Dear Valued Clients and Friends,

Greetings from Dallas, TX, where the entire TBG company has been together for the last few days, enjoying our annual off-site. Yes, we have made some time for fun and dinners and activities (and have more Friday afternoon, evening, and Saturday), but we have spent much of the last couple of days in intense all-day meetings and discussions, and it really is the most fruitful and productive time one could imagine. We first started doing this annual affair when there were six or seven people in our ranks, well over ten years ago. As we now prepare to cross 90 people in our ranks, these events are not only much more complicated (our Team Experience Director is an absolute saint and a beautiful woman) but also more important than ever. Not only is the TBG team a very family-like culture, but we are a pretty competitive, driven, determined bunch, and to achieve the proper focus on our vision of delivering the right client experience is very, very important to us. This was a really productive week to that end, as it always is.

Late last week, President Trump announced a final deal between the United States and China. He said the deal was a 12 on a scale of 1-10. One month ago, the market dropped nearly 1,000 points on a Friday amid fears that tariff threats were escalating and that China was implementing stricter controls on exports of rare earth minerals, exports on which the U.S. is highly reliant. Less than a month later, we hear that the deal was a “12.”

In today’s Dividend Cafe, we are going to look at what we really know about this new deal, what it says about the state of things with China, and most importantly, what it may mean for you! This subject has been either the core economic issue of 2025 or at least adjacent to it. I am confident that more intelligent commentary on it is needed than the highly politicized versions of the content making the rounds. Today’s is as close to calling balls and strikes as you will find, and the focus is on markets and the economy. Let’s jump into the Dividend Cafe!

|

Subscribe on |

Where’s the Beef?

Let’s just start with what we do know about the deal so far. In no particular order, the basic deal points include:

- The U.S. is reducing tariffs on China by 10% after President Xi promised to do more to clamp down on fentanyl coming into the United States.

- China is “pausing” its export controls (review process) on rare earth minerals for a year, and the U.S. has dropped its threat of an additional 100% tariff. China is issuing general licenses for the export of gallium, germanium, antimony, and graphite to benefit U.S. end users and their suppliers worldwide.

- A “tremendous amount” of U.S. soybeans is to be bought by China (the White House press release says it will be 12 million metric tons this year and 25 million metric tons each of the next three years).

- The U.S. has greenlighted a significant amount of Nvidia chip sales to China (there remains uncertainty about the higher-end Blackwell chip).

- China appears to be purchasing oil and gas from the U.S. (oil from Alaska; LNG from a variety of U.S. sources).

- The U.S. has agreed to suspend port fees on Chinese ships for a period of time.

- China will remove the retaliatory tariffs it imposed earlier this year on various U.S. agricultural products (my research indicates we barely sell any wheat or corn to China, regardless, and only about $1-2 billion of pork and beef).

- The U.S. suspended its Section 301 tariffs on Chinese imports for another year.

The posture of President Xi was that cooperation is a better way for the two sides to get things done in each other’s interests, while retaliation is counterproductive. There is no question that both sides have exerted leverage over the last six months, and particularly in the last six weeks, and that both sides have essentially come out of this (so far) with a very different outcome than the other side has threatened throughout the process.

I think a very fair and succinct summary is that:

- China says it will be a bigger customer of soybeans, oil, and gas.

- China says it will continue selling rare earth minerals to the U.S.

- The U.S. says it will keep selling China high-tech equipment and computing power (allowing U.S. companies to do so is a better way to put it).

- Most other elements of the deal are “status quo,” and many previously announced but unimplemented tariffs on China will remain unimplemented.

The Future Unknowns

Where things are not quite clear is in the following:

- We are told that a “broader trade deal” should be signed soon. What will be included in that deal and at what terms is not immediately clear

- President Trump will travel to China in six months for a meeting with President Xi. A lot can happen between now and then, and what will need to be agendized by then is unknown. There is a lot of speculation that, by then, Xi’s agenda will be more to discuss a softer U.S. stance on Taiwan’s independence. That subject has not been officially covered in the talks thus far.

- There is also a stated intention for President Xi to visit the United States after President Trump’s April visit to China. This would be a major move in U.S.-China relations (which is not to say it is good and not to say it is bad; it is to say it is major).

- What posture China will take with Russia going forward (particularly when it comes to buying oil) as the U.S. seeks to bring the Russia-Ukraine war to an end.

- When the next 10% tariff reduction will kick in (consensus view is that it will be April of next year when the President lifts the other so-called Fentanyl tariff)

From Liberation Day to This

My friend, Rene Aninao, of Corbu LLC, used this phrase in a commentary last week that I found extremely useful:

“The post-Liberation Day market discipline — and subsequent rewards in capital markets — has converted the President from a protectionist to an integrationist”

How do we interpret the language being used now about the U.S.-China trade deal versus the language being used six months ago? Gone is the discussion of “decoupling.” Gone is the language of “bringing those manufacturing jobs back.” Even if that second piece remains a policy objective, the President appears far more aware of the impossibility of that actually happening and has substantially re-shifted the policy focus from doing less trade to doing more trade. I agree with Rene that this was a hand forced by market discipline in the aftermath of Liberation Day’s market response.

But it also seems to be the stated policy objective of Treasury Secretary Bessent. While everyone in the administration has done their part to toe the party line on tariffs, Secretary Bessent has repeatedly placed this objective in the context of expanding markets, not trade protectionism. Now, reasonable people can agree or disagree on whether China will, in fact, buy more soybeans from U.S. farmers or more oil and gas from U.S. producers, but that is certainly the weight of the deal we now see.

Beyond soybeans, oil, and gas, the rare-earth minerals and high-tech semiconductor/technology aspects of this are front and center. First of all, they are textbook examples of comparative advantage. China has and can do rare earth minerals better than the U.S. can, and the U.S. has and can do high-tech chips better than China can, so they are agreeing to sell more of their respective strengths to each other.

