The Economy’s Foundation: Productive Workers

At the risk of stating the obvious: an economy needs productive workers. We tend to abstract our measurement of the economy into terms of money, but dollars are just an arbitrary unit of keeping score of the real human activity of providing goods and services. Put another way, we can print as much money as we like, but without real productive activity – i.e., people making things – there would be nothing to buy. No matter how much money we might have, it would just be so many slips of paper or entries in a ledger.

So: the real economy consists in the production of goods and provision of services. At the most basic level, in order to produce goods and services, we need:

- People: An economy of 100 million people has more potential than one of 1 million or 10 million.

- Those people to be working: It doesn’t have to be all of them (indeed it can’t be). But the greater the share of people in a population participating in the labor force, the greater the potential for output.

- Those workers need to be productive: People need to be working to produce goods and services of value, i.e., “busy” is not necessarily a synonym for “productive”. Further, workers will be able to enhance their productivity if they have access to financial, physical, intellectual, and human capital. If you can get a loan to buy a backhoe, and you know how to use it, then you can be more productive (i.e., create more value for yourself and others) than you would be with no training and a shovel. Investment transforms financial capital (e.g., bank balances) into physical capital (e.g., backhoes) or intellectual capital (e.g., production methods or software code). Human capital can be acquired in many ways, including education, training, mentorship, or experience. People with more human capital and access to physical, intellectual, or financial capital can produce more real output. Importantly, it’s humans that create all of these forms of capital (see #1 above).

One of the most basic and important economic truths is that, over the medium-to-long term, the size of an economy will be a direct function of its number of workers and their level of productivity. The obvious corollary is that economic growth will be driven by the growth in the number of workers and the rate of increase in productivity per worker. Armed with these basic concepts, we can understand much more clearly the consequences for economic growth of trends in fertility, workforce participation, immigration, and the policy decisions that affect them.

Looking Back: The Demographic Dividend of the Baby Boom

The two most important legacies bequeathed to us by the Greatest Generation were victory over the Axis in WWII and victory over the Soviets in the Cold War. George H.W. Bush exemplified his generation: he enlisted in the Navy on his 18th birthday in 1943 and served as a naval aviator in the Pacific. Not quite 50 years after that, his presidential administration presided over the fall of the Berlin Wall and the break-up of the Soviet Union.

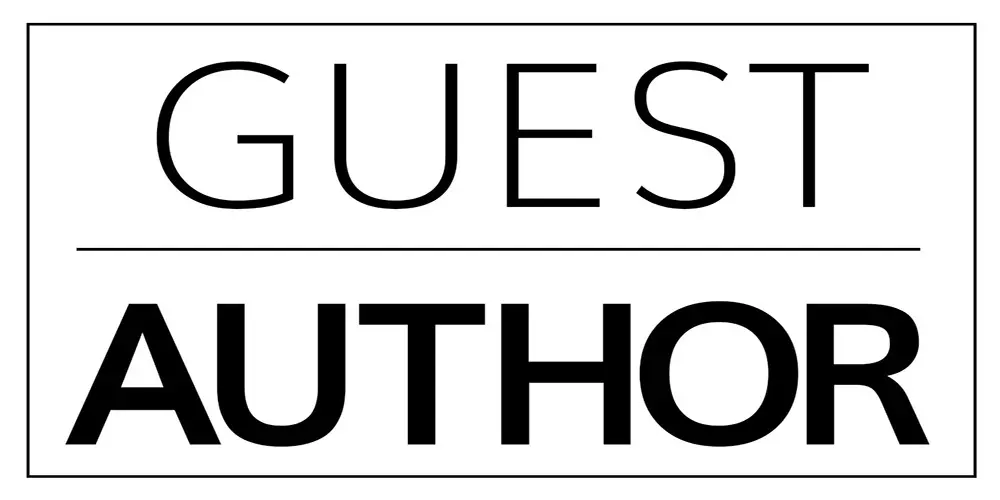

Having secured much of the world for free men and free markets, the WWII generation made a very different but equally important contribution to economic growth: they raised a lot of children. Between 1946 and 1964, 79 million children were born in the US (six of them to George and Barbara Bush). Over this period, the annual fertility rate for women aged 15 to 44 was between 102 and 123 per thousand – meaning that between 10% and 12% of women in their childbearing years had a baby in every year of the Baby Boom.

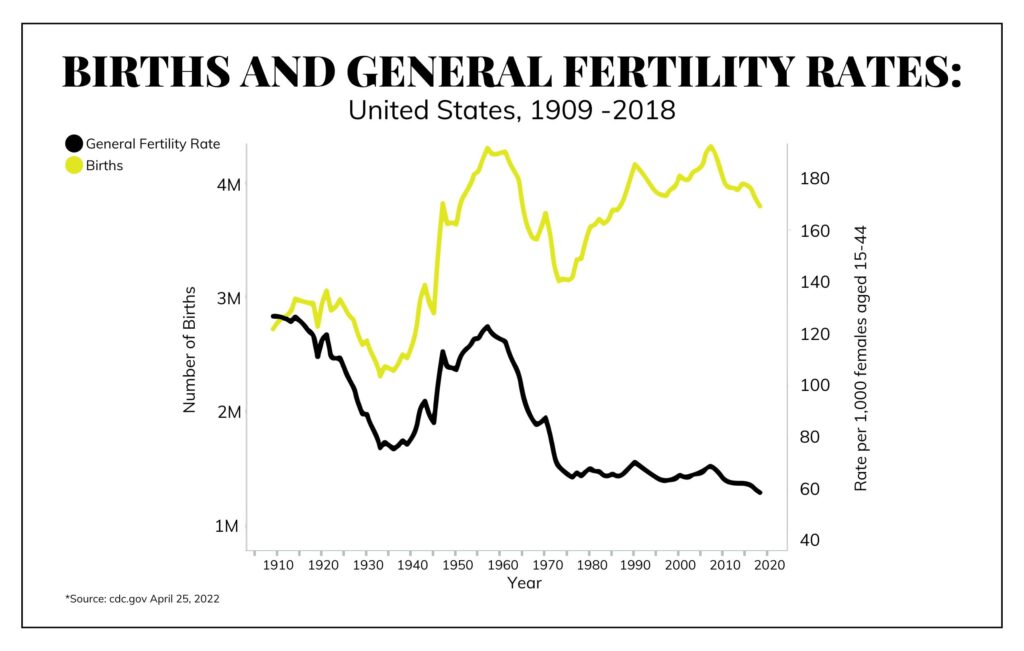

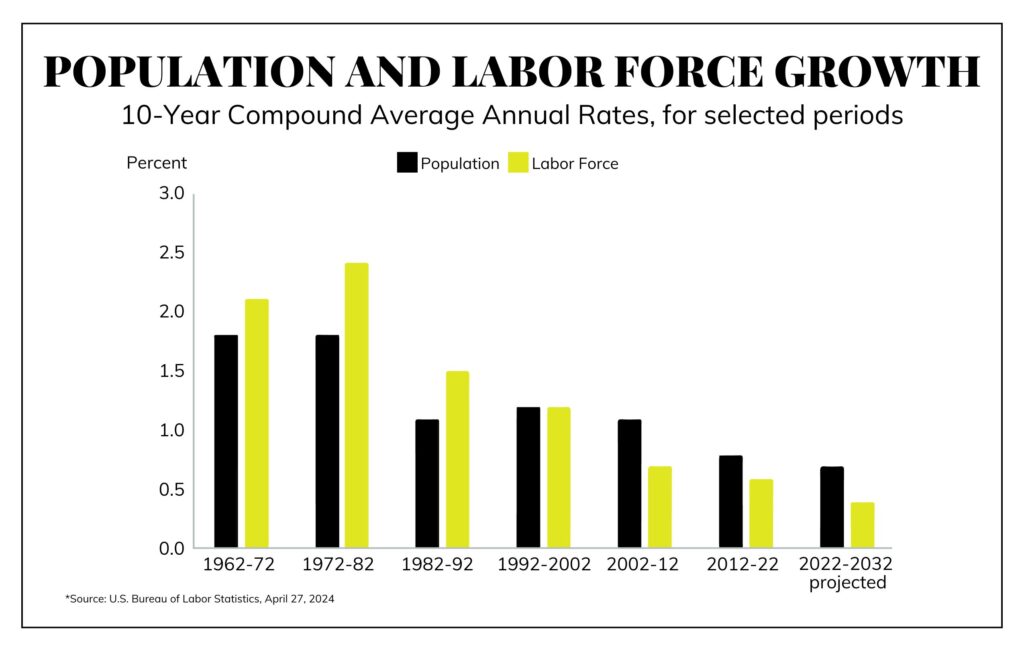

This massive investment in the human capital stock of the United States went on to pay a multi-decade demographic dividend in economic growth. The first boomers turned 16 in 1962 and entered their prime working years (25-54) in 1971. The youngest boomers were 18 years behind. The Boomers’ peak productivity years were roughly 1990 through 2005 when the largest share of the cohort was in the peak productivity age range of ~35 to 50. You can see this phenomenon play out in the graphics below, where labor force growth peaked as the Boomers aged in (~1962 to 1980), and productivity growth spiked as the boomers enjoyed their most productive years about two decades later.

If we remember that growth in an economy is a function of growth in workers and growth in those workers’ productivity, we can appreciate the strength of the economic tailwind of the Baby Boom. From the late ’60s through the advent of the Global Financial Crisis, the sum of labor force growth and productivity growth averaged between 3% and 4% per year. Year-to-year GDP growth was more volatile and influenced by events and policies that varied over that time period; there is no doubt that the monetary miscues and energy crisis in the 70s detracted from growth, while the Reagan-era supply-side reforms, the post-Cold War peace dividend, and the 90s technology boom were strong positive catalysts in the twenty-five subsequent years. But at the most basic level, the economy was resting on a sound demographic foundation.

The Post-Boomer Slowdown

With the exception of a sharp and short downturn during the COVID moment, the US economy has avoided recession since emerging from the Global Financial Crisis. However, growth in that period has been underwhelming: from 2010 to 2022, US GDP growth averaged 2.1%, as compared to 3.3% in the 45 years between 1962 and 2007. One could argue that public policy over the recent period has been a negative factor, and there is a lot to criticize in the policy mix. But relative to history, taxes are not particularly high, fiscal deficits have been large, and monetary policy has been extraordinarily accommodating. What do we see when we look at the fundamentals of people, work, and productivity?

People

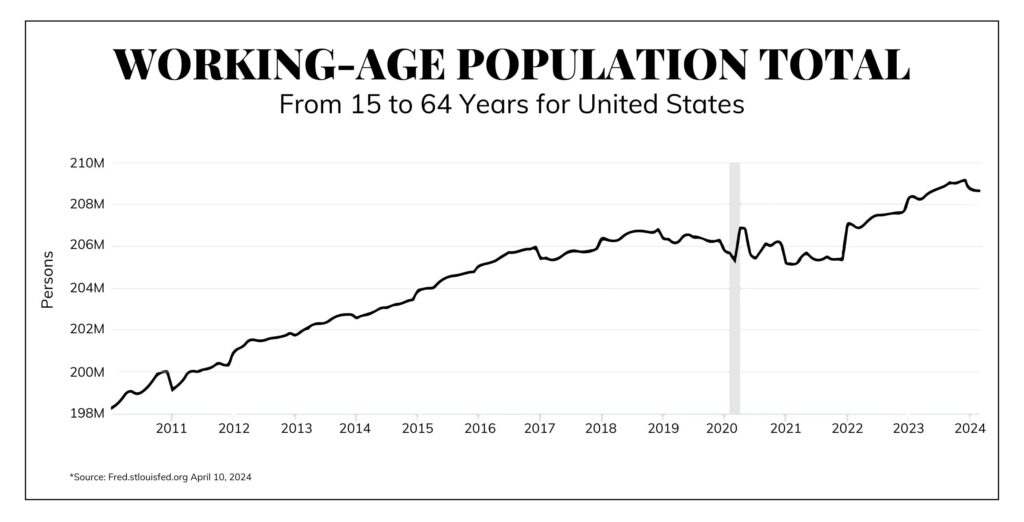

The oldest Boomers turned 65 in 2011 and the youngest today are 60. Both births and the fertility rate hit their high-water mark in 1957. Births dropped steadily until the mid-1970s, when they began to recover, but they only matched the 1957 peak for a single year in 2007 before dropping off again. Fertility – births as a percentage of the population – have never recovered, crashing from the 1957 peak through the Great Depression-era nadir in 1972, from which it has continued to drift downward. The result has been stagnating growth in the working-age population since 2016, which was actually negative in the three years between the end of 2018 and the end of 2021.

Working

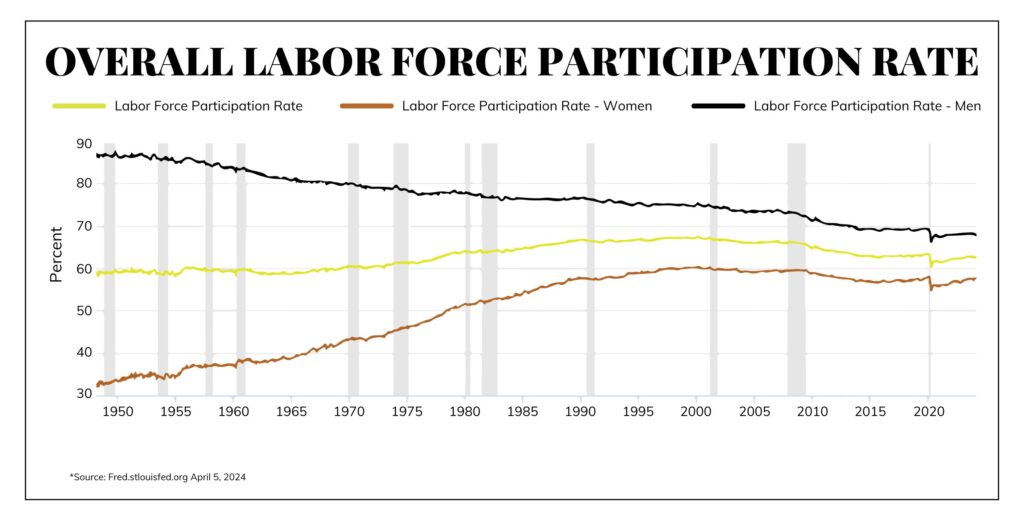

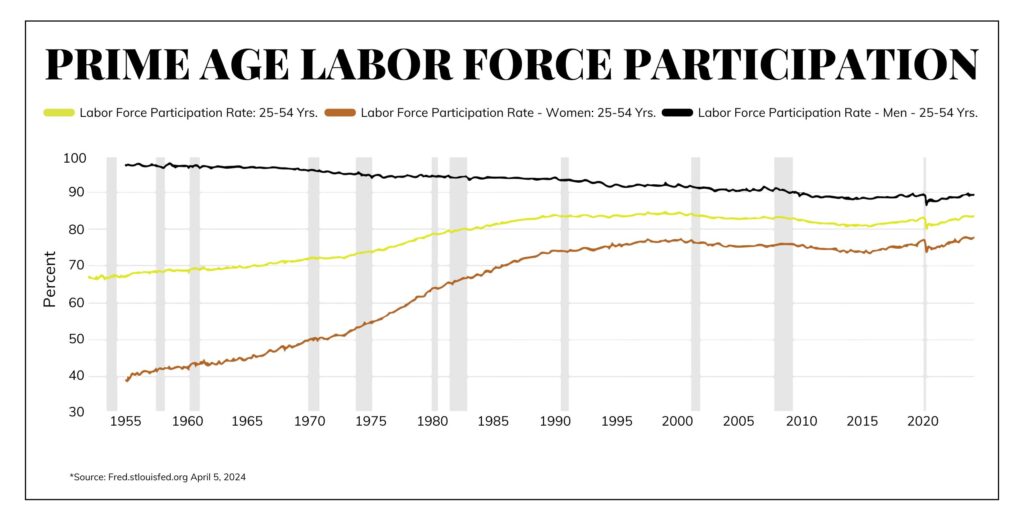

Increasing labor force participation (LFP) compensated for decreasing population growth to drive steady growth in the working-age labor force through about the end of 2018. However, underneath the headline LFP number, a massive, secular increase in female LFP masked a substantial decline in male participation. A steadily smaller share of prime-age (25-54) males have participated in the labor force each year since at least the 1950s (dropping from 98% to 89%), while women’s participation has grown from 38% to 77%. However, there is a limit to what women can do to compensate for what men do not. Even as male LFP continues to decline, female prime-age LFP leveled off in the 1990s and then trended down slightly before recovering recently to its previous high. And women get old as fast as men. We are past the point where we can count on female workers to make up for both the aging of the Boomers and the secular decline in male LFP.

Productivity

Compounding the slower labor force growth has been a decline in productivity growth from 1990-2007 highs. The sum of labor force and productivity growth since the GFC has been about 2.2%/year, compared to the 3% to 4% average over the prior 40 years. This difference (about 1.3% per year) is remarkably similar to the difference in overall GDP growth between the Boomer era to the post-GFC regime.

The COVID Shock

As these secular challenges with worker growth and productivity were playing out, the economy was hit by the COVID shock. Under the best of circumstances, the pandemic would have been a setback for the economy, but the policy response of extended lockdowns plus universal transfer payments and other measures (e.g., loan forbearance) to compensate for lost wages, was almost tailor-made to exacerbate the secular decline in LFP and worker productivity.

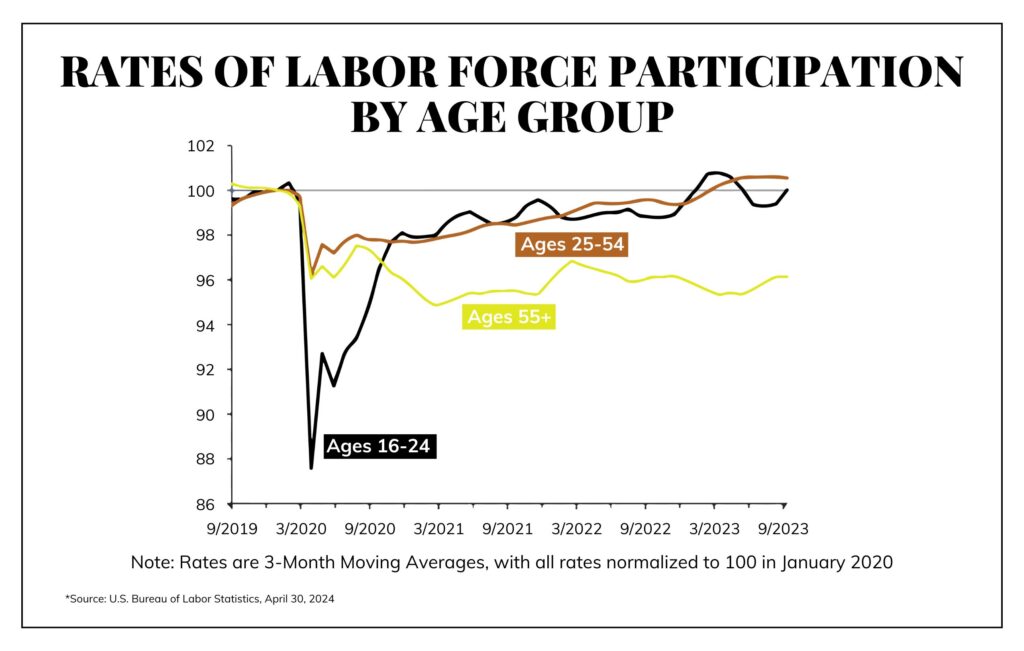

The San Francisco Fed recently released a study of LFP data from the COVID shock. All demographic groups suffered declines in LFP, most immediately and extremely among the youngest workers, and most permanently among the oldest (i.e., the Boomers), who have undergone what appears to be an en-masse early retirement, pulling forward an exit from the labor force of its most experienced workers.

The youngest workers will suffer the worst effect on their lifetime human capital accumulation from the compounding effect of lost experience in their early working years. Post-pandemic, they will continue to suffer the ongoing injury of the loss of in-person mentorship and experience accumulation due to the emptying of in-person workplaces. That said, workers under age 55 at least seem to have returned to their pre-COVID LFP rate, albeit after a three-year hiatus.

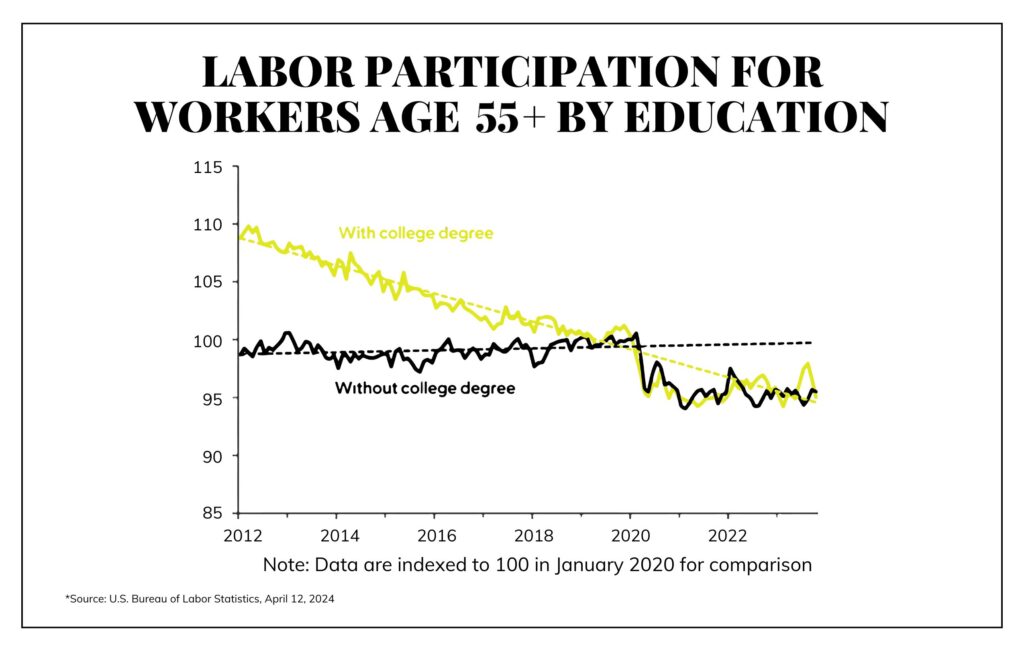

Workers over 55, in contrast, left the labor force and have not come back. There doubtless are multiple reasons for this (less “marketability” of older people who needed to find new jobs; some degree of “throwing in the towel” among people who might otherwise have worked a few more years). The most pronounced change in this cohort seems to be with non-college-educated workers.

One interesting – and discouraging – finding of the study is that the most educated workers had been trending toward earlier retirement for nearly a decade before the pandemic. In retrospect, this is perhaps not surprising. College-educated Boomers have enjoyed significant lifetime advantages in wage growth vs. their less educated peers. They benefitted disproportionately from the run-up in asset values during their prime working and saving years, and especially in the massive post-GFC bull market. They are more likely than non-college Boomers (and younger workers) to have defined-benefit pensions. And those with mortgages were able to lower their housing cost as interest rates bottomed during the various phases of the Fed’s GFC- and COVID-driven “quantitative easing.” Non-college Boomers did not enjoy these advantages [which, as an aside, likely explains their disproportionate attraction to populist political messages]. But post-COVID, their likelihood to have exited the workforce has converged with their college-educated peers. The forced hiatus of the lockdowns might have made these older workers less employable, and in some cases, COVID-relief transfer payments might have provided a bridge to Social Security. Whatever the explanation, our most experienced workers left the economy during the COVID moment, and they have not come back.

Immigrants to the Rescue

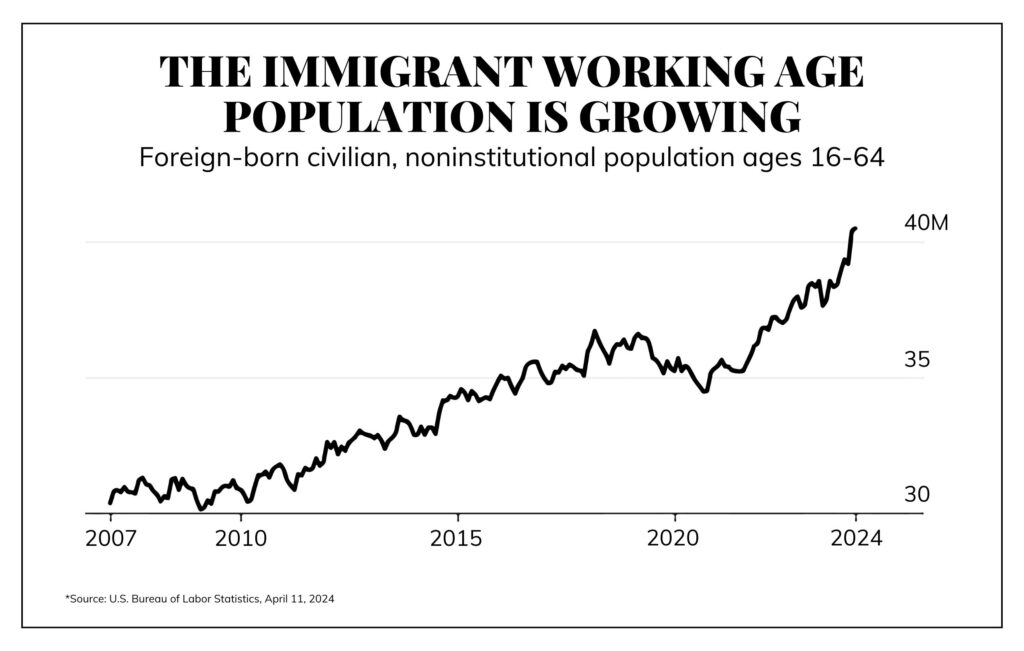

With the secular challenges to population and LFP, compounded by the COVID shock, the US was facing a potential human capital crisis that, combined with suddenly restrictive monetary policy, might well have tipped the economy into recession. But as it happened, in 2022, the supply of workers in the US economy suddenly recovered from years of stagnation. Since December of 2021, the total US working-age population has grown by about 3.3MM people. More than all of this gain is accounted for by a 5MM+ increase in working-age immigrants.

Immigration is a politically charged issue for a host of reasons, many of which have nothing to do with the economy. As pertains to growth, employment, and wages, the most contentious questions often boil down to, “But aren’t they taking our jobs?”

In a word, the answer is “No.” Consider the following:

- US male labor force participation, both overall and among prime-working-age men, has been falling since at least the Eisenhauer administration. Women picked up the slack for decades, but that trend has reached its limit.

- The Boomers are retiring, and neither they nor their children raised enough children to replace them.

- Wealthier people with college degrees have been retiring earlier for over a decade; since COVID, this phenomenon has spread to the non-college educated workers.

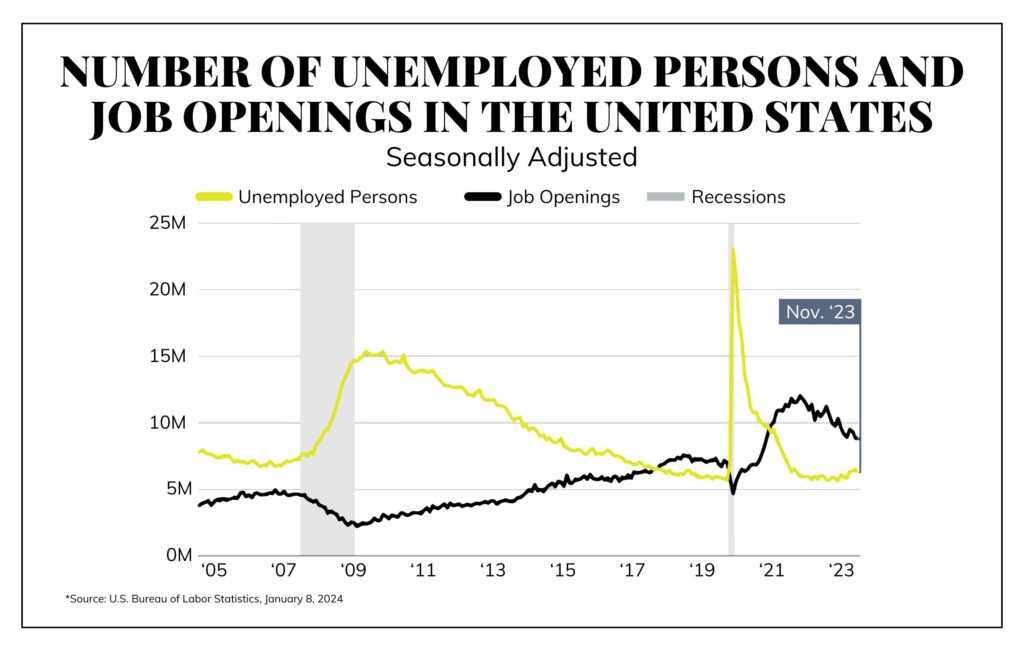

- For most of the last several years, the US has had more job openings than unemployed workers.

None of this is to endorse or excuse massive, chaotic, illegal border crossings. Stable enforcement of laws, including immigration laws, is critical to a functioning economy. But the problem is not immigration per se. The United States, after all, is a nation of immigrants. Many would argue (certainly I would) that much of the economic dynamism of the United States derives from our society’s ability to assimilate people from around the world who have the intrinsic motivation to move to America and make a go of it in our free society. This is as true for the most humble day laborer as for members of the global elite, who are as eager as anyone else to immigrate to the US. Fun fact: four of the “Magnificent Seven” CEOs (MSFT, GOOG, TSLA, NVDA) are immigrants. My own great grandfather – who arrived at Ellis Island near the turn of the 20th century and worked in a Connecticut quarry – had at least one thing in common with Elon Musk: they both came here for a better life and by so doing, they made everyone’s lives better.

Workers, free exchange, creativity, and abundance

The more fundamental problem with the “aren’t they taking out jobs?” line of thinking is the underlying conception of the economy as zero-sum – in this case, that there are a fixed number of jobs that will be filled up by a variable number of workers. This fallacy is really just a particular variation of the more general erroneous idea that an economy can only support a fixed number of people before scarce resources run out. This logic is exactly backward: the more workers there are (and the more productive each worker is), the more goods and services will be produced for everyone.

So we end where we began: Workers are the fundamental supply-side resource. “Too many workers” is never a problem in any economy, at least over the medium term. “Limits-to-growth” problems arise instead from inhibitions to work and productivity. Some of these are the result of bad policies that discourage either or both work or job creation, including high effective marginal tax rates (including at the low end of the income scale, where earning a bit more can cost worker subsidies or refundable tax credits); regulations that inhibit growth and job creation; or transfer payments that subsidize idleness, such as the massive increase in social security disability payments over recent decades. Culture also has played a role in devaluing work, as detailed at length in Charles Murray’s 2010 book, Coming Apart, as well as a newer book by an author familiar to readers of these pages.

The fallacy of an economy as the zero-sum division of scarce goods is as old as Malthus. The truth is that an economy – at least a free economy – is the collective endeavor of individuals and groups working and innovating to serve one another’s needs via voluntary exchange and, in the process, creating wealth and abundance. The more work and creativity – the more workers – the better. The great Thomas Sowell famously observed that the cavemen had exactly the same natural resources at their disposal as we have today. The difference between their world and ours – from adequate nutrition and penicillin to Disney World and iPhones – is the sum total of creativity, work, learning, and knowledge that mankind has accumulated through eons of collective endeavor. Long may it be so.

Michael Poulos and McLarens are not affiliated with Hightower Advisors, The Bahnsen Group, or any of their affiliates. His opinions are his and his alone.