Trending

As a financial advisor, you get used to the fact that if you show up to a family function or a gathering with friends you are bound to get asked a handful of questions on personal finance, the markets, the economy, etc. The funny thing about these questions is that they are almost always seasonal, meaning they will revolve around the hot topic of the day.

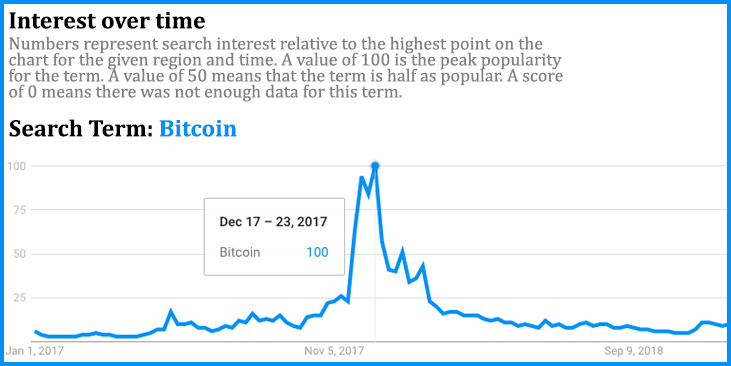

When I was attending holiday parties in 2017, I was getting a lot of questions about Bitcoin, but not so much anymore. The chart below from Google Trends shows the search popularity of Bitcoin, which probably helps explain why that was the question du jour.

Source: Google

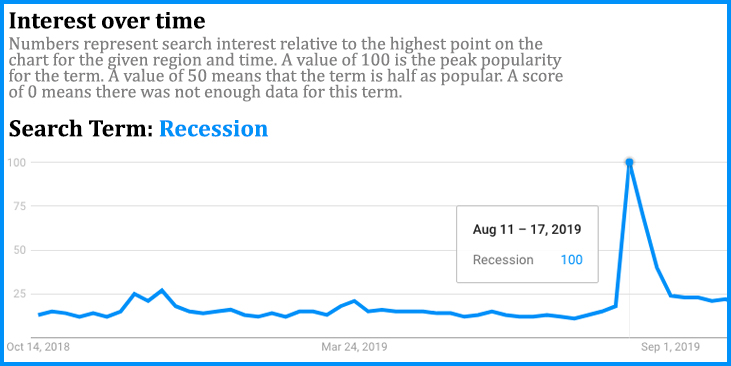

So what’s the new trending question that tends to pop up in all my conversations?

Source: Google

Is there going to be a recession? And the answer is … drum roll please … YES. Yes, we will have a recession at some point in the future. This should not be feared, but rather expected.

Timing is Everything

Although, here’s the real question you probably want the answer to, “When will we have the next recession?” And to that questions, I must answer, “I don’t know.” I really don’t and I am convinced that nobody does. Yes, we can discuss the health of the economy compared to what we have seen to be historically normal and yes, we can discuss leading indicators that usually provide insight to where the economy is headed, but no, we cannot provide with a 100% confidence the date that we will see the tides turn.

But Why Do You Ask?

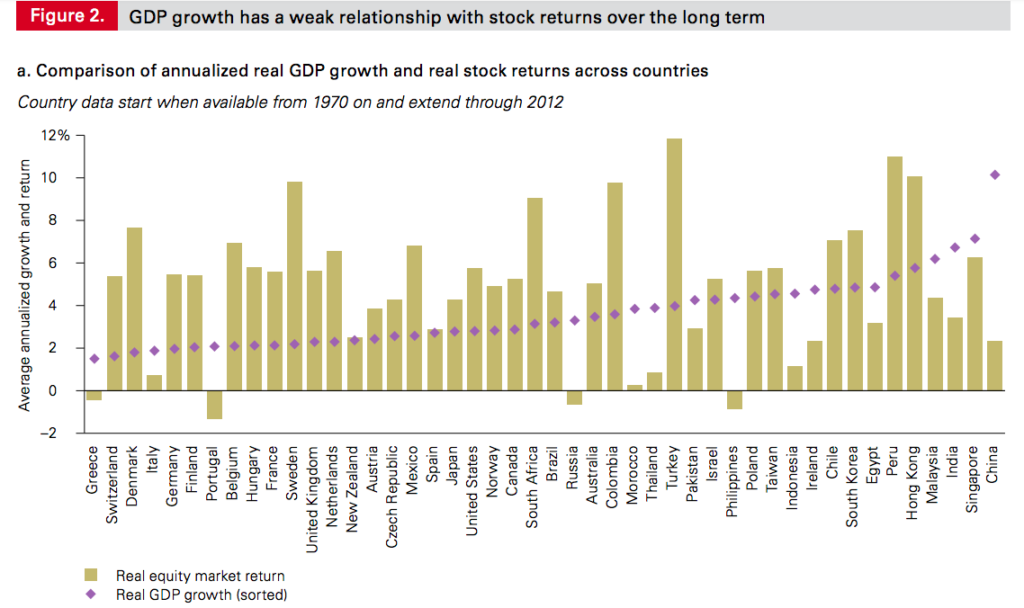

What if I did know? What if I could tell you the exact GDP growth over the next four quarters? What would you do with that information? (Remember, a recession is defined by two consecutive quarters of negative GDP growth). I guess if you knew a recession was coming the intuitive answer would be that you’d sell all your investments, place your savings in cash, and wait for the waters to settle. This strategy relies on a big assumption and that assumption is that there is a perfect correlation between GDP growth and market returns. I mean this is why you want to know, right? So you can make a market timing decision with your investments.

Well, let’s take a look at the research and see if there is a significant relationship between stock market returns and GDP growth. A whitepaper published by Vanguard Research found that “The average cross-country correlation between long-run GDP growth and long-run stock returns has been effectively zero.” The following chart accompanied this conclusion:

Great Expectations

I am sure you’ve heard the adage, “under promise and over-deliver.” It’s a truth that folks in the service industry hold tight to because they know the type of reaction that comes from customer disappointment. And you’ve experienced this disappointment before – a meal that you were really looking forward to and even at the first bite, you knew it was blah or a movie you had been waiting and waiting to see that didn’t quite deliver the entertainment you were hoping for.

Dr. Robb Rutledge, a neuroscientist at the University College of London, helped to conduct an MRI study that provided the science behind this relationship of expectations and happiness. Rutledge says, “It is often said that you will be happier if your expectations are lower, we find that there is some truth to this: lower expectations make it more likely that an outcome will exceed those expectations and have a positive impact on happiness.”

This doesn’t mean you should always expect the worse and adopt a doom-and-gloom, Eeyore type of outlook. It means that you should set realistic expectations so that you are not surprised when the inevitable occurs.

Setting Expectations

Listen, there is a high probability (perhaps a certainty) that we will have a recession at some point in the future. That’s how business cycle work, they expand and they contract. I will note that it has been nearly 30 years since Australia had a recession, which reminds us of the difficulty of pinpointing the timing behind these things. We also just learned that a recession doesn’t inevitability mean an equally bad outcome for your investments. Again, they don’t zig and zag perfectly in concert with one another (GDP and the stock market).

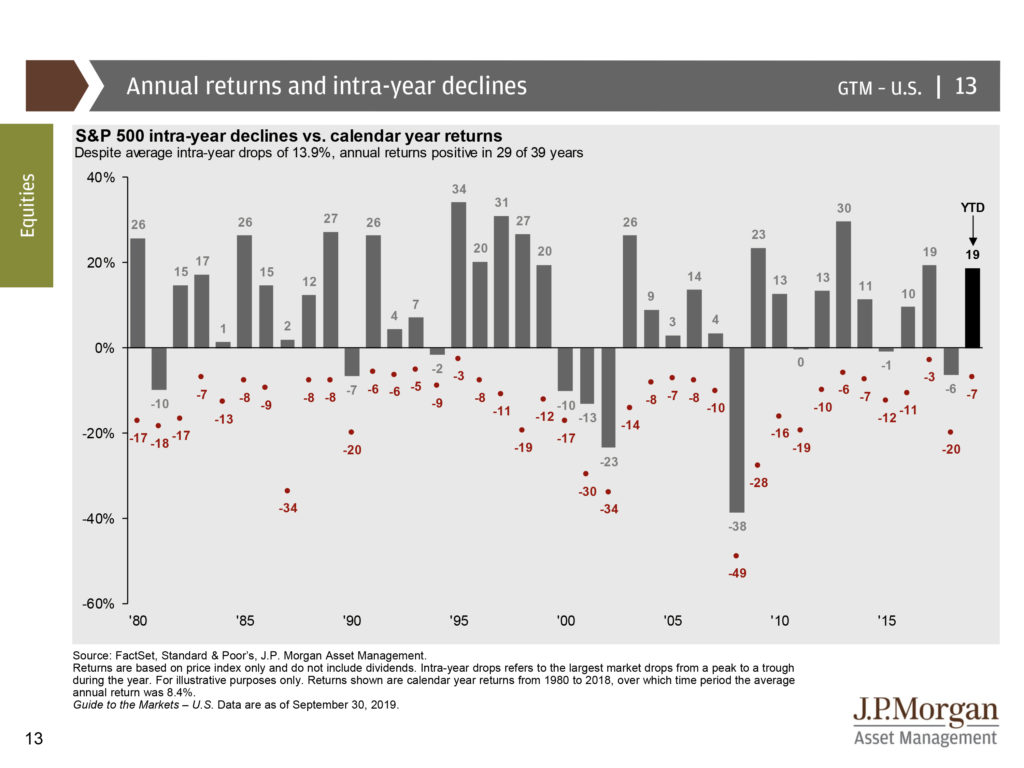

So, here’s what you should expect – you should expect your portfolio each year to fluctuate in value. This means that every month you will open a statement of your investments and they will most likely be worth more or less than they were the previous month. This is normal. This should be expected.

Source: J.P. Morgan

The chart above should be comforting. As it states, “Despite average intra-year drops of 13.9%, annual returns positive in 29 of 39 years.” This means that throughout the year an investor will see big swings between the peaks and troughs of their account value, but a majority of the time they will end up with a greater value at the end of the year than they did at the beginning of the year.

Keep it Simple

Embrace this historical truth, calibrate your expectations accordingly, and be at peace knowing everything is going as planned. That’s it. That’s all I have for you today, so until next week…