Does this decouple the U.S.-China relationship? Of course not. Does it double it down? It would appear so. What could change that “double down” direction? If China develops its own abilities around high-tech chips, and/or the U.S. develops its own resources around rare earth minerals. I will let readers decide which they feel is more likely to happen.

But the major point I make here is that isolationism is not at the foundation of this deal—integration is.

Rare Earths

There are a few things at play on this subject that are intertwined but not the same issue. The U.S. has a few policy objectives, and they are not going to work in perfect sequence. On the one hand, the U.S. wants to reduce its dependence on China for its rare-earth mineral needs. On the other hand, the U.S. wants China to sell them what they need, now, before that “less dependence” has been achieved. I have done all the research I can here and cannot find a scenario with any level of investment in which the U.S. can entirely meet its rare earth needs, especially not quickly, without foreign trading partners. Compounding the problem is that the biggest need the U.S. has is for the heaviest minerals, which are themselves the rarest and where China’s strongest competitive advantage lies. Some form of stockpiling would be wise while the spigots are open, and the ongoing pursuit of new options with other countries more aligned with America (Malaysia, Australia) should be pursued—but they are not 100% solutions (especially for magnets needed for high-tech), and they are certainly not quick.

It Pays to be Big

The big winners this year have been the big U.S. companies for whom tariff exemptions and waivers have been granted throughout the year. This is evident not only in their stock prices and revenue growth but also in the actual explicit deals, in which various tariffs were threatened but not implemented, and now, where U.S. facilitation is specifically part of the deal. The new deal states that Nvidia will hold its own talks with China, but the U.S. will “moderate” them.

Even if a Blackwell chip is approved for China, questions remain about its viability. In August, the White House reversed an export ban on an older Nvidia chip if the company shared 15% of its China revenue with the U.S. government, an arrangement that some lawyers say amounts to an unconstitutional export tax.

Not Out of the Woods in China

A mild stabilization of this tension with U.S.-China trade calms things down a bit and removes one tail risk for China’s economic vulnerability. It does not, of course, solve the problem that truly plagues China. They remain unresolved about the bursting of their property bubble, and they remain almost unmoved in their desire to balance their economy with greater domestic consumption versus such a heavy reliance on production exports. They cannot resolve this easily, though, to their credit, they have resisted the Japan-U.S.-EU model of the last fifteen years that gets the patient addicted to the sweet, sweet elixir of monetary policy. But ultimately, they remain a Communist country which does not allow the free flow of either people or capital, and to ever put their economy in the right state of equilibrium, people and capital have to flow freely.

But for what plagues them — and what continues to plague them —removing this U.S. trade war and destabilization risk (or at least tabling it for now) is a much better option for them.

All that said, advanced technology is a major part of President Xi’s vision for improving China’s economy, and he’d rather see productivity increase via their vast investment in tech (private and public investment) than see it increase the old-fashioned way, the 1776 way, the Genesis 1 way. To each their own. What we know is China’s history here has been to “first imitate then innovate” (h/t Capital Economics) and their R&D spending indicates they are quickly moving to that second sphere. This has not yet led to greater productivity, and I am quite certain that if China thought they were further along in the tech arms race, they would have flexed even harder in this latest negotiation. I would suggest there are two major, and I mean major mistakes one could make here:

- Believing China is far more competitive and shovel-ready with high innovation technology than they are, and allowing that belief to rationalize cronyist U.S. policies and subsidies that are wholly unnecessary and ill-advised to our national well-being

- Believing China is not a formidable technology innovator and will never be ready for prime time when it comes to AI and other high-tech innovations.

That second category is, of course, a concern for American companies, not the American government. Does industrial policy drive innovation? Hardly. If so, we wouldn’t be having this conversation because China would be eating our lunch. They are not. Industrial policy harms productivity by subsidizing under-performing companies (mis-allocating resources). It fosters gamesmanship and politics within companies rather than innovation and competitive superiority.

I am far more concerned with the U.S. hurting itself by imitating China than I am by the U.S. hurting itself by not imitating China.

Not out of the Woods in the U.S.

This current trade deal/truce is a good macro move for the U.S. relative to the alternative, but it does not address the following things:

- The U.S. will be more dependent on China for rare earth minerals than ever before, and that disintermediation is not progressing (as far as the public eye can see)

- The U.S. is selling its best technology to China en masse, and if that is a security risk, as has been previously stated, it is now being codified and enhanced.

- It is a good thing for the U.S. to be a seller of oil and gas to China, but the DEMAND issue remains unanswered. If China’s economy continues to slow, is global demand falling to the point where our own energy sales will be minimally needed?

That all said, the foreign direct investment from China to the U.S. here is likely real, certainly stimulative, and without question, pro-growth.

Conclusion

Financial markets can breathe a sigh of relief that both sides, both of whom have ample leverage here, have chosen de-escalation and cooperation, for now. This does nothing to advance the prior agenda of “de-coupling” from China, which appears headed the way of the hula hoop. And I will bet you that the hula hoop was probably made in China.

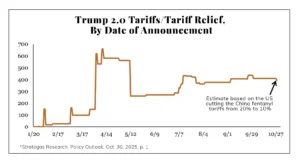

Chart of the Week

We remain at what appears to be a $350 billion level of taxes on the American economy from tariffs, far less than the $700 billion threatened in April and much higher than the $30 billion at which we started the year.

Quote of the Week

“You can’t name a good deal with a bad person.”

~ Warren Buffett

* * *

I will see you back in the Dividend Cafe on Monday for the normal Monday version. In the meantime, go Trojans, and send any questions you may have. And Dallas, TBG truly loves you!

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet