Today I’m going to tell you a story about Mary. Mary is retired and perhaps the sweetest person you could ever meet. The type of person that just lights up the room. Someone that always makes you feel like family.

Some years ago I was honored with the opportunity to steward over Mary’s investments. As is usual practice, I began with reviewing her current portfolio that her former advisor had constructed for her. When I opened her account statement I was absolutely shell shocked by what I saw. Considering her age, income, assets, etc. her portfolio was a woefully misguided one. As I look back, I think it was one of the first times in my career that I felt broken-hearted during a review. Feeling such, I was determined to take a closer look to understand better what possible strategy her advisor was trying to employ.

Mary owned a portfolio of investments that reflected the advisors’ beliefs about the world, not her goals or her financial needs. I actually knew the advisor; we had interacted a few times in the past. I would describe him as quirky and his investment viewpoints definitely leaned toward pessimistic. Yet, I still would not have imagined that he would’ve managed Mary’s nest egg in this manner.

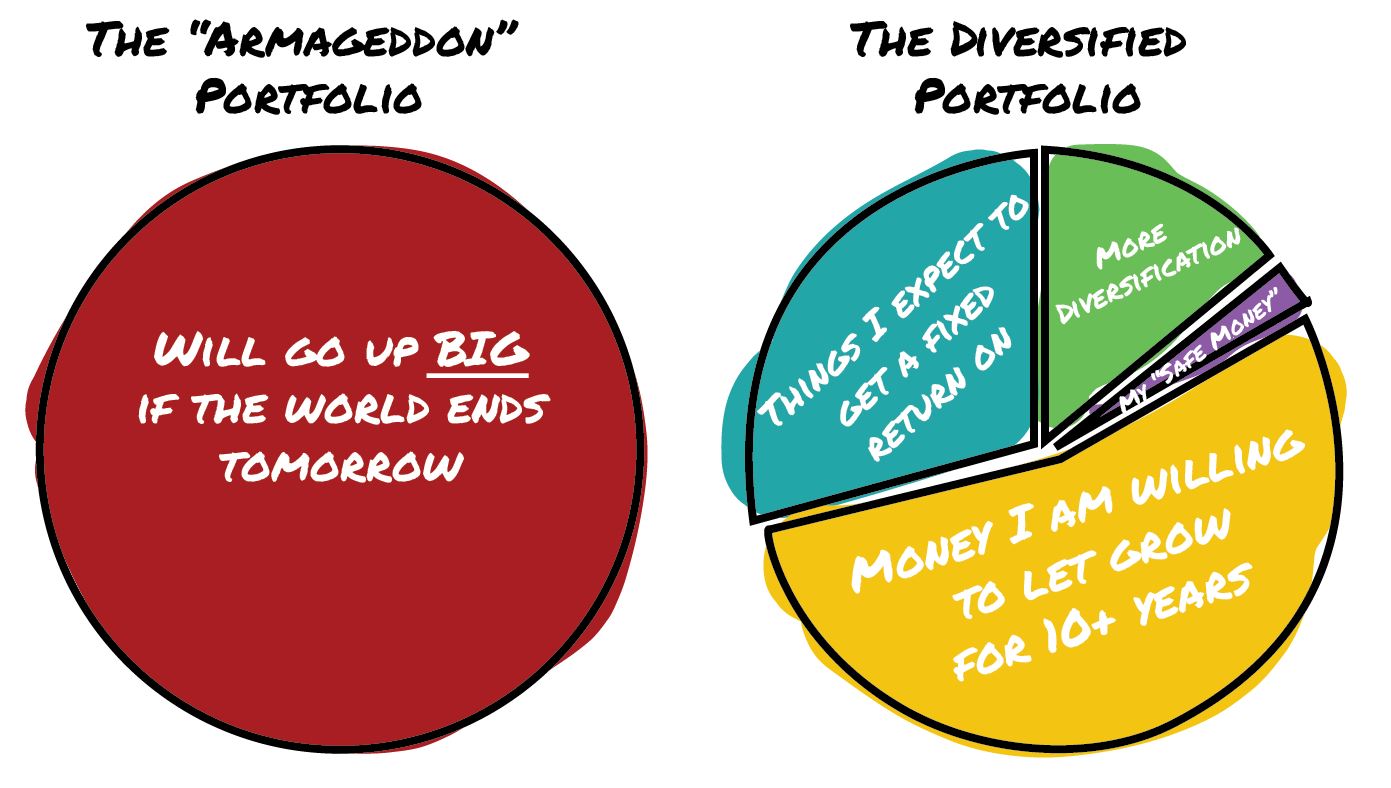

The portfolio was full of foreign currencies and funds that were SINGULARLY built to profit from the market going down, and inversely one would lose money if the market went up. I categorize this as an “Armageddon” portfolio, a direct reflection of (as I later confirmed with others) this advisors political and personal beliefs.

So what could be done to undo what had been done? Our first action step was to reallocate Mary into a diversified portfolio.

Post 2008 the market has grown by over 350%. Some 11 years later and any well-diversified portfolio would have fared quite well even with the most conservative of plans. Unfortunately, by the time I began caring for Mary’s portfolio, she had not only missed out on this extended upswing, but she had also seen her hard-earned savings depreciate significantly.

Now you can understand why that initial review broke my heart. Put in the same situation, I’m sure you’d have felt the same. I’d like to say this was a one-time occurrence, but sadly it is not as I have come across this a few times since.

How To Keep From Being Led Astray?

Over the years I’ve seen investors who have led themselves astray by investing according to their own off-kilter beliefs. But sadly and more often, I’ve seen people GUIDED astray by a trusted advisor. The reasons are many, with some bordering on irresponsible.

When you take a non-consensus view, as this advisor had, you’ll find yourself swimming against the current. Markets on average have a positive outcome, especially as your time horizon becomes longer. It takes a very skilled individual that can build a portfolio that benefits from a negative market outcome and that person is most likely not you or me and definitely not Mary’s former advisor.

Don’t get me wrong here; you shouldn’t always have a consensus view. Following the herd can get you in trouble, too. A contrarian perspective can at times be appropriate and beneficial. Problems tend to surface when your allocations are solely constructed from a viewpoint that’s truly divorced from reality.

To Mary, she viewed her former advisor as a professional and why not? He had a nice office, in a big building, and wore a nice suit. It’s easy to sniff out a crook or bamboozler because their evil motives tend to surface pretty quickly, but a professional preaching something he actually believes in can be much more difficult to avoid. Mary’s advisor wasn’t trying to swindle her, he believed in the portfolio that he had constructed and that’s the scary part

Next week we are going to expand on this topic of how to avoid being misguided and we are going to talk about the importance of valuation. Topics like cryptocurrency and cannabis might be all the rage right now, but how do we go about figuring out the difference between a great story and a great investment? Come back next week to find out.