The beginning of the year leaves a lot to the imagination, right? Like, what will happen in 2020? Who will win the election? How will my investment portfolio perform? And so on, and so forth. Here’s the trouble, none of us have a crystal ball, so we leave a lot of these conclusions about the future up to speculation.

I had two conversations last week that came to opposing conclusions about 2020. One friend told me they had a gut feeling about 2020 and they felt strongly that the momentum from 2019 would carry over and their stock investments would do even better in 2020. Another friend told me that they felt like 2019 led to an overheated market and they were fearful whether they should own any stocks at all. To both conclusions, I replied with the same question, “Why so?”

I asked this question because I wanted to know if their conclusion was grounded in logic and evidence or if it was simply birthed from a feeling. Our emotions can be deceiving, and our memories can be selective, which is why I don’t put a lot of confidence in these types of gut predictions. But, hey, let’s lean into these claims and parse them out in today’s Thoughts On Money.

Probable vs. Possible

Allow me to make one quick clarification before we jump into today’s discussion. Anytime we address a predictive claim it is not wise to form a quick rebuttal that something is impossible. We can provide research, historical evidence, etc. to claim that something is improbable, but rarely can we conclude that something is impossible. Improbable means that it’s not likely to happen, but yes there is a small chance that it could happen.

If you are a football fan, this month you witnessed the Tennessee Titans upset the New England Patriots in the Wild Card Round of the playoffs, followed by a win over the red-hot Baltimore Ravens in the Divisional Round. The Titans only had two wins as of week six in the season, so it was definitely improbable that they would be in the Conference Championships, but it obviously was not impossible. Whether it be sports, politics, or economics, this past decade has proven that almost nothing is impossible and even things with no historical precedence can indeed occur.

With that said, it’s also important to remember that one can be right, even if for the wrong reasons. Back to my football analogy, I am sure there was at least one die-hard Titans fan betting for his team regardless of the odds. The Titans overcoming the odds did not justify his gamble, for it wasn’t diligent research that led to his conclusion but rather an emotional bent for his hometown team. Being right for the wrong reasons is scary because it typically leads to an overconfidence that results in bigger wagers and greater risks.

2020 Hotter Than 2019!?

To my friend that believes the momentum from 2019 will carry over to 2020 resulting in stock returns that are even greater, I respond, “That is improbable.” I understand your gut leads you to believe so, but let’s take a look at the facts.

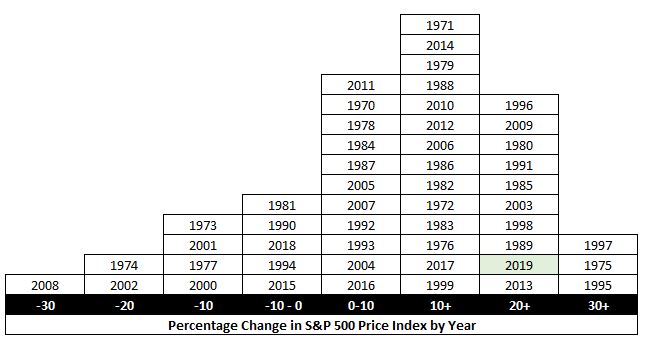

I would like to get into a conversation about the relationship between stock price performance and corporate earnings, as I believe that’s a more meaningful conversation, but let’s start with just standalone numbers. In 2019 the price return on the S&P 500 was 28.9%. So, to “do better” in 2020 we’d assume this infers that the return would need to be +30%. Over the last 50 years, this is what returns have looked like, categorized by percentage:

Only three times has the index had a +30% return, which means it has happened about 6% of the time. This makes this result an improbable outcome. Yes, it does happen, but rarely.

