Complex Simplicity

Reuben Garrett Lucius Goldberg.

Does that name ring a bell?

This famous American cartoonist is better known as, Rube Goldberg. Even if you don’t recognize the name, I’m sure you’d recognize his work.

Source: Wikipedia

Goldberg was best known for his cartoons depicting complex, multi-faceted, machines that execute fairly simple tasks. Although Goldberg passed in December of 1970, you can still see the popularity and modern-day mimicking of what are now known as “Rube Goldberg Machines.” You could find yourself getting lost in the library of YouTube videos capturing all sorts of wild creations. Red Bull’s ode-to-Rube is one of my personal favorites (link: https://youtu.be/M0jmSsQ5ptw).

Today I’d like to discuss interest rates, which have been a hot topic in markets. I want us all to understand both the basics of interest rates and how interrelated interest rates are to the markets at large. To me, Rube Goldberg’s art expresses both the complexity and chain reaction nature of interest rates, as well as the simple results/outcomes they produce. A home purchaser might see their mortgage rate as a simple cost function that determines their monthly payment (simple), but they might also now consider the impact that the Federal Reserve has on how that risk (their mortgage) was actually priced (complex).

So, I invite you to join me on this journey through the wild world of interest rates.

… and so, without further ado …

Let’s Start with Mortgages…

When you bought your first house, did you pay cash? For most of us, the answer is “no.” We saved up some portion of the money (down payment) and then we financed the rest of the purchase through the bank. We borrowed the additional money needed, and we call this a mortgage. We were able to enjoy our home today and pay for it over time. This is a profitable endeavor for the bank because we (the borrower) pay interest for the opportunity to enjoy the home now and make payments later. We could apply this same concept to retail shoppers using credit cards or business owners borrowing to finance certain projects.

The bank is a business. Businesses need to be profitable, so one duty of the bank is to make sure loans are paid. Banks also need a backup plan in case loans are not paid. Mortgages are a good lending example because we can see that the bank (1) gets paid interest and (2) has collateral (the home), so if the loan payments are not made the bank can foreclose on the property.

Twice as Much!

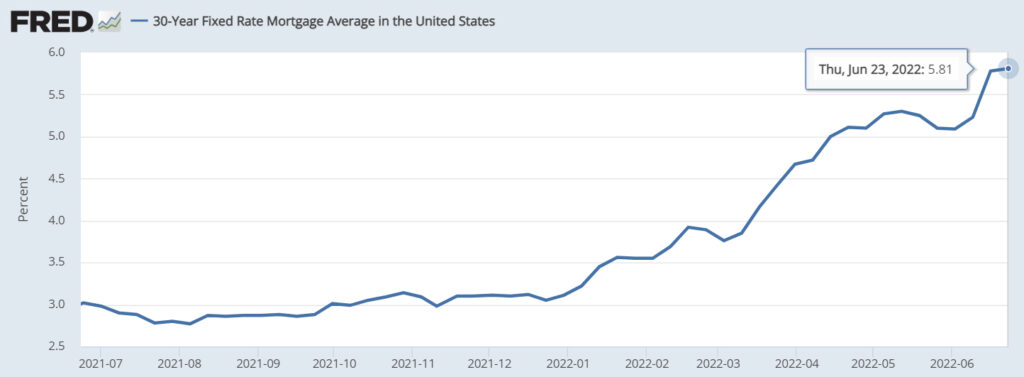

Now, we add a layer of complexity. Mortgage rates today are about twice as high as they were one year ago.

Source: FRED

Why?

To fully unpack this answer, it might look a lot like a Rube Goldberg machine. But let’s just peel back the sequence of events that immediately preceded this increase in mortgage rates. Well, we know that we’ve seen an uptick in inflation. We also know that our central bank – The Federal Reserve – operates under a dual mandate, (1) maximum employment and (2) stable prices. To combat inflation, the Fed uses multiple tools (Monetary Policy), and one of those tools is adjusting the Federal Funds Rate – up or down. (This is the rate that banks borrow from the central bank.) So, simply said, an increase in the Fed Funds Rate will have a ripple effect that results in an uptick in how banks price mortgages. If the bank pays a higher interest rate themselves, then they pass that cost along to the customer (the borrower). Again, a rise in inflation sounded the alarm for the Fed, who then increased rates to combat inflation (cool things down), which ultimately resulted in that additional cost finding its way to the consumer/borrower in the form of higher mortgage rates.

