Dear Valued Clients and Friends,

Our nation sits on top of a $37 trillion balance of its total national debt, $29 trillion of which has to be paid back to others. It adds $1 trillion to that in a good year, and lately much more than that. It has trillions of dollars of unfunded liabilities in its Social Security and Medicare system. And its political leadership is almost entirely unwilling to do anything about it, realizing that the far better play for their own power is to build a brand as someone who is mad at the other side when they are in power and don’t address it.

A few weeks ago, I wrote a Dividend Cafe with a few things I would do if I could be king for a day and just do what I wanted to do. I was very clear that I did not find all of my solutions to be realistic in our political reality, and that “Dave-land” was a fictitious place, not a reflection of potential policy. A few people replied with some version of:

“Okay, so your ideas are not likely to happen – but what will happen if we do nothing? What are the outcomes in front of us absent some serious attempt to deal with this?”

And since this is one of my favorite topics in the world, and it warrants an answer outside of Dave-land, I have decided to dedicate today’s Dividend Cafe to the subject of “what will happen if we do nothing?” It matters to investors a lot, and there are a lot of wrong answers out there. Let’s jump into the Dividend Cafe!

|

Subscribe on |

In All Thy Getting, Get This

The absolutely best thing I can say about what will happen if we don’t address the national debt fiasco is that:

“No one knows.”

I don’t believe readers of the Dividend Cafe will ever be able to comprehend the contempt I have for the perma-bear cottage industry of doom-and-gloomers who haven’t right about one *&@$#% thing their entire lives, and yet who have successfully scared many well-meaning people out of the prosperity and stability they deserved by fooling them into believing they knew something was going to happen, when they knew no such thing. I believe what compounds my disdain for these people is the compounding of their own grift, hubris, and incorrigibility (re-read the first word there) … They are never content to be wrong just once. Rather, they have somehow created a business model whereby they are wrong over, and over, and over again. And yet their own stupidity is matched only by their shamelessness and inability to feel embarrassment. That there is an insatiable number of people desperate to hear doom and gloom messages is the wisdom of their business model – “I don’t ever have to be right; I just have to find the many people out there who want to believe what I am saying is true.” It’s gross.

Beyond those who peddle in doom and gloomism is the simple fact that no one has been right up to this point, and therefore, I have no reason to believe anyone will be right in the future. This is not a critique of the ability or integrity of the well-meaning forecasters about such things (in contrast to the camp I describe in the preceding paragraph, who I loathe), but rather a comment on the basic impossibility of getting right such inherently unpredictable and multi-faceted things. I do not mean no one is right when they make a highly vague and macro assertion (i.e., “there is going to be a price to pay if we do not address the national debt). Yes, assertions at that level of depth and certainty have a pretty good chance of being validated over time. “If that guy does not lose weight, he is going to have health issues” are often pretty safe claims. But that is very different than predicting a specific health event at a specific year (or even decade).

The objective cannot be, and should not be, the finding of a crystal ball. No such thing exists. Nor can the objective be an even less specific take that requires a pretty specific path to play out. There are simply too many possibilities of being wrong – of variable outcomes that domino into different directions and go very astray.

So, before I go on to make a case around this subject that does not violate my own rules, do not forget the main takeaway in the question, “What happens if we do nothing?” No. One. Knows.

Past the Point of Pain-free Options

I do not know if the solutions to our debt fiasco will involve pain felt a little bit for a long time, or deeply for a short time, or hard for one group and less so for another, or any other combination of possibilities you can come up with. I just know one thing: There is absolutely no option to address this issue without some pain, to someone. The hypothetical of the question we seek to answer today is that the issue is not addressed, but I believe it will be in some manner, at some point – with some pain. And I think some options involve more pain than others, and some options distribute the pain differently than others, but none are pain-free. And perhaps the most important point: The pain gets worse as more time goes by. The sooner the better.

A Framework for Answering

I would not say that “dogs and cats falling out of the sky if we do not address the national debt” is a wrong answer … I certainly wouldn’t say it is a right answer, either, and if I had to go place bets on various options it isn’t the option I would bet the most money on. But I would say that, right or wrong, it isn’t a helpful answer. For one thing, if dogs and cats fall out of the sky, what does that mean to you and your portfolio? And when does the rainstorm of pets begin, exactly, in three years, or three decades? Oh. And I forgot. When this feline frenzy begins, what will the response to it be, and how will that affect me?

So, generic chaotic predictions are low probability, they lack specificity on timing, and they lack clarity on second and third order effects, which may prove most relevant practically.

What I might suggest for a framework in answering the question is to make a list of legitimate options for reactions that get a little more specific, and avoid the hyperbole of cats and dogs falling on your head.

An Incomplete List of Potential Responses and Outcomes

- This one should be disqualified from the list because the subject today is the hypothetical of “if they do nothing”. But in theory, the option of “Immediate Fiscal Responsibility Combined with an Aggressive Economic Growth Agenda” would be a really good option to consider. It is certainly not going to happen, and it would not be even close to pain-free if it did. But since it is the option I want, I feel compelled to include it. You can call this the Calvin Coolidge Option, but it may as well be off the list, I am sad to say.

- Financial repression is almost assured to be a part of the outcome, but this has varying degrees of possibility. Best case it means Japanification, manipulated interest rates, and central bank interventions. Worst case it means actually erasing the governmental debt held by the central bank (literal monetization of the debt). The latter is textbook inflationary. The former is textbook deflationary. And both are grotesque. But do I expect financial repression to be a part of the outcome of excessive national debt? About as much as I expect myself to be asleep before midnight tonight (hint: I am in bed before midnight every night). The dramatic version of this involves forgiving the debt owed to the central bank, or issuing a trillion-dollar coin that is then used to satisfy debt, but lingers in outer space on the balance sheet of the Fed as quasi-debt monetization. I believe these things are front and center in the playbook, with the ones they have already done (ZIRP and QE) obvious, and the ones others have done, less obvious but not impossible (monetization, selective reduction).

- Some would say full Debt Default is a possibility – not merely through central bank monetization of the debt but in actually not making principal payments to creditors (i.e., sovereign wealth funds, pension funds, insurance companies, savers, banks, and investors, etc.). And yes, certain third-world countries have done it, and some have done it more than once. But no, this would not be low-hanging fruit for the same reason most chronic borrowers do not default – because they need to keep borrowing. You hear some say things like, “they can just not pay China (or other adversaries) back but still pay the good lenders back,” and the answer to that is, “ummmm, no, they can’t.”

- Allow me to get very realistic for a moment. A recalibration of Social Security and Medicare benefits is going to happen if nothing is done beforehand. All we are debating is whether or not it happens with a gun to the head, or without a gun to the head. It would seem to me the discussions would go better without a gun, but if the discussions can’t happen without a gun, then it is what it is. But some recalibration of benefits, age eligibility, and other peripheral details will happen, with all these things going much better if they start deliberations now, versus at the point of emergency (see: Fannie/Freddie)

