Dear Valued Clients and Friends,

I receive a lot of correspondence from people offering [what I think are] compliments about my diligence in writing Dividend Cafe. If I understand the sentiment correctly, they seem to be graciously thanking me for the work in writing Div Cafe every week, which I hope means they enjoy reading it. But I always feel guilty receiving these compliments, because the fact of the matter is I love writing the Dividend Cafe every week. It does not feel like toil or drudgery at all because it is one of the things I love most about my weekly endeavors, all of which I basically enjoy (full-time). However, if there is one thing that I confess is a challenge sometimes, it is not writing Dividend Cafe, and it is certainly not the reading and research that goes into it (my lifeblood). Sometimes, though, the selection of what to write about can be very challenging. And this week was a case in point!

Consider how this week has gone: If there were no news, market events, or macro happenings to even think about, I already have big picture pieces I really want to do about the state of China, the reasons for my Crypto apathy, a deep dive on tariffs, and a few other single-issue topics that loom large on my to-do list. And then this week alone, we started the week with a bloodbath in the Nasdaq and the Nvidia/AI world, had a major Federal Reserve FOMC meeting and announcement, suffered an unspeakable airplane tragedy in Washington, and advanced through the hearings of some of the most controversial of President Trump’s cabinet nominations, all the while earnings season hit fifth gear and an avalanche of companies reported quarterly results (with many more to come in the next four days). Anyone of these things represents a dedicated Dividend Cafe, yet all of them seem to warrant some coverage.

So that is what I will try to do – pay attention to all of the big news of what was a big week, focus investors and readers on the stuff that matters, and stay away from the noise. Someone has to do it because too many others are determined to do the opposite (it is like their motto is, “Don’t focus on what matters – focus on the noise!”) Business models matter. My business model is simple: Use the Dividend Cafe, to tell the truth, no matter how boring it may be. And if some people like being told the truth, they might like The Bahnsen Group. To that end, we work.

And hey, sometimes it gets me nice emails. Let’s jump into the Dividend Cafe!

|

Subscribe on |

First the Fed

As expected, the FOMC left interest rates unchanged at this week’s meeting (a fed funds target rate of 4.25-4.5%, down from last summer’s high of 5.25-5.5%).

Earlier in the month, the 10-year treasury yield was 4.8%, but it is now 4.5% (with no change in policy or policy expectations from the Fed).

The futures rate market indicates an 82% chance that the Fed will also do nothing different at the March meeting and a 57% chance that there is no move at the May meeting either. By the end of the year, there is over a 60% chance that we will have gotten either two or three more rate cuts (between now and then). Markets seem more focused on where things will be in 6-12 months than in 6-12 weeks, which is nice to see.

The basic lay of the land is this: The Fed is resisting the media prodding to comment on how hypothetical tariffs may impact their policy decisions; the Fed is ignoring any tweets or trolling from the White House; the Fed is talking about the normal things they always talk about (labor markets and price expectations); and the Fed is deeply focused on how to utilize monetary policy to avoid a tightening of financial conditions that will reverse the soft landing (no landing) that they feel they have pulled off so far. The vulnerability is Housing, where they believe broader economic activity is at stake, yet high mortgage rates have frozen would-be sellers in place, all the while, prices have not moved behind a supply deficit that remains deeply imbalanced with demand.

I continue to believe (read all about it) that they will continue to find quarter-point cuts here and there between now and the end of the year, all the while doing Fedspeak about jobs and prices, ignoring any incomings from the White House, and eventually ending the balance sheet reduction they have been doing known as quantitative tightening, with a goal of loosening conditions to where the long end comes down and housing thaws. It is all guesswork, patchwork, trial and error, and darts against a wall. It is what we call “central planning,” and it is a lot less scientific than many need to and want to believe it is.

The Real AI Question is not about China

Some of the initial feedback to last weekend’s events regarding DeepSeek, China, AI, and Nvidia was centered around whether or not China was now a formidable competitor to U.S. attempts at creating language-learning models and generative AI tools. It allowed for all of the normal things one expects in this day and age – basically, people bringing their priors to a subject that has nothing to do with what their priors are obsessed with. We got the usual skepticism about Chinese data claims (always worth considering). There were concerns that our policies had forced China into becoming a formidable competitor. There were concerns that we were not being stringent enough with our policies. And there was general hand-wringing over what the AI “thing” meant in the U.S. relationship with China.

