Moving Walkways

We just returned from a wonderful family trip to Kansas City, full of great friends and memories to last a lifetime.

On our way home, we found ourselves trekking through the airport, grateful for the moving walkways (or travelators). Our two older kids decided to race against the walkway going in the opposite direction. Despite their best efforts, their little legs just couldn’t make any progress. No matter how fast they tried to go, they stayed in the same place.

Inflation

Inflation is like walking on a travelator in the wrong direction. If you stand still, you’ll slowly drift backward. That’s what inflation does to your purchasing power over time. The only way to make progress is to move forward at a pace faster than the walkway is carrying you back.

Number One Fear

Natixis recently reported that 61% of U.S. investors ranked inflation as their top financial fear.

One of my favorite things to do is alleviate financial fear – so let’s jump in to see why inflation is not something to be feared, but something to be prepared for.

The Definitions

In the financial world, almost all returns are measured in nominal terms. However, the more relevant numbers are real returns. Though the technical calculation for real returns is a bit more complicated, we can approximate real returns as simply nominal returns minus inflation. If your nominal investment return is 10% but inflation is 3%, your real return is approximately 7%. In other words, your purchasing power has increased by about 7%.

The Fed and Inflation

The Federal Reserve (the “Fed”) has been in focus lately, as just this week, they cut their benchmark interest rate by 0.25% (to a range of 4% – 4.25%).

The Fed’s dual mandate aims to achieve two primary goals: maximum employment and stable prices (low, stable inflation). For the latter, the Fed has targeted a 2% inflation rate over the longer term.

Why Not Deflation?

Some might say, “Why shouldn’t we root for deflation? I want the price of things to go down!” This was especially common in 2022 when prices spiked over 9% in a 12-month period.

The problem with deflation is that it creates a vicious cycle. Consumers expect prices to fall, so they delay spending. Businesses sell less, reducing profits, which leads to layoffs and other negative effects.

This vicious cycle is why a low, stable rate of inflation is a good thing.

Historical inflation rate

If the Fed has targeted a 2% rate of inflation, it naturally leads us to inquire what the actual inflation rate has been.

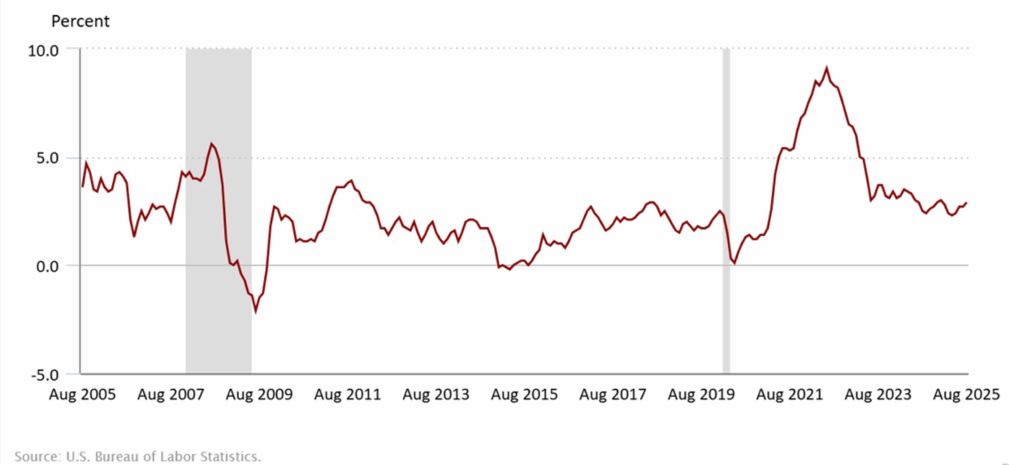

Below is a graph of the 12-month percentage change, Consumer Price Index, not seasonally adjusted.

As you’ll see, inflation has spent much of this century between 0 – 5%.

How to Prepare

If inflation is like a moving walkway in an airport, then you need to be able to walk faster than the walkway to make any progress.

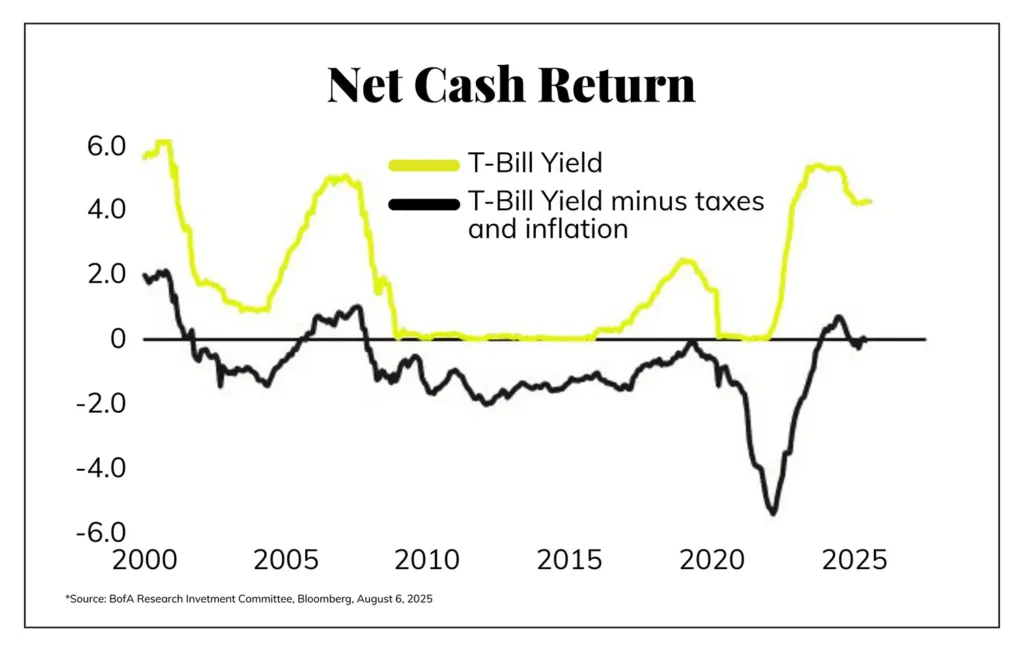

While many cash products (T-bills, money market funds, CDs, etc.) were yielding north of 5.0% in late 2022, many of those same products are now yielding south of 4.0%. With the most recent inflation reading (CPI) at 2.9%, this means real returns on cash are about 1%, and the picture is even more bleak after taxes are considered (see chart below).

This is why I wrote What is Risk Anyway? back in January 2024.

Fixed income yields are not much higher, with bonds (as measured by the iShares Core U.S. Aggregate Bond ETF) posting an Average Yield to Maturity of 4.30%.

The challenge with cash and fixed income is that the income is fixed, and therefore, the purchasing power is eroded over time.

Building the Skyscraper

While cash and high-quality fixed income are not designed to outpace inflation by a large margin, there is still a place for them in many portfolios.

Building a skyscraper starts with a deep, solid foundation. Only after that groundwork is secure can the visible, awe-inspiring structure rise toward the sky. The strength and integrity of what’s beneath the surface is what makes the heights possible.

This is why we advocate for Expense-Based Planning. While I encourage you to read the entire article, the first step is to establish a “safety net” of your portfolio in cash and/or high-quality fixed income (your “Stable/Reserves” bucket). The second step is to earmark the rest of your portfolio to grow (your “Growth” bucket).

While the price of the Growth bucket (think stocks, high-yield bonds, and some alternative investments) can fluctuate (sometimes significantly), history has shown that they are the most effective inflation-fighters.

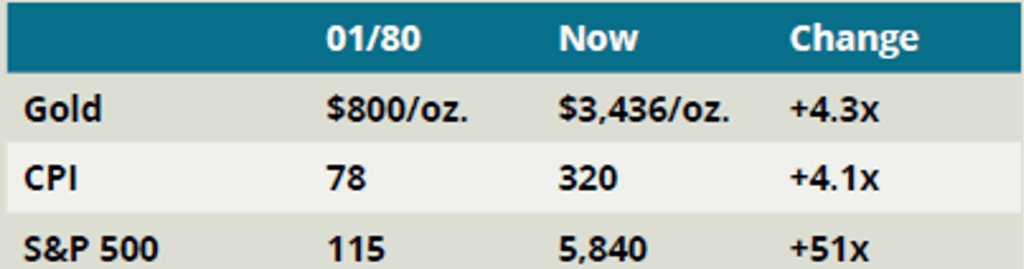

Note the chart below (from Nick Murray Interactive, Volume 25, Issue 6, June 2025).

Cost of living (as measured by CPI) has increased 4.1x since 1980, Gold has increased 4.3x, and the S&P 500 has increased 51x!

The Power of Dividends

Beyond the potential for long-term asset appreciation, a Dividend Growth investing strategy offers another powerful advantage: rising income. As companies increase their dividend payouts over time, the income generated can grow faster than inflation.

For a retiree staring down a 35-year retirement, this becomes essential to afford things in their 80s and 90s.

Bottom Line

Inflation is not something to be feared… it is something to be prepared for.

If you want to make progress against a moving walkway in the airport, you must walk faster than the speed at which the walkway is carrying you back.

Once a safety net is in place, a well-constructed portfolio (especially one focused on growing income) can help you move faster than inflation, making real progress over time. Remember – it’s not the nominal return that matters, but the real return.

As always, if you’re wondering how inflation might impact your financial plan or whether your portfolio is positioned to keep pace, feel free to reach out.