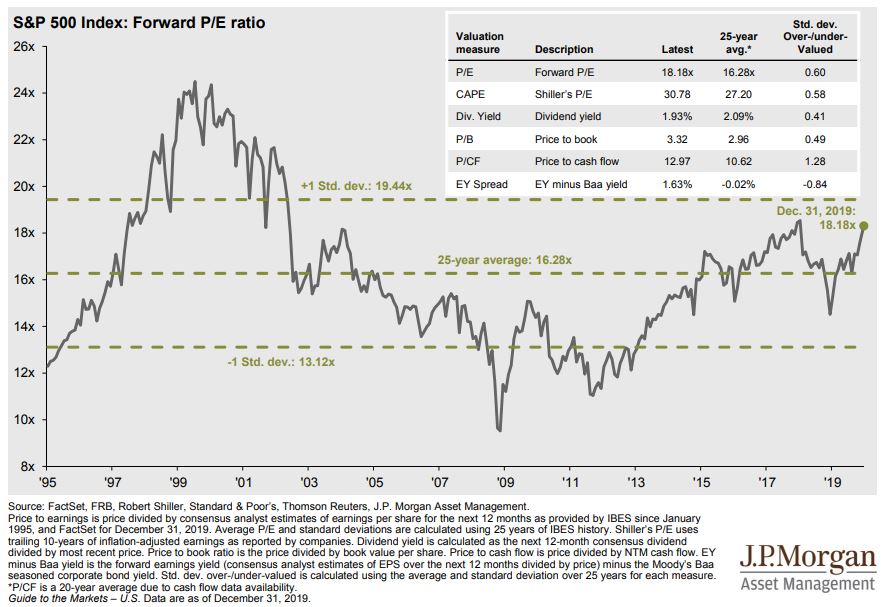

This type of quick assessment is a bit simplistic though. Let’s dive a little deeper. Here is a quick finance truth for you, the starting valuation of your investment has a strong correlation to your expected future return. You might need to read that a few times, as it is a mouthful. Stock prices and corporate earnings have a nearly perfect correlation over the long term. For this reason, we often use P/E Ratios (price-to-earnings ratio) to understand what the valuation of the market is, and we can compare this metric to historical valuations. This is what that looks like:

Source: J.P. Morgan

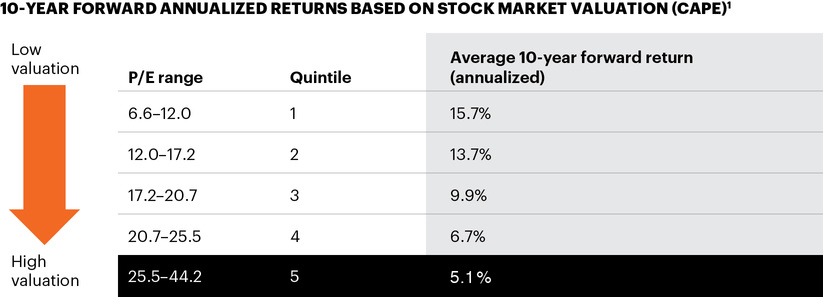

The current multiple on the market as of December 31, 2019, was approximately 18x earnings. Translated as the stock price is $18 for every dollar of earnings (on average). What does history tell us about valuations at this level? That the future expected return is lower (see below).

Source: Farnam Street

Is this current valuation a cause for concern? At this point, I would say no. I would encourage you to read David Bahnsen’s annual letter, Year Ahead, Year Behind and draw your attention to the section titled “Theme #1: Have Earnings, Will Prosper.” In 2020 we will need corporate earnings to be strong, as they are expected to be. The valuation metric I referenced, the price-to-earnings ratio has two parts to it – price and earnings. In order to bring that valuation back to the average territory, we need the denominator to grow, we need strong corporate earnings.

So, no, I do not believe that 2020 will deliver a better result than in 2019. If it does, which is not impossible, then yes this could be a cause for concern. Growing valuations without the support of growing earning is what we call a bubble (e.g. Dot Com Bubble).

2020 Doomed Based on 2019!?

To my friend that fears that 2019 success may inevitably lead to a horrific 2020, I respond, “Have a plan.” I understand where this line of thinking comes from, that too many good things in a row must eventually lead to a bad outcome. I agree that there will be an event in the future, that is unexpected, and perhaps unwelcome and this is exactly why a plan is so important. A well-crafted financial plan that outlines an appropriate allocation across your investments should build these downside expectations into the plan.

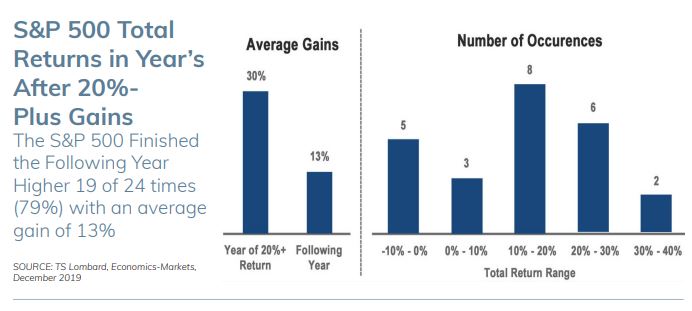

The plan should not be to build out a timing strategy where you come in and out of the market seeking to dodge the unknowns, it should be built with prudence to endure different market outcomes and it should be accompanied with appropriate investor expectations. In David’s Year Ahead, Year Behind he provides the perfect graphical illustration of why this gut-feeling-market-timing isn’t wise:

Back to this idea of leaning on history and data to craft our opinions, rather than our feelings, what is the average return of the S&P 500 following a year of +20% returns? It’s 13% on average. Perhaps that would not have been your guess and probably not mine either. I suppose it’s not intuitive, but it is reality.

For me though, I will not anchor my expectations for 2020 simply on this chart. I understand that the last 10 years has been very favorable for my investment portfolio, I’ve created a financial plan that factors in the potential downside outcomes, and I will try my darndest to not let my emotions rule the day when this downside presents itself. I would advise you do the same.