I love playing basketball, watching basketball, thinking about basketball. I love basketball. Maybe it’s because it not only requires skill, agility, and endurance but also because the best teams win because they have a good game plan, one that is able to adjust to their opponent, one that is disciplined and practiced to perfection.

If you would be so kind as to indulge my obsession for a minute, I believe the analogies I use for my favorite sport and my favorite profession will be interesting and helpful. So let’s dribble on in. Sorry, I couldn’t help myself!

Our world is changing

The original iPhone was introduced in the summer of 2007 and today we couldn’t imagine life without it. From how we communicate, how we travel, how we spend our free time, is constantly evolving. And when things evolve, we must learn to adapt to the new environment.

Adapting is hard and change is difficult. We build our worldview and beliefs on a deep foundation of principles and values that we’ve accumulated throughout our life resulting in us being a stubborn species, pretty set in our ways. Yet, the man most associated with intelligence – none other than Albert Einstein – provides us with this pearl of wisdom, “The measure of intelligence is the ability to change.”

Today on TOM we will discuss the everchanging financial landscape and how we can adapt to these changes. Specifically, we will discuss what this low-interest-rate environment means to savers and borrowers, and just for fun, we will talk a little basketball too.

The Changing Landscape of The Basketball Court

It was 1891 in Springfield, Massachusetts when a P.E. teacher by the name of James Naismith invented the game of basketball.

Source: Bettmann/Getty Images

As you can derive from the picture above, a lot has changed in the game of basketball over the last 120+ years. One of those “game-changing” modifications was implemented in 1979 when the NBA adopted the 3-point line. Coincidentally, 1979 was also the rookie season for Hall of Famer’s Magic Johnson and Larry Bird.

At the inception of the 3-point line, basketball was already 88 years old and you can imagine that coaches and players had their preferred strategies and approaches to the game. This rule change would prove to be incredibly impactful to how the game is played, but a transition to a new style of play was also slow to be fully adopted.

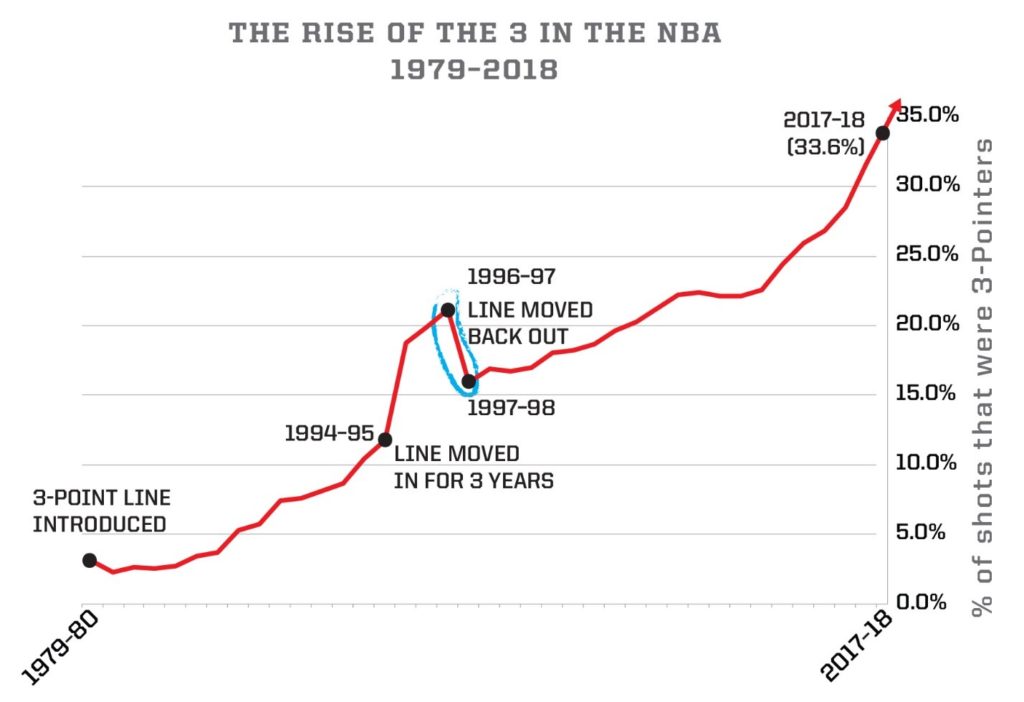

Source: Kirk Goldsberry

I am sure stubbornness and a tight grip to tradition are what slowed this evolution of the game down, but as you can see, over the last 40 years the use of the 3-point shot has increased tenfold. And, this style of play – lots of three-point shots – was even further popularized by the dominance of the Golden State Warriors who participated in the NBA finals for the last 5 seasons!

Basketball & Finance

So, you are probably thinking to yourself, “what in the world does basketball and personal finance have to do with one another?”

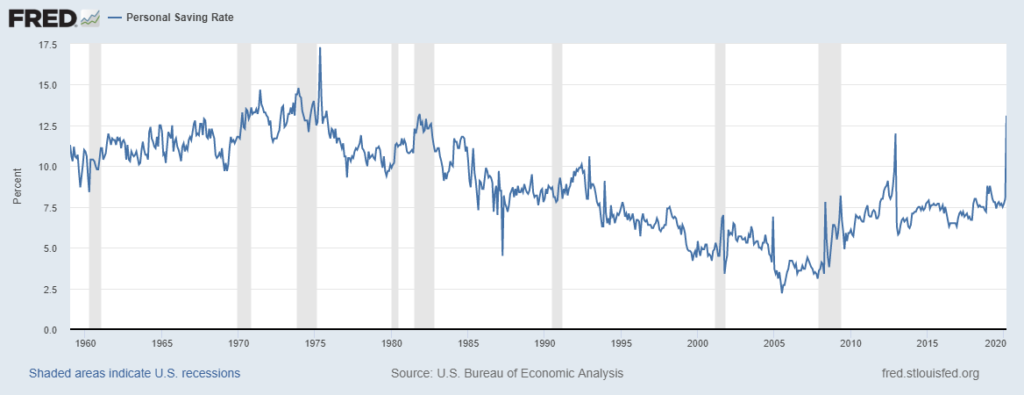

Well, just like the basketball landscape, the financial landscape has greatly changed over the last 40 years. Back when the 3-point line was first introduced (1979) a saver could yield an interest rate of over 10 percent when lending money to the US government for 1-year. It was a good time to be a saver!

Source: FRED

The yield has now shrunk to nearly zero.

We are now in an environment that in one sense or another, punishes savers and rewards borrowers.

The Influence of Statistics

If I were to begin reading you a resume and told you that an individual had this educational background, a bachelor’s degree in computer science with an emphasis on statistics from Northwestern University and an MBA from MIT, what profession might you guess this person is in? Maybe the CEO of a large corporation or maybe the founder of a technology startup? I’d say those are good guesses, but you’d be incorrect. This is the resume of Daryl Morey, the General Manager of the Houston Rockets basketball team.

Morey is also the co-founder of the MIT Sloan Sports Analytics Conference which was founded in 2006. Over the last 14 years or so this conference has attracted a very unique intersection of mathematicians and sports fanatics. The entire goal is to find ways to assess players and assist teams with finding a statistical edge in how they construct rosters and how they play the game.

Here’s the simple truth that changed the game of basketball. A three-pointer is worth more than a two-pointer and if one could shoot a three-pointer at a high enough efficiency then it becomes a more economically desirable shot.

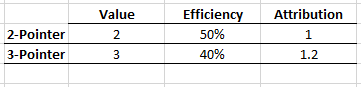

Here is an oversimplification of this truth:

If you can shoot a 3-pointer and make it 40% of the time, then it is worth more than shooting a 2-pointer shot at a 50% efficiency. This is an environment that punishes mid-range shooters and rewards, three-point specialists.

Back to Finance

If we were to play a word association game, I am imagining that if I said the word “debt,” that for many their knee jerk reaction would be to respond with “bad” or “burden” or “evil” or some other negative association. Now, my intention for this article is not to advocate for borrowing or to encourage you to take on more debt, but rather to make you aware that the rules of the game have changed and to challenge any stubbornness you may have about debt. Debt is not itself inherently evil, but it can and has been used imprudently by many.

I am sure you can provide countless anecdotes of companies and/or individuals that have been absolutely ruined by debt and for these exact reasons, we must be careful and wise with how we resource borrowing in our financial plan.

A couple of facts to consider:

1. Post-2008 home prices have increased on average by ~ 25%

Source: FRED

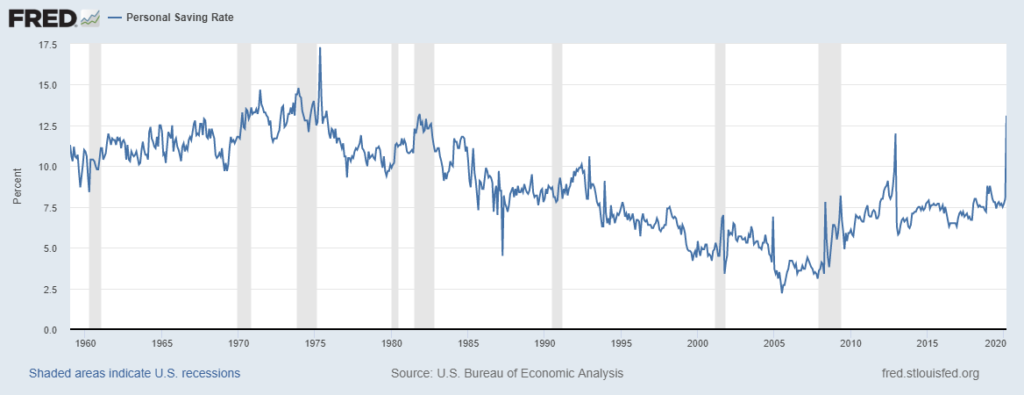

2. The personal savings rate in the US is currently at a 38-year high

Source: FRED

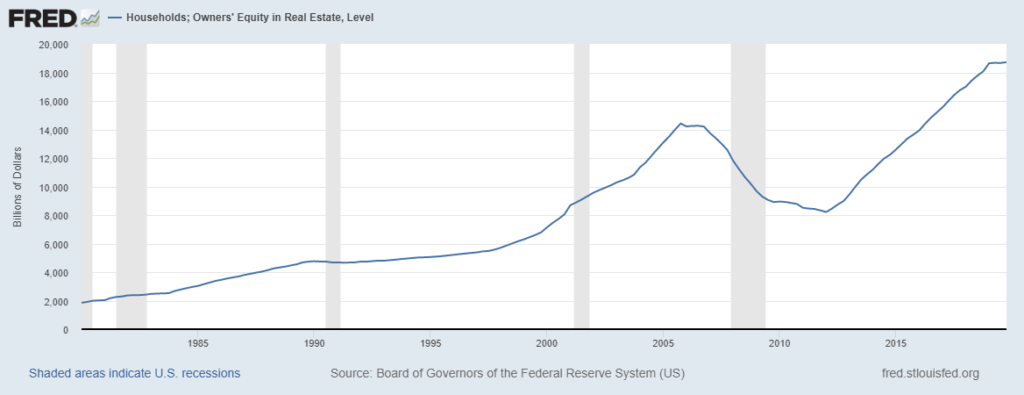

3. Homeowners have more equity today than they did prior to the financial crisis

Source: FRED

All this to say, on average, many folks have very healthy balance sheets right now. Balance sheets full of cash and home equity.

Will Cash Become the Mid-range Jumper?

As you can imagine, I talk to a lot of investors. What inspired me to write on this topic is this constant glut of cash I see on people’s personal balance sheets.

I am not talking about the traditional “emergency savings” of 3 to 6 or even 12 months of expenses, I am talking about amounts that add up to be a sizable portion of their liquid net worth. I believe this surplus of cash has accumulated for one or all of these reasons: (1) people are too busy to research and decide where to employ this cash (2) they have a slight fear or concern that they may need these funds in case of an unforeseen emergency and/or (3) they have such a strong disdain for investing that they just opt out altogether.

This made me start to wonder, with this low-interest-rate environment will cash savings eventually become like that of the mid-range jump shot? If you are a basketball fan like me, you know that longer-range 2-point shots have decreased significantly over the years. This is due to the statistical influence of people like Daryl Morey and the reality that these shots are less efficient than a layup and worth less than a 3-point shot. But this change did not happen immediately, it took some education and proof of concept to move the traditionalist into this new type of play.

I believe corporate America has already adopted this reality and this is clearly visible by looking at the growth of corporate debt post-financial crisis. Borrowing is cheap and intelligent CFO’s understand that if they can identify favorable projects and borrow at near-zero rates that they can maximize the opportunity that this environment presents.

The Baton Pass

I wish that I could provide the same advice that would work for everyone one of my clients but no two people have the exact same goals, are the exact same age, or make the exact amount of money. We all have unique circumstances and needs that warrant custom-tailored advice. So, could it make sense for you to reduce the cash allocation across your balance sheet? Maybe. Could perhaps a line of credit provide another safety net for you in case an emergency did arise? Again, maybe.

This is where I provide the baton pass and encourage you to have this conversation with your advisor. Take a deep dive into your current cash position and the liabilities on your balance sheet to discuss what changes and adjustments are needed.

I apologize in advance for sounding like a broken record (I remember those, by the way) about this, but the financial landscape has indeed changed, and these changes affect savers and borrowers alike. You must adapt to this environment and adjust your plan accordingly.

With that said, I will close us out here. I hope everyone is staying safe and healthy during these trying times. Please reach out to me at with any comments or questions.

Until next week… This is TOM signing off…