Growing up, I had a lot of pets; my family loved animals.

We had cats, we had dogs. We had snakes, we had lizards. We had turtles, we had rabbits. At one point, I think we may have had a chinchilla.

When I was in kindergarten, we had a whippet, a dog breed that looked almost like a miniature greyhound. His name was Whip. Real clever, right?

In high school, my mom ended up adopting/rescuing a chihuahua. This was around the same time as those Taco Bell commercials where the little chihuahua would say, “Yo quiero, Taco Bell,” so the timing was perfect – that little pup was a cultural icon. Thinking it wasn’t wise for this little guy to be alone (the justification of all pet owners who are seeking to grow their flock), we ended up adopting another chihuahua. Then the shelter needed homes for some of his other k9 siblings, and all of the sudden, we had four chihuahuas. That’s right, FOUR chihuahuas – ay caramba!

My mom loved those four little mini dogs. They were feisty and full of energy. I remember when people would come to the door, they’d jump back in fear as they were startled by the rumbling barks, and then when they caught a glimpse at the profile of those 5-inch monsters making all that noise, they’d laugh. Little dogs, all bark, no bite.

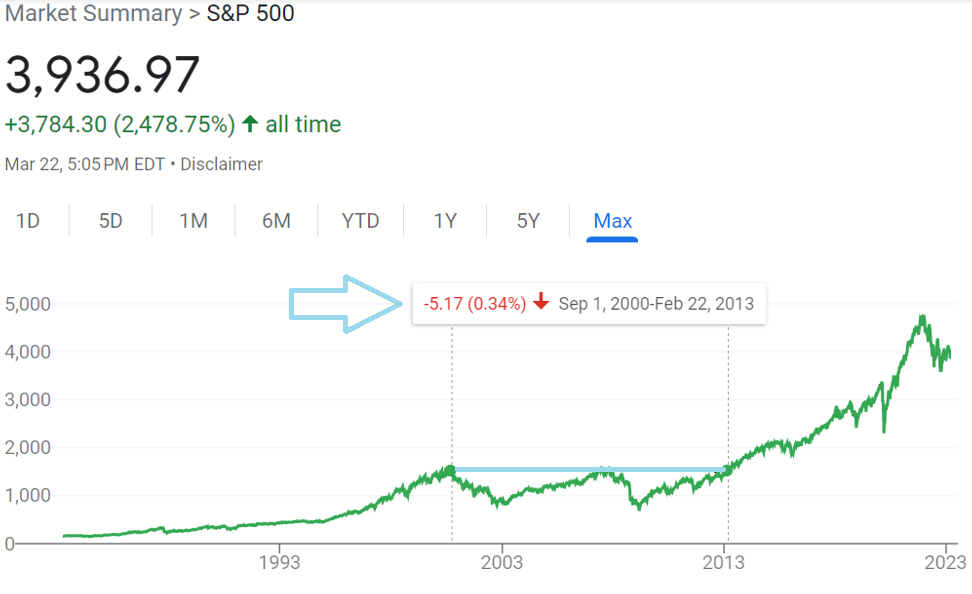

In honor of my late great furry little family members, I thought we could talk about chihuahua markets today. Now, hopefully, you aren’t getting a visual of some pet store where you can buy little dogs – this is not what I mean by chihuahua markets. I specifically mean those markets with all bark and no bite. Where the headlines and the anxious chatters (the barks) make your spine shiver, but the actual market prices end up right where they left off (no bite).

I was reading David’s DC Today on Monday, and I really like the two words he used to describe these markets, “directionless volatility.” David reviewed a handful of days of market movement describing the big swings down, followed by a strong next-day recovery, and then giving it all back again the next day – wash, rinse, repeat for days on end. It’s just like my chihuahuas, from behind my front door, they can induce some fear, a lot like the headlines we’ve been reading these past few weeks, but when you get a first glimpse at them, your fear converts to humor quickly. It’s almost laughable when you look at a stock market chart and realize prices today are the same as they were two weeks ago. All these headlines, all this investor anxiety, all this bark, and we’ve really gone nowhere. These are chihuahua markets.

Source: Google, March 21, 2023

If we expand on this thought of go-nowhere markets, we realize just how frustrating flat markets can be emotionally and how damaging they can be for a financial plan. Human beings are emotional creatures, I say it all the time. We thrive on passion – love and hate – and we despise apathy. Love me or hate me, just don’t ignore me or feel indifferent about me. Same with markets, investors are passion junkies, they secretly embrace the somberness of market bottoms and get high on the euphoria of market tops. It’s the apathy of flat markets that creates the greatest irritation.

We are embarking on a two-year anniversary of a go-nowhere S&P 500, and I’m starting to see those investor frustrations surface.

Source: Google, March 21, 2023

For me and for my colleagues here at The Bahnsen Group, it’s these types of markets that fuel our passion for the strategy/philosophy we promote – dividend growth. Why? Because we believe it is (1) logical that business owners (shareholders) should expect a growing income (return) on their investment; their share of profits, (2) financial commitments, such as dividends, act as a great accountability tool to keep leadership fiscally responsible (3) from a planning perspective, dividends provide cash flow to satiate living expenses, acting as a replacement for wages/income. I could go on with 99+ other reasons, but you start to get the idea of why we are passionate about the topic.

Let’s keep it simple. Imagine this, imagine if you created a financial plan that relied on your portfolio for 4% withdrawals per year. This would be a pretty typical financial plan and one that most financial advice givers would sign off on. Now, just for our hypothetical, let’s imagine that your investment returns for the next 10 years we’re 0%. In this illustration, we won’t even factor in any volatility, just 0% year in and year out for a decade. Where would you be 10 years later? You would’ve spent 4% a year for 10 years, and you’d be left with just 60% of your original total. Even with modest inflation over that time period, we could imagine that the remaining 60% of what we have left couldn’t even buy the same amount of goods and services it could have a decade earlier. What we just described was the absolute destruction of capital; the unfortunate erosion of a nest egg that someone spent a lifetime to acquire.

If this hypothetical seems armageddon-ish, I assure you it is not. This is the quiet destruction flat markets can cause, and exactly how an investor felt during the first decade of this millennium (2000-2010).

Source: Google, March 21, 2023

Put simply, a financial plan becomes a lot easier to understand and execute when your spending is completely covered by the dividends that deposit into your account on a monthly basis. Again, I hope you are starting to see why we are convinced that this approach is preferable.

If these last two years have caused you frustration, I’d encourage you to buckle up because this can go quite a bit longer. History has shown this to be true.

As I wrap up today’s discussion, I’m reminded of how much I personally benefit from this writing. I set out to serve my readers, and yet I find myself learning and maturing along the way. That simple little reminder from David Bahnsen about directionless volatility was such a great reminder for me. Lots of noise, and lots of anxiety, yet if you just closed your eyes for one small moment, you realized markets essentially went nowhere. Again, a barking chihuahua behind closed downs might give you a spook, but when you realize you could literally punt those cute little monsters across the room, you could only smile and laugh. Controlling our emotions and getting the right framing is so key. I hope my writing is a good complement to the healthy serving of content David Bahnsen is providing. Additionally, I hope that we can all grow in our investor maturity from these discussions/writing so that we can all go out there and fight to good fight.

Until next week, friends…