It was just a few months ago, a Monday morning if I recall, and I had quite a busy morning on the calendar.

Then it happened…

Mid-sentence, mid-client conversation…

WOOT! WOOT! WOOT! PLEASE EVACUATE THE BUILDING IMMEDIATELY!

My reaction? “Not again!”

The screeches of danger and the monotone directions to evacuate didn’t even make me flinch. Why? Because this was our annual surprise fire drill.

Off we went circling our way down three flights of stairs, grumbling to one another about needing to rearrange our schedules for the day, and engaging in curious conversations about whether the guys and gals on the 20th floor really had to take the stairwell all the way down.

It was just a few days ago, perhaps it was a Monday as well, and I was in quite a deep sleep.

Then it happened…

Mid-REM, mid-dreamland…

WOOT! WOOT! WOOT! SMOKE HAS BEEN DETECTED!

My wife’s reaction? “I think the humidifier in the boy’s room set off the smoke detector.”

I’ll be honest here, this time I flinched. I don’t know if you have experience with being woken up from a deep sleep by a smoke detector, but it’s no fun. Once the grogginess faded and I was alert, I was more angry than scared. Why? Because most of my experiences have been with false alarms, not fires.

***

Life is full of false alarms.

The stock market is full of false alarms.

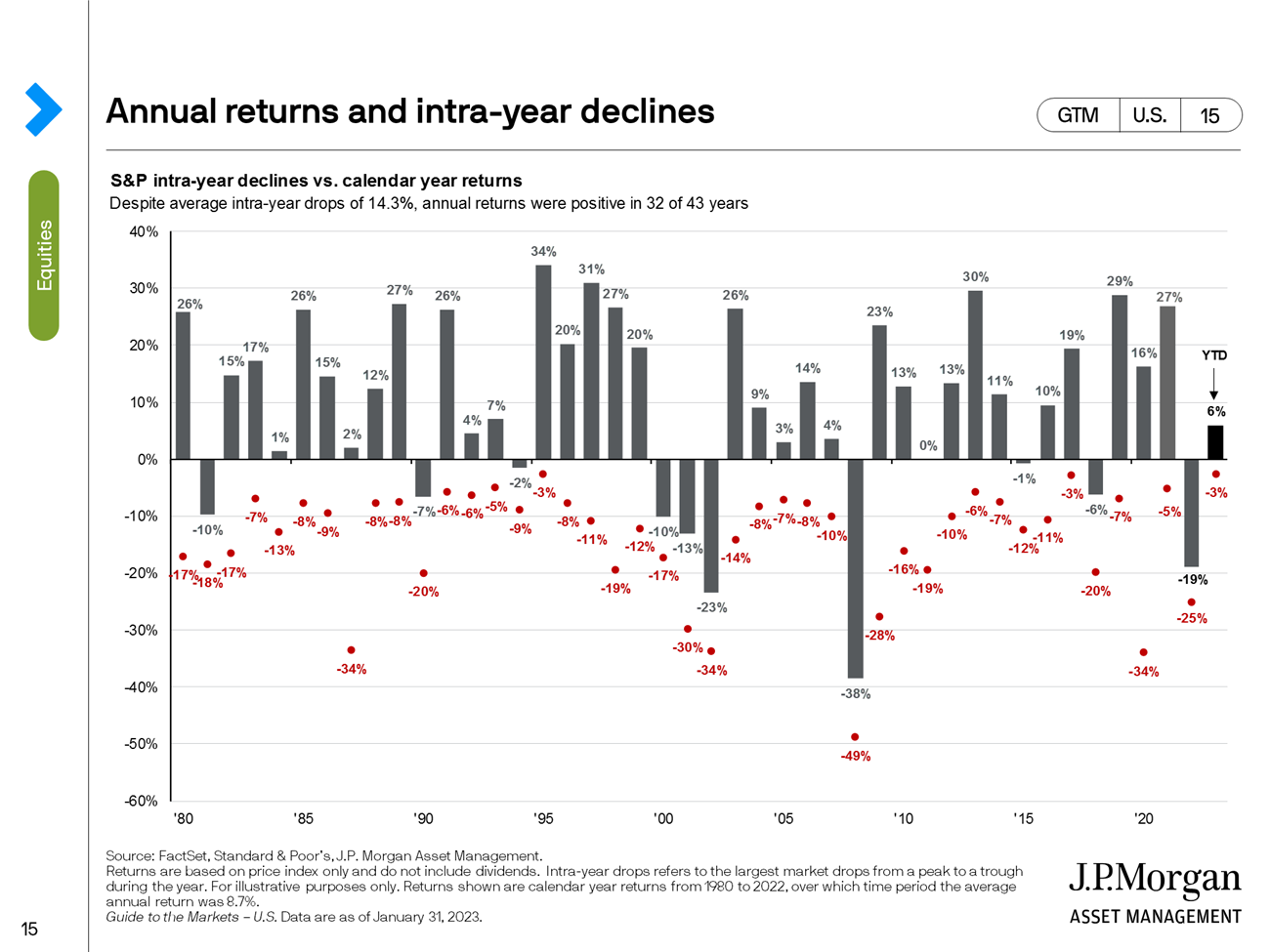

Today I want to talk about one of my favorite stock market charts. A chart is worth 1,000 words, right? This chart simply reflects the year-by-year peak-to-trough drawdowns (drops) in the stock market.

Here’s one way to view this data, in 32 out of 43 years returns were positive, roughly 75% of the time. Yet, on average, those intra-year drops were more than -14%. To me, this means that 75% of the time those wild market gyrations were false alarms. Like a tiny dog – all bark, no bite.

It’s almost like the stock market has its own annual surprise fire drill. Yet, unlike the disgruntled reactions from my stories, many investors react hysterically, not apathetically.

So, why bring this up now? Well, the stock market was up roughly 6% in January, we have 11 months left on the calendar this year, and that -14.3% average drop seems appropriate to mention.

I don’t want you to mistake a false alarm for a fire. Fires are destructive, yes, but when it comes to investing, one’s misplaced reaction to a false alarm can be just as destructive.

A big part of investor maturity is (1) understanding that these drops (volatility) are average and normal and (2) that the returns you seek – what we call the risk premium – are the reward for your willingness to endure these temporary drops.

Are false alarms annoying? Absolutely! Especially when you are in a deep sleep, but they are not destructive or abnormal.

Everything inside of you may want to relate this next -14% drop to the recession you knew was coming, or to a new strain of COVID, or to the missteps of the Fed, but I encourage you to remember this article. These drops are… normal.

