There Must Be Something in the Water

I attend a small church in San Clemente, with maybe 200 members. For such a small church, we have a disproportionate number of new babies. It seems like every Sunday, we are announcing and celebrating how this family or that family just brought their new bundle of joy home.

The “there must be something in the water” adage has become popular pulpit humor. One of those idioms we use when we see a trend but can’t exactly pinpoint the cause.

Today, I want to draw attention to a handful of recent conversations and interactions I’ve had that seem to be forming another trend: market euphoria. It’s been a while since I’ve seen this sort of investor hubris and disrespect for risk. I can’t exactly pinpoint the cause, but “there-must-be-something-in-the-water”.

A colleague sent me this beauty (see below), and what a wonderful throwback to 1999 it is:

Source: @newyorkcity.vintage, September 5, 2025

There is no better representation of 1999, and the peak of the tech bubble, than this New York Cityscape with that prominent advertisement. I could share statistics, charts, quotes, etc. from this mania period, but they’d all pale in comparison to this photo.

A picture truly is worth a thousand charts.

This is exactly what Greenspan called irrational exuberance, or Keynes referred to as animal spirits. However you want to describe it, there are times in history when people become belligerent risk junkies.

Expensive by All Measures

Here’s the thing: any time we talk about the past (1999), we are, in a sense, also talking about the future. As the often quoted saying goes, “History doesn’t repeat itself, but it often rhymes.” It’s not that the same people go out and make the same dumb mistakes (although some do), but rather a new generation of people go out and make the same dumb mistakes as the past generation. Humans are susceptible to greed, envy, fear of missing out, and a handful of other emotional quirks that can create a herd mentality of buying expensive things, hoping they will get more expensive. This is also not an “American thing,” but rather bubbles can be studied throughout history and geographies (e.g., Japan 1986-1991).

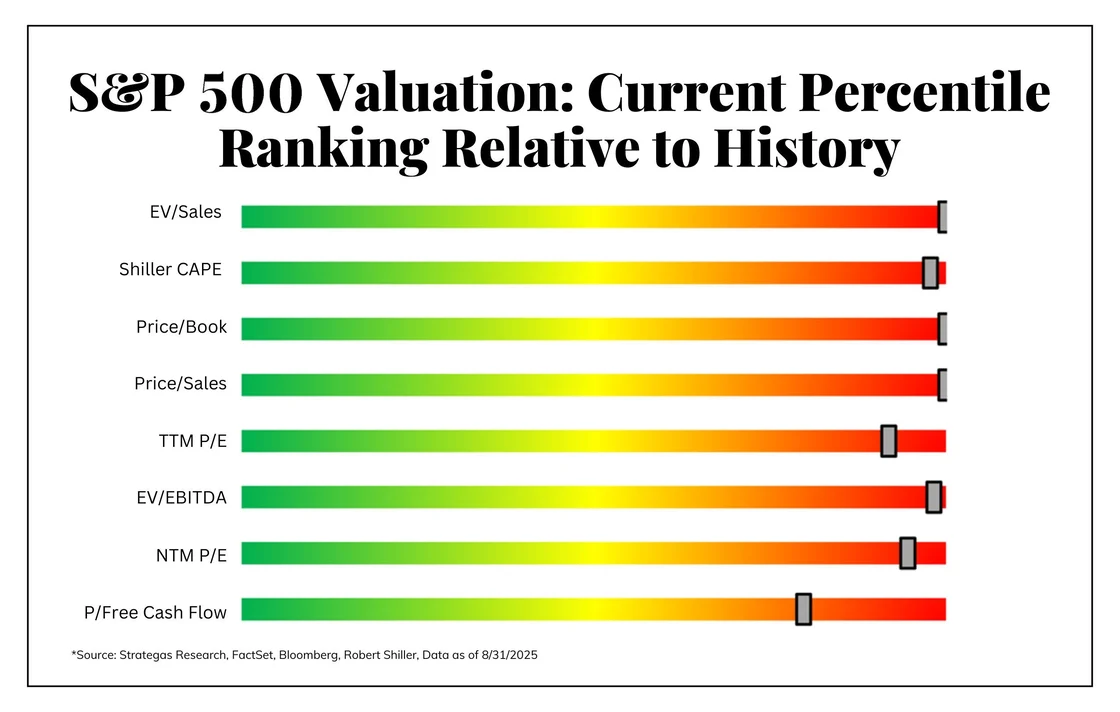

This week, in David Bahnsen’s daily writings, he included this chart:

Which leads us to the appropriate question of, “is there any way to describe this current market other than expensive?” The answer is no.

Just This Week…

If we think about this logically – which markets/people don’t always behave logically – then we’d assume that expensive markets would form risk-sensitive investors. Yet just this week, I saw an investor expressing disappointment in a well-diversified and suitable portfolio sharing a desire to own more growth stocks, precious metals, and cryptocurrencies. These particular asset classes are at or near historical all-time highs, which creates this magnetism and interest. All-time highs in isolation should not be the sole reason for concern. Market participants rightfully expect growth, and with growth, because of math, you will inevitably get new all-time highs. The real concern is new all-time highs or near all-time highs in valuations, which has much to do with what this chart above reflects.

Again, this week I’ve been a part of three investor conversations where the question has been posed, “Why did we sell this? And why do we still own that?” A simple highlight and respectful critique that the manager sold something that then went up in price, and continues to hold something that has gone down in price. Critiquing performance and price over a very short-term basis (months) is a very shallow assessment, but “there must be something in the water”. This is not to say that these questions should not be asked; they should. These questions open up intellectual discourse around our investment process, sell discipline, and overarching philosophy. BUT if the response to the content and research is that “Ya, but still, this went down and that went up,” it just makes for difficult dialogue.

And, yet again, I was attending a function for my 6-year-old son, and an investment discussion sparked. I was being told about a stock that would “for sure” double in the next 12 months and how to make money in crypto assets using a “buy-low, sell-high” strategy. My exterior posture was listening intently and respectfully; my internal posture had my hand over my face as I was shaking my head.

These are the types of conversations investors have when luck has been on their side, and they are yet to be burned by speculation. If one goes on a lucky streak or markets remain irrational for an extended period of time, this often just means that more will be placed at risk, and there is a greater chance of severe financial damage.

Buyers Beware

I write this article for one reason and one reason alone; I simply want you to be careful. Things that fly to the sky can drop hard. I mentioned this recently, but I remember a client asking me to buy a high-flying stock that was benefiting from the shelter-in-place reality of COVID. The stock was up nearly 435% that year, and the investor was genuinely disappointed that I had advised against the investment. I looked at the stock today, and it’s down 95% from its high, and an investor who would’ve bought the stock at the beginning of 2020 and held it to today would’ve been down 73%.

I am being a bit cheeky when I say that “there must be something in the water”, but I really have had that feeling lately based on conversations inside and outside of work. Here’s the important part, though: that theme I am seeing, those anecdotes I’ve shared, are they driving me to change my personal investment portfolio? Absolutely not. I know that valuations and gut feelings are not reliable tools for timing markets, so instead I lean towards a Dividend Growth strategy that buys more fairly valued assets and has a historical reputation of weathering bubble storms well.

Before you leave, please scroll up and read the advertisement just one more time: “If your broker’s so great, how come he still has to work?” I will say, it’s great marketing – humorous and memorable. The same company is famous for the talking baby who traded stocks. Why? Because they wanted you to know that trading stocks is so easy that even a baby can do it. Here are the returns of the Nasdaq in the years following this advertisement:

2000 -39.29

2001 -21.05

2002 -31.53

Trust me, that is one painful way to learn your lesson when it comes to speculating.

Be safe out there…