Over time I’ve realized that Thoughts On Money [TOM] is a great platform to answer common/relevant personal finance questions. We can come here to find answers to the questions we all have but don’t know who to ask.

Lately, I have had many friends reach out to me all with the same question – is it a good time to buy? This inquiry is often followed up with some background details like, “I have some extra savings that I don’t know what to do with” or “I am planning to buy a new house in a year or so, but in the meantime, I have this extra cash lying around” or an array of different particulars.

So without further ado, let’s jump right in and tackle this question – is it a good time to buy?

Depends On Who You Ask

For today’s conversation let’s assume someone is asking this question relative to buying stocks. They want to know is it a good time to buy stocks?

Depending on who you ask this question you might get very different answers.

Let’s suppose you ask a financial analyst. The analyst will dig deep into their analytic tools and historical reference points to most likely conclude that it is indeed a good entry point (time) for buying stocks. Based on the recent drop in stock prices, history tells us that the probability of positive and above-average forward returns is likely.

Now, what if you asked a financial planner? I believe they’d agree with the analyst, but they would want more information to understand your situation better. A planner wants to contextualize this question and get an understanding of your liquidity needs, tax situation, tolerance for volatility, etc.

One Question Leads to Another

I’m a planner, and from experience, I can tell you that people can get very frustrated when I turn a yes or no question into a long drawn out Q&A. A planner has an obligation to fulfill their fiduciary duty; they are wired to make sure they cross every “t” and dot every “i.”

So… what’s a planner to do? As I mentioned above, there is a plethora of information needed to build out a financial plan but to ease the frustration of my inquirer I have to decide what piece of information is the most important to know.

Here’s what that conversation now looks like:

Friend: Should I buy stocks?

Me: What’s your time horizon?

Time Horizon is Key

Of all the financial planning questions I want to be answered, it is most important to know what your time horizon is? If you were going to invest this money in stocks, I’d need to know when you will eventually want to sell those stocks and use the money to make a purchase or fund some other need. That’s what time horizon is – how long you plan to stay invested.

Imagine asking a chef, “What should I cook for dinner?” Without any other information, this would be a tough question to answer. Ultimately the chef would want to know your food preferences, allergies, cooking background, access to equipment, ingredients on hand, etc. What else would they have to know? The chef must know how much time you have. He or she can recommend a 12-course meal, but if you only have enough time to make a grilled cheese then this recommendation would be worthless.

Let’s go back to our conversation with the financial analyst. If you bought stocks based on the analyst recommendation and 12 months later you saw that your stocks were worth less than when you purchased them, you might be upset. Maybe your time horizon was 12-months and you now need these funds to pay tuition or a down payment on your dream home. This recommendation was lacking because the context was missing.

Improving Probabilities

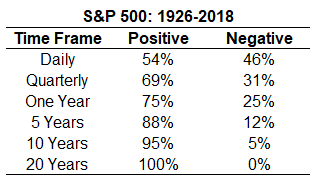

Here’s the reality with stocks, as you extend your time horizon your probability of a positive outcome increases dramatically. If you measure stock performance using shorter periods, the array of outcomes (a.k.a. the dispersion of returns) is much wider – both positive and negative. If you zoom out 5 years, 10 years, 20 years, etc you see these probabilities skew to your favor:

Source: www.awealthofcommonsense.com

As you can see from the chart above, the daily outcome of stock performance is near that of a coin flip, while the 20-year outcome (from 1926-2018) has always been positive. Yes, 100% of the rolling 20-year periods over the last 90+ years have had a positive result.

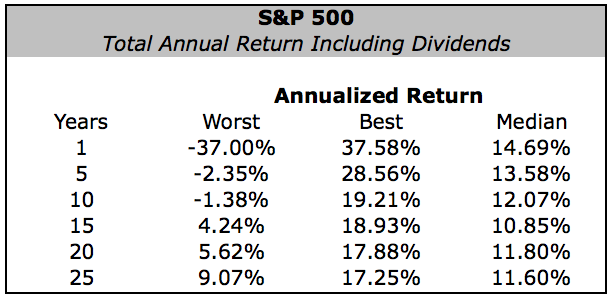

Now, let’s look at what those negative and positive ranges were like over the last 50 years (annualized):

Source: S&P 500

Based on this information, during the best 10 years, an investor was able to grow $100,000 investment into $579,598, while in the worst 10 years a $100,000 investment shrunk to $87,026. Those are two wildly different outcomes and they are both absolutely possible in the future.

Set The Right Expectation

As you can imagine, 10-years probably feels like a lifetime. An investor that saw their portfolio continue to take one step forward and two steps backward may eventually just swear off stock investing altogether. This is why you must understand this range of potential outcomes in order to set those right expectations.

The intention behind owning stocks is to build long-term wealth and this will take patience and perspective to help you endure. So, if you are wondering is it a good time to buy stocks? I’d encourage you to first decide how long you plan to stay invested.

Maybe this is why I love dividends so much; rain or shine, up markets, down markets, sideways markets, and all the like I still get to enjoy those consistent dividend payments. Hmmm… perhaps another topic and discussion for another day.

As always, please email me at with any questions. I hope everyone is staying safe and healthy in these trying times.

Until next week, this is TOM signing off…