La Comida

If you are from California, there is a good chance that Mexican food is a staple part of your diet. California has lots of Mexican restaurants and lots of GREAT Mexican food. Growing up here, I just assumed this was the norm regardless of where you lived in the country.

I can now tell you from experience that this is not the norm.

I spent my teen years competing as a cyclist and traveling the country to different events. I learned that it was hard to find good Mexican food outside of California. Hence, when I was hosting guests from out of town, I always liked to treat them to taste real Mexican food.

And Nachos, Please

One humorous memory comes to mind. A friend was in town from upstate New York, and I treated him to one of my favorite restaurants. He studied the menu and asked me multiple questions, things like, “Remind me again, what’s the difference between a taco and a burrito?”

Eventually, our waiter came to take the order. My friend recited his order, with some coaching from me, and then I proceeded with my order as well. Right as the waiter was getting ready to walk away, my friend added, “Can we start with some nachos as well, please.” My initial reaction was, “Hmmm… that’s going to be a lot of food,” but I didn’t object. I just assumed he was starving.

Eventually, the main-course-sized nacho appetizer arrived, and my friend looked at me with a perplexed expression, “What are these?” and I replied, “Well… these are the nachos you ordered.” After a handful of back-and-forths, I came to realize that he just wanted chips and salsa, and he didn’t actually realize that “nachos” was a whole dish on its own.

Lost in translation, I suppose.

This is a comical story and one that my friend and I can look back on in laughter. I reference this story because I see this same lost-in-translation stumbling block prevalent in personal finance as well. My friend confused nachos for chips and salsa, similar to how I see investors misunderstand the concept of diversification.

Today on TOM, we will discuss what diversification is and what diversification is not.

Diversification is…

One of the forefathers of financial planning, Harry Markowitz, said it best, “diversification is the only free lunch in investing.”

Diversification is a simple way to reduce risk. Imagine if you own one company’s stock, then your results will depend on that one company’s performance. If that company’s CEO is convicted of illegal activity or if a competitor releases a superior product, it could create a BIG negative impact on the stock price. BUT if you were to take smaller position sizes in many companies, you are reducing your exposure to the particular business risk of that one company or one industry.

For this reason, investors are often seeking to diversify their investments across companies, industries, geographies, types of assets, etc. Just like an insurance company seeks to diversify their risks across their book of clients. Imagine if an insurance company was only underwriting homeowners insurance in areas with a high probability of wildfires – one catastrophic event could put that insurance company out of business.

Again, diversification is a strategy to reduce risk.

Diversification is… Limited

The unfortunate thing about diversification is that it is limited. It is true to say that adding additional investments – like going from one stock to two stocks – will reduce the risk of the portfolio, but this reality also has a diminishing aspect to it. The measurable reduction of risk going from one stock to two stocks has a greater impact than going from thirty stocks to thirty-one stocks – potency is lost with each marginal addition.

Let’s use the stock market as an example to help us explore this truth. When you buy a stock, there really are two definable risks that you are taking on – business risk and market risk. That is the risks surrounding that individual business and the general risk of the market as a whole. When an investor diversifies their stock portfolio by increasing the balance of companies they own, they are essentially reducing the size of each position and, therefore, reducing the impact that individual business risk has on their total portfolio. Regardless of how many companies are added to this portfolio, though, one is not reducing “market risk,” as all of these companies are impacted by the general ebbs and flows of the stock market as a whole. One would need to purchase non-stock assets to attempt to mitigate this stock market risk.

Here’s what this concept looks like graphically:

As illustrated, a majority of the benefits of diversification are obtained at around 30 stocks. Meaning that you’ve basically maximized the mitigation of business risk once you own approximately 30 companies. Keep in mind this is assuming that you own a diverse group of 30 stocks across different sectors and industries.

Diversification is not… Always the Same

One thing investors don’t often understand is that diversification doesn’t always look the same. How two assets perform relative to one another can look very different in good times versus bad times.

Often we measure diversification benefits based on how two different investments behave in relation to each other. We like to look at how the two assets correlate. We use a straightforward measurement on a scale from -1 to 1 to measure this relationship. Two assets that perform opposite to one another, like being long the market and short the market, would have a -1 correlation; each move is the exact opposite of the other. On the other end of the spectrum, two stocks in the same industry might correlate close to 1, meaning the movements of each stock are almost identical in nature. When you find assets that have no definable relationship in how they behave, we’d assign this a correlation of 0.

Now that you understand the math and the measuring tool, I will explain the problem. Something on paper might have a quantifiable defined correlation, but it might behave very differently in times of calamity. You will often hear folks in the industry say, “when things get ugly, all correlations go to “1,” which means there is nowhere to hide – most assets all behaving in lockstep with one another. These are times when diversification can be frustrating because it feels like it’s not working.

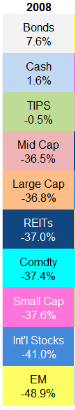

Looking at a broad range of asset classes in 2008 helps to illustrate this point:

Source: www.awealthofcommonsense.com

A “when it rains, it pours” type of moment.

Diversification is not… More Custodians

One common misconception I hear is that increasing the institutions (custodians) you resource to hold your investments is in and of itself a form of diversification. Now, I would say this is true if you are referring to diversifying the user interface of the different webpages, or diversifying the paperwork, or diversifying the 1-800 number you call for customer service. This is not true if you believe it adds some diversification benefit to your investment portfolio – it does not.

One of the first steps with many of the clients I assist is simply consolidating their investment accounts and simplifying their portfolio management. Investment portfolios can sometimes be like garages. Over time they collect dust, junk, and clutter and need to be reorganized. For me, organizing the garage can be a very cathartic process. As is, helping an investor organize and consolidate their investment assets.

I hear some objections to consolidating, and I have heard every advocation in the book for why one prefers resourcing multiple custodians. I rarely hear a clear, definable, logical, and reasonable justification for not consolidating.

Here’s the reality, I’ve assisted a widow in the settling of her deceased husband’s estate. Her late husband did not do any of this consolidation work, and he had the “messy garage” like most of us do. I will tell you from experience that the process for settling all of those scattered inherited accounts was a cumbersome undertaking in a very fragile time for someone in grief. The paperwork, the different requirements, the missed beneficiary assignments, the probate process, and the list goes on. Life is constantly changing, and having to keep multiple custodians updated on these crucial changes is a full-time job in itself.

Believe me, I moved recently, and just updating our address at our bank, investment custodian, healthcare provider, employer, etc., was an undertaking in itself. Imagine multiplying these tasks across more providers and more updates (estate plan changes, beneficiary updates, etc.).

Simply put, more custodians is not a form of diversification.

Diversification is not… More Advice Givers

Often diversification is misapplied to advocate for an investor having more advice-givers – multiple financial advisors. The adage of “don’t put all your eggs in one basket” easily rolls off the tongue as a justification. BUT this is actually the wrong adage. The appropriate application would be “too many cooks in the kitchen.”

When you hire multiple advisors to serve your planning and portfolio needs, it causes confusion, lack of continuity, and a less than ideal situation for the investor. When there is no “Head Chef,” ultimately, the client then takes on that role themselves. Hiring one or two or even three advisors means the client is then responsible for coordinating and assuring that all advice is being implemented holistically, that there is no unintended redundancies across the portfolios, that no advisors is taking on more risk than appropriate to try to win more business, and so on.

If you hire multiple advisors, then you, the investor, become the lead advisors (Head Chef), and you are responsible and accountable for the results as a whole. The goal of hiring an advisor is to shift these responsibilities and that accountability off your plate. This is why I feel strongly that the multi-advisor approach is typically a sub-optimal solution.

Diversification can be… Distracting

Diversification can also be distracting. Sometimes investors and advisors alike can get so caught up in the treasure hunt of finding non-correlating assets that they forget about the objectives of the financial plan.

At the end of the day, the financial plan will be somewhat indifferent to how “smooth” your investment returns are (assuming your diversifying efforts are reducing volatility) if the total return generated is not sufficient enough to meet your planning objectives. Financial calculators, investing ratios, Monte Carlo analyses, and a plethora of other financial nerdom often puts too great of an emphasis on reducing volatility and forgets the importance of meeting the minimum return targets for a financial plan.

Yes, short-term government treasuries and US stocks behave very differently, and they are great diversifiers to one another; good complements within a portfolio. BUT if you decide to allocate 50% of your money to short-term Treasuries and 50% of your money to US stocks because you like the potential diversification benefits this will create, you must also look at what the estimated expected return is for this portfolio. If we hypothetically assumed your treasuries were to return 1% and your stocks to return 7%, then if you mix the two in a 50/50 balance, the expected return would be 4%. You have to decipher whether this is a sufficient return for your financial plan before implementing the final portfolio design.

Diversification is important, diversification reduces risk, and diversification can be distracting, so remember, this is one of the multiple financial variables that must be considered in the planning process.

Back to Nachos…

As I said, my friend made a harmless and comical error. He learned his lesson. Nachos and chips, and salsa are not the same. Similar, but different.

Growing up, I didn’t know the difference between salad and lettuce. I’d always asked my dad to put salad on my sandwich. Luckily, dad knew what I meant.

All this to say, words have meaning, and they can often get lost in translation. There is a lot of vocabulary when it comes to finance, and there is a language of finance. You need to be careful not to misuse these financial terms in a fashion that would mislead your portfolio or financial plan.

It’s helpful to have an advisor. They can be your guide; they can be your translator. My dad was a great advisor; he didn’t pile a salad onto my sandwich. Our waiter just took our order and gave us what we asked for (nachos); he was not much of an advisor. You need an advisor, as these mistakes in the realm of personal finance can be costly.

Because maybe, just maybe, diversification doesn’t mean what you think it does.