The global financial crisis was the mother of them all, but with a really massive fundamental implosion in credit markets underneath it all, making things much worse. The 1987 Black Monday event is related to this. I could go on and on. And I dare anyone to tell me that “now it is different.”

What I am describing is the reality that:

- A lot of people out there have used borrowed money to buy risk assets they like.

- Their liking these things probably means other people like them, too, and using borrowed money to buy more puts upside pressure on these likable risk assets.

- When these things go higher it makes other people want to buy them to avoid missing out.

- Rinse and repeat.

This creates a scenario where a lot of very popular things have been bought by a lot of people (who fancy themselves cool), often with a lot of borrowed money and often at very high (dangerous) prices. In this scenario, when things drop in price, the debt has to be paid back and generally done so by selling an asset whose price is now a falling knife. No one likes selling things falling quickly in price, so usually they try to sell OTHER stuff in the portfolio that may NOT be down much. When that happens (a bunch of people now selling the same things that aren’t down that much), you see prices drop on other things besides the cool and likable things that everyone was borrowing money to buy to begin with.

THIS is the lesson of today’s Dividend Cafe. If your investment thesis for a company is, “I like it and want to own it,” it may work for a while. Things one group likes are often things another group likes, and when things start getting bought heavily with borrowed money, they tend to go up in price. YET, time and time and time again, the volatility in bad times is exacerbated by the fact that investors have to start selling other things in their portfolio, and usually a lot of these investors all own the same things.

The dividend growth investor in me says, “Why in the world would I care what others are doing in their FORCED sales (or buys) if I am purely focused on dividend growth?” The answer ought to be, “You shouldn’t,” but investors deserve to know that sometimes people are not good at this. Exacerbated price volatility can shake people out very quickly, and it leads me to three positive conclusions:

- Never be a forced seller. Forced buying makes prices go up, but forced selling makes it go down. To clear a market when a lot of people must sell means matching buyers and sellers at lower prices. The best defense against forced selling is to not have to do it. Dividend growth without leverage seems like a popular way to do this.

- Do not get shaken out when your “good stuff” goes down in price when forced sellers sell their “good stuff” to limit the losses in their “bad stuff.” Recognize it will be short-lived, and if you have any appetite for it, consider being the buyer of the forced sellers.

You can’t get forced out if you are not a forced seller, and you can take advantage of that dynamic to be an opportunistic buyer. If it all feels comfortable the whole time, it isn’t working according to plan. There will be times when it is destined to feel unpleasant. That is the litmus test because the good times that come with doing this come to those who wait through some real discomfort.

Risk parity leverage in 2020. Portfolio insurance in 1987. The low volatility trade of 2018. Yen carry in 2024. Crowded hedge funds throughout – always hedge funds loaded up on the same side. My friends, I think the super-sized hedge funds are more on the same side of certain trades now than they ever have been. Sometimes, this can be because they lack imagination and copycat others. Sometimes, it can be because they all have very smart people working for them, and all these smart people have similar ways of thinking. But sometimes, it happens because these ginormous hedge funds have all become liquidity providers to everyone else! After Dodd-Frank, the unintended consequence of this bad legislation was to take the investment banks and proprietary trading desks out of play, leaving only hedge funds to execute certain trades. A whole lot of trades exist out there, and a whole lot of people have done them, and the unwinds create panics and forced selling. Where there is leverage, it accelerates. Rinse and repeat.

It is something dividend growth investing is made for. You either aren’t a part of it at all, or to the extent you get pulled in because your “good stuff” gets sold when there are incidents, they can’t sell your shares; all they can do is make the price lower for a time, which should be a gift to you.

Conclusion

Monday was not the end of the yen carry trade unless it was. And if it was, it was not the end of forced selling, leveraged buyers, and other incidents of market disruption that hit your screen, and give you the chance to do three things:

- Do nothing, knowing you are not a party to this idiocy

- Buy from the forced sellers, knowing national forced liquidations are usually just a few weeks long if that, and the prices you see on the buy side will not last forever; and

- Whether it be #1 or #2, add some GRATITUDE to the mix, that you are not in crowded trades, that you did not borrow money to buy your portfolio, and that the results you generate as an investor will come down to the execution of a great business, not the luck of other irrational people. Some of those people are in over their skis. Some are psychopaths. Some mean well but got caught offsides.

But none of them are you. Buy cash-flowing dividend growth stocks with cash, not cash you borrowed. And be prepared for these scenes to come and go. One day, you’ll look forward to them like I do, I promise.

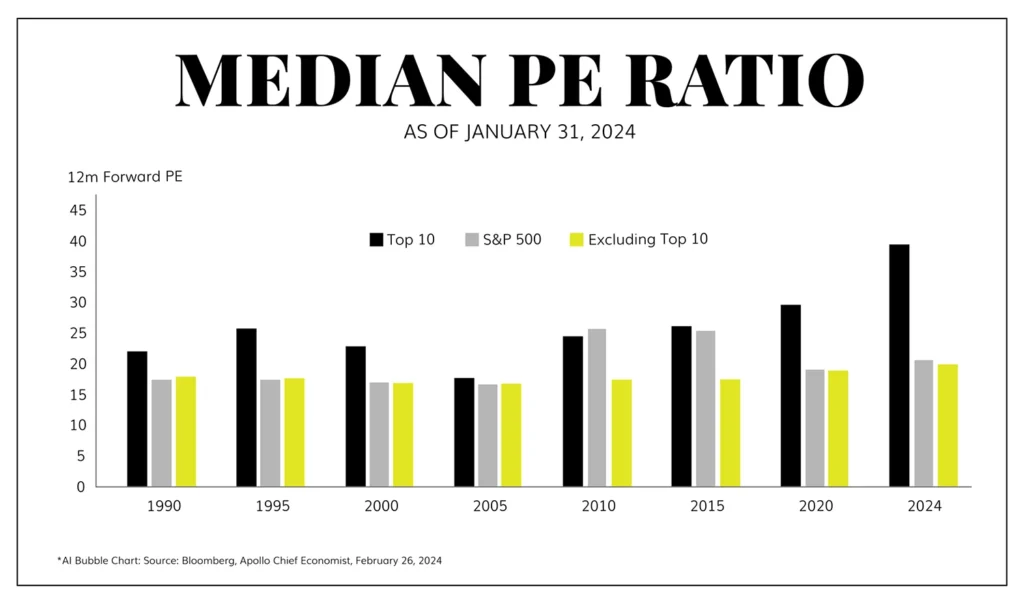

Chart of the Week

I ran this chart in February. Would it shock you all to know that all of those bars on the far right are now HIGHER than they were then?

Quote of the Week

“All of sports betting, all of playing poker, and all of options trading is making sure you’re betting against someone that you are smarter than.”

~ Jeff Yass

* * *

It was the thrill of a lifetime for me and many from my team to ring the bell on the floor of the New York Stock Exchange this morning. Next week (Mon or Fri), I will share more about the experience. For now, just know that we love American capital markets, and we love what they mean for our clients, for the people God created who benefit from them, and for ourselves. Our financial markets in America are a dream. And now, there are two things in this week’s Dividend Cafe I have suggested gratitude for.

To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet