Here’s the question we are going to address on TOM today: Is debt evil?

Seems like a funny question, but after spending years talking to folks about their money, this is a prevailing theme. It is no wonder why there is a stigma around debt for when we hear horror stories about the financial destruction of a company or of an individual there is often some debts involved.

Today on TOM we will unpack why debt gets such a bad rap. We will debate on whether or not the villainization of debt is truly warranted, and then discuss some inherent “benefits” to debt you may not have considered.

And off we go…

Debt & Alcohol

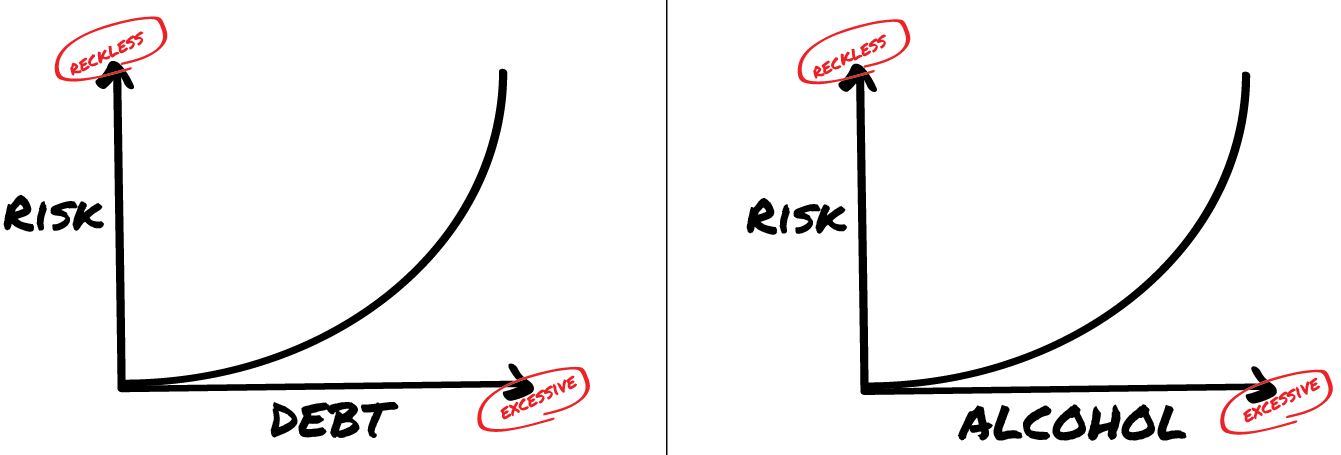

One of the optimal places to start this conversation is to understand that debt itself is not inherently evil. The perversion of debt comes when it is used in excess and without prudence. Debt and alcohol have this in common. A glass of wine with dinner might make a great compliment to the meal, but excessive drinking can destroy lives.

Both debt and alcohol each have this parabolic nature to them, that as you continue to indulge more, the risk becomes progressively greater.

Who’s to Blame?

Because we all have stories and experiences about a time someone got in over their head with debt, it’s natural to collect anecdotes and opinions that build a case against debt. Debt gets such a bad rap simply because we can’t help but focus on the bad outcomes that routinely accompany stories of financial ruin. In reality, we actually misappropriate the blame to the debt itself, while it’s the imprudence of how it is used that creates these unfortunate outcomes.

So, I ask, can good come from debt? Yes, most definitely, yes.

On this very day, a young man or woman will be given the opportunity to attend the university of their dreams solely because of student loan programs. On this very day, there will be a medical breakthrough that will be life-changing for many, all made possible by funding from a business loan taken out by the manufacturing company. On this very day, a family in your hometown will move into the house they’ve been saving many years for, thanks to a mortgage loan. Debt can and often does good. So again, why is it so villified? Let’s look at ways to assess the kind of debt one might take on and how to structure it in a way that does good, not evil.

No One Size Fits All

One question I often get asked is, “should I pay off my home?” This is a difficult question to answer because it’s not the same for everyone. Some people have a financial plan that would benefit from refinancing and extending the debt, some can afford to pay it off early, and for some, it just makes sense to let the payoff schedule continue as is. So in this case, is debt good or bad? It really depends.

So, rather than try to answer any specific debt related questions, let’s build a framework around how to assess each situation and learn how to use debt appropriately. Here are four rules to follow to make sure that you are not reckless with debt:

1. Consumptive vs. Productive

When deciding whether or not to borrow to make a purchase, you should first identify if what you are buying is consumptive or productive. The easiest way to decipher if the purchase is productive is to measure your return on investment.

If Joe owns a landscaping business and he borrows to buy a new truck that will expand his territory and the amount of work his team can do, then this is a productive example of borrowing. On the other hand, if Joe decides to put new flashy rims on all his work trucks because he likes the way they look but doesn’t generate more business, then this would be an example of consumptive borrowing.

Borrowing allows you to do something today, that you normally couldn’t do until later. Therefore, debt should be used to invest in things that will help to improve your productivity today, rather than consume something that will end up costing you more than it’s actually worth.

2. Margin of Safety

Elroy Dimson, the author of Triumph of the Optimists, defines risk this way, “Risk means more things can happen than will happen.” Even with a good plan and the most well thought out intentions, things can still go awry.

When using debt, we need to plan for the worst. We need to build into our plan a margin of safety. This means that we need to calculate the cost of our debt and then assure that our income sources can cover this cost a few times over. In some cases, it may also mean insurance is needed to cover for those “just in case” circumstances.

You should never borrow if you can barely afford it, you should always have ample coverage.

3. Cost of Capital vs. Expected Return

When a business is making a capital allocation decision, they are going to resource two primary metrics in the decision-making process: the cost of capital and the expected rate of return. They will not invest in a project in which the cost is greater than the return. That would be silly, right? It would be a money-losing endeavor.

We should approach our personal finances with the same rigor and analysis. It’s simple, don’t ever commit to an interest expense that is greater than the expected return of your investment.

4. What’s the Alternative

In life, we frequently make decisions prior to ever doing much research. We selectively find some confirming evidence and then trek forward with just that “one side” of the consideration. This kind of thinking will often end in what is known as a “rash decision” which is when you don’t fully consider all the ramifications of an important decision. I encourage you to always ask this question, “if I didn’t decide to go this route, what’s the alternative?”

Typically, if debt is the only alternative, then I would encourage you to really slow down the decision process. Debt should not feel forced and you shouldn’t feel cornered when making this decision.

In Defense of Debt

I hope today’s discussion helped you to expand your view of debt and perhaps challenged your paradigm a bit. Remember, debt itself is not what creates problems, but rather how it is used. This is why it’s so important to build a framework like we introduced today so that you can filter all of your borrowing decisions and avoid reckless behavior.

Always remember, DON’T GET DRUNK ON DEBT!

That’s all we got for TOM today, so until next time…