Dear Valued Clients and Friends,

I wrote this week’s Dividend Cafe on Thursday morning, something I haven’t done for a Friday publication in a long time. For virtually all of 2020, there was a huge focus on making the distributed commentary as “current” as possible before submitting it. Markets were moving so quickly that if the focus of the commentary was on what was happening in the markets, any delay between submission and distribution was likely to result in some part of the message being “obsolete” by the time it got to you, the readers.

Indeed, as I type this beautiful Thursday morning, I have no idea what the markets will do on Thursday, let alone Friday. But I don’t particularly care, for reasons I will explain inside the Dividend Cafe.

I have been writing the weekly market commentary since the financial crisis, as a large portion of you know. I am grateful to all of you who have stuck with the reading of this for so long. It has really always been written “as I go” throughout the week, sometimes with a lot of weekend reading the week before driving some of the messages, and almost always with bit by bit writing throughout the week leading to the eventual finished product. I may get inspired on a Monday morning about emerging markets and write something then, and find a development in rate policy on Tuesday and write more still, then. It has always been the culmination of many hours of reading and writing work throughout a week.

The beginning of The DC Today a couple of months ago gave me a new venue for such ad hoc and market-sensitive writings, and I am loving doing it. It also enabled me to transition the Dividend Cafe to less spotty writing, and hopefully a more cohesive weekly offering.

Well, that brings me to this week’s Dividend Cafe, and the topic of the here and now. Some reflections are in order, and I hope my reflections will resonate with you to some degree, and even provide some investment application that speaks to your situation. So without further adieu …

Timing isn’t everything

The reason I am writing this on Thursday morning even though it is going out for Friday distribution is two-fold. First and foremost, it is patently absurd that I should ever be so concerned with one day’s worth of market action that it would alter my approach to writing the Dividend Cafe, let alone a few hours worth of market action. At the height of market volatility in Q1 this year we would frequently record in the morning on Friday, and then see a market reversal one way or the other of a few hundred points, and then re-record and re-write key parts of the commentary, if not all of it. I remain sympathetic to our thinking at the time – that readers in moments of heightened anxiety want as updated of news as possible, and so to knowingly send something that become marginally antiquated after publication is sub-optimal. Indeed, as an obsessive consumer of news data who also loves reading a physical newspaper in the morning, it is painfully weird to read stories in the Wall Street Journal in the morning that I already read online the afternoon or evening before.

But the reality is this: that concern only mattered in the heat of the moment where daily market gyrations were sort of all that was on anyone’s mind. And as I wrote at some point in a Dividend Cafe earlier this year, those daily gyrations in the market are never, ever going to be what primarily determines an investor outcome. Yet I am not naive – in the heat of those moments, most readers are not as interested in what I have to say about asset allocation or the time value of money …

Well back to this week’s writing. I am comfortable writing on a Thursday what will go out on a Friday because those circumstances of Q1 are long behind us, and I don’t care what the market does today or tomorrow. You may think you care, but your long term success does not care. And I believe “time-sensitive” considerations around this commentary should be hyper rare, not at all the norm. So I defend what we did in Q1, but also defend not doing it anymore.

A glimpse at a normal life

There is another reason I am writing this on a Thursday and sending it Friday; I will be unavailable to write it on Friday, because I am going out of the country with my wife for a few days, and I am not going to work Friday. I have not gone six hours without my computer in over ten years, and I have never taken a day off, ever, without working on the day off (which I think means I may not know what a day off means). So I am going to unplug Friday (from the computer, probably not the phone), and enjoy a long weekend at a secret spot. I hear normal people do this kind of thing.

What do you care?

If I were you I would not care about my hardly-secret workaholism or weekend travel plans. But there is a greater investment lesson in this than might be apparent. In the here and now, in this exact moment, my willingness to unplug for a day, to write Dividend Cafe a day early, and to project my daily market apathy to the world, is a direct by-product of the incredibly different set of circumstances we now face than just a few months ago.

Markets are capable of big moves up and big moves down at any time, but the day-to-day anxiety of what a COVID headline would do is a thing of the past. And while it is my contention that markets re-priced and re-formulated COVID realities many months ago (hence the reason the summer “surge” never impacted markets), the election has still lingered as a primary factor around many people’s investing anxieties. I simply lost count of how many people asked me if they should go to cash until the election was over to mitigate the risk of a bad outcome or an uncertain outcome (a “bad” outcome being defined entirely by the partisan inclinations of the person asking the question). Fair enough. Well, that was all 3,000 points ago – meaning – as we went into the weekend before the election we were at 26,200, and as I type we are at 29,300. I stand behind the counsel I gave of the folly of playing roulette into cash around the most polarizing event of our year. But I digress.

The “trauma” moments for markets – real or potential – have subsided (for now). COVID is not going to kill millions of Americans, and the election is not ushering in a new period of Venezuelan-style socialism. New reasons for ups and downs are inevitable. But the trauma of 2020 is changing. Thank God.

I am so blessed in my professional lot in life that I try my very hardest to ever come across as ungrateful or discontent. Yes, I do work about 16-18 hours per day, and yes, I am pretty much working even when I am not working. But I also am paid for this lifestyle decision I have made, and I have no basis for complaint. Yet with that said, I have pushed the boundaries of mortal capacity this year mentally, physically, and emotionally, and I am ready to breathe for a few days with my bride and some books.

Market blessings

It is hardly an act of market apathy that the Chief Investment Officer of The Bahnsen Group would take a weekend plus one market day to go off-grid, and yet it does speak to a set of circumstances that ought to be understood for investors. Consider the following:

- Markets spend much of their time pricing in risks. The risk of election stalemate has been [almost entirely] eliminated. The risk of a single-party far-left government has been defeated. The risk of worst-case COVID predicaments has been mitigated. With less tail risk events to price, it allows for upward bias in risk assets.

- Risk assets are priced against the risk-free rate (what we call the “discount rate”). That rate is 0% now and will be for a long, long time. This allowed stretched valuations in many risk asset categories to not just be sustained, but rationally so.

- While significant economic challenges persist, we have seen across the board since the COVID spring that the worst-case economic prospects have not been realized, and that many aspects of the economy – labor, wages, housing, production, consumption, manufacturing, etc. – have proven to be more resilient than once feared.

Market fears

And of course, on the other hand, consider the following:

- The price of dealing with the lockdowns was, so far, ~$3 trillion of additional deficit spending, a ~$7 trillion Fed balance sheet, and a real codification of a Fed/Treasury accord as a means of dealing with the debt challenges of modern economic life.

- Corporate earnings took a hit in the belly of the lockdowns, and even though they have recovered since, questions remain about the durability of revenue growth, the forward direction of profit margins, and the animal spirits in the economy necessary to feed ongoing production.

- A re-regulatory environment is likely to, at least on the margins, replace a reasonably de-regulatory environment (certainly in particular sectors), and may impact momentum, valuations, and other peripheral realities of the economy.

Breathing today about the benefits tomorrow

If I have said one thousand times in the Dividend Cafe that markets are, always and forever, a discounting mechanism, pricing in today what they believe about tomorrow, then I have not said it nearly enough. And no matter what comes up between now and the end of the year – no matter what certain governors and mayors do about COVID cases – no matter who is appointed the deputy undersecretary of the commerce department’s committee on trade – no matter if Congress passes a new fiscal package or not – markets right now are able to look ahead to the reality of a post-vaccine era, a world of unprecedented pent-up demand, a society desperately seeking normalization, and the fiscal and monetary gravy that go on top of that big heap of mashed potatoes. It is the story we face right now. Filled with uncertainty, yes. But certain of a few things that were themselves, previously uncertain.

Contrarian realities and investments

Is it hard to get excited about the Energy sector right now? Consider this and tell me how it is possible to not be excited about it. Demand is now going higher, and supply has gone way lower. Oh, and it has been hated by almost everyone. Are these conditions for bearishness or bullishness?

Is it hard to feel good about the political environment right now? Consider this and tell me if it warrants a re-adjustment. Is the momentum right now behind moderation or extremism? Just consider some of the high profile events in the media of the last few months, and the outcome of the election, the fight currently taking place in the House of Representatives, the blitz of center-left writers leaving mainstream outlets to take on their own very popular writing venues, the combined messages from the Presidential and Senatorial elections, and tell me how it is not possible to see that perhaps we are in for a period of market-liking moderation in the political sphere?

Is it hard to be excited about emerging markets right now? Look at the removal of an overvalued U.S. dollar that has been a millstone around the neck of that assets class for 5+ years and then look at the P/E ratio of emerging markets equities relative to the rest of the world, along with the organic earnings growth the space is generating, and then tell me how it is possible to not be excited about it?

Is it hard to be excited about over-valued big tech right now? Look at the world-changing technologies coming from small tech – from the post-FANG space of true innovation and tell me how it is possible to not be excited about it.

Truth in advertising

I can write about all of these positive things in the runway for investors right now with a straight face because they are all true, even as the perpetual reality of investing rings loud and clear – that markets are inherently unpredictable. And anyone whoever tells you that (a) You can get paid a really attractive premium return in investing, and (b) Do so without the persistence of premium risks and uncertainties, is a liar and a charlatan (or worse, a know-nothing incompetent). So yes, I stand behind my current view of the world, and at the same time, reiterate the never-changing truism of investing. The world is messy.

More meat on the bone

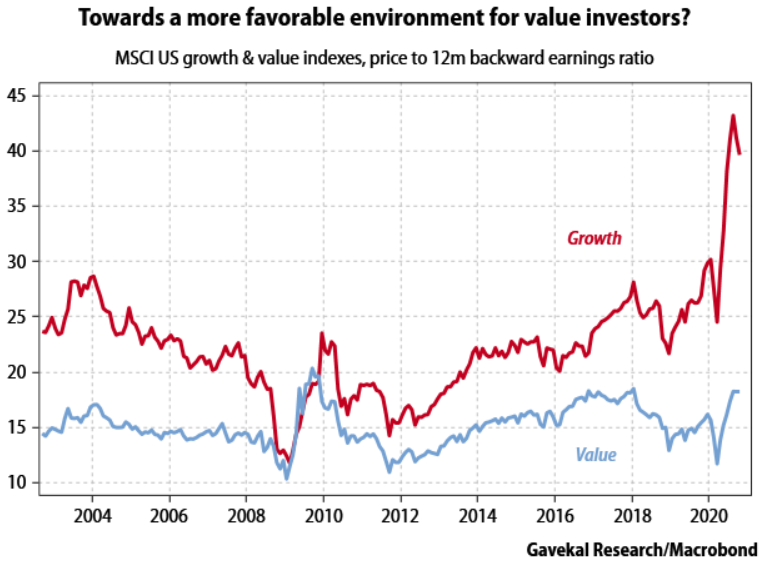

I do believe there is a rotation underway in equity markets that will take a long, long time to play out. This last Monday we saw a teaser of what it will look like, but it is not a one-day or one-month event. History has been very clear – trends that take years to form can take years to mean-revert. But mean-revert they do. And we will spend a lot more time in the Dividend Cafe talking about that between now and the end of the year.

Concluding thought

Markets never sleep. This is true. But investors should sleep. That is actually the point of investing in markets – because doing so gives you a greater capacity for enjoying life – it gives you more resources to do the things you care about in your life. Being invested in markets should never ruin peace and rest because the point of it all is more peace and rest. Don’t ever lose track of that reality.

Politics & Money: Beltway Bulls and Bears

- All eyes are on Georgia for about seven weeks. Reach out if you want to be more involved.

- I will be particularly focused on the income Biden team in The DC Today for the rest of the year.

Chart of the Week

Quote of the Week

“Trials and tribulations are the transportation for where you are going.”

~ Mark Jackson

* * *

I will really look forward to being back next week because I love my work, I love my clients, I love the market, and I love the daily grind. And for the next few days, I love the peace and quiet. “Be still and know that I am God,” the Psalmist wrote. Well “still” I shall be for a couple days, and praise the Lord for it.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet