Last week I talked about one of our family traditions growing up – watching Jeopardy together. One of our other favorite pass times was and is, playing cribbage.

Whenever we’d have friends over we’d teach them how to play so they could join in the fun. Cribbage isn’t go-fish, but it also isn’t bridge. All that to say, you could easily teach the basics of the game in 10 minutes. We always started with the key numbers you have to know if you are playing cribbage – 15 and 31. The game has lots of rules and nuance, but if you’re teaching a new play, you need to make sure they know the importance and relevance of 15 and 31.

The rules of personal finance unfortunately cannot be taught and learned in 10 minutes. This is a craft that can be studied over a lifetime and perhaps never fully mastered. Just like cribbage though, I believe personal finance has some standout numbers and I’d like to discuss those today.

Here’s an important differentiator though – cribbage is just a game. No matter how competitive, emotional, and animated you get about this game, it’s still just a game. Personal finance deals with your money, the money you toiled and sweat to acquire and accumulate. Your money and your financial plan are not a game. The seriousness and weight financial decisions and plans carry make this a very emotional endeavor.

What I intend to elaborate on in today’s discussion is how these three key numbers help to build hope, security, and perspective; important emotional components to fuel a successful financial life.

So, without further ado…

Hope

Knowing how much your investments have grown since day one should build optimism and hope that helps you to endure the difficult times; hope is drawing on past experiences to fuel you through future the inevitable obstacles and setbacks.

Neither you nor I know what the future has in store. The future is uncertain. For many, this uncertainty can be unsettling. An unknown future leaves a void that can be filled with either fear or hope. Fear that the worst that could happen will happen. If not fear, we can choose hope.

Now, I am not referring to blind faith here or wishful thinking. The hope I am describing is grounded in history and experience that things have indeed turned out well in the past, so it is best to assume that they will in the future as well. Professor, Elroy Dimson, co-authored a book that provides a sort of yearbook of investment returns and I think the title speaks to the point I am making here, Triumph of the Optimists: 101 Years of Global Investment Returns. Stick with me, I’ll explain…

One of my favorite numbers in personal finance is the total growth of your portfolio since inception (in dollars). Typically, the longer you stay invested the larger the gap between your contributions and the value of your investment portfolio. This gap represents the lifetime growth of your portfolio. This is how many more dollars you have today vs. what you deposited. These are the spoils derived from your willingness to endure and stay the course.

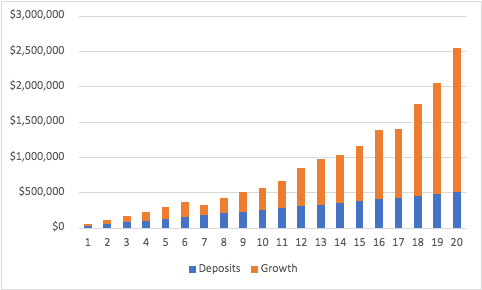

Here is a fictitious investor that saved $25,000 a year over the last 20 years and invested those monies into the US stock market on an annual basis:

*For Illustrative Purposes Only

Our hypothetical investor saved a total of $500,000 over these 20 years and the ending value was $2,045,333.38. This investor had $1,545,333.38 more dollars that were all attributed to the growth/return of their investment. As you can see in the graph above, the blue bars (representing the deposits) were a majority of the portfolio value in the early years, but by year 20 the cumulative deposits represented less than 25% of the total portfolio value.

Now, if I were to compare these 20 years to other historical periods they were not impressive, and perhaps even below average. They included the tail end of the Dot Com crash, the Great Financial Crisis of ‘08, and the COVID market mayhem of March 2020. If you were to compare these results for US stocks vs. other potential investments (private equity, venture capital, etc.) I am sure you could find something with better results. BUT this is why I don’t focus on percentage returns or comparisons, I simply like to see how much more money was created from the compounding growth of my investments.

Why? Because this builds hope. Hope is the fuel that helps me endure down markets, ugly markets, sideways periods, and everything in between. These dollar figures represent the reward or the compensation for that very endurance. Saving $25,000 a year for this fictions investor wasn’t outlandish or impossible, it was just a simple discipline. That saving, with the ability to stay invested, and compound over two decades is what generated that significant gap between total portfolio value and actual contributions.

In my client reviews, I will often start by looking at that very dollar figure and taking a moment to appreciate the beauty that is compounding growth and the attribution that has to one’s long-term wealth accumulation.

Do you know your number? You should.

Security

Knowing that your investments produce enough income to cover your withdrawals should breed a feeling of security.

Most of us just want financial security. We want to know if what we have and what we’ve saved is “enough.” We want to be reassured that our nest egg is sufficient and that we won’t outlive our savings.

The next number we will zoom in on is withdrawal percentages. This is simply the figure a retiree withdrawals from their portfolio each year divided by the size of their actual portfolio. This is sometimes referred to as a withdrawal rate.

Here at The Bahnsen Group, we manage portfolios that focus on income production. We are maniacal about building portfolios that produce cash flow in a manner that is sustainable, reliable, and growing. So much so, that our founder wrote a book titled, “The Case for Dividend Growth: Investing in a Post-Crisis World.”

When we build a financial portfolio that produces more income than a client plans to withdraw or even if we just match that cash flow number to the desired withdrawal number this will often produce a sense of security. A sense that everything is going to be ok. A sense that one has built a viable financial plan. Often, this also produces a feeling of relief, like a burden has been lifted.

Your withdrawal rate is a key number when it comes to personal finance. You should know it and you should compare it to the income that your portfolio generates.

Perspective

You must ignore the inflation that you see on the news and focus on how much your personal expenses have gone up or down.

Lately, there is a lot of talk out there about inflation and I’m sure we have all experienced an uptick in our expenses. But let me ask you this, have we all experienced the same uptick? Have your expenses increased at the same rate that my expenses have? Is it possible that some folks have seen a decrease in their spending? I am sure this is true for some.

Here’s the problem, we talk about inflation at the national level and we talk about it in terms of averages, but at the personal level – when dealing with personal finances – we don’t experience the average. We have our own personal inflation experiences.

Just like you wouldn’t look at the average weather across the US tomorrow to decide how you will dress for the day (h/t David Bahnsen), you shouldn’t let national averages around inflation drive your emotions, habits, and financial decisions.

I’ve always encouraged investors to have a strong awareness of what they actually spend. I’ve never been a big advocate for budgets, as I know they can sometimes come and go, very similar to diets, but I am a huge advocate for being aware of what you actually spend. You should have a monthly report that tells you what you spent last month. You should compare that to what you spent this same month last year. You should see how it compares to how you spent over the last few months. This awareness and exercises like this will give you good context into what your personal inflation figure is.

Yes, for me and my family we are spending more in 2022 than we did in 2021, but we also – unintentionally – spent much below average in 2020. In 2020 we didn’t go out to eat as much as we were accustomed to or travel or do much of any of our normal entertainment activities. So, in reality, much of our “overspending” this year is just averaging out with what we didn’t spend in 2020.

Again, this isn’t to make light of inflation and the rising expenses that we are seeing out there, but rather to build perspective and to foundationally build that perspective from your personal inflation number.

So, what is your personal inflation rate? What does your spending look like this year or this month compared to previous years? Are your figures more or less than the national averages?

Again, to me, this is one of those key numbers you want to know. Your personal inflation rate is what 15 and 31 are to cribbage.

In closing…

Finance is both quantitative and qualitative. We live in a world full of opinions and perspectives, and often you have to tune out the noise to focus on what matters most. You also have to engage and empower these key metrics to help calibrate your own emotions. As we discussed today, your investment gains should fuel hope, your withdrawals in relation to your income should drive security, and understanding your personal inflation numbers should help to set the right perspective.

Money is all about feelings and figures; that’s just the way it is, and the way it has always been.