Bonds are on FIYA!

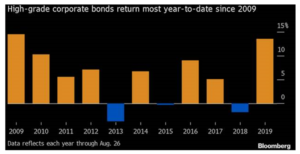

In the August 30th issue of David Bahnsen’s, Dividend Café, he included the chart below, which highlights the investment performance year-to-date of the investment-grade corporate bond sector.

“I really don’t even know what to say about this. Rates have dropped. Spreads have tightened. And it would be tough to argue that corporate bonds are the most compelling part of the taxable fixed income universe. But if anyone could have guessed that high-quality corporate debt would be up 13% in eight months at the beginning of the year, I have a flying cow to introduce you to.”

In the first 8 months of the year, BONDS, as an asset class was having its best performance since 2009. This investing news highlight has led to an influx of client questions regarding bonds.

So, as TOM topics go, this seemed like a good time to discuss bond basics. I will say bonds are definitely not the sexiest financial topic. But, as we typically aspire to do here on TOM, we plan to keep this discussion succinct, educational, and most importantly – fun!

And off we go…

TOM Podcast

Keep It Simple for Me – What is a Bond?

Have you ever lent someone money? If you have, you know the drill. You lend them money, they agree to pay you back on a certain date, and maybe you charge them a little interest. Well, that’s a bond. You have a lender, a borrower, a specified borrowing period, and an interest payment paid along the way. If you are issuing bonds, you are the borrower and if you are purchasing bonds, you are the lender.

When you purchase a bond, you’ll typically want to know things like:

- Who am I lending to? Do they have a good credit rating?

- How long am I lending the money for?

- What type of interest will they pay me to borrow my money?

So, now you know what a bond is! You should also know that they come in all different shapes and sizes; 3-month bonds, 30-year bonds, fixed interest rates, variable interest rates, convertible bonds, etc. etc. etc. Bonds will find themselves to market via an auction or an initial offering and then just like stocks, they can be bought and sold on an exchange. This is where all the market participants (you, me, and every other investor) decide how much we are willing to pay for each bond and this price is determined by some of those questions we listed above.

Understanding Performance

As you may know, stock prices tend to move around every second of the day. Much of this is based on the most recent transaction, in which a buyer and seller made an exchange. Understanding these price movements can be confusing. It’s not always easy to pinpoint the exact piece of news or financial information that is driving these price changes. All we can really do is speculate and make an educated guess to what caused the change.

Bonds are different. The price movements in bonds can be explained by things like movements in interest rates and the overall risk sentiment in the market. This is important to know because you definitely don’t want to set your future return expectations from a bond based on what you might have seen in the past.

Let’s start with these first two bond basics: duration and credit risk.

Premiums & Discounts

As we explained above, after bonds are issued, they can be bought and sold on a secondary market. You might be familiar with a CD (Certificate of Deposit) that you purchased at your bank in the past, in which you are paid a fix payment, but the value of your CD does not typically fluctuate on a day to day basis. Bonds do fluctuate and one of the reasons they do is because interest rates fluctuate.

Let’s keep it simple. Suppose you bought a bond today that had a 1-year term and paid a 3% interest rate. Then tomorrow interest rates moved, and they were issuing a similar 1-year bond at a 3.25% interest rate. What do you suppose the price of your bond would do? Well, if you wanted to sell it, you’d have to offer the buyer a discount to compensate them for the fact that your bond is paying a lower interest rate than the new issues for a similar bond.

And this is where we will pick up two bond vocabulary words. When you are selling a bond for a price less than the issue price that’s called a discount and when you buy a bond for a price greater than the issue price, that’s called a premium. Remember, the “for sale” price may fluctuate to reflect the price another buyer would be willing to purchase it for, but if held to maturity you’d still expect to get back the original offering price (referred to as the par value).

Duration

We use the word duration to describe how much the value of our bonds will fluctuate based on the movement of interest rates. It’s actually pretty simple – if a bond or a bond fund has a duration of 5, then that means that a 1% move in interest rates will cause a 5% move in the price or value of the bond. This is an inverse relationship, so a 1% move up in interest rates would mean a 5% drop in the bonds price.

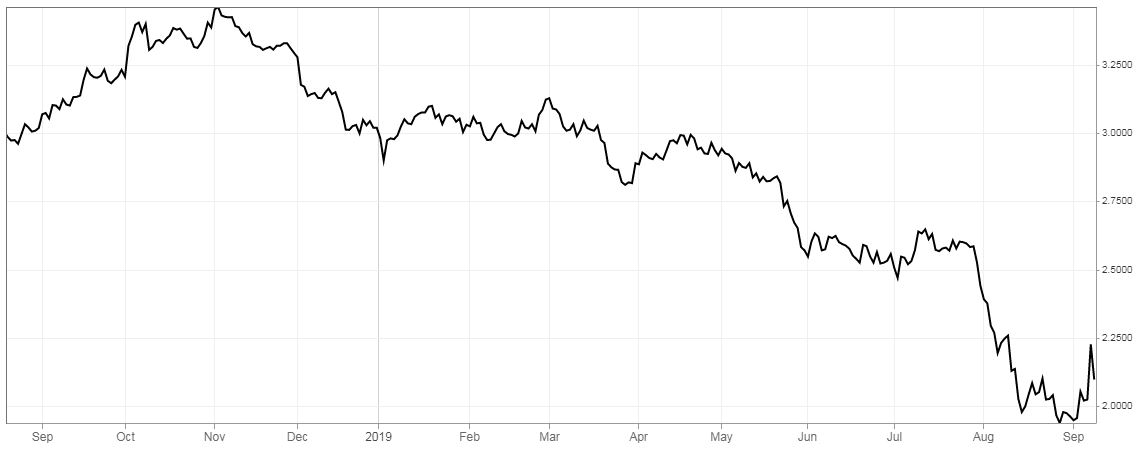

If you are thinking, “Sheesh! This is a lot of new vocabulary, why do I need to know this?” Well, I’ve received a lot of questions recently on whether an investor should own long bonds based on their recent performance. Here’s my point, the positive move in bond prices for longer-term bonds can be simply explained by duration. Look at what interest rates on the U.S. 30-year treasury have done in 2019:

Source: CNBC

From peak to trough, you can see that the rates dropped approximately 1.5%. So, if you owned a bond or a bond fund with a duration 15 or 20, then you would see the price increase by 20%-30% (1.5% move in interest rates multiplied by the duration). It’s just simple bond math.

Here’s the dangerous part. Let’s say you came across a high duration bond fund, saw the spectacular YTD performance, attributed it to something other than falling interest rates, and then purchased the fund with expectations of getting this same performance. Well, there would be a good chance that you’d be very disappointed. To glean these same results, there would have to be another aggressive drop in rates like we saw over the last 9 months.

Credit Risk

If you are a regular reader of the Dividend Café you will know that David is often referring to credit spreads. A credit spread is a term used to define the difference in yield between two similar bonds with different credit quality. Essentially, this spread is telling you the market’s appetite for risk. Remember, when talking about bonds, the risk we are referring to is the risk that the borrower won’t pay you back.

If you have a concern of potential default, then you definitely want to be compensated with a higher yield (interest payment) for the risk you are taking.

These credit spreads can be narrow or widen. Typically, this description is anchoring on what historical averages are on spreads. When spreads are narrow, we’d assume that the general market place is feeling good about the future of the economy and is not as concerned with potential defaults. Now, if the spreads are widening that would describe a growing concern with the future and potentially be a warning sign of a coming recession.

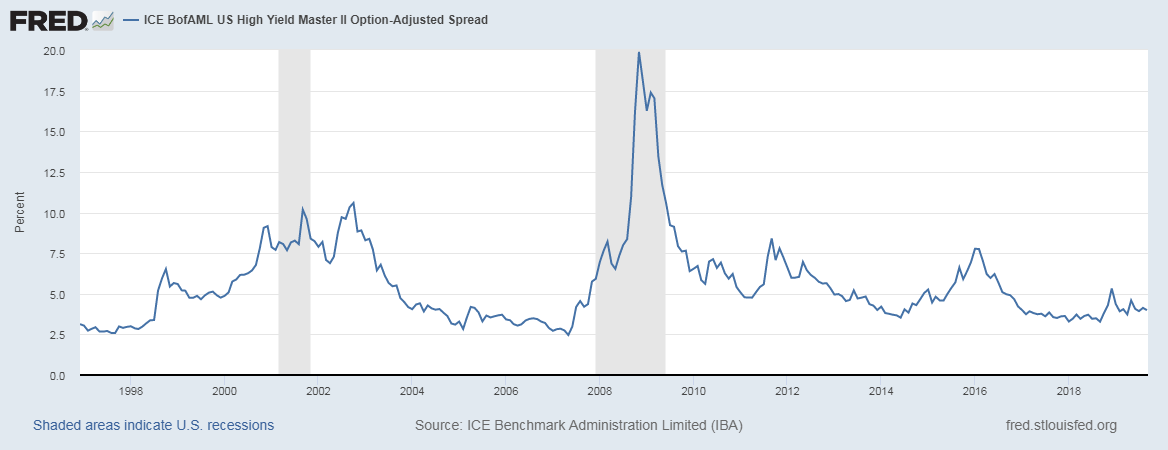

Here’s an example of what credit spreads (high-yield vs. treasuries) look like:

The grey shaded areas represent recession, so you can see the spreads widening into and during these times of elevated concern and then easing back to average during more normal environments.

All This to Say…

Here’s the motivation for today’s discussion – you should know what you own and why you own it. As human beings, we are easily drawn to narratives that tickle our ears and wooed towards investments that have done well recently. Not you though. After today’s discussion, you now have a better understanding of what drives bond returns and you have a better grasp of the risk/reward associated with duration and credit risk. Consider yourself equipped. Knowledge is power, right?

I hope you enjoyed today’s discussion and I hope we were able to make this fairly dry topic a little bit more fun and easier to understand. These articles are written with you in mind, so please do email me to let me know what questions you have and what you want to learn more about. I can be reached at .

Until next week…