Remarks at the Piper Sandler Macro Conference New York, New York

5th September 2024

As prepared for delivery

Good morning. It’s really an honor for me to be here.

First, for the privilege of batting “lead-off hitter” for my big brother and mentor – and I’ll say, future Chairman of the central bank – the great Fed Governor, Kevin Warsh. Also, as many of you know, in a prior life I worked for Ed Hyman at Evercore ISI, and so it’s a real pleasure to be here, standing on Nancy’s stage — which is again proof of the old dictum that “behind every great man, there is a woman who’s coming up with all the great ideas.”

CORBU is known across the Street and in governments around the world as standing at the intersection of policy, national security, and markets—or what’s often otherwise known as “geopolitics.”

But the thing that makes us different from all the firms who traffic in geopolitical space is that all our colleagues come from a markets background.

MARKETS

Secondly, the rally in Taiwan-related asset prices — despite market participants’ overwhelming expectations [+75% !] of a cross-Strait contingency – means 1 [or all] of 4 things:

- There remain ample profits and returns to harvest before the contingency occurs

- Semiconductor supply-and-demand networks have increased resiliency sufficient to withstand such a shock

- Any Taiwan contingency would just alter the composition of global market chip share – but not result in the actual impairment of chip production

- “Losing Taiwan would not really matter economically for the US-NATO+ alliance – and any subsequent fallout [eg, from G7 sanctions] is more a problem for China’s economy [and would arguably explain the stark divergence between the US-PRC asset prices]

Now for many years, I sat in your seat, in symposia just like this one. And since the beginning of my career in the early 2000s, if you had a panel on “geopolitics,” it usually meant that you were about to experience something like the following: some old white guy; who has no idea what a bond is; talking about some far-flung people; and trying to scare you about something that’s totally irrelevant to your PnL.

I promise you will not get that today.

WHY

What I hope you will get, however, is three things:

- First, why geopolitics now matters for market participants

- Second, how geopolitics has been the primary driver of all the major market themes in the post-pandemic

- Third, what the investment implications are for capital flows and asset prices

So here’s what we’re going to do.

I’ll take the next 10 minutes to do some quick “scene setting,” and put a few remarks “on the record” about the medium-term.

And then we’ll spend the rest of the time together discussing the events of the present — but in a more open dialogue format with all of you and my favorite Dutchman, Jan Stuart, with whom I’ve had the privilege, for many years, of carrying on what the Dutch Calvinists used to call a lectio continua.

LECTIO

The lectio is a very simple concept.

It’s that a dialogue must analyze events sequentially in the order that they occur, because what came before matters a great deal for what comes next.

And most importantly, because events are often related in ways that one might not initially realize or perceive.

My favorite way to illustrate the lectio is through these two paintings, made almost 200 years apart, from the 15th and 17th centuries.

Here is a detail of the Apostle Matthew from da Vinci’s Cenacolo [The Last Supper] on view in the Santa Maria delle Grazie in Milan

Here is Rembrandt’s De Staalmeesters [The Syndics], on view in the Rijksmuseum in Amsterdam.

Now if you’re a market participant, I think The Syndics should be your favorite painting for obvious reasons [it’s my personal favorite].

But what makes Syndics such an arresting work is the movement in [the other Jansz] Jansz Volkert, standing up from that table to greet you.

I say it’s like watching a motion picture, 250 years before cinema.

But that Syndics gesture, of depicting motion — it came straight from da Vinci’s Apostle Matthew leaping up from the table during the Cenacolo. And this isn’t just conjecture.

MOTION

Rembrandt drew it, almost 30 years before The Syndics, here is the red chalk sheet, which you can find a few blocks north of here in the Lehman Collection at the Metropolitan.

Now at this point, you’re probably thinking: why the hell is RJA telling me all this ?

PROCESS

But I’m telling you this just to illustrate that process, of seemingly-unconnected-but-intimately-related events, from da Vinci to Rembrandt, is exactly the same process happening today across geopolitics and markets.

I’ll dig into some examples.

Since the beginning of the post-pandemic period from January 2022 to today, there have been only four big thematic trades you needed to get right:

- #1: the central bank hiking cycle

- #2: the generative AI rotation

- #3: the capital outflows from China

- #4: the US productivity boom

While few on the Street would articulate it this way — I’ll tell you that’s a list of geopolitics trades.

Start with the hiking cycle.

HIKES

Had Putin not invaded Ukraine, and had US headline inflation not approached +10%, does anyone in this room believe the FOMC would have responded with 4 consecutive +75bps hikes — hikes that cut the NASDAQ by a third and sparked banking crises across Europe and US regionals ?

Of course, we can’t “prove” it — but you guys know the answer is no.

Or take the generative AI trade.

CONTROLS

The scene is October 7th, 2022. The day before, President Biden was at James Murdoch’s townhouse on 69th Street, where he said that we were close to “Armageddon” because Putin was threatening Kharkiv with the use of nuclear weapons.

In response, the White House announced a historic slate of wartime controls on technology exports… to China.

A few weeks later, on November 30th, OpenAI releases GPT-3 into the wild.

Since then, who’s been the global leader in AI? The United States.

If I had asked any of you in this room, who the global leader in AI was in say, 2019 or 2021, what’s the answer almost everyone would have given ? China.

Which is a perfect segue to the capital outflows from China.

OUTFLOWS

It’s not a coincidence that in the wake of Putin’s re-invasion of Ukraine and Beijing’s support of the regime in Moscow, one of the best trades investors could have done outside the United States was to be long Japan — the closest NATO+ ally — and short China.

And while the US and Europe’s policy mix of aggressive countermeasures have truncated the structural growth path in China.

Beijing’s policy mix—clearly constrained by ideology and geopolitics—has driven the collapse in investor confidence.

Xi Jinping sees the world from a more Eastern horizontal or landscape perspective rather than a more Western vertical or portrait perspective.

And so when Xi Jinping tells his Central National Security Commission that the United States is trying to “contain, encircle, and suppress” China — he’s not necessarily wrong.

FADE

The last trade of the post-pandemic era is the most important one — the US productivity boom.

And while we can let the economists argue about the size of the Solow residuals over time, one thing is very clear: there’s been a conflict-driven capex cycle, into dual-use technology — which is transforming the logistics and energy sectors.

Will argue that this theme has been best expressed by fading oil price shocks.

Because there is something far deeper at work [especially in the back-end of the curve] beyond just the explanations of OPEC+ balances or embedded spare capacity in shale.

CULTURE

When EV trucks are now the vehicle of choice for cool young black kids in Houston, Texas — the energy capital of the world — that should send chills up the spine of every member of the OPEC cartel.

DOWNSTREAM

In any case, I think we can all finally say the quiet part out loud: that “the transition” has absolutely nothing to do with the climate, John Kerry, or 1.5 degrees Celsius—it is only about geopolitics and the post-9/11 US security posture.

Those four geopolitics trades all serve to illustrate the main point that I hope you’ll take away with you this morning.

COSTS

And it’s that we are in an era of open economic warfare.

In a protracted conflict environment between blocs of nuclear superpowers, the primary site of conflict — migrates — from the kinetic and military domains to the markets and the economy.

And this is particularly true given the dilemma posed by China, where the United States, for the first time, faces a military problem that can’t be solved by a military solution — but instead requires an economic one.

DISINFO

While market participants may not realize they are involved in Economic Warfare, I can assure you that the Adversaries know it.

The Adversaries very keenly understand the power and dominance of US capital markets — and it’s why they spend so much effort trying to degrade it.

PUTIN

The best example of this is actually Vladimir Putin.

We often forget that the first invasion of Ukraine in 2014 was sparked by a potential trade war with Europe — and the looming flood of imports that would have entered Russia via the Association Agreement.

But if you read Putin’s speeches, you’ll find that he is totally immersed in the macroeconomic statistics.

He knows the US inflation rate to the 2nd decimal; he’s used the words “US dollar” orders of magnitude more frequently than he’s ever used the word “nuclear”; he can, by memory, rattle off a comprehensive list of US sanctions.

KATERINA

But maybe most revealingly, Putin’s daughter, Katerina Tikhonova, runs an institute at Moscow State University for… artificial intelligence.

The long-term problem for Putin’s Russia, much like for Xi Jinping’s China, is that in this environment of economic warfare — both leaders still believe that it’s, ultimately, the role of the state to “ensure the efficient functioning of markets” — and not the other way around.

BIDEN

Which brings us to US policy, and here it’s worth making just one point about what history will call “Biden Doctrine.”

If Biden Doctrine is a policy mix of three key tenets: exhaustive diplomacy; escalation management; and attritional economic warfare over time.

Then I’ll posit that the United States is also pursuing a policy of Economic Warfare — regardless whether anyone across the interagency articulates it that way.

THEMES

So what does all this mean for market participants?

I’ll quickly put three big themes on the table, which we can elaborate on during the upcoming sessions.

The first big theme is that the slate of expansive national security controls means the US productivity boom currently underway will not proliferate to emerging markets like it did during the post-1989 period.

This suggests that structural outflows from the EM complex will continue, benefiting USD-denominated assets and countries inside the NATO+ alliance.

The second big theme is a follow-on from the first, and it’s that the wave of capital inflows to developed markets means it’s time to start looking for the next leg of the AI trade — far beyond the “AI picks and shovels” of the “Magnificent 7”

And while I know there are graveyards littered with the words “US value rotation” etched on their tombstones, two examples from the pre-War period are useful.

RAILROADS

Railroads and refrigeration fundamentally changed the human experience in the late 19th and early 20th centuries.

That said, the best investment idea was not to be long Maytag stock or to own the bonds of Union Pacific — but instead to be long Sears Roebuck [on the railroads] and own Coca-Cola [on refrigeration].

So if NVIDIA is the 21st-century “railroad,” — then who is the generative AI version of Sears Roebuck?

VALUE

This segues to the third and final theme — which is that the answer to the “21st century Sears Roebuck” question lies at the intersection of robotics and biotech.

SHORT PHARMA

In the interest of time, I’ll refrain from elaborating any further on this, except to say that if you think about the future of biotech as “short pharma” and “long manufacturing” — you’re probably more than halfway there.

EARNED ≠ INHERITED

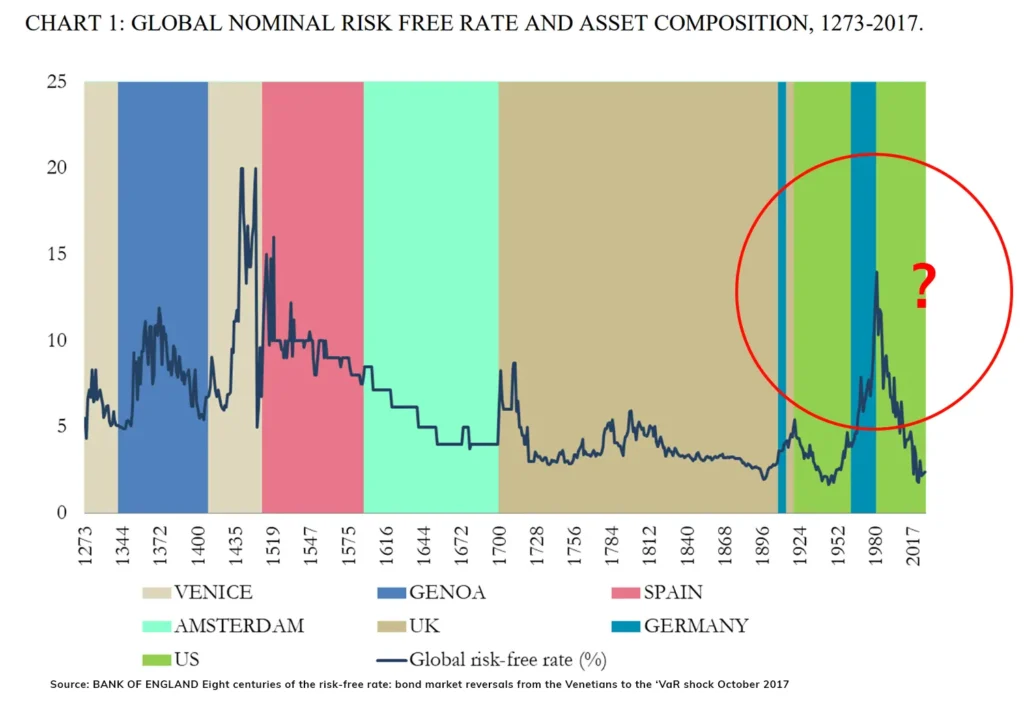

I’ll close with this final chart, especially given all these explicitly pro-America takeaways we’ve had thus far. It’s my favorite chart of all time. It’s from a Bank of England paper titled “Eight Centuries of the Risk-Free Rate” — but I told them they should have called it “from St Thomas Aquinas to Trump.”

And whether it’s the Catholic Church from 1250-1500; the Spanish caretaker through 1600; the 17th century Dutch, to the British Empire of the 18th and 19th.

When the global reserve currency issuer fails to carry the burden of maintaining price stability — the empire ends.

Let’s be very clear: US global leadership is not guaranteed.

It’s a privilege that’s earned, not inherited.

And it’s covenant in global markets that must be re-consecrated every generation.

So, as I’m often known for saying…

“Let’s see.”

Thank you.