Hello TOM Subscribers,

This week we welcome back Kenny Molina for another guest post. Kenny covers the allure of so-called “easy money” investments and the historical evidence around the financial destruction left in their wake. Kenny provides some fascinating research and prudent advice to help all of us avoid these financial traps. So sit back, relax, and enjoy!

– Trevor Cummings

*****************************************************************************************************************

“Shopping” for Investments

Think about the last time you went grocery shopping; you probably arrive with a list based on your household’s needs and wishes. The store is well organized, prices are clearly listed, and there’s even a calm tune playing in the background. Everything has been laid out in a manner to make your experience enjoyable in hopes that you’ll consider buying more than just what’s on your list. In financial markets, on the other hand, there is what seems like an endless catalog of investment options, ever-shifting prices, and no shortage of voices and opinions noisily filling the jostling bazaar that is capital markets.

Going Off the Rails

All of us have been introduced to a certain ‘hot’ stock, product, or ‘idea’ from countless sources; whether it be a friend, headline, or something overheard at a dinner conversation there is no end to the stream of tips or next big thing(s). It can be easy to be drawn to what appears like ‘simple’ gains or low-hanging profits, enticing propositions which can lead even the savvy investor to second guess his or her current portfolio/strategy.

The market is rich with stories of latest and greatest investment opportunities, from recent buzz around cryptocurrencies, the dot com crisis of the ’90s, even dating back to the railroads (yes there was a railroad frenzy)! There is plenty of historical context that should encourage you to be cautious about conversations that appear to reveal a “sure thing” or a “can’t lose” proposition.

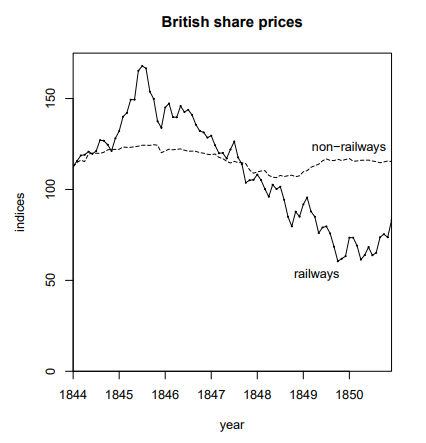

Source: University of Minnesota

While this is not a piece on the wisdom (read: occasional madness) of crowds and bubbles, we are wise to understand the emotions that can lead one to doubt their current plan when the ‘rise’ of others seems to have no end.

Looking at the graph above, 1845 probably seemed like a great time to sell ‘non-railway’ holdings and ride the rails; after all what better way to achieve your portfolio objectives like double-digit returns, right? 1845 Britain would have been a very difficult time to be a disciplined investor as headlines, town squares, and anyone partaking in this ‘mania’ would be proudly boasting about their success. Some of these FOMO1 investors would have initially experienced immediate positive reinforcement around their decision to get on-board. This immediacy of returns leads to false confidence and a self-perpetuating reinforcement by like-minded ‘investors’ in the collective decision that was made; what behavioral economists call a positive feedback loop. Investopedia defines this as,

“a self-perpetuating pattern of behavior. In the context of investing, the term often refers to the tendency of investors to follow a herd mentality when buying or selling assets.”

Moo’s and Boo’s (or following the herd)…

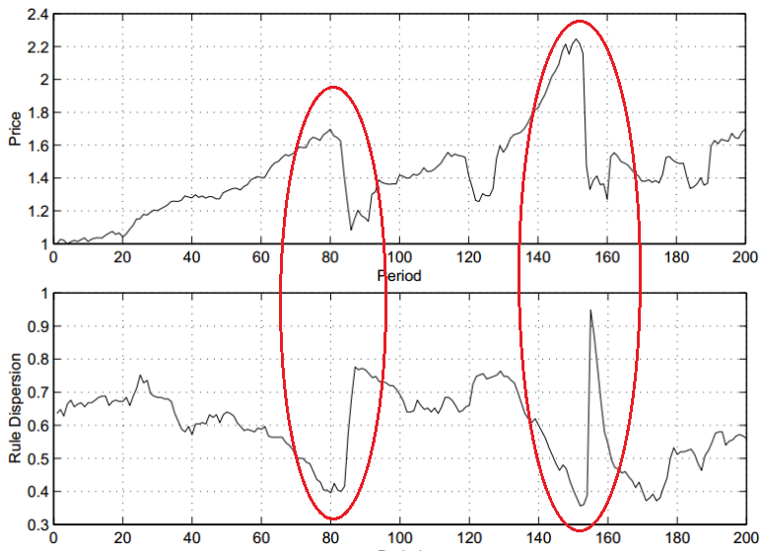

Going against the crowd can at times be a feat of herculean endeavor, the following chart illustrates how when general investor mentality begins to ‘herd’ (dispersion decreases) there is almost always an initial increase in the value (price) of a holding:

Source: Blake LeBaron, “Financial Market Efficiency in a Coevolutionary Environment”

The implications are truly chilling, as Michael Mauboussin, of Blue Mountain Capital Management, further explains,

“as the agents lose diversity by imitating one another, the initial impact is that they get richer. This is why betting against a bubble is so hard. Positive feedback pushes price away from value and creates lots of paper gains along the way. Being wrong in the short term, even if you are correct in the long term, introduces career risk where poor results put a portfolio manager’s job in jeopardy”

When everyone seems to be ‘winning’ (a relative term since their portfolio performance in no way hinders/advances your own objectives), portfolio managers are getting smeared for not having ‘seen it coming,’ and everyone else is capitulating it’s exactly the right time to focus and stay the course.

Buy High and Sell Low

A couple of decades ago, famed investor Warren Buffet expanded on what his mentor, Benjamin Graham, had to say about “Mr. Market” (the embodiment of the collective action of investors),

“Sometimes he is euphoric and sees only favorable outcomes and hence names a very high buy-sell price. Other times he is depressed and sees only negative outcomes and provides a very low buy-sell price. Mr. Market is there to serve you, not to guide you. It is his pocketbook, not his wisdom, that you will find useful.”

Social feedback, mania, break-outs, panic, euphoria, i.e. the compendium of Mr. Market’s opinion(s), is why it’s so important to have a plan and stick to it! Along the way as an investor, it’s easy to lose focus and want to chase the next big thing or look to what everyone else is doing.

If we need any more evidence as to why FOMO1 investing is not in our best interest we need look no further then this popular Fidelity study that sought to identify traits of long-term outperformance across their retirement accounts. They found that the portfolio’s that outperformed were (drumroll) those where investors forgot about their account! Basically, when left to our natural biases (a fraction of which are highlighted in this writing) we tend to buy high and sell low as our short-term intuitions so easily lead us astray from a prudent plan.

So, the next time Mr. Market comes loudly and hurriedly knocking, just act like no one is home!

1 Pop culture acronym for “Fear of Missing Out.”