And while it seems fair to point out some of the obvious things that many people’s priors want to ignore:

- China is ahead of the U.S. in 5G

- China is ahead of the U.S. in electric vehicles (look no further than trade barriers imposed by the Biden Administration, the European Union, and the Trump administration for this admission)

- China is ahead of the U.S. in batteries and drones

- China graduates more STEM students each year than the rest of the world combined (h/t Louis Gave)

And at the same time, it seems fair to point out other things, perhaps far more significant, that a whole different group wants to ignore:

- China is in a deflationary slowdown with a property bubble burst that has left their state-owned banking and credit system in shambles

- China has no rule of law worth taking to the bank

- China has no free flight of people or capital wherein market innovations can fertilize and grow

- China is Communist, does not have free speech, does not have a free press, and its language-learning advances are controlled and filtered by the CCP. Use that tool to cheat on your high school homework (one thing I know about those who use AI to cheat on their school work – they demand a free flow of information in their cheating scoundrelry).

But with all due respect, the debate that has been going on for years and years as to where China is a formidable competitor and where they are an un-investible disaster cursed by its own oppressive government and false understanding of a market economy is not the one the events of this week bring to the surface. All sorts of “experts” have chimed in to tout DeepSeek over the American AI tool, and all sorts of other “experts” have chimed in to pour rain on DeepSeek and the capabilities behind current Chinese AI tools. If it sounds like a lot of people “talking their book,” it’s because it is.

But here is where the light ought to be shining … U.S. AI Capex has grown exponentially on a promise of a result from AI tools that no one seems able to define, for which there is no proof of concept, for which there is no commercial model, and from which, historically, costs collapse over time – not increase exponentially. You can believe DeepSeek and China have revealed a chink in the armor of U.S. AI, or you can believe that DeepSeek is a Deep Fake, or you can believe something in between those two theories (might I recommend you consider the third option?) … But regardless, this much is true no matter what:

Assumptions of permanent ascendancy of U.S. AI tools seem priced in, and that assumption is vulnerable. Assumptions of the need for high-cost AI capex are priced in, and that assumption is vulnerable. Assumptions of eventual mass adaptation and acceptance of AI across society are priced in, and that assumption is vulnerable. The assumption of little or no competition for the current ringleaders in the space is priced in, and that assumption seems vulnerable.

I do not believe that China is going to eat the U.S.’s lunch unless the U.S. goes the way of China when it comes to freedom and the rule of law. But that does not mean one has to be a U.S. AI Bull. There is more at stake than just DeepSeek in this narrative. These vulnerabilities were there before DeepSeek beat ChatGPT in the Apple Store. This week, I just got a few more people talking about them. Human people talk without the use of an algorithm.

A Fair Question

Do I believe that all of the AI spending of the last couple of years is at risk of being the Metaverse debacle of 2022? Not exactly, but sort of. I certainly believe big tech companies are capable of massive, unprecedented, almost indescribable over-investment into something that has almost no practical benefit at all or that the public at large just rejects out of hand. I don’t think we will ever hear the words metaverse again, and I am confident Apple’s electric car and Google glasses will not be talked about much in the future. But the bigger issue around the capex that has gone into AI is not whether or not language-learning models and generative AI tools will exist – they already do. The questions are more about the utility, the cost-benefits analysis, and who will benefit. One company’s capex is another company’s revenue, and all capex for the spender must turn into revenue for the spender, or it was money set on fire and a declining revenue to the recipient of it over time.

Metaverse? Probably not. But a lot to learn still about how this all plays out? Oh, I think that is safe to say.

