For those of you who did not get a chance to read Blaine Carver’s Thoughts On Money last week, I would encourage you to do so. His article had a meaningful impact on me, and I’ve been thinking about it ever since.

Blaine’s aim was to discuss New Year’s resolutions. He wanted to point out the reality that these aspirations have a short life span, as the goal-setter (you and I) often lose steam and motivation. His advice on improving follow-through was simple – start with WHO you want to be versus WHAT you want to do

So, over the last week, I’ve been personally reframing my goals and thinking about them through the perspective of WHO I want to be.

Thank you, Blaine.

With that said, this has led me to think about this question: What are the key attributes and/or traits of a successful investor? This question gets me to an article for you on WHO you should aspire to be as an investor.

A successful investor is self-focused, a student of history, strategic, a long-term thinker, and humble.

Run Your Race

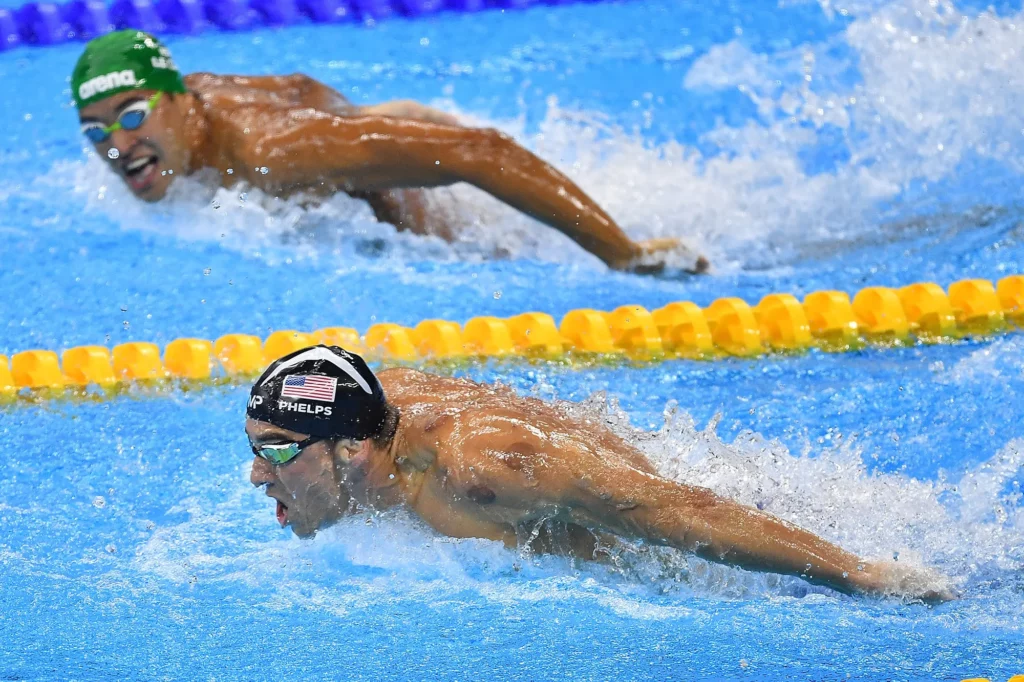

In the 2016 Olympics, there was a long-awaited match-up between Michael Phelps and Chad le Clos of South Africa in the 200m butterfly.

The race lived up to the hype. The two racers played mind games with each other outside of the water and postured pre-race to try to express their dominance. Like two wild animals puffing their chest as they seek the same mate – a gold medal.

Then…

That unforgettable photo. The one that would go absolutely viral and create great content for articles like this one.

Phelps won by a fraction of a second, and de Clos was caught in a photo staring directly at his competitor, as opposed to the finish line.

Source: Time.com

Phelps was racing his race, and de Clos was focused more on beating Phelps as opposed to simply winning and running [swimming] his own race.

Great investors run their race. Who you should aspire to be is an investor who is self-focused, not comparing returns to neighbors, billionaires, or click-bait articles. Run YOUR race.

Same As Ever

Morgan Housel is one of my favorite finance authors. He has a way of taking complex topics and not only making them palatable but thought-provoking, relevant, and sometimes comical. He takes finance, holds it up against history, and shows the themes and patterns that are never changing.

Housel’s recent book, Same As Ever, has a fitting title. He unpacks how, in history, the characters change, the details morph and evolve, yet the behavior is… same as ever.

A successful investor is a student of history. They study sirens of years past to help avoid the pitfalls and calamities the investors of yesteryear suffered from.

Are you a student of history? Do you learn from your own mistakes? Do you look for the patterns and common stumbling blocks of other investors?

You should.

What’s the Plan?

In Lewis Caroll’s Alice’s Adventures in Wonderland, one notable quote always seems to come to mind – an interaction between Alice and the Cheshire Cat:

“Would you tell me, please, which way I ought to go from here?” “That depends a good deal on where you want to get to,” said the Cat. “I don’t much care where–” said Alice. “Then it doesn’t matter which way you go,” said the Cat. “-so long as I get SOMEWHERE,” Alice added as an explanation. “Oh, you’re sure to do that,” said the Cat, “if you only walk long enough.”

As this feline wisely and simply states – plan or no plan, a destination in mind or not, if you continue long enough, you will get… somewhere.

I talk to multiple investors every week, investors that are NOT clients of The Bahnsen Group, but that are seeking guidance and/or feedback on their current portfolio. Nearly every time, I can’t easily see the theme, strategy, or plan these investors are deploying. Primarily because they don’t have a plan, a process, or a defined objective. They have a basic understanding of what they own, but not why they own it or any semblance of a cohesive and defined strategy.

Great investors are strategic; they have a plan, and they can easily show how their portfolio is designed to meet the objectives of their financial plan.

Humble Pie

Perhaps Yogi Berra said it best, “It’s tough to make predictions, especially about the future.”

The downfall and bailout of Long Term Capital Management in the late 90’s expressed this well. A team of highly intelligent individuals – many of them rocket scientists – found themselves destroying such a large amount of capital that the US government had to step in to avoid further damage to the economy at large.

Even extreme intelligence is no substitute for humility. I cannot even express how often I see this sort of misplaced hubris among the investors I meet. A great investor MUST be humble; if not, markets will most definitely seek to humble them.

WHO > WHAT

Again, my sincere gratitude to Blaine for shifting my paradigm here. This mantra of WHO is greater than WHAT will definitely stick with me.

I hope you can use today’s article as a measuring stick of sorts. An opportunity for you to humbly assess who you are as an investor and begin to update your resolutions of who you desire to be.

Be self-focused, a student of history, strategic, a long-term thinker, and humble.