September.

Was.

Ugly.

The S&P 500 was down more than 9% in the month of September alone.

Markets were dropping, and investors were stressing.

When it comes to investing, we have a lot of metrics and measurements to analyze investments. We typically like to express these measurements in ratios – allowing us to compare one particular figure with another. Think return-on-investment or price-to-earnings ratios. Here’s a ratio you won’t find in your financial textbook: return on stress.

As you might imagine, these markets have led to skyrocketing levels of stress for investors. Anxiety is peaking, as uncertainty seems to be at an all-time high. Yet, let me remind you that return-on-stress is always zero. Our anxiousness, our fears, and our stress do not add an ounce to our investment returns. It’s these very emotions that typically get us in trouble – I can’t begin to describe how much financial damage has been caused by poor investor behavior.

But, when stress is high, many of us don’t want to hear any of the familiar financial platitudes:

“Stay the course…”

“This too shall pass…”

“We are one day closer to the bottom…”

So, what is an advisor to say?

Well, I was blessed with the opportunity to deliver the message at my church this last Sunday, and I think there were a few tidbits from this sermon that are applicable to investors and our discussion today. In my intro, I spoke about what fear and faith have in common, as they both deal with an undetermined future (h/t John Gordon). We either choose to fear what the future has in store for us (negative anticipation), or we choose hope/faith, believing that goodness lies ahead (positive anticipation). I went on to explain how faith is often misunderstood, and how our experiences can sometimes derail our faith. I explained that faith is not having clarity in the process, but rather having clarity in the outcome.

Most advisors intend to comfort their clients and exercise empathy. They want to listen, and they want to help. The advisor also wants to follow the financial plan that was crafted in collaboration with their client. A financial plan is designed for both the good times and the bad times. Yet, investors/clients feel like a lack of action in times of strife can feel foolish or lazy. There is a tension here.

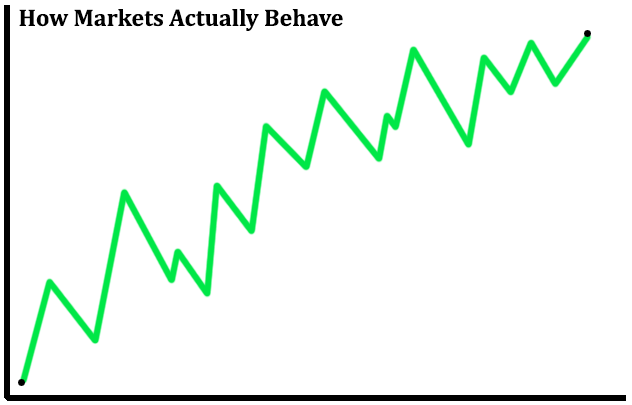

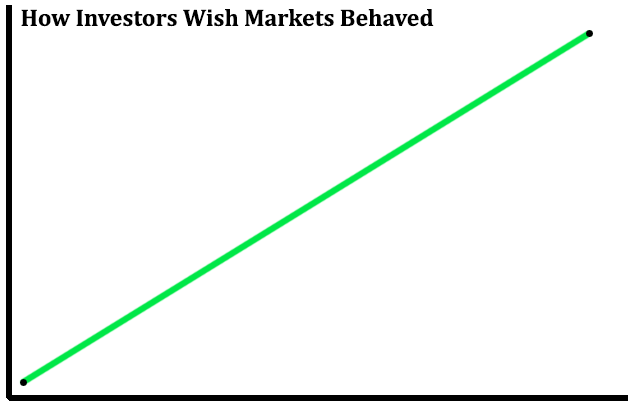

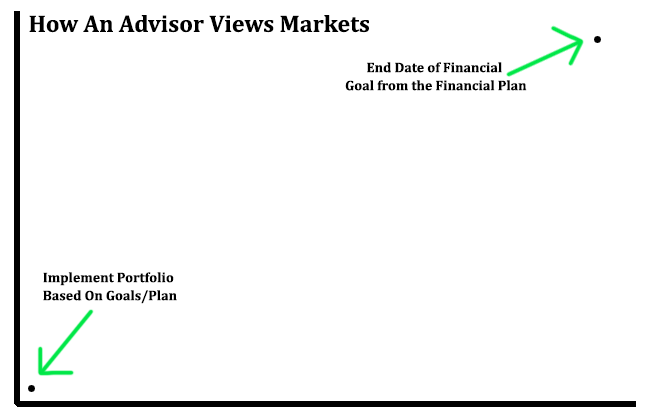

To better understand this tension, let’s explore (1) how markets actually behave, (2) how investors wish markets behaved, and (3) how an advisor sees markets – through the lens of a financial plan:

Advisors operate in faith. Not blind faith, but rather a faith that is steeped in history and probabilities. History shows us the relentless growth of markets and the fruitfulness of compounding that benefits long-term investors. Market history also reveals the difficulty, or rather impossibility, of trying to time markets. This last chart (How An Advisor Views Markets) represents the idea that advisors do not have clarity in the path, but do have clarity in the outcome. Investments and portfolios are chosen and designed based on a defined time horizon. Advisors lean on history and probabilities to identify the most suitable mix of investments to hit the objectives/goals outlined in the plan. What an advisor can’t do is perfectly map out the path from inception to the end date of your goal. Volatility is the entry fee paid for the returns needed to achieve your financial goals – we can project the long-term outcomes with a high level of clarity, but we are in the dark regarding the day-to-day path to get there.

This is where being human comes into play. Where we (advisors) try our darndest to listen, to understand, to comfort, to encourage, but also to not go soft on our convictions, and to not pander to our clients’ unhealthy financial instincts. You want an advisor who will tell you the truth, even when it’s not what you want to hear.

For clients/investors, I would encourage you to adopt a new processing method. When stress is knocking on your door, I want you to bifurcate your concerns into two different categories (1) what I can control and (2) what I can’t control. You can’t control the next decision from the federal reserve, you can’t control the upcoming elections, and you can’t control how markets behave on daily basis. But you can control the design of your financial plan, the clarity around your specific financial goals, your own personal investing behaviors, and you can put probabilities in your favor by electing for long time horizons that are most conducive for compounding.

Like I said from the get-go, the return on stress is always zero, but stress is energy, and you can refocus that energy on healthy habits like retirement planning or mapping out tax strategies, or whatever other financial hygiene objectives that are the top priority for you.

It wouldn’t be fair of me to tell you – don’t stress! So, I won’t. What I will tell you is that you should be mindful of what you do with that stress and what you allow that stress to do to you. September was a rough one, that’s the truth. Let’s go ahead and file away September in the what-I-can’t-control bucket.

As a wise man once said, “Therefore do not be anxious about tomorrow, for tomorrow will be anxious for itself. Sufficient for the day is its own trouble.” (h/t Jesus of Nazareth).