Life is Complex

Many researchers conclude that an average adult is responsible for making 35,000 decisions a day. Some of these decisions are big, like who you will marry, and others are small, like deciding whether you want cream and sugar in your coffee. To help us navigate these complexities, and the barrage of decisions to be made, we lean on heuristics – little mental shortcuts that help us make quick rule-of-thumb judgments.

Some of these heuristics come packaged neatly in an easy to remember saying, like “look both ways before you cross the road.” We each have a collection of these adages for everything from sports to finance, and we use them to influence and process our decisions.

The trouble with these over-simplifications is that sometimes we know the saying but are unsure about their real-life application. This becomes troublesome, especially in the complex world of finance.

Today I would like to address one of the most common finance adages, “Cash is king” and discuss how we should and should not be applying this to our personal finances.

And off we go…

Misapplication

Often these sayings can be misapplied when someone tries to use them to justify a decision they made or are planning to make.

Here’s an example, imagine if someone got fed up with all of the market volatility they are experiencing this year and decided they wanted to take action. They were tired of the fluctuating prices of their stocks, so they decided to sell everything. They know this is an emotional decision, but to help justify the decision they tell themselves, “Cash is king.”

How about another example. Perhaps an advisor recommends his client reduces the cash position he or she holds in savings. The advisor reviews the financial plan, explains the effects of inflation, and advises that reallocating some of this cash would be wise. The client understands the reasoning and the recommendation, but prefers to leave as is concluding, “Cash is king.”

Both examples represent a misapplication of this adage.

When is Cash King?

Cash, like any other asset (stocks, bonds, real estate, etc.), is king when it is the most suitable asset based on the goal it is allocated to. Every asset has its own key attributes and it is when these attributes align with the specific financial goal that this asset becomes “king.”

Here are the key attributes that are unique to cash:

- No price volatility

- Common exchange for purchasing goods and services

So, let’s imagine that you have some money set aside to purchase a new home in one year from now and you are deciding where to place these funds while you await the purchase date. Let me provide you three options of assets you could use to fund this goal:

(A) Stocks

(B) Collectible Artwork

(C) Cash

Well, if you placed the money in stocks then you run the risk of the asset depreciating in value and being worthless in one year from now than it is today. If you placed the funds in collectible artwork you run the risk of not only the asset depreciating in value, but also perhaps not being able to easily find a buyer to convert this asset to cash. Remember, the home seller is not going to barter, they will not accept your stocks or artwork in exchange for the property, they are going to expect cash. The correct answer is “C” because this asset (cash) will retain its value (no price volatility) and it will be the expected form of payment (common exchange for purchasing goods and services) that you will need to complete your home purchase.

In this example, cash is king.

When is Cash not King?

Most financial goals are not short-term. When we have a short-term financial commitment, we are much more likely to see it as an upcoming expense, as opposed to a goal. Many financial goals have a long-time horizon – future college expenses, retirement, life-time distribution strategies, etc.

These goals depend on assets that appreciate over time or that produce current income. It is these types of attributes we are looking for in an asset for most financial goals. Cash does not have these attributes.

For most goals, and most of the time, cash is not king.

Takeaways

Here are the biggest takeaways I would like you to gather from today’s discussion (1) Be very careful when using heuristics when it comes to big decisions – how you like your coffee and your marriage vows should not be given the same amount of thought. (2) Stop yourself whenever you lean on one of these shortcut sayings and confirm that the context matches the application. (3) The optimal asset to invest in (“the King”) depends on the circumstances – the objective is to find the asset that correctly fits the end goal.

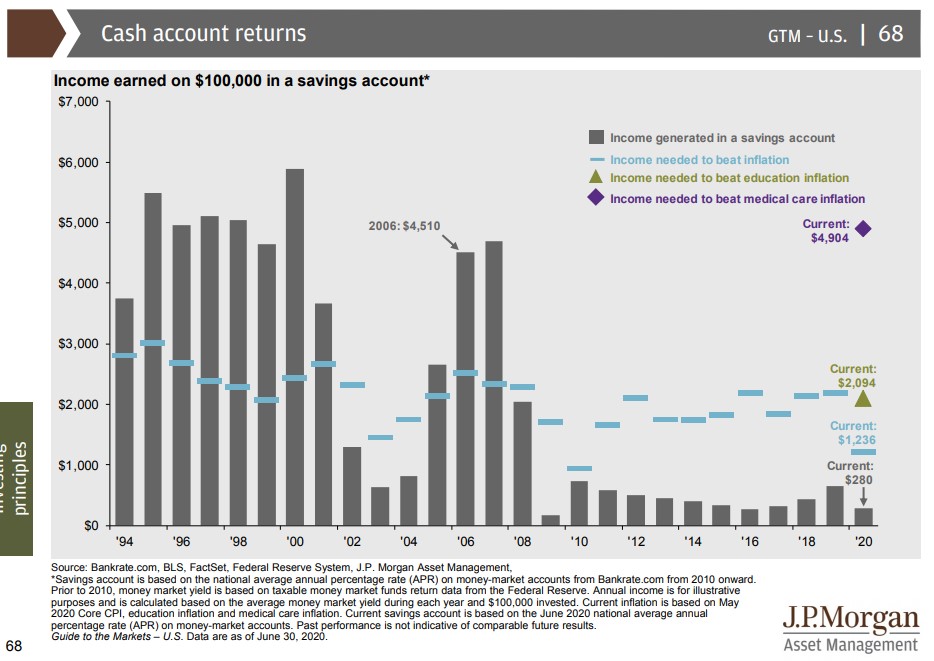

I will leave you with this one final chart to ponder. You can take a look at the journey cash has been on for the last 25 years and perhaps conclude why cash has been dethroned.

As always, please reach out with any questions or comments at .

This is TOM signing off… until next week…