For many of us, we’ve spent the last few weeks in a shelter-in-place mode. This change in our schedule has eliminated our commute, cleared our social schedules, and created some margin that we may not have had before. We’d like to think that this new surplus of time would be absorbed by the if-I-had-more-time-I-would list that we’ve accumulated over the years. You know, the aspirations to learn a new language, read the classics, take up pottery, etc.

In reality, though, many of us have backfilled this time with more media. We’ve dove headfirst into articles about COVID-19, elevated our time on social media, and probably watched an excessive amount of news and press conferences. From my experience, these outlets are not the most encouraging and the headlines are usually crafted with shock appeal to entice more eyeballs.

This type of media can be exhausting, right? Well, today here on Thoughts on Money [TOM] I am going to outline three things that I find to be encouraging. I hope this perspective will help to balance your media diet and you will walk away with a healthier outlook for the future.

And off we go…

(1) We’ve Always Recovered

When it comes to financial discussions it is rare that we can ever use extreme language like “always” or “never.” There will typically be one historical data point that is an outlier, which negates the use of this all-encompassing language, but that is not the case here. We indeed have always recovered.

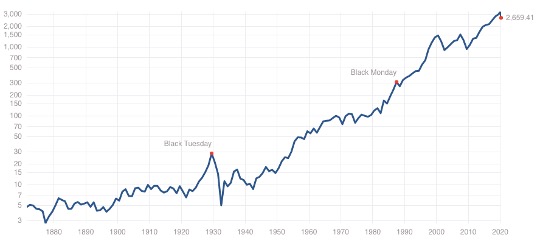

Here are the last 150 years of S&P 500 (older data gathered from Robert Shiller and his book Irrational Exuberance):

Source: www.multpl.com

As you can see the chart is not a straight line. It’s full of peaks and valleys, but as you zoom out, those former extremes tend to fade into this positive trend line. The market has made a reputation of setting new all-time highs.

So, right now we are in a valley and I am sure a lot of us are wondering when the recovery will start and how long it will take. I can’t answer the question to exactly when this will happen, but I can tell you that I believe whole-heartedly that it will eventually happen.

During the financial crisis the market bottomed in March of 2009 and it took five years for the market to set new all-time highs. In 1987 the market experienced a 34% decline intra year, yet the market had a positive return (~2%) for that very year. Who knows if 2020 will take a positive roundtrip like 1987 or if it will take years like past recoveries, but I am encouraged to know that the US market has always recovered in the past.

(2) Dividends Continue to Pay

The chart and discussion above was all about the price of the S&P 500. As a dividend investor, I am actually more interested in the income from my portfolio, as I plan to preserve the corpus and just spend the income.

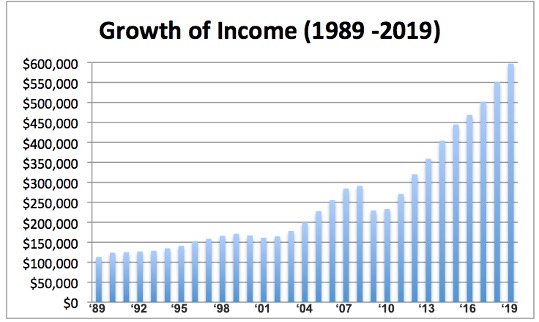

So, how has history faired for dividends? Well, I am glad you asked. Here I charted out an investor in the S&P 500 that received $100,000 in dividends in 1988 and what those income payouts looked like year-over-year for the last 31 years:

Historically, stock prices have been more volatile than dividends. Over these 31 years, the dividends have only shrunk year-over-year three times. The most significant decrease in dividends was 2009, which was only a 20% decrease, a much more palatable decline than that of stock prices during the financial crisis. As you can see, that patient investor grew their $100,000 of annual dividend income to nearly $600,000 a year over those 31 years.

So, yes, I am encouraged by the fact that I will continue to collect my dividends and have the option to spend them as I need or reinvest them at these current bargain prices.

(3) We Are in This Together

I have been through a handful of traumatic events during my life and in many of these circumstances I initially felt isolated. I wasn’t sure if anyone really understood what I was feeling, but I found comfort talking to others who had similar experiences. This is why there are grief groups and other communities out there to help folks find others who they can relate with.

Our country is experiencing a traumatic event right now, but I am encouraged that we are in this together. Our neighbors, our businesses, our government is all hands on deck to help. Our country is unifying around this cause in an effort to bring resolution.

Sure, we disagree and there is banter around different potential strategies/solutions, but I do feel like we are in this together.

As an investor, I own stocks. My stocks are currently valued at less than they were at the start of the year. But I am encouraged by the fact that nearly every endowment, pension, hedge fund, etc. also owns stocks and their stocks are worth less than they were at the start of the year too. I am looking forward to all of us – institutions and individuals alike – participating in this recovery together and all the residual benefits that will come from this wealth creation.

I am not here to tell you that this isn’t a painful year to be an investor or that investing isn’t a frustrating endeavor, but I am here to tell you that you’re not alone. We are in this together.

That’s a Wrap

Well, there you have it, three simple tidbits of encouragement – the hope of a recovery, the comfort of dividends, and the communal reality of this crisis. I do hope that you dedicate some time to check off a few of your if-I-had-more-time-I-would items and you throttle down your media time. You deserve a break from the constant barrage of headlines.Please do reach out with any questions; you can email me at . If there are any specific subjects you’d like to see covered here on TOM, please send those over as well. Until next week…