Most investors and savers have one common goal – retirement. They are aspiring to achieve financial freedom that will allow them the liberty to do whatever they’d like. Some will transition into volunteer work, some will start new businesses, and some will travel and spend more time with family. The idea is that if you build up a large enough nest egg, you can just live off the interest. Translated as the income (dividends and interest) from your portfolio would satisfy all of your living expenses.

There’s one tiny problem. Interest rates and dividends just ain’t what they used to be.

How Low Can You Go

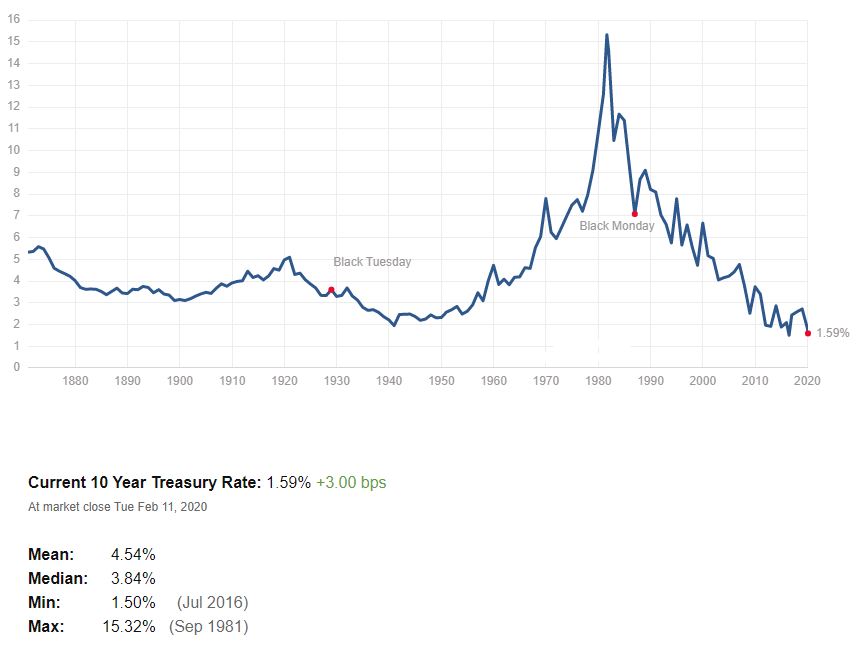

Take a look at the current 10-year government treasury yield in context to the last 150 years:

If you lend the US government your money for 10 years, the current interest rate (as of February 11, 2020) is 1.59%. Over the last 150 years, the high was 15.32%, the low was 1.5%, the mean average 4.54%, and the median 3.84%. So, again, in context to historical averages, we are basically at all-time lows when it comes to treasury yields.

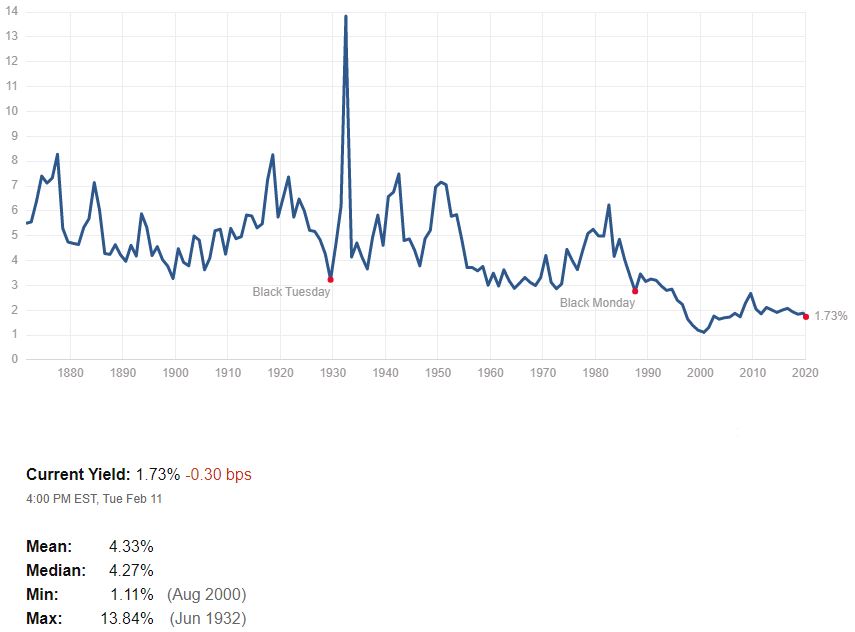

Now, let’s take a look at dividends. Here is the dividend yield on the S&P 500 for the last 150 years:

That is a 1.73% yield, which means that a million-dollar investment in a stock (S&P 500) portfolio pays approximately $17,300 a year in income. This is compared to a historical mean average of 4.33% and a median of 4.27%. Put another way, the historical average used to produce 2.5x the amount of income than it does today.

Again, this poses a problem for that retiree that plans to just “live off the interest.”

Now & Then

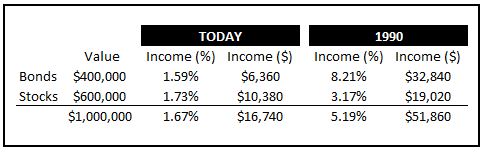

To further illustrate this, let’s look at what a traditional retirement portfolio might look like. The “typical” retirement portfolio would be something like 60% stocks and 40% bonds, often referred to as the “60/40” portfolio. Here’s the income that a 60/40 portfolio would produce today vs. 30 years ago:

That is a HUGE difference. Today an investor is getting approximately $1,400 a month in investment income, while 30 years ago that number would’ve been around $4,300 a month. For many investors, this means that they cannot afford to just “live off the interest.”

Live Off of Appreciation?

The logical reaction to this reality is, why not just sell a portion of the portfolio each year and live off the appreciation. The compounding average growth rate of a 60/40 portfolio over the last 20 years has been 6.63%, which seems like it would more than satisfy annual expenses for most.

This would be a good plan if markets always provided “average” returns, but they don’t. Over this 20-year period, the 60/40 portfolio didn’t have one year where it returned between 5% – 7%. Most of the years were well above or below this average.

This varying sequence of returns poses a risk to the retiree. In the world of financial planning, this is aptly referred to as sequence-of-returns-risk. Here’s the risk, if you plan to withdraw a fixed percentage from your portfolio each year and you begin retirement during years of negative or flat returns then you end up needing to sell your investments at below-average or depressed values in order to meet your withdrawal needs. In turn, this means that your future returns are now growing off a smaller base and that same withdrawal target becomes more burdensome on this smaller base.

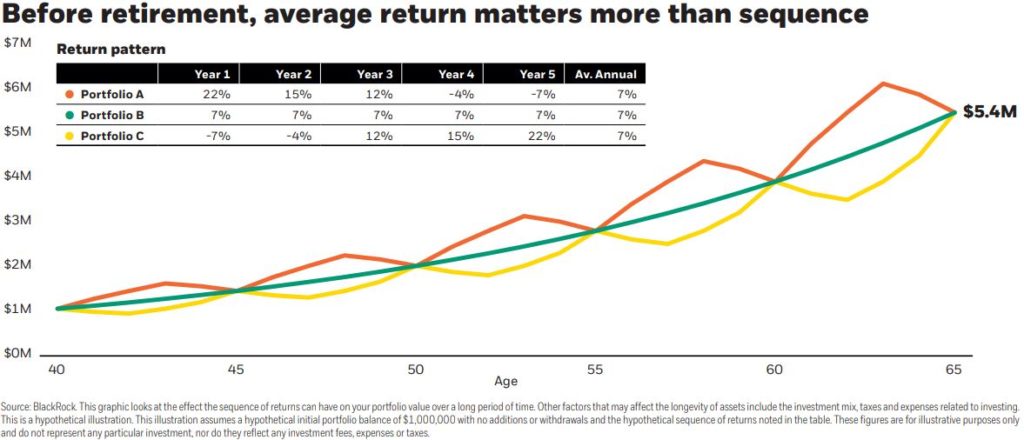

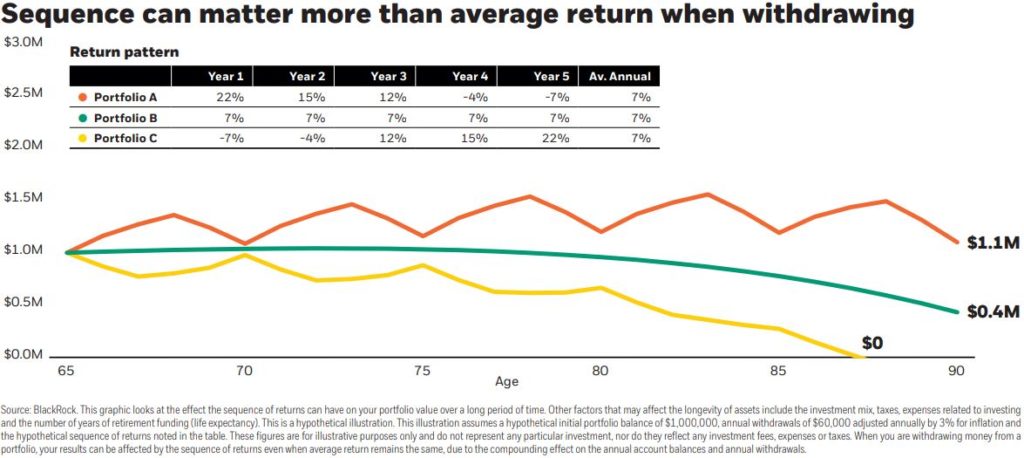

If this is your first time hearing/reading about sequence-of-returns-risk, then that explanation might’ve been too vague. Let’s take a look at these illustrations from Blackrock that really help to explain this.

Here are three different portfolios (A, B, & C) that all produce the same average return of 7%. Every 5 years each portfolio achieves that same average with its own unique sequence. During the accumulation phase (pre-retirement) of life, these varying sequences have no effect on the end result; each portfolio grows to $5.4mm.

Now we shift to the withdrawal phase (retirement) of life and look at those three portfolios experiencing these same varying return sequences. Take a look at what a difference those withdrawals make on the outcome:

Portfolio C ran out of money, as it started off retirement with a -7% return, followed by a -4% return. As you can see, if you are depending on the appreciation of the portfolio to satisfy your withdrawal needs then the sequence of returns can pose a BIG problem.

Yikes! What’s the Solution!?

Here at The Bahnsen Group, we believe the best solution is to design a portfolio that does produce a sufficient amount of income (yield) to satisfy your expense (withdrawal) needs. In today’s environment, this is not an easy task and the classic 60/40 portfolio may not suffice. Our founder and CIO, David Bahnsen wrote the book, The Case for Dividend Growth: Investing in a Post-Crisis World, which is a great resource for learning how we design the nucleus of a portfolio based on a dividend growth philosophy. This core allocation is then complemented by an array of different investment allocations like real estate, oil & gas pipelines, private debt, customized bond portfolios, etc. to create a sustainable and sufficient income stream.

A key focal point of how we design these portfolios is based on appropriate risk management. I’ve seen too many DIY investors, and unfortunately some advisors as well, that build income-centric portfolios with no recognition of the embedded risks. These investors find themselves chasing after yield and then are disappointed when these income streams dry up, leaving them with an asset that is worth much less than they paid for it. This is why we value the due diligence and research we commit to because it helps us to identify those allocations that provide sustainable (keyword) income.

Ok, well, we will leave it there for today. If something in today’s discussion piqued your interest or if you have any follow up comments or questions, please do email me at .

This is TOM signing off… Until next week…