Trending

In the last few weeks, I have had more conversations about a recession – and what that would mean to markets – than I’ve ever had in my entire career. As I’ve mentioned before, I heard one pundit cleverly ascribe this as the most anticipated recession of all time.

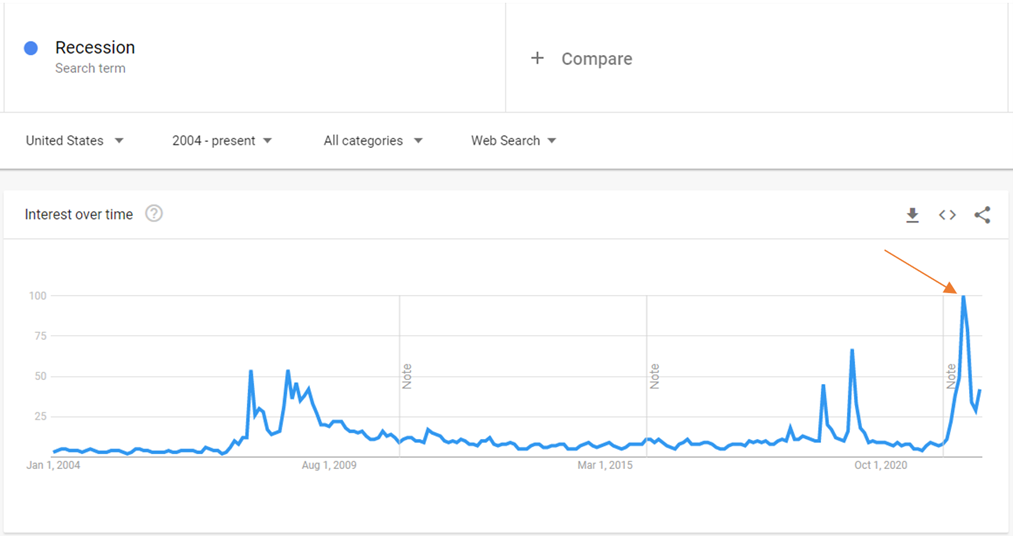

Out of curiosity, I wanted to see if this trend went beyond the discussions I was having. I decided to take a look on Google Trends to see how often “recession” was being searched, and how this compared to history. Sure enough, recession curiosities were indeed trending across the country and peaking relative to historical search data.

Now, just so I am not misunderstood – I don’t see any problem with searching “recession” or brushing up on your high school economics to refamiliarize yourself with the term. The concern I have is when this search behavior amplifies investment anxieties which then lead to actions that are most likely not in the best interest of your financial plan.

This is Personal…

So, I asked myself, what are people actually anxious about? Is the overarching concern really related to the health of the economy and where we are in the business cycle? I don’t think so. I think the primary concern is the impact a recession would have on one’s personal investment portfolio.

If my assumption here is correct, I do want to remind people that the economy is not the stock market. Also, as I’ve noted before, the stock market is a leading indicator, and recessions are only defined in hindsight. Essentially, reacting to the announcement of a recession would be like trying to drive somewhere while only looking in the rearview mirror.

If 2022 has ruffled your feathers, I understand. As of this writing, the market (S&P 500) is down over 21% on the year, and if the year ended today, this would be the 5th worst year in the last 85 years of market history. As a leading indicator, the market is hinting toward your very concern – that we may very well be in a recession, BUT maybe much of the damage to your portfolio has already been dealt.

So, Where Do We Go from Here?

Perhaps the real question on your mind is, what’s next? Maybe you are disappointed about the value of your portfolio today, and you just want to “stop the bleeding.” Ultimately, for most of us, that is our primary concern – the value of our portfolio – and we are wondering where markets will go from here. Our default guide for where markets will go next is often dictated by the direction of where we’ve seen markets go recently; the rearview mirror perspective or what we call in personal finance, recency bias.

Let me be clear, I don’t have the crystal ball, and I absolutely won’t prognosticate about what short-term market returns will look like. What I do want to do though, is challenge our default assumptions, and ultimately try to reshape our perspective/expectations about the future. Think about it this way, if we were a jury in a courtroom, what would we rely on? The evidence presented. If we were interviewing candidates for employment, what would we rely on? Examples of past behavior that would best fit the role we are hiring for. So, let’s look at the evidence and past behavior we’ve seen from markets over the last 85 years to help craft our assumptions.

Historical Precedent

Over the last 85 years, the market (S&P 500) has record negative returns worse than -20% (including dividends) on four occurrences:

1937 -35.34%

1974 -25.90%

2002 -21.97%

2008 -36.55%

Just like 2022, these were difficult years for investors. The same frustration, disappointment, anger, etc., you feel today would have been felt equally or worse in these example years. Here’s the difference, you don’t know what 2023 will bring, but you do know the results that followed each of these unsettling years – here they are:

1938 +29.28%

1975 +37.00%

2003 +28.36%

2009 +25.94%

Should this give you complete confidence that 2023 will be a stellar year for markets? No. Should this influence your perspective and give context about how markets have behaved in the past? Absolutely. Investing is a mental game, and there is so much junk food out there that you can feed your brain. There is endless content that will lead you to pessimism and fear. I just want you to consider the evidence and past behavior to help build your paradigm about how markets typically behave.

For me, I anchor to probabilities. I know I can’t control markets or predict markets, so I use history as a guide for what’s the most probable outcome. I often refer to markets as two steps forward, one step back or two steps back, three steps forward, or however the sequence might present itself. Most of us do wish markets were linear and more predictable in the short run, but we need to remember that the premium returns markets deliver are directly related to the volatility we are willing to endure.

Dividend Growth!

Here at The Bahnsen Group, we are not index investors, so our approach and investor experiences are different. As I mentioned earlier, investing is a mental game. The investment playbook you create needs not only to create favorable results but also needs to be something an investor can stick with. Investors hate seeing the value of their portfolio drop significantly, we call these drawdowns. When drawdowns get deep enough, investors begin to capitulate and abandon the playbook.

This is what we need to solve; we need a playbook that will help investors endure. We know that volatility is associated with premium returns, so seeking to remove the volatility isn’t the answer. Drawdowns are inevitable.

We at The Bahnsen Group believe that a dividend growth approach is a solution to this riddle. A diversified portfolio of businesses (stocks) that all pay dividends and have shown evidence for growing that dividend into the future can help investors endure difficult markets. Think about it this way, does the value of the home you live in fluctuate? Yes, of course, it does. Does the volatility of your home price cause you anxiety? No, you simply enjoy the benefits of living in your home – you are not interested in selling your home, so the potential offer prices are meaningless to you. Real estate investors are similar, the focus is on rent collection and the growth of rents, as opposed to the current value of the property. If your time horizon for owning an asset is forever, you shift your focus to the other measurable benefits.

For a dividend growth investor who aspires to hold their basket of businesses for the long term, the dividends become the focal point. These dividends don’t have the same volatility as stock prices, and history has shown dividend payments to be reliable, sustainable, and growing. Retirees will spend these dividends to cover their lifestyle/expenses and accumulators of wealth will use these dividends to reinvest.

At the end of the day, we do find psychological comfort in these dividends, and this approach does help us as investors to stick to the playbook.

Spilled Milk

We often use this idiom, “It’s no use crying over spilled milk,” to encourage a friend to recalibrate their attention on looking forward as opposed to dwelling on the past. For investors, this advice is very fitting as well. This doesn’t mean we can’t analyze the past or be thoughtful on how we gameplan where to go from here, we just need to try to diffuse some of those regretful emotions that lead to bad investor behavior.

Personally, I am optimistic, hopeful, and excited about 2023. These feelings are fueled by how I believe markets behave and what history has revealed to us. Additionally, as a dividend growth investor, I know that any stock price disappointment will quickly be squelched as I refocus my attention on the dividends I am receiving.

I hope you found today’s discussion helpful, and as always, please do reach out with any questions or comments.

Until next time…