The Woes of Retail Banking

My introduction to the world of finance was via a job in retail banking. Although I despised the job at the time, I’m thankful for what I learned while I was there. Basically, my role as a retail banker was to sell customers banking “products” whether they really needed it or not. Because this didn’t sit well with me, it quickly became a problem for me and the bank that signed my paycheck. My manager would review my customer interactions with me and pepper me with questions about why I didn’t offer this or that. I needed to find a solution quickly or else I’d need to find a new job.

The Refi Guy

The solution hit me right between the eyes while I was helping a customer collect some needed documentation to refinance their mortgage and I realized how impactful this “product” would be – helping this customer save money and improve his financial situation also suited me much better and avoiding more of those uncomfortable ‘training’ sessions with my boss.

From that point on I made mortgage refinances my niche at the branch. I learned everything I could about mortgages. The timing was good too because mortgage rates were hitting historical lows and most customers had an opportunity to benefit from a refinance. I built a great relationship with the mortgage officer at the branch and I spent most of my day interacting with bank customers discussing refinance opportunities.

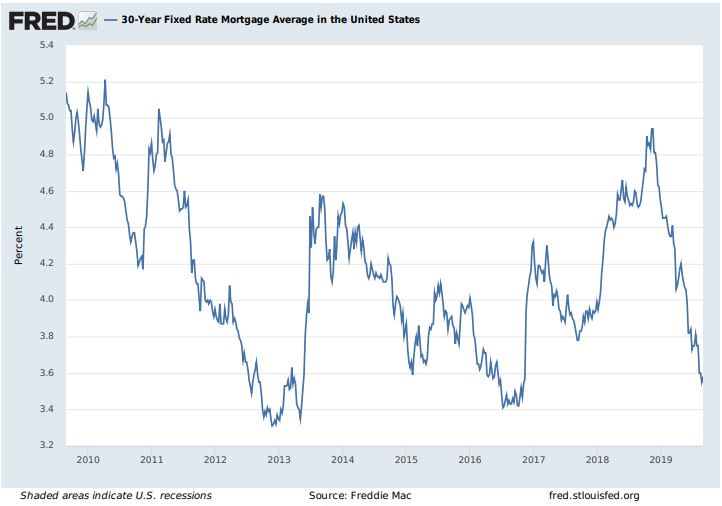

How Low Can You Go

As you can see from the chart above, mortgage rates are beginning to flirt with those all-time lows again. And I’ve seen a few financial media outlets begin touting this as potentially the second coming of the “refinance boom.” Add in the fact that there is a high probability that the Federal Reserve will continue to lower the federal funds rate (the rate at which banks borrow) this year and we could very well see another big spike in refinancing activity.

Keep Drinking Coffee

One common mistake I see people make is that they spend way too much time stressing about small expenses and don’t invest enough time trying to reduce big expenses. So, if you’ve beat yourself up about drinking too many Starbucks coffees throughout the week, I’d encourage you to cut yourself some slack. Stop spend shaming yourself.

Here’s a better place to devote your energy, work on reducing the big expenses where possible. What’s the biggest monthly expense for most people? Housing. The typical household usually spends about 1/3 of their monthly budget on housing (rent or mortgage). A potential refinance could have a BIG impact on your monthly expenses. I know I’ve heard many people say that they dread the associated paperwork, but I am here to tell you that it just may be worth it.

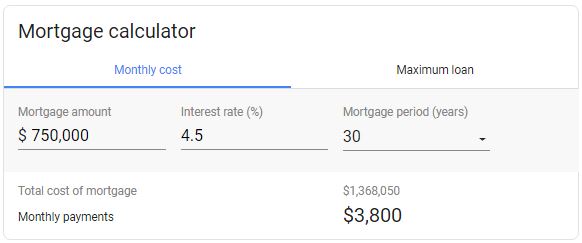

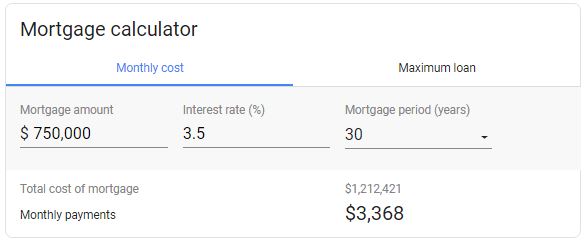

Above is a simple hypothetical example of what impact a 1% reduction would have on a $750,000 loan. For this example, it would equate to an ≈ 11% reduction in monthly payments and a savings of ≈ $150,000 in interest expense over the life of the loan. That savings in interest expense could pay for approximately 50,000 cups of coffee, so enjoy!

Loan Prejudice

I’m sure you already know this, but there are a lot of different types of loans out there. Yes, we are all most familiar with the traditional 30-year term with a fixed interest rate, known commonly as a “30-year fixed,” but there are many other options as well. There are Adjustable Rate Mortgages (ARMs), there are interest-only mortgages, there are 10-year mortgages, there are 20-year mortgages, there are Veteran Affairs (VA) loans, there are Federal Housing Administration (FHA) loans, and the list goes on. On top of this, some loans allow you to put zero down and others might require +30% down.

As you can see, there are lots of different loan options, which allows for a lot of customization. Here’s my advice, don’t develop a “loan prejudice.” I’ve interacted with too many folks that have a strongly developed opinion about a particular type of loan, without really understanding the pros and cons. This opinion typically coincides with a horror story of a loan gone wrong from their personal experience or that of a friend. To avoid possessing a loan prejudice, be open, do your research, and seek the help of a finance professional who will take the time to understand your personal situation, who will make clear of the loan options available to you, and then decide which type might be the optimal fit for you.

Finding the Right Fit

Your loan needs to have the features and benefits that align with your situation and your financial plan. It would take me way too long to unpack the cost/benefit of each of these loan types in today’s discussion, which means this warrants a scheduled discussion with your financial advisor. Much of this decision will come down to a few primary factors: liquidity, cash flow, risk, and time horizon.

Liquidity – For some, their home will make up a significant portion of their net worth. Which means their down payment may be a large sum as well. When designing the perfect mortgage for your situation, you need to factor this in, understanding that the equity in your home does not have the same liquidity profile (accessibility) as cash in the bank or other investment opportunities.

Cash Flow – As we referenced above, there is a good chance that your monthly housing cost will account for about a 1/3 of your monthly expenses. Some of these different loan options have different terms and interest rates which will dictate the monthly cost. It’ll be important to match the right loan to your particular cash flow needs.

Time Horizon – How long do you plan to stay in this home? Is this your forever home? Or perhaps you have plans to move away in the near future for retirement or job opportunities. Some of these loans have benefits for borrowers with a shorter time horizon and others are a better fit for longer time horizons. Again, it’s all about matching up your loan with your financial plan.

Risk – This one may seem a bit more abstract, but some of the options available have variable features associated with them. Perhaps the interest rate is fixed for a period and then becomes variable. This presents a risk that interest rates could move out of favor at the time when the rate is no longer fixed. A borrower needs to consider these potential risks before committing to a loan.

In Closing…

Ok, like many of the TOM articles, the intention behind today’s discussion was to (1) help provide some context around a potentially complex topic (mortgages) and (2) provide some framework (liquidity, cash flow, risk, and time horizon) for having a fruitful conversation with your trusted financial advisor. Today’s topic is also a timely one based on the recent moves we’ve seen in interest rates. I hope this will lead to some enriching dialogue and as always, do feel free to reach out with any questions you might have. I can be reached at .

Until next time, friends…