When constructing a client portfolio, some of the investments are very familiar to people and other investments are not. Domestic stocks and bonds are often recognizable, but allocations like emerging market equities seem a bit more foreign (pun intended). This will often raise a lot of questions, as people are interested to know, what exactly are emerging market equities and why would one own them?

This is the subject that we will tackle on TOM today. We will help to provide a better understanding of emerging markets, why one might invest in them, and how they fit into a diversified portfolio.

And off we go…

Defining EM

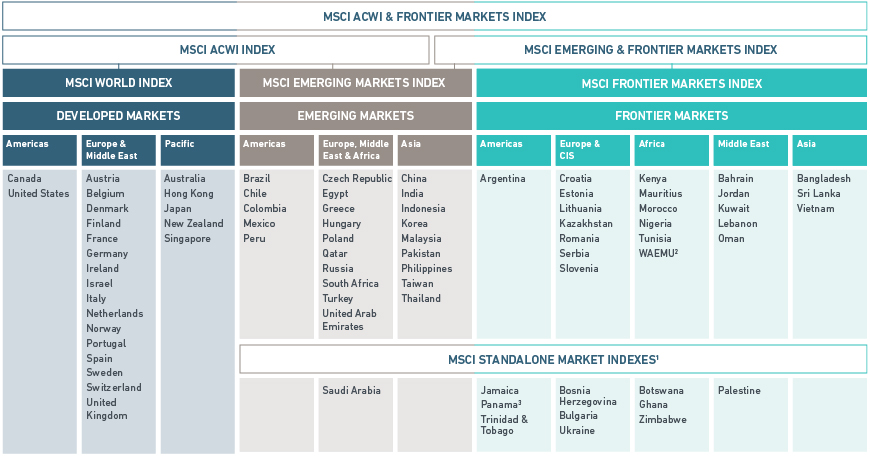

There are 195 countries in the world. Some of these countries are well developed and have strongly established financial systems, political stability, developed infrastructure, etc. Other countries are aspiring to this, and they are developing systems and structures with the hope of one day becoming a developed market – these are emerging markets. MSCI Inc., a global provider of market indexes, categorizes countries into one of these three categories: Developed Markets, Emerging Markets, and Frontier Markets.

Source: MSCI

Frontier markets are developing to become emerging markets, just as emerging markets are establishing themselves to become a developed market. The flow chart of a maturing nation might look something like this:

Frontier Market → Emerging Market → Developed Market

MSCI, Inc. is specifically categorizing these countries based on: economic development, size and liquidity requirements, and market accessibility criteria. Although investors have been investing in projects and companies around the world since the beginning of time, MSCI developed their emerging markets index on December 31, 1987, making this a fairly young asset class when it comes to data.

Diversification

If someone was to ask, “why would I invest in emerging markets?” perhaps the easiest answer would be diversification. Remember, this means owning investments that behave differently than one another – one zigs while the other zags. Over time, a diversified portfolio should create a better risk-adjusted return, meaning that you would be able to derive more return for every incremental unit of risk you took. Risk is measured by volatility (standard deviation) and when constructing a portfolio, you are looking for assets that do not correlate perfectly with one another. This non-correlation is what provides our diversification benefits.

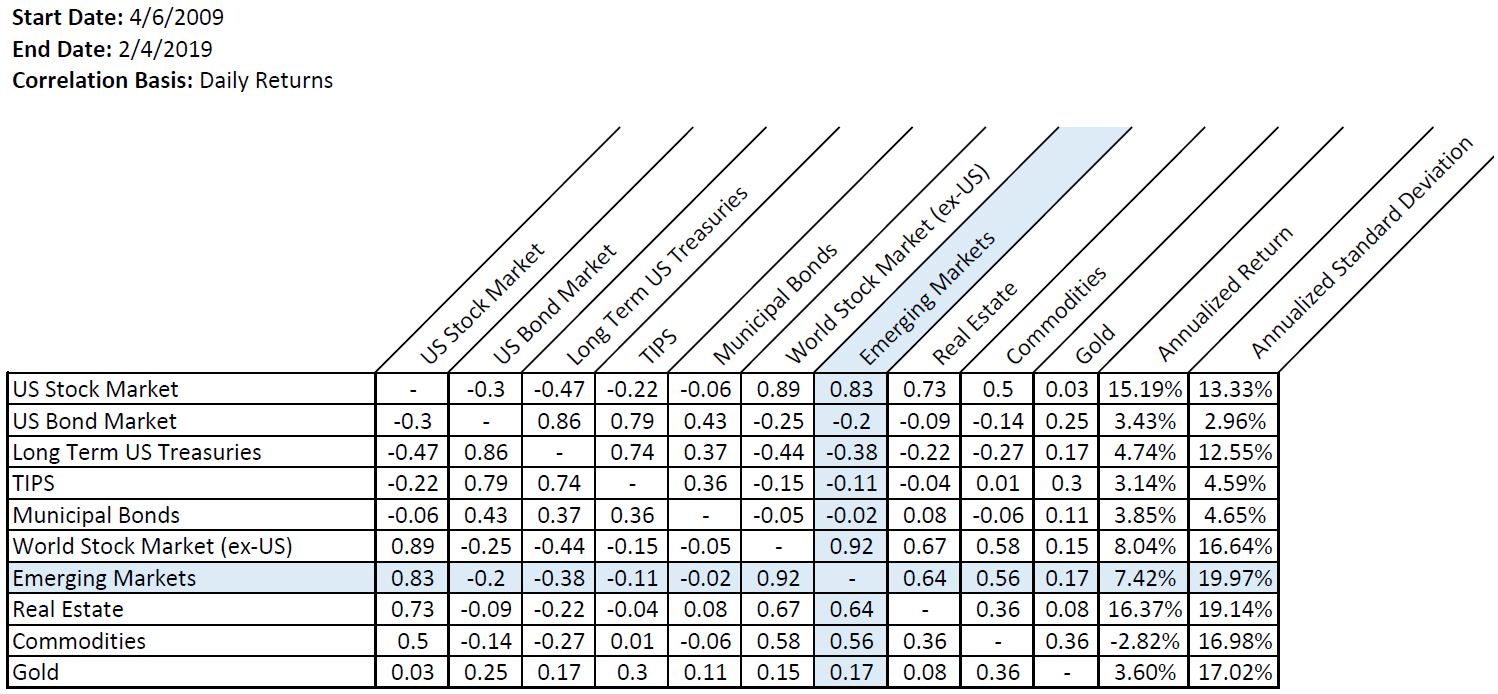

Source: PortfolioVisualizer

To help understand this concept, I’ve included the chart above that I created at www.portfoliovisualizer.com. I know there are a lot of rows, columns, and numbers, but let me help you simplify this table. The list of asset classes in the first column (on the left) are the same list of asset classes in the row along the top. By looking where these asset classes intersect on the table you get a metric that represents the correlation of those two asset classes. Correlation is measured this way, 1 represents a perfect correlation meaning that the two investments move in lockstep together and -1 means they have an inverse relationship. Everything falls between -1 and 1 and that defines how these investments behave compared to each other. So, let’s take a look at our table, see where emerging markets intersects with the “World Stock Market (ex-US)” on our table? At 0.92, which is close to 1 meaning these asset classes are highly correlated. How about emerging markets and long term US treasuries? -0.38 and this negative number means that these two assets have a low correlation.

I know that was a mouthful but hey, now you can tell your friends at coffee that you know the ins and outs of portfolio construction 😊

What You Don’t Own Matters

Ok, as I mentioned, diversification was the easy answer and can really be applied most of the time when you are introducing a new asset class to a portfolio. Here’s the thing though, many great investors are known not only for what they do own but also for what they avoid. In the world of investing, sometimes losing less can be more important than winning big.

Let’s take the Chief Investment Officer of our group, David L. Bahnsen, as an example. If you’ve seen David on TV or if you’ve read any of his commentaries, there is one thing that you will definitely hear about – Dividend Growth Investing. The man lives, eats, and breathes dividend growth investing. His book on the subject comes out on April 9th of this year called “The Case For Dividend Growth – Investing In A Post-Crisis World” – and we’ve even created this short video to share the philosophy:

Now, if you are a dividend growth investor you are going to be self-selecting yourself out of a large segment of stocks within the investing universe. If you are filtering for companies that have lower than average debt, lots of free cash flow, a reputation of paying a dividend, and a trajectory to continue to grow that dividend at a sustainable pace then you are going to end up with a collection of well-established companies. This means you are not going to own many of the speculative “high growth” names because they don’t fit your criteria, and guess what, some of those companies are going to experience HUGE growth. I want to emphasize the word some and I might even want to state that as just a few. Chasing after these types of companies can be a painful endeavor, as some will lose half their value in a day, others will be a slow bleed over time, and if you are lucky you may find one big winner. If you have emotions, that is to say, if you are human, then this is a VERY difficult and draining way to invest.

Unicorns

In the world of venture capitalism, there’s a term for these investments that go from zero to hero, they call them Unicorns. These are privately held startup companies that are valued at greater than $1 billion. Perhaps the name is fitting because finding one of these investments can feel like the equivalent of finding a real-life Unicorn. The plight of a venture capitalist is to invest in a handful of companies, knowing very well that most will go to zero, some will break even, and the hope is that one will make up for the shortcomings of the rest.

Where Do You Get Your Growth From?

So, maybe you agree with me and believe that chasing unicorns is not a game you’d like to play. Is there somewhere else you can go to supplement for this growth in your portfolio, but not have to pay an outrageous valuation? You betcha! Emerging markets are a great place to find growth at a reasonable price.

Valuation Matters

In the world of finance, we have lots of metrics to help compare investments and provide context. One popular metric is the “P/E Ratio,” which is simply the price of a stock (or a collection of stocks) divided by the earnings. The P/E Ratio basically tells us how many dollars (price) that we have to pay for each $1 of earning that a company produces. Much of the long-term performance of an investment can be determined by the initial valuation that you pay. So, how do emerging markets stack up today?

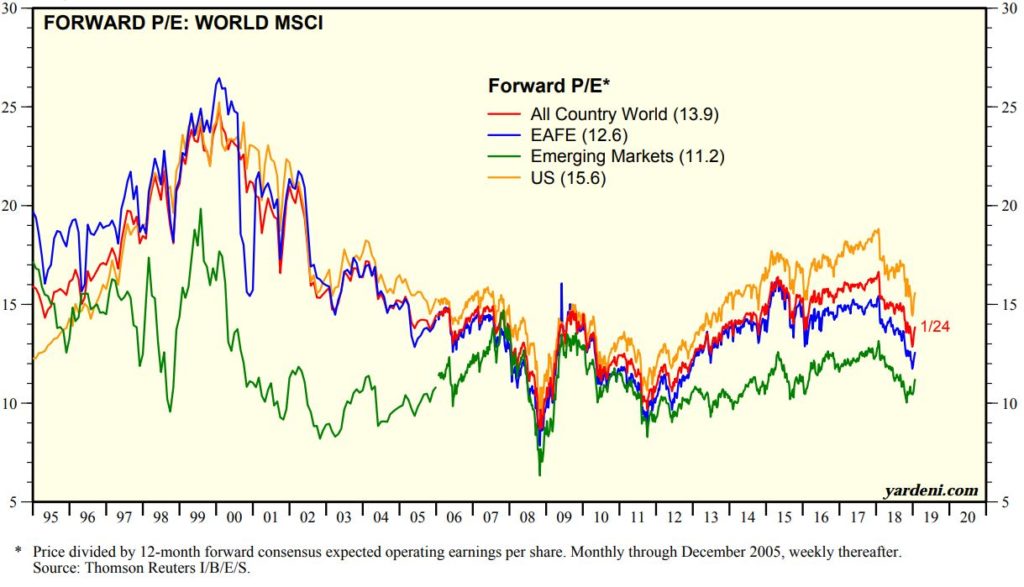

Source: Yardeni

This chart shows us the historical valuation (P/E Ratio) of Emerging Markets compared to the world (All Country World), EAFE (Non-US Developed Markets), and the US. As of this publication from Yardeni Research, Inc. on January 30, 2019, emerging markets had a forward P/E ratio of 11.2. Again, one would be paying $11.20 (price) for every $1 of earnings created by this collection of emerging market companies.

The graph makes it easy to see that these valuations for emerging markets are below average, but how about another measuring tool to help provide context? Just take the P/E ratio and inverse it (E/P) and this provides what is called the earnings yield. So, for our emerging markets example above, we’d just take 1/11.2 and we get 8.93% as the earnings yield. Professor Jeremy Siegel, from the Wharton School at the University of Pennsylvania and author of Stocks for the Long Run, often sites earnings yield as a good predictor for future long-term performance.

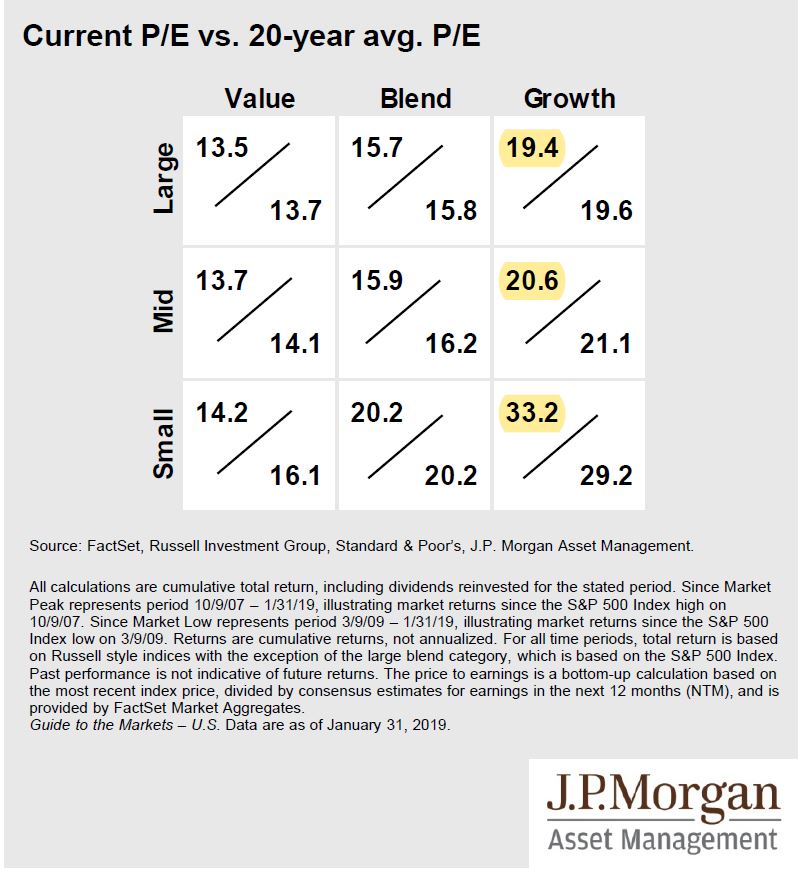

Again, to provide context and circle back to my earlier question, “Where do you get your growth from?” let’s take a look at domestic companies and specifically the current valuations (P/E) for small, mid, and large sized growth companies here in the US:

I highlighted in yellow the P/E ratios and I trust you can make a general comparative to our former chart. These ratios are 2-3 times the valuation of our emerging markets example. Now, one could argue that because of currency risk, political risk, and the general instability within the emerging markets that a premium is deserved for US companies, but a premium of double or triple? Again, it is an expensive endeavor to chase unicorns and often these growth companies are priced for perfection, so anything short of perfect can cause the price to adjust drastically.

So, perhaps if you are building a portfolio constructed around a dividend growth philosophy made up of reliable and well-established companies, then a potential place to supplement your growth would be an allocation to emerging markets. Hmmm… sounds like a pretty good idea to me.

No Such Thing as a Free Lunch

I thought it’d be important to include this friendly reminder, as I know we’ve discussed it here on TOM before, but definitely worth repeating. Risk and Return are best friends and they go everywhere together. Their relationship is almost inseparable. So, if we are discussing an investment that we are seeking for potential growth, we must remember that this will also include an elevated level of volatility. Again, in the world of investing we use volatility for the measurement of risk and specifically we use standard deviation to provide a metric for measuring this risk. Go back to our correlation table from earlier and take a look at the last column. Which asset category had the highest standard deviation at almost 20%? If you said Emerging Markets, then you are correct!

Biting Off More Than You Can Chew

If you are a chef you know that a little cayenne goes a long way, if you are a poker player you know the importance of sizing your bets, and if you are an asset allocator you prioritize setting your allocations appropriately. We might believe that emerging markets have the greatest probability of the highest return over the next 10 years, but we also know the reality that these countries have an elevated level of instability and this is reflected with an elevated level of volatility. If one is to over-concentrate a portfolio with this asset class, it may increase volatility at the portfolio level that is unbearable for the investor. Meaning, gyrations and price fluctuations that could scare an investor away before they glean the rewards (return) they are due – imagine trying to ride a bucking bronco, it could feel something like that.

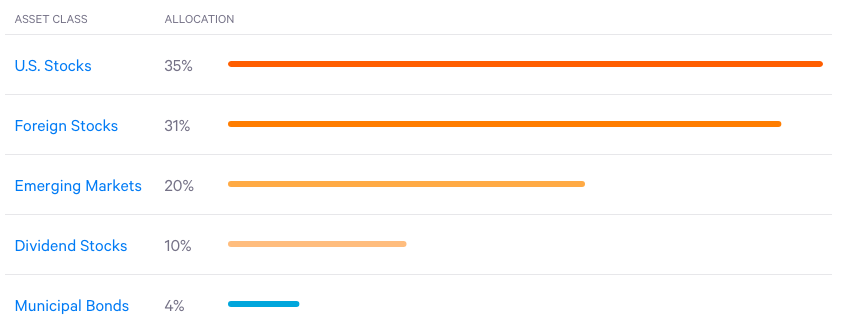

Now you might think this is an obvious truth, everything in moderation, right? Then I come across these robo-advisory services that allow people to take a short risk questionnaire prior to the “robot” investing their money. I took the questionnaire this morning and it generated this portfolio recommendation:

Source: Wealthfront

I’ve done this exercise before and some of the recommendations were north of 30% for the emerging markets allocations. Which for some people, for certain circumstances, I suppose could be suitable (maybe). But I don’t know how that suitability was determined by just a few quick questions. All this to say, is that the unknowing investor that walks into an allocation like this seeking to “maximize returns” might be very disappointed if theit timing is unfortunate. This is how many folks become jaded about stock market investing. I will say that these types of experiences definitely give me a strong sense of job security – people aren’t just numbers in an algorithm and sometimes robots have trouble seeing past that.

Bringing It All Together

There is plenty more to discuss about emerging markets, but I will have to leave it here for this week. The asset class as a whole is intriguing, and you can spend days reading about how all the different currencies factor into the results, how different geopolitical events affect the asset class, and all sorts of different tidbits that could make for another good discussion in the future. Here at The Bahnsen Group we are very much interested in the consumers within these emerging markets and seek investments that benefit from this growing consumer base, rather than companies that are export dependent. We believe that emerging markets are a key part of our client’s investment portfolios and our team does exhaustive research to make sure that we size these allocations appropriately and that we create the type of exposure that matches our thesis. This is the prudent thing to do and the way we serve our clients.

I hope you enjoyed this short lesson on emerging markets and you are walking away knowing a bit more than when you started. I hope this also sparked some questions and brought some more curiosity around how portfolios are constructed. As always, feel free to reach out with any questions.