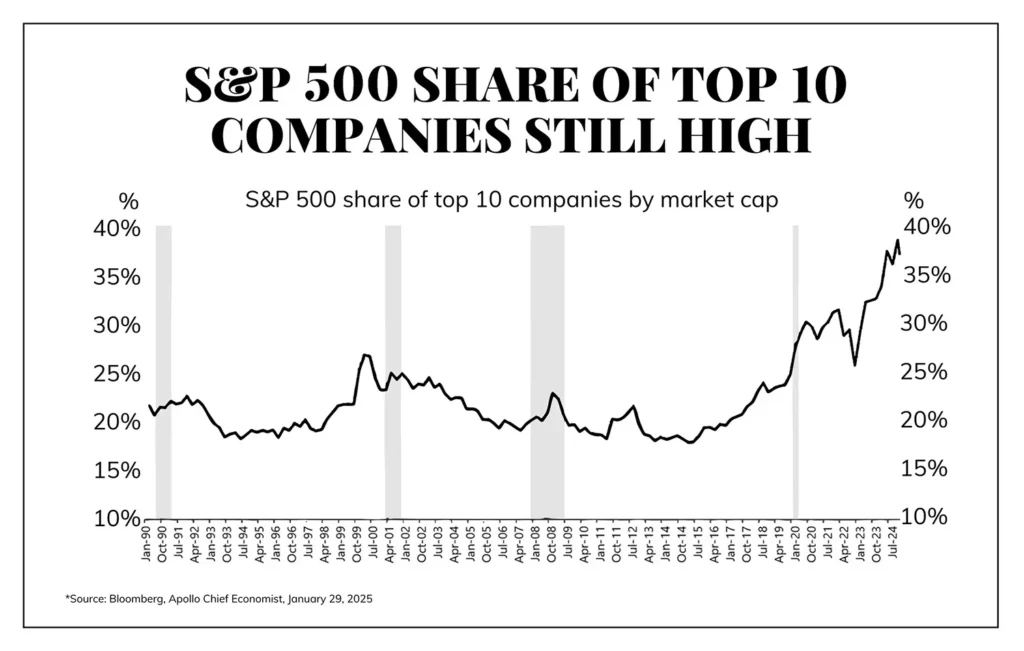

A Valuation Disparity

The S&P 500’s P/E ratio for the next year (if earnings targets are reached) is 22x. But, the P/E ratio for the top five names in the S&P by market cap is over 31x … The MEDIAN P/E is 18.6x … Meaning, the whole S&P is expensive, but 65% of the delta over its historical valuation average is coming from just five names.

Math is Math

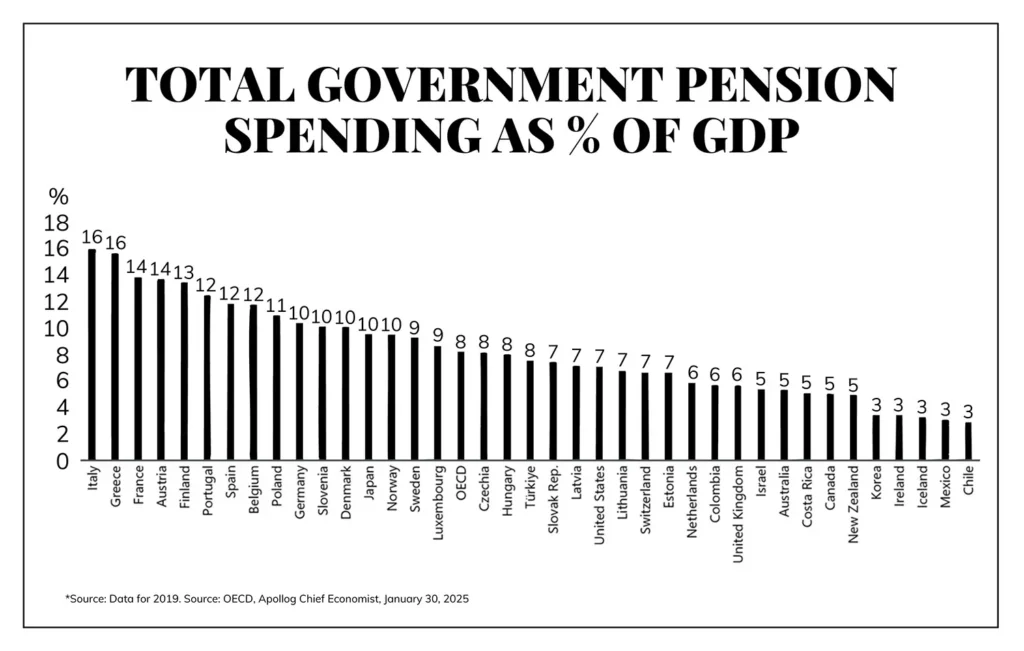

Pensioners need to receive their promised pensions. I know of no reasonable person who believes that retirees who receive a promised retirement benefit (whether from the government or from their company’s defined benefit pension plan) should be cut off from that which was promised to them. Those (like me) who are critical of promises that have been made to large segments of the population in various jurisdictions do not argue that promises that should not have been made do not need to be kept. And by the way, there is also a big difference between criticizing the level of pension benefit promised to certain people (often legitimate) and criticizing the fact that those promises are often not funded by the people who make them! Some could argue that we have been recklessly generous with pension promises and recklessly irresponsible not to fund those commitments. None of that seems like a stretch to me. Yet even then, I believe promises made to retirees need to be kept.

So that all said, if you ever want a single chart explaining why some Western countries are stuck in a low/slow/no growth economic malaise, this may be the one. Promises to pensioners must be kept, but the higher the percentage of GDP (total economic output) these payments represent, the slower growth you can reasonably expect. Some percentage of GDP resources is needed for spending on pensioners, and at some level, is just plain anti-growth. A picture tells a thousand words.

Chart of the Week

It hasn’t been a great month for the top ten companies (by size) in the S&P 500. A couple are up, a couple are down a little, and a couple are down quite a bit, but as a group, they are down a few percent on the month. And yet, the percentage of the S&P 500 they represent has barely nudged.

Quote of the Week

“Speculation is a name given to a failed investment and investment is the name given to a successful speculation.”

~ Edward Chancellor

* * *

I am writing and recording from Atlanta this morning. I speak at a conference this afternoon and will head back to New York City tonight. Writing today has been a lot of fun because it always is. Now, I have to figure out what to write about next week.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet