Dear Valued Clients and Friends,

Markets re-opened Tuesday this week after the MLK holiday on Monday, and experienced some modest moves to the downside on the week as of Thursday’s press time … But in a shortened market week where the big political news (impeachment hearings) are completely ignored by markets, and where there is no notable macroeconomic news or Federal Reserve announcements to process, it gives us a great opportunity to catch up on other topics not given enough attention in the Dividend Cafe.

We’ll talk shale this week, viral fears in China, why a high bond supply does the opposite to interest rates that most people expect, and we spend a lot of time in Politics & Money …

So jump on into the Dividend Cafe. It’s a good one.

Dividend Cafe – Podcast

Call me in eight months

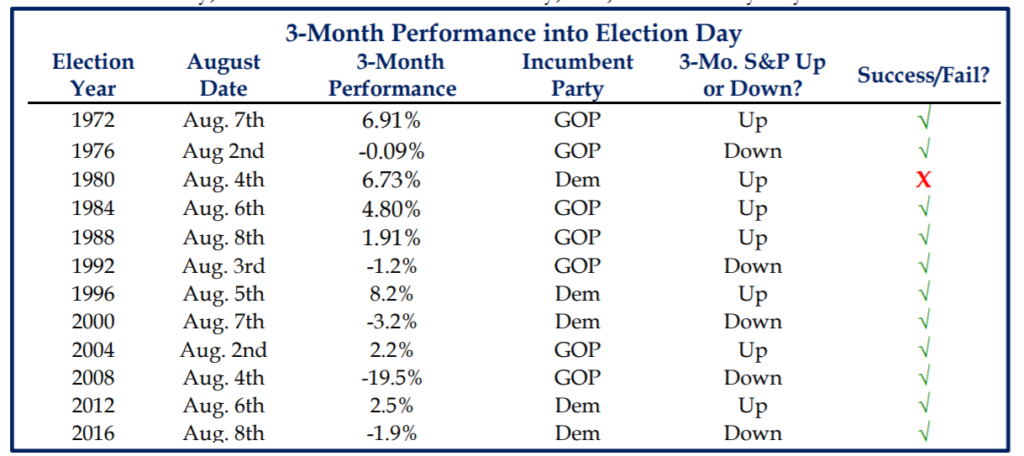

I have written in the past of the fascinating historical correlations between stock market performance in the year or two before a Presidential election and the predictive value it offers to what will happen. But I was fascinated this week to read of how much better a simple 3-month prior to the election analysis has been in offering predictive value. The fact of the matter is that this high correlation, though, maybe as much effect as cause (in other words, in many cases the market may be moving up in advance of an election because of what it believes the results are going to be; as opposed to the election going the way it went because of what the market did in those final months). But apart from that chicken-or-egg discussion, there is clearly a high correlation between the three-month indicator and the ultimate market result.

* Strategas Research, Quantitative Research, Jan. 23, 2020, p. 1

What to own when things get shaky, and when they aren’t shaky

A major theme for us in 2020 is the superiority of owning quality right now vs. lower quality equities (in terms of balance sheet strength, valuation, and debt ratio metrics). It should be pointed out that lower quality has outperformed higher quality in the first three weeks of 2020, but alas, our theme is for the whole year …

Goldilocks, meet Shale

I have been writing for many years about the delicate dance oil prices represent in assessing the global economy. Prices much below $50 per barrel start to point to weak global demand, meaning weak global growth, and become a self-fulfilling prophecy of such as prices dip below a level of profitability for many American producers. But prices much above $75 become highly problematic as well. While they may boost energy producer profits, prices that high tie up the working capital of most oil consumers, take dollar liquidity out of the economy, and weigh on prices and consumer spending (especially in areas like Europe where no such margin of error is readily available).

Oil prices have tethered between $50 and $75 for several years, and the market has liked it all. The end of that range speaks well for profits in the energy sector, and the low end of that range still represent profitability for American companies who have simply done yeoman’s work at improving their efficiencies.

U.S. shale companies are sitting on 7,500 drilled but unexploited wells. The cost of activating those wells is dramatically lower than it was five years ago. Barrel-per-day production is likely to exceed 1.2 million this year, all of that profitable at the margin. We have production capacity outside of OPEC to maintain a perfectly adequate supply to avoid a price shock to the upside, and yet global demand is strong enough to maintain the higher prices we presently see.

All of this leads to a range-bound oil price that is pro-growth and anti-inflation, good for U.S. producers, good for the infrastructure of shale, and most of all, good for the economy overall.

Viral fears

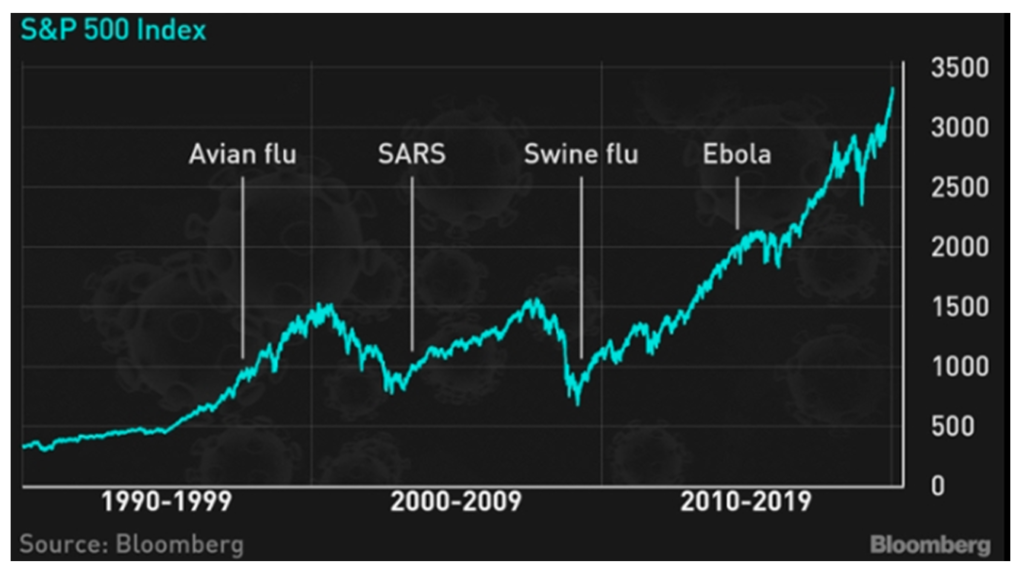

At first, when I heard the expression “coronavirus” this week I mistakenly thought it was a media jokester’s funny term for a hangover, but by now we know there is a flu outbreak in China that sounds like a positively awful thing. Analogies quickly went to the 2003 SARS event, something I remember well as one of the first times financial media ran with something that was not a market event in order to try and make it a market event (the S&P 500 was up over 26% in 2003). The infectiousness of this new virus let alone how lethal it is are not known, and little information is known. The transparency and preparedness of the Chinese government appears to be night and day different from what transpired with SARS seventeen years ago.

Who knows what the human toll will be in the days and weeks ahead (we pray, of course, that damage will be extremely limited). Thus far the reports are 17 fatalities and 500 infections (in China). But from an investor standpoint, we do not see it as anything that would alter properly constructed investment policy. Indeed, the last three major global health incidents saw markets advancing throughout …