One common exercise/routine I have with clients is to review the monthly performance of their portfolio from inception. I do this for a few reasons. First, I like to highlight and remind both of us just how erratic and bipolar stock prices can be on a month-by-month basis. I then like to juxtapose this against how stable and consistent dividends are on a month-by-month basis. This is a good reinforcement of our own investing philosophy here at The Bahnsen Group and a way for clients to find solace by shifting their own focus from price to income (dividends). From here, I always like to zoom in further to highlight the ugliest months for the time period measured. For 2022, September was one of those really ugly months. I do this because typically the pain and uneasiness is felt in the moment and less so in hindsight; it’s like reviewing game film. From this vantage point, we also get to see what the next few months looked like. September 2022 is comical in hindsight because the drop in prices was steep and ferocious, but there wasn’t much need for patience because October erased the drop and November added another positive leg up.

I like using the language that October and November were the compensation for the pain of September, and it was well worth it. I wish it always worked out that way, where we only had to have a steady hand for a month, but sometimes your patience will be put to a greater challenge and called to a longer period of endurance. This is just how investing works.

On the path to endurance and enlightenment, we will often fool ourselves along the way. We will think that markets have some sort of pattern or rhythm that makes them predictable, and then we will be dealt a speculator’s punishment for acting on these forecasts; hopefully learning not to touch that hot stove again. Take our chart above as an example, the shallowest drop recorded for that time period was -3%. This was matched on a few different occurrences, but uniquely in 2017, it coincided with the least volatile year in market history (based on the VIX, a volatility index). What else happened in 2017, the inauguration of perhaps our most volatile president of all time? Bernard Baruch summed it up best, “The main purpose of the stock market is to make fools of as many men as possible.” Things just aren’t always as they seem, or as we think they should be.

The lesson here is that markets are acting normal when they are fluctuating. We will all attempt to fit a narrative as to why this is happening, and we will often lose sight of the reality that this is just normal. We must digest this truth and allow it to take root in a manner that will reshape our behavior. Smoke detectors alert you of danger, but they often malfunction, misunderstand, misinform, and run innocent drills.

Be wary of false alarms, my friends.

Trevor Cummings

PWA Group Director, Partner

tcummings@thebahnsengroup.com