Today on Thoughts On Money we have another guest post from Kenny Molina. Kenny dives into the world of behavioral economics and provides some tips for avoiding unwanted anchors. We’ve also included a link to the most recent TOM Podcast where you will find a conversation with David Bahnsen and I discussing some of the recent posts from TOM.

I hope you enjoy this piece as much as I did and without further ado, TOM presents Anchors Aweigh!

– Trevor Cummings

*****************************************************************************************************************

TOM Podcast |

|---|

Have you ever come across a promotion for a featured item and thought ‘nope, not at that price!‘? I must admit that when I do, I can’t help but think that other similar items seem to look like a better value! I commonly find myself in these situations at Costco; just a few days ago I ended up updating my electric toothbrush because I ran into one that was less expensive than the one they were showcasing and it felt like … do I really want to lose out on this bargain 😀 ?! Just like that, the price of the expensive item had me sunk; I anchored to its price!

Anchoring is a cognitive bias (a systematic pattern of deviation from rationality in judgment) that causes one to fixate on a ‘target number’ and disregard/underweight additional or even updated information. The latter part of the definition is usually what is commonly discussed in financial settings, but both are equally important to our daily lives. Expanding for a moment on the Costco scenario, the price of the featured item framed the whole experience; everything became relative. Even if I may not outright buy the expensive item, I may (read: did) end up buying an item priced somewhere below since everything appears cheaper in comparison to the expensive, featured item.

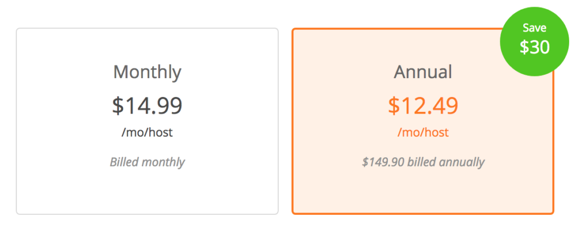

Anchoring bias isn’t always a loss-loss scenario; it is commonly used in sales tactics to incentivize behavior. Take, for example, the decision below:

This is probably an option most of us are very familiar with; be it an app, subscription, or gym membership; there always seems to be a push for the lump-sum discount purchase. Companies, of course, are not altruistic entities they simply understand that by creating a perception of savings and contrasting the discounted bulk price, a prospect may choose the ‘cheaper’ annual bill-cycle. There are multiple objective reasons why the annual, lump-sum, purchase price may not be the best option for the consumer such as locked-in terms, unexpected issues, change in expectation, etc. but focusing on the purchase decision alone; the consumer pays x10 what they originally intended to.

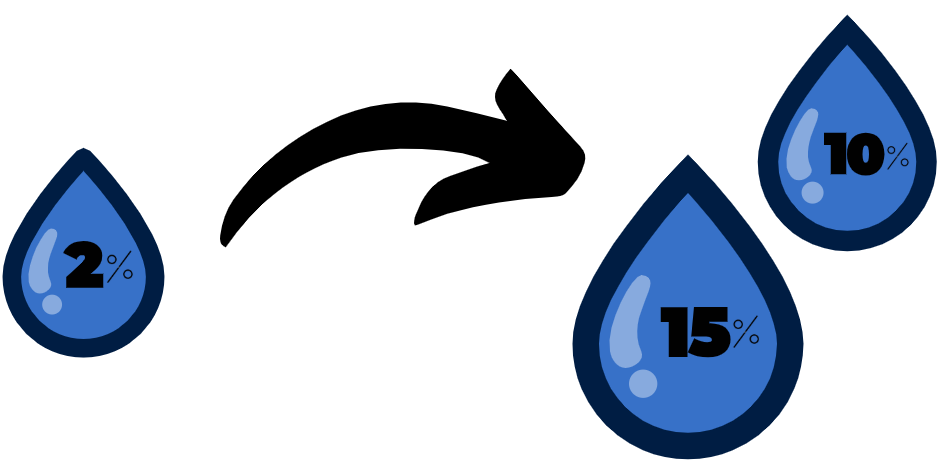

Anchoring is not all smoke & mirrors; it can also present itself in our own retirement planning. Many companies have begun auto-enrolling employees in a 401(k) in order to frame the decision to save as a default that the contributor must opt-out of (smart, right?). While 401(k) auto-enrollment has arguably been a net-positive it’s only a start! Plan contributors tend to treat the default contribution rate, ~2-3%, as their anchor (reference point). Although that low-contribution rate is good for younger contributors who need to instill and ease into healthy financial habits, it is not enough over the span of your accumulation-period (advisors and experts recommend 10-15% min). Unfortunately, while the default rate to an auto-enrolled 401(k) plan is only a suggested foundation, many can be reluctant to increase it in any meaningful magnitude. Doubling, tripling, perhaps even quadrupling can seem like a daunting proposition, but quadrupling a 2% annual contribution rate only brings it up to 8% (2% under the bare minimum long-term recommended rate).

The good news is that there’s a pretty simple practice to aid in our anchoring bias; research and education. Our thought process is uncomfortable with uncertainty, and thus anchoring is a natural result of us trying to familiarize our self with an unfamiliar situation and make an ‘informed’ decision. The more we can think ahead and research a situation/product, the less susceptible we become to creating a un-advisable reference point or to being swayed by sales/marketing. Simply, consider as much about the purchase or situation beforehand and set your own anchor point, here are a few ways to approach some of the scenarios we’ve covered;

Regarding a purchase

- Have I bought something like it before?

- If so, at what price and why should that change now?

- If not, what does the average consumer purchase this for?

When considering a one-time lump-sum payment v. subscription

- Is there a test trial/refund period before I commit to the lump-sum option?

- Have I compared services and packages with like companies?

Retirement savings

- What’s the projected value of my account at retirement given my current contribution rate and expected return?

- Does this projected value meet my expected retirement needs?

- If not, by how much can I comfortably raise my contribution everytime my earnings increase?

We will anchor whether we like it or not, but we can greatly diminish or even change its effects on our behavior. Conduct as much research as possible and always try to recall previous experiences regardless of current specials or discounts. So, once you’ve charted your course feel free to open up the sails and head out with confidence knowing that when you drop anchor, it will be at your port of choosing.

Kenny Molina for Thoughts on Money