Speaking of an S&P 500 on the rise …

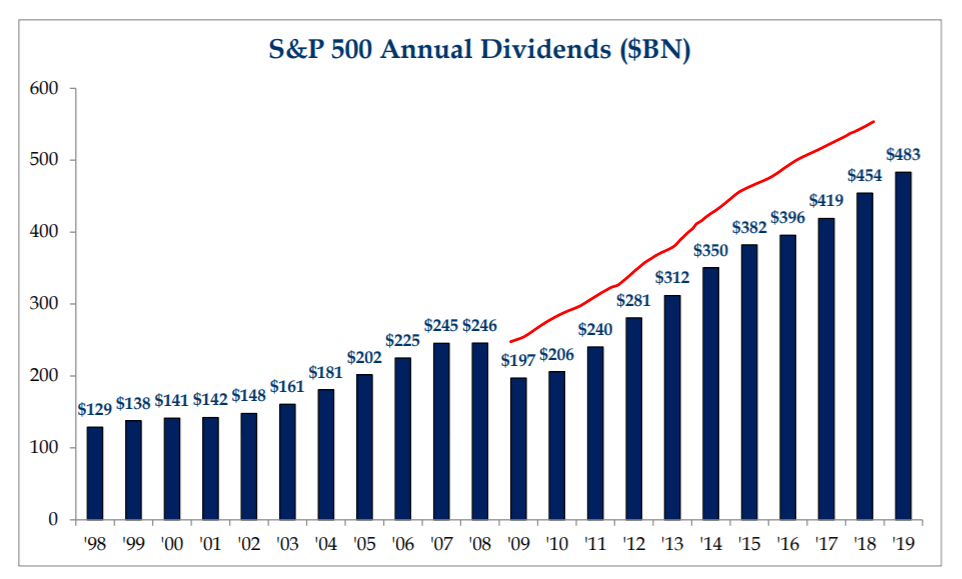

Whenever someone says that they believe the S&P 500 has risen too much since the financial crisis, I encourage you to look to this chart to understand the proportionate increase in dividends from the S&P 500.

Prices follow cash flow. Always and forever. If the rate of price growth gets way out in front of income growth, a correction becomes necessary. Consider real estate prices pre-crisis relative to rent levels. And of course, this does not help us rationalize some of the frothy valuations in the tech or consumer space, for example. But dividends across the whole market went down during the crisis, and the rate of price increase since that bottom is perfectly in line with the rate of dividend growth. It’s almost like there is an economic law playing out here or something …

But anecdotally …

Note, by the way, that there are years in market history (see above) where the S&P had unimpressive dividend growth from the prior year (2000, 2001, 2008, 2010), and even one year with a substantial drop of dividend income (2009 – financial crisis mayhem). This, of course, is why dividend growth investors cannot be S&P index investors – because the good business models of 25-50 companies are disrupted by more cyclical models of 300 others. Avoiding dividend reduction comes from the intentionality of seeking sustainability and culture in dividend growth. To that end, we work.

Economics lesson for the week

Quantitative easing is essentially the buying up of bonds with money that does not exist. There are record levels of bonds issues by the United States treasury, but also Japan, Europe, etc., to fund record levels of budget deficits. The more the government spends, the more they issue bonds to pay for their spending. And quantitative easing is essentially the central bank of that country funding that deficit by buying those bonds (monetizing that debt). So why would more bonds (higher supply) push the prices of bonds up, when supply/demand would suggest it should push the prices down (and lower bond prices means higher bond yields)? In other words, why are we getting lower bond yields, when we should be getting the opposite based on supply and every other intuitive fundamental?

Because as debt rises, expectations for long term growth must inevitably decline. That debt today is taking out of growth in the future. A claim on some future economic output has been marked today by government debt. Declining growth outlook means downward pressure on interest rates – you cannot raise rates when growth expectations are dropping! But this is the part that matters to us as investors – this “ceiling” in interest rates (created by the economics of debt biting into future growth) impacts asset prices! It makes stocks and real estate and other risk assets worth more because the discount rate by which you measure the risk asset’s future earnings have been lowered! It is just math.

And it gives investors the ability to bid up the prices of risk assets and feel okay doing so. It invites risk, malinvestment, misallocation of capital, and all sorts of problems (distortion), but it is the price central bankers are willing to pay to avoid the unthinkable.

Politics & Money: Beltway Bulls and Bears

- White House economic director, Larry Kudlow, has been tasked with designing a Tax Cut 2.0, aimed at the middle class, in what will be a key part of the Trump administration’s 2020 campaign platform. Of course, the votes are not there in the House right now to get such a bill passed, but it could become campaign fodder in the election year and present a glimpse of the agenda should the Republicans pick up seats in the House.

- The tax cuts that can get done without Congress are:

- Lowering of trade tariffs

- Indexing of capital gains to inflation (the President has said he is not intending to do so)

- The tax cuts that we expect to be part of a Kudlowian package (but would require Congress) are:

- An expansion of the Earned Income Tax Credit

- A payroll tax cut (it is simple and easy to articulate, but not very stimulative on the supply side)

- And while not a tax cut, we expect much of what they do will get linked to greater infrastructure spending

- This remains a pure campaign discussion, not policy probability, unless the GOP is to re-win the House this November

- If I could wave a wand and make a Tax Cut 2.0 bill say whatever I wanted, it would be for lower marginal rates across the board, but that is the least likely thing to happen politically speaking. Lower-income rates are more stimulative on the supply side than lower payroll taxes for a variety of reasons.

- So ironically, the most stimulative thing the President can do is one of the only things he can do without Congress, and that is because he did it already the other way without Congress – a lowering of tariff rates. Tariffs were implemented without Congress which means the President can undo them without Congress, providing a significant increase to economic incentive and growth. Of course, he has other policy agendas that may not allow him to do so, but how many times can you say that the President can create his own tax cuts if so desired?

- It may seem boring and undramatic, but one of the biggest stories of the week is that the Trump administration has finally sent Judy Shelton to the Senate for approval as a governor on the Federal Reserve board. Judy is a well-respected advocate for sound money.

- Gary Cohn, former president of Goldman Sachs and former National Economic Council Director for President Trump, on the state of the economy and how it benefits and doesn’t benefit President Trump’s re-election effort:

“The stock market he’s got. Wages he’s got. The consumer side of the economy is working really well … The soft underbelly is that capital expenditures are not there. He stood there in Pennsylvania and talked about bringing steel mills back and what’s happened is we’ve cut steel lines. We gave companies a big tax cut but then took it away with tariffs. These are the pieces that are missing. I think he could have had it all. And he doesn’t have it all.”

I think politically this is a good assessment. The trade war hurt. The tax cuts helped. The consumer and jobs are strong. Business expenditures are not. The economy is a net plus for the President’s re-election effort, but not the slam dunk it otherwise would be sans trade war.

- Elizabeth Warren wrote letters to the eight largest bank CEOs this week demanding to know their plans for dealing with climate change. No further comment.

- Wharton Business School released its Penn Wharton Budget Model this week projecting that the Sanders/Warren wealth tax proposals they are largely campaigning on would generate $1.5 trillion less in revenue that the candidates have projected.

Chart of the Week

I honestly never thought I would see this, but we presently have five companies – five – that represents a stunning 18% of the S&P 500. The number was ~16% in 1999, and that became a few months later evidence of a massive distortion in technology sector stock prices. This is not a statement about the valuation of these companies being too high or not too high; but it is a reflection of what risks investors actually own in their index composition these days. It is very different, and much less diversified than many understand.

Quote of the Week

“Free men know what tyrants never learn, that the ultimate economic resource is the mind and energy of a free person.”

~ George Roche III

* * *

I am looking forward to having a better assessment of earnings season next week and the week following. The results are highly (and not unexpectedly) mixed thus far, both in our own portfolio but also across the market. There remains idiosyncratic events driving many company results, and we want to take advantage of any company situations that create buying opportunities. But as for broad market positioning and appropriate weighting of stocks, bonds, and alternatives, we feel very good about where we stand.

So enjoy a football-free weekend … I have not taken a breath since the new year started between all the new portfolio positioning, client review season, and out big strategic priorities for the year (we want every client being updated on financial planning, estate planning, insurance review, tax needs, cybersecurity, and our custom portal). I also have a new book out, and a big announcement is coming next week regarding our team (new hires in our new and improved New York office). I have a few hundred pages of research to take in this weekend and will enjoy some real quality family time. That sounds like paradise to me.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

www.thebahnsengroup.com

This week’s Dividend Café features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet