As we closed out 2019, I fielded a lot of questions about Donor Advised Funds (DAFs). For some, this inquiry was sparked by an interest in the tax benefits for 2019 planning and for others it came from a place of curiosity whether a DAF would be suitable for their situation. I know we’ve touched on Donor Advised Funds before here at TOM but based on all the inquiries, I figured it would be worthwhile to have a refresher. So, today we will be discussing the ins and outs of Donor Advised Funds.

A Quick History

According to National Philanthropic Trust the first DAFs were created in the 1930s, while the supporting regulations were put in place via the Tax Reform Act of 1969. Since then the DAF has continued to grow in popularity. The 2019 DAF Report put out by National Philanthropic Trust helps to illustrate this…

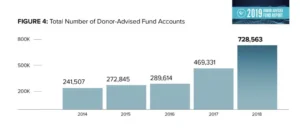

Growth of total accounts:

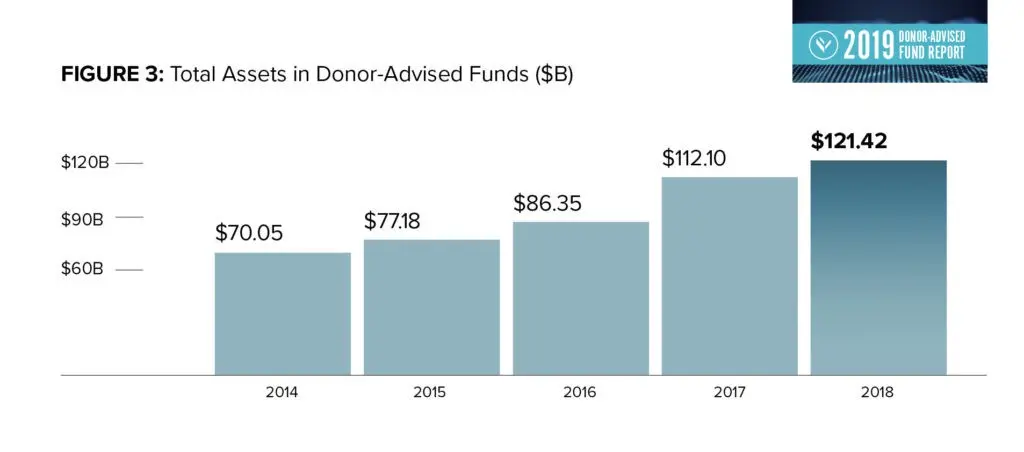

Growth in total assets:

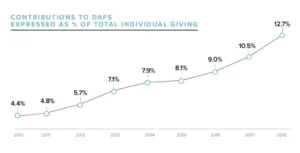

% of total individual giving:

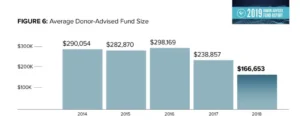

One additional chart from the report that I found interesting was the shrinking size of the average account. To me, this reflected the wider adoption and democratization of the DAF beyond that of just the ultra-high net worth.

Many of these custodians are now offering minimum account sizes as low as $5,000. And as you will see from the graphic below, these DAFs are receiving total donations larger than that of some of the biggest non-profits in the world:

So, what exactly is a Donor Advised Fund?

Here is how a DAF works:

Step One: You make an initial contribution into a Donor Advised Fund (cash, stocks, real assets, etc.)

Step Two: Your contribution is recognized in the year you make it, as a charitable deduction

Step Three: You allocate the balance within your DAF to stocks, bonds, cash, etc.

Step Four: At any future date you can make grant recommendations to qualified charities

Simple, right? Typically, the most attractive part of the process is the timing of it all – the ability to receive the deduction now and grant the money at a future date. This allows for all kinds of different tax planning strategies.

How One Might Use a DAF

Here’s an easy example. Let’s suppose that you had an anomaly year in which you had much more taxable income then the norm (sale of a business, bonus at work, etc.). This year you are going to be in a higher tax bracket then in subsequent years. So, you decide to fund a DAF now to benefit in this tax year, and then grant the money at your leisure in future years.

How about another example. Let’s say that you currently give an amount that is less than the standard deduction. You give each year, but you never have enough in deductions to itemize. Here’s an idea, what if you lumped together multiple years of giving, maybe this year and next year, as a contribution to a DAF. You’d then itemize your deductions this year, glean a greater tax benefit, and then take the standard deduction next year. You’d repeat this process every other year and come out spending less in taxes by implementing this simple strategy. The charities that you give to wouldn’t even notice the difference, as you could release the grants at the same frequency that you normally give.

Important to Note

One thing that is really important to know and understand is that these contributions are irrevocable. You are gifting the money to the institution that administers your DAF and there are no take backs. Once the gift is made, that institution (e.g. Fidelity Charitable, National Christian Foundation, National Philanthropic Trust, etc.) has exclusive legal control over those contributed assets.

Yes, it is in their best interest to facilitate whatever grants to qualifying charities that you request, but it’s important to understand the legal mechanics of the transaction. Why is it in their best interest? Well, they are in the business of being an intermediary between your donation and its final destination, and while the assets are under their care, they collect a fee for the management/administration. They are a customer-centric business and it is in their best interest to process your grant recommendations as you designate them.

My Favorite Part

I wanted to wrap up today’s discussion with my favorite part about the DAF – the designation of the successor. I’ve mentioned this a few times here on TOM, that I assume that most of my readers will do a great job saving throughout their lifetime, planning out their retirement, and eventually living off the income (dividends and interest) from their portfolio. This means that they will eventually have a sizable nest egg (investment portfolio, real estate, etc.) to leave to their beneficiaries. I also assume that many of us will live a long and healthy lives, which leaves this future inheritance to a time when our children are already grown, self-sufficient, and most likely wealthy themselves. And I’m sure you’ve read countless stories about how a big lotto winner or heir to a large estate was ruined by the windfall of wealth.

This is why I look forward to passing down my DAF to my children. They will be named the successor of the DAF and when mom and dad’s tour of duty are done here, they will carry forward the giving baton. This will allow me to leave my family a legacy beyond just a large bank account and some property. My heirs will have a responsibility to grant these funds to the causes and organizations they believe in.

You also get to name your Donor Advised Fund. Some name it after their family e.g. The Smith Giving Fund. My wife and I named it after our son who we lost in 2017 and it makes giving that much more special knowing that it’s all in his name. A Donor Advised Fund can be a very family-centric and meaningful financial tool. I hope todays discussion gave you more insight to what a DAF is and started the thought process of whether this might be a good solution for your family.

That is all we have for you this week… this is TOM signing off…