As we enter into 2020, we know one thing to be true – politics are going to be a hot topic. Each week the news is going to headline different candidates, we will get a break down of each of their platforms, and there is going to be much uncertainty around who will win the election.

One of these topics that are going to get a lot of air time is student debt. Currently, the U.S. Department of Education has lent to about 43 million borrowers, and there is about $1.4 trillion of outstanding debt (Source: www.studentaid.gov). These are big numbers!

The Growing Cost of Education

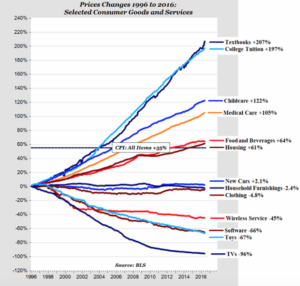

One reason these debt numbers are growing is that the cost of tuition is growing:

Source: www.awealthofcommonsense.com

Over the last 30 years, it has become financially easier to acquire a big-screen TV, but much hard to cover the cost of college.

Like any problem, this one is surrounded by opinions, finger-pointing, and lots of proposed solutions. Everything from Income Share Agreements (ISA) to total debt forgiveness. Today I want to present another potential solution – Qualified Tuition Programs (QTPs) a.k.a. a 529 plan.

The Planning Process

In my family, each year we do a review of our finances. We get a general idea of how much we plan to spend for the year and what our expected income will be. We’ve committed to a lifestyle that equates to us spending less than we make, so after this simple math, there is always a surplus. The next step in our planning process is to assign this surplus to the financial goals that matter most to us. That list of goals usually looks something like this: retirement, charity, and education.

The next part of the planning process is to identify the most tax-efficient way to save for these goals. For retirement we use tax deferral plans like a 401(k), for charity we fund a Donor Advised Fund, and for education, we use a 529 plan.

The 529 Plan

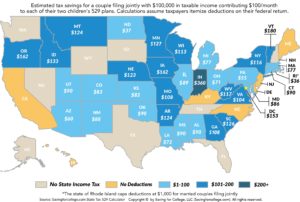

Here’s how the 529 plan works. The money deposited into the account grows tax-free and if distributed in the future for a qualified education expense it is also tax-free. Additionally, for some states you can also receive a state tax deduction:

Source: www.savingforcollege.com

Regarding funding limitations, it’s typically wise to not contribute more than the gift tax exclusion, which is $15,000 per individual for 2019. So, for someone like my wife and I, we are able to contribute $30,000/year to our sons’ 529 plan (that’s $15,000 each). Also, just to note, you can “superfund” the 529 plan, by making a 5-year election allowing you to put 5 years of the gift tax exclusion ($75,000) in at once. If you do superfund, just remember that you will need to work with your CPA to report this each year over the next 5 years on Form 709.

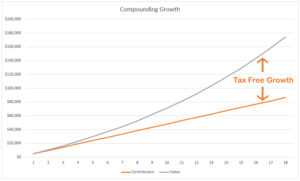

You will glean the greatest benefit of the 529 by funding it sooner rather than later. Here’s why, most of the tax benefit comes from the growth of the account and in order to maximize growth you’ll want the longest time period to compound. Here’s what that looks like graphically, this is someone who saves $400 month into a 529 plan, growing at 7% per year, over 18 years:

In this simple illustration, the value of the 529 account grew to nearly $175,000 with almost $90,000 of that from tax free growth. That is the power of compound interest, that just $400 a month would pay for multiple beneficiaries’ way through college.

A Great Idea for Grandparents

I paid my own way through college and it was difficult. I had to work full time as I attended school, which definitely limited my options of where I could go to school and at what times I could attend classes. In hindsight, I am sure this was a great life lesson that built perseverance and work ethic, but I also know it would have been a great blessing if I had a little help too.

As odd as this sounds, when we (my family) are funding our 529 plan for our kids, I plan to overfund these accounts. Meaning I plan to grow the balance to a value greater then my kids will need for education in their lifetime. My hope is to pass down this education savings to the next generation. 529 plans allow you to change the beneficiary from a child to grandchild, which means this change can be made after my kids finish school. Again, the longer time the account gets to compound the greater future benefit it will create.

Working as a financial advisor I work with a lot of families that have planned well. Many of these individuals are retired and living off of just the income from their portfolio. This means that one day their heirs will inherit a significant amount of money. This inheritance will probably come at a time when the heirs have already established their own wealth.

Since most of us reading this blog don’t plan to bounce our last check before leaving this earth, then I encourage you to consider funding a 529 plan for a future generation. Maybe you are newly retired and a new grandma or grandpa, what greater joy than to begin setting aside some savings to help fund that little one’s college. One day you will attend their high school graduation, you will celebrate as they head off to college, and you will get to see the fruits of your labor and savings during your lifetime.

In closing…

So, as we ramp up and prepare for the 2020 election and we wonder how the next generation will cover the cost of education I encourage you to start saving now.

I hope you enjoyed today’s discussion and as always, please do reach out with any questions or comments. You can reach me at .