Step One: Catch the Ball

Here’s the scene: You’re a wide receiver and you line up for the final play of the game with your team down just one point. The coach calls the play and the quarterback hikes the ball. With some fancy footwork, you break loose from your defender and see that there is no one between you and the endzone. It’s your time to shine! You turn back to the quarterback just in time to see the ball in the air and headed to its final destination – your hands. As soon as the ball hits your hands, you turn your head and head for the end zone. Oh no! You were so focused on the end zone that you dropped the pass. Game over.

Sorry I didn’t let you catch the game-winner but isn’t that a familiar scene? The football player starts to run for the touchdown before catching the ball or the baseball player attempts the throw to first base before fielding the baseball or the basketball player pivots to the hoop before catching the pass. Sometimes we get so excited about the end goal that we forget about the fundamentals.

Step One: Save, Step Two: Where to Save?

When it comes to financial planning, I see a similar situation. People become so laser-focused on one goal – retirement and it drives them to focus on just one discipline – saving. As you know from past articles, TOM is a big advocate for saving, but as we will discuss today there are other factors that matter as well.

One of those other factors is the type of account that you are saving into. Think about it, where do a majority of Americans save for retirement? Their company-sponsored plan, be that a 401(k), 403(b), or any other plan type that their employer might be providing. Typically, they are primarily saving pre-tax money into these accounts, which will be subject to be taxed as income when they distribute it in the future.

The Potential Problem

This all seems harmless enough, right? People are saving and that should be the only thing that matters, but let’s take a look at what this might mean for their future.

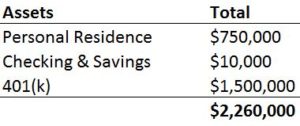

Meet Bob. Bob is your average American. He’s spent the last 40 years working hard and saving. Bob has finished putting his two kids through college, paid off his house, saved for retirement, and now he’s ready to call it quits. This is Bob’s balance sheet:

When Bob retires next month, he will begin to withdraw from his 401(k), as these distributions will replace his income. Bob read somewhere that you should limit your annual withdrawals to 4% of your retirement account value, so he plans to follow this rule of thumb. Bob has been tracking his monthly expenses and this withdrawal plan should cover just about everything.

Remember, all distributions from Bob’s 401(k) plan are taxable as income because he accumulated these savings with pre-tax money. So, although Bob’s balance sheet reflects $1,500,000 in the 401(k), he must remember that Uncle Sam has a claim on a portion of those assets.

Exciting news! Bob’s daughter got engaged and is planning to get married before the end of the year ($30,000). Uh-oh! Bob’s car won’t start, and it looks like he’s going to need a new car ($25,000). Bob just remembered that he promised his wife, Sally that they’d celebrate retirement with that Alaskan Cruise that they’d always talked about ($10,000).

It looks like Bob just came into a few expenses that he didn’t plan for. Here’s the potential problem, in order to cover these three expenses of $65,000, Bob will need to withdraw this money from his 401(k). This means that he will need to withdrawal, even more, to account for the taxes that he’ll owe on the distributions. Maybe this bump in distributions will also bump Bob to the next marginal tax bracket.

Because Bob accumulated all his savings into this one account type, a 401(k) made up of pre-tax money, he must create more taxable income every time a spending need comes up. In our playful example maybe this doesn’t seem like a big deal, but I have seen this play out numerous times where it has created some serious financial issues.

The Solution

Sure, one could argue that Bob could have taken out a car loan to stretch the expense of a new vehicle and he could’ve explored a personal loan or home equity line of credit to stretch out the other expenses as well. But what if Bob just planned ahead and built up his savings throughout his career in different types of accounts that would give him more optionality on where to draw this money from in the future.

In financial planning, we call this tax diversification. The idea is to accumulate assets in accounts that have different tax treatments, which will allow you in the future to strategically identify which account would provide you the most favorable distribution.

The Big Three

When building out a “tax diversification” strategy you will have three primary account types you will focus on: tax-free accounts, tax-deferred accounts, and taxable accounts. Remember, Bob had all of his accumulated assets in a tax-deferred account, which made it difficult because large expenses were driving up his tax bill.

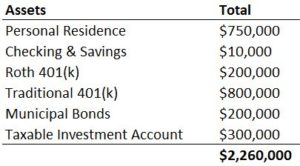

Now, let’s imagine if Bob’s balance sheet would have looked like this:

By diversifying the account types and the tax treatment of those accounts, Bob now has a lot of different options for how he might buy that new car, pay for his daughter’s wedding, and fund that Alaskan cruise. Bob could sell some assets from the taxable investment account and benefit from the favorable long-term capital gains treatment of some of those assets or perhaps he would resource some of the tax-free income from his Municipal Bond holdings or just maybe Bob would have decided to take a tax-free distribution from his Roth 401(k).

The moral of the story is that Bob would have lots of options of where to take this money from and this optionality would allow him to fund his expenses in the most tax-friendly way.

Nuances

As it always seems to be, there are always nuances. Every situation is different, and every situation warrants a thorough review and a customized strategy and plan. This is why I always encourage our readers to use these blog discussions to start a dialogue with their advisors. Collaborate with your advisor to confirm that you are maximizing the opportunities of tax diversification and for those not yet retired you still have time to build out a more diverse base of account types.

Furthermore, to keep today’s conversation short and sweet we stuck with the basics, but there are even more advanced strategies like Roth conversions that would coincide with this type of planning and potentially create big long-term benefits to an investor.

But, for now, I will leave it here for this week. As always, please email us with questions, comments, and topics you’d like to hear more about on TOM. I can be reached at .

Until next time …