Rates Determined by Risk

From here, we start to get this concept that interest rates also have a relationship with risk. What is risk? The risk that I (the lender) won’t get paid back on time or in full or paid back at all. The more reliable borrowers, those very likely to pay on time and in full, will be offered the most attractive interest rates as lenders compete for the opportunity to lend to these high-quality borrowers. Each layer of safety you add to a borrowing contract (loan) – think collateral or high credit scores or co-signers – will have a positive impact on how that interest rate is priced. High reliability equals lower chances of default, and therefore lower interest rates. This is all fairly intuitive. Credit card debt is higher interest because there is no underlying collateral, while mortgages are typically lower interest because the property itself is offered as collateral.

Understanding Spreads

Now that we’ve agreed that as we go up the risk spectrum we should expect (as lenders) to receive a higher interest rate, and vice versa lower risk resulting in lower interest. We can also conclude that studying the relationship between traditionally higher-risk investments and lower-risk investments can also give us a general idea of what the consensus “mood” around risk is currently. Let’s say that in a different way, we often describe the relationship between the interest rate on a government treasury (referred to as the “risk-free” rate) and high-yield debt (or junk bunds) in terms of a “spread.” The spread is expressing how much more an investor would expect to receive in interest on a junk bond vs. a 10-year treasury. Just knowing the spread at some certain point in time is not very helpful, unless we understand that spread in the context of history. When this spread is high, the general sentiment is that of “risk-off,” while when the opposite occurs (tight spreads), we conclude that investors are very “risk-on” in their investing posture.

Source: FRED

Today these high yield credit spreads sit in the 5% range, while they were in the 3% range one year ago. This rise in the spread is a reflection of a cautious sentiment, as fears of inflation and recession continue to pile up. Often these measurements can be an indicator of growing / maximum optimism or declining / maximum pessimism. Some contrarian investors would look for these pessimistic indicators as opportunistic entry points to invest.

Not a Surprise

So, was the fact that the bond market just delivered one of its absolute worst first-half returns in fifty-some years surprising? No. What was surprising was how quickly and violently interest rates rose. The decline in bond prices is just a mathematical function/reaction to that rise in interest rates. Again, we peel back another layer of this complex machine. Duration, a measurement for expressing the sensitivity of bond prices, specifically shows us how sensitive a bond price is to moves in interest rates. If our advisor tells us that our bond portfolio has a duration of 7, we’d expect that a rise in interest rates of 1% would result in a fall in our bond prices of 7%.

Again, this is why we shouldn’t be surprised by the drop we saw in our bond prices because interest rates have moved somewhere in the range of +1.5% over the year. It really is just math. Higher duration bond portfolios were hit the hardest by this surprise increase in interest rates. Back to our Rube Goldberg Machine visual – inflation rose, the Fed reacted by increasing the Federal Funds Rate, this nudged up other rates along the risk spectrum, which ultimately had a negative impact on the price of the bonds you currently own.

Credit & Duration

Now we understand that there are two different ways we can increase the yield on our investments – credit and duration. As an investor, when we buy a bond we become the lender, and as the lender, we expect a higher interest payment when a loan has a high duration or lower credit quality. This may sound simple or insignificant, but this truth helps you understand where exactly you are deriving your returns from.

If duration, you understand that rising interest rates, as we are experiencing now can have a significant negative impact on the value of your current bond portfolio.

If credit, you understand that a recession could result in a rise in defaults (non-repayment from borrowers) that would have a negative impact on the value of your current bond portfolio.

One of the key tenets of successful investing is fully understanding the risk you are taking, and using clarity and knowledge to avoid being surprised by markets.

Fixed & Floating

We should also know that loans can be created with different types of agreements in regard to interest rates. Let’s go back to our mortgage example. When you apply for a mortgage, you can customize the term (duration) and whether the interest rate is fixed or adjustable (floating). Often you can negotiate lower rates by reducing the term (15 years vs. 30 years) and accepting an adjustable-rate (ARM vs. fixed). Why the lower interest rate? Because with shorter terms the duration risk is lower for the lender and for floating rates the lender is insulating themselves from the risk of rising rates on their bond (mortgage) prices.

This translates across the whole fixed income market – you can buy fixed-rate bonds and you can buy floating-rate bonds. In a year like 2022, that floating-rate debt has behaved a lot differently than its fixed-rate cousin. Here is a look at high-yield loans vs. floating-rate bank loans in 2022:

Source: Google

And Equities…

Guess what else interest rates impact? Equities; the stock market. Now, we will refrain from going too deep on this subject today – another TOM discussion for another day – but we will take a basic look at how this rise in interest rates is impacting the equity market.

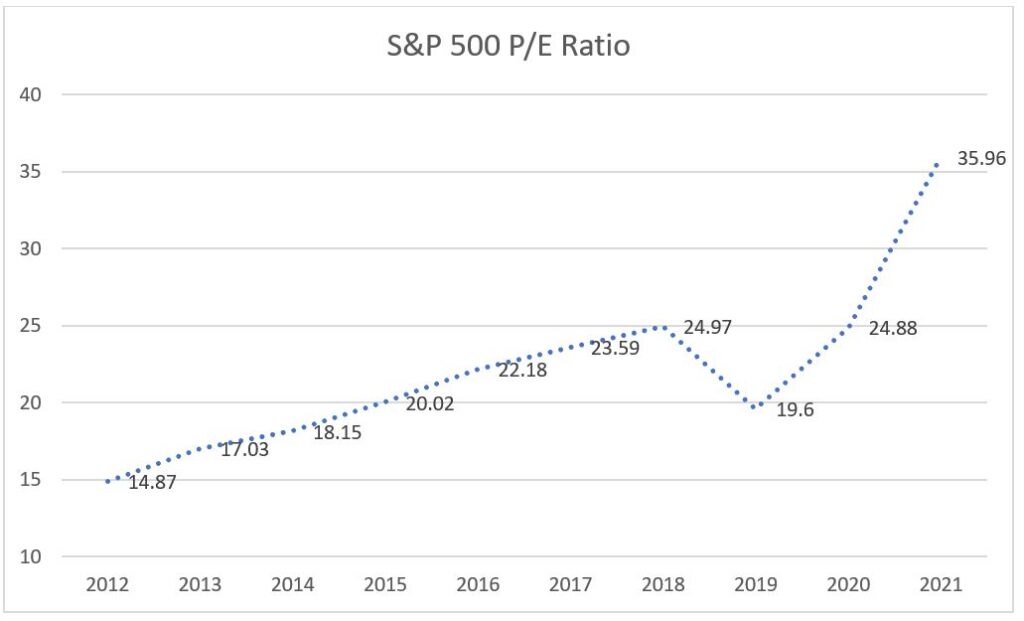

Because interest rates have been at rock bottom levels for such a long time, equity investors have been pretty lenient with how they’ve been valuing stocks. We typically measure stock prices in relation to earnings, often referred to as the P/E ratio, and we’ve seen a consistent uptick in that multiple over the last decade:

Source: Google

Remember, stock prices are the net present value of future cash flows. I will say that again, stock prices are the net present value of future cash flows. Stock investors are attempting to figure out what a stock should be worth today based on the earnings they believe it will create in the future. When investors started to believe that interest rates would be low forever, they started to purchase companies whose success may be promising but far off into the future. Think of unprofitable companies that were burning cash to build up a critical mass of users before they would “monetize” their scale. Basically, investors started to buy more “longer duration” equities.

What happens to longer-duration assets when interest rates rise? Prices decrease. Growth stocks tend to have that higher duration aspect vs. their value stock counterparts. Here is a visual showing the impact so far in 2022:

Source: Google

Again, so much more to unpack here, but I really just want you to gather (1) the reach of impact interest rates have on all investment assets and (2) the importance of understanding what causes something to rise or fall in price – knowledge is power.

Enough is Enough

Thank you for your patience 😊

Today you’ve endured a much longer TOM discussion than normal.

BUT I hope these details and descriptions are helpful. As mentioned, interest rates and inflation are all the hype right now, so I want to help educate you on what’s important. So much of our battle as investors is our ability to separate the noise from the signal.

I want to reiterate this point – getting a general understanding of how this complex machine works (“the market”) and what dominoes impact one another should help to reduce anxiety. Have you ever been in a new home and found a light switch that you couldn’t figure out what it was connected to? You finally identify the relative outlet, and it is a eureka moment. Not understanding cause and effect can be so frustrating, and when it comes to our finances it can generate both frustration and anxiety.

I am sure you have questions and questions are GOOD! Connect with your advisor or email – we’d welcome the opportunity to be a resource.

And with that, we will sign off until next week…