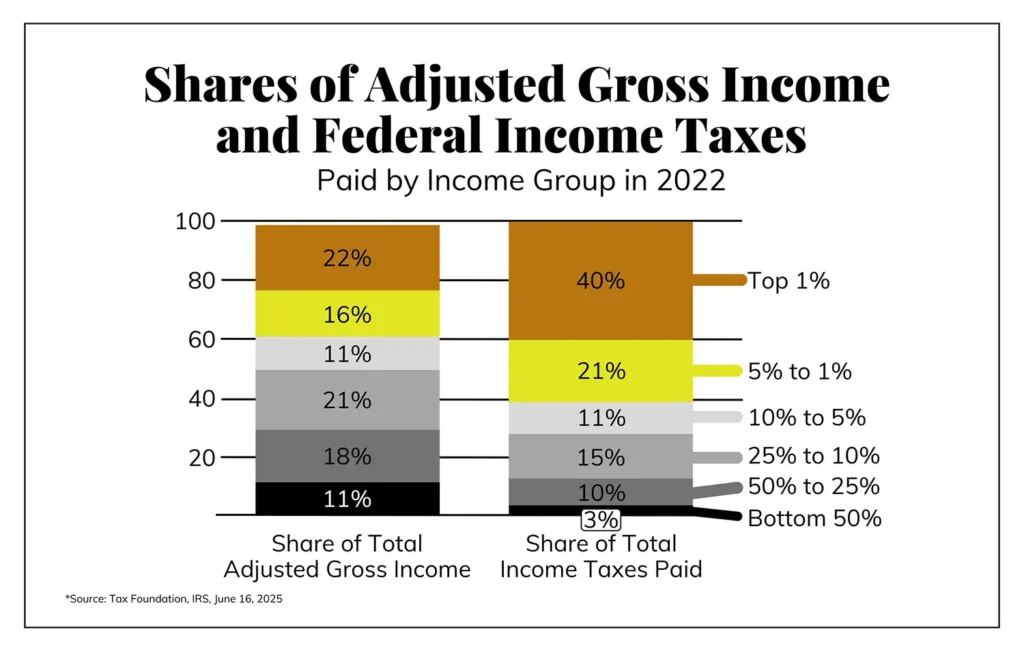

- Higher tax rates on the middle class (and a VAT tax) to generate more revenue are extremely likely. Why do I say middle class, you ask? Because I assume they would have already raised rates on the highest wage earners before the emergency comes, and the middle class is the only section of wage earners paying less than their contribution to federal outlays. The top 1% of wage-earners already pay 40% of federal income taxes and earn just 22% of total income. But the middle tier of wage earners (25-50%) pay just 10% of income taxes, but earn 18% of total income, while those above that in the 10-25% class of wage earners pay 15% of all tax while earning 21% of all income.

I am not saying I want it. I am not saying it could happen without massive political pain. Heck, I am not even saying it could happen without some social unrest. But I am saying that mathematically the revenue will be easiest to find where it is most missing in proportionality now – and that is from the 5th to 9th decile of wage earners, the so-called middle class.

- The federal government has some assets it could sell. Their actual financial statements refer to $1.3 trillion of land, property, and equipment, so a drop in the bucket, even if it were saleable. But, and this will really upset some people, they also own $23 trillion of federal land (according to various studies by the Bureau of Economic Analysis). From oil to gas to minerals, there is a fortune of assets that are considered completely and totally off limits, and I do not think you will find national parks being converted to a Four Seasons by Blackstone any time soon. But do I think some degree of liquidity could – could be created by selling federal assets? Well, yes, I do.

Summary

I would expect the following to all be utilized in the future around the fiscal fiasco that has come upon our national debt situation:

- Financial repression (central bank manipulations)

- Asset sales

- Recalibration of Social Security and Medicare obligations, including means testing, age eligibility changes, and benefit reductions

- Higher taxes

Inflation, Deflation, or Disaster?

My base case has been, for some time, that the most likely outcome of continued fiscal mismanagement is exactly what we already face, non-hypothetically. Downward pressure on real growth as more and more resources are sub-optimally and inefficiently allocated to fund a bloated government, where the most stark price is paid in the form of reduced growth, productivity, and prosperity. Running at sub-optimal growth is not cats and dogs, and it is not acceptable, and it is also unlikely to stay at 2% growth (vs. 3%), but could very easily move to much worse levels of Japanification.

Or not.

No one has ever gotten rich underestimating American innovation and productivity. I am not one to suggest a white knight, but I bring up the possibility of an industrial revolution changing everything because, well, one time an industrial revolution changed everything. It is hard to see exactly what thing may be, but it is not as hard to see that there may be something. I haven’t found TikTok to be quite the change to our standard of living that the automobile or personal computer were, but that’s just me. But I think lower growth is a mathematical byproduct of how growth works. One of my favorite living economists, Lacy Hunt, has made this abundantly clear for years:

National Income is reduced by National Debt

Savings come from National Income

Savings = Investment

Investment drives Productivity

Productivity drives Growth

Ergo, national debt reduces growth

Disappointment

Am I suggesting a half dozen or so possible government actions (that will all be bad), and then repeating my basic Japanification thesis (suppressed growth made worse by fiscal and monetary response to suppressed growth), as the takeaway to this week’s Dividend Cafe? Yes, I am. You may be disappointed. You may have wanted to hear that we will be trading furs with each other on a river after shooting each other’s next of kin (or something like that). And I promise you that point of view is out there.

But what I promised is what I have done. I refuse to be a false prophet. We have real problems, and we will face them the hard way, or a harder way.

But predicting the end of the world is a luxury of those who don’t actually manage any real money for any real people.

Quote of the Week

“Pessimists sound smart. Optimists make money.”

~ Nat Friedman

* * *

I am sending this from a land far away, where I have been with my family this week, returning stateside later today. I am looking forward to being in our new Grand Rapids office next week. And I am praying that many of the things in this week’s Dividend Cafe will prove more wrong than they already are sure to be. Where there is a political will, there is a way.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet