As we approach the end of the year, I brace myself for the many retrospective look-backs on 2019 from my favorite media sources. And being that this year also marks the end of a decade, it will naturally invite even more reflection of how the past may inform our future.

In the world of investing, the former decade (2000-2009) has now been appropriately deemed, “The Lost Decade.” A ten-year period that was bookended by two significant market events – The Dot Com Crash and The Great Recession.

And this leads me to wonder, what central theme will we assign to the 2010’s?

The Lost Decade

Let’s take a quick stroll down memory lane and discuss the 2000’s. As I mentioned, this decade captured two very significant negative market events and was one of few times in market history that the S&P 500 recorded a negative compounding return over an entire decade. The annualized return (with dividends reinvested) over this 10-year period was -0.58%. This means that if someone made a $1,000,000 investment in January 2000 that it would be worth $943,490.62 around the end of 2009.

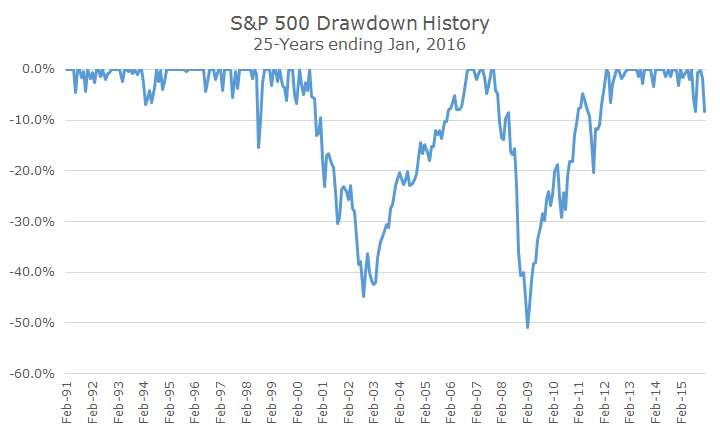

Ten years is a LONG time and I don’t even think the description above about the shrinking million-dollar investment does it justice. Take a look at the drawdowns an investor would have had to endure along the way in the 2000s:

SOURCE: Acropolis Investment Management

Our fictitious investor would have started off seeing their portfolio get chopped in half over the first three years, logging the following returns: -9.10%, -11.89%, and -22.10%. Then, what came next? Well, in the next handful of years our investor would have seen the value of their portfolio restored only to be eventually cut in half again in 2008. This was a gruesome decade for the stock market.

The Chicken Little Decade (2010-2019)

In the interim, until this decade (2010-2019) receives its official name, I’d like to deem it as The Chicken Little Decade. My choice of theme is because this decade could be best defined by its anticipation of pending doom where no actual doomsday event occurred. Do you remember the story of Chicken Little? If not, let me refresh your memory,

“Once upon a time there was a little chicken, and everybody called him– Chicken Little. And one day while he was out walking, up in the sky a bird flew over and it dropped an acorn, and the acorn fell down and– bip– bopped him on his head. Chicken Little said “AWK! ” and looked up, and didn’t see anything, and he looked down and didn’t see anything. So he said “Help, help the sky is falling! Help, help the sky is falling! I have to tell the King!” And he went running down the road, looking for the King.” SOURCE: www.folktale.net

Just like Chicken Little, investors of The Lost Decade did experience pain – their acorn came in the form of two horrific market events. Chicken Little’s mistake was that he misinterpreted this pain and came to the wrong conclusion, that the sky was falling. Similarly, investors operated with an exaggerated level of fear in the 2010s and allowed their stock-market-PTSD to dictate their investing decisions.

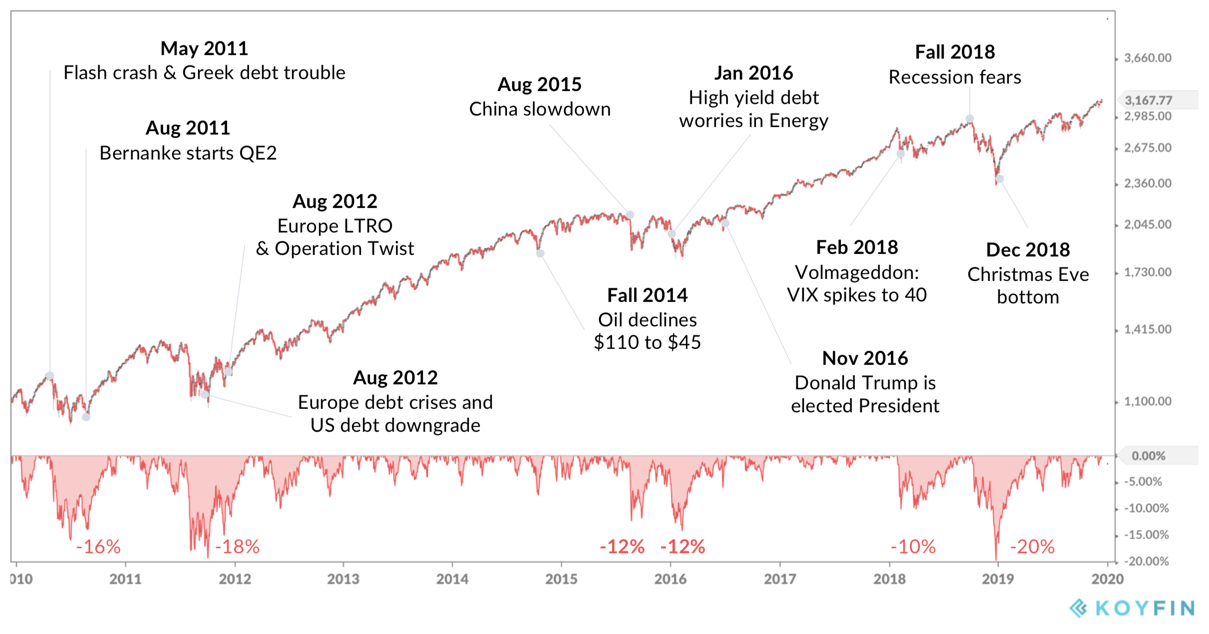

Granted we still have two weeks left to close out the year, but this is basically the sum of this decade:

SOURCE: Koyfin

Each of the events notated above caused us to cringe when we experienced them and it, at times, did feel like the sky was falling, but in hindsight of actual data, it was a relatively calm decade. Over this almost ten-year period, we didn’t experience one drawdown (change in value from peak to trough) greater than 20%.

Additionally, over the last 119 months (Jan. 2010 – Nov 2019) the S&P 500 has compounded at 13.235% per year (Dividends Reinvested). If you were to ask Chicken Little back in 2010 if he expected this outcome, he would have told you emphatically, “NO!”

Recency Bias

As humans, we are fallible. Every day we are making split-second judgments that allow us to make decisions. Some of these decisions are small – soup vs. sandwich – but some of these decisions are BIG, like how to allocate your retirement portfolio.

It is our natural bent to lean heavily on our recent experiences when making decisions. At times, this can be very helpful. For a child that touches a stove, he learns very quickly not to touch that stove again. For an investor, this same inclination can pose problems.

Market cycles are long, yet our memories are short.

Not many of us have a catalog in our brain detailing the last 100 years of stock market returns, so we settle for our most recent experience to dictate our investing decisions. This often leads us to chasing yesterdays winners and insuring against the next crash after we just got burned by the last one.

Juxtaposing these two decades helps to illustrate this point. A stock market investor in the 2000s felt like investing was a lost cause, while an investor in 2010’s might have too high of expectations going forward. As investors, we must be aware of our bias to lean heavily on recent events and resolve to build a portfolio that is well equipped for all market cycles.

The Next Decade

Unfortunately, I do not have a crystal ball and I do not know what this next decade has in store for us. Here at The Bahnsen Group, we strive to be students of the market and students of history. Our intention is to help build client portfolios that are equipped to weather whatever storm comes our way. We also know that sometimes our investment journey will entail seasons of calm waters and sunny days, so we want to be well prepared for that potential reality as well.

This last decade has made many doomsday-newsletter-authors very wealthy. Investors felt blindsided by the previous decade and sought out the soothsayers to help them avoid being duped again. Unfortunately, these subscriptions and silly advice led them further astray. As Bernard Baruch once said, “The main purpose of the stock market is to make fools of as many men as possible.”

Wishing you the very best…

This is the last edition of TOM for 2019 and I wanted to take this opportunity to thank all of you who support me with your reading of Thoughts On Money. Few things are more rewarding in this life than knowing that one’s effort makes a positive impact on people. I am grateful for my clients, friends, and family who have shared with me the benefits they’ve gleaned from these little tidbits. I am looking forward to this new decade and whatever history ends up calling it. I hope everyone has a wonderful end of the year, full of celebration and quality time with loved ones.

Until next year…