Only Fools Russian

I would like to encourage you to listen to the TOM podcast this week, as Sean Latimer and I will discuss the question we’ve been getting multiple times a day recently:

I am concerned with everything going on in the world right now; don’t you think we should adjust my portfolio accordingly?

I first want to say this is (1) a good question and (2) absolutely a valid question. In life, when we feel threatened it is our natural instinct to react – to feel inclined to do something.

I want to note, as I use this colloquialism/pun, “Only Fools Russian” I am not belittling the human tragedy taking place but merely want to highlight how some investors fail to understand how they should react with their portfolio to the current events we face.

A Timeless Truth

A few years ago I wrote an article on this topic and I titled it, Staring Down a Lion. The whole premise was around this question – what does one do when they are literally staring down a lion? I’ll borrow this excerpt from the article:

Go ahead, google search it, “what to do when you see a lion?” Were you surprised with what you found? I know what my instinct tells me –RUN! Skedaddle! Vamoose! Scram! which is exactly the wrong thing to do. The National Park Service website says, “Do not run from a lion. Running may stimulate a mountain lion’s instinct to chase. Instead, stand and face the animal. Make eye contact.” Ok, I guess this makes logical sense, I mean I can’t expect to outrun the lion.

Should the current news feed and what is going on in our world startle you? Yes, and so should staring at a lion eye to eye. My advice is not to suppress this fear, but rather to let it fuel you to be courageous.

That’s right, I said it. Sometimes you have to be courageous as an investor and sometimes your reaction will be to stand your ground.

A Portfolio Design Reminder

If you are a client of mine, then you are familiar with the simple process of how we designed your portfolio. We started first with understanding your expenses, and we used this figure to make sure you had sufficient “reserves.” What is sufficient? Well, this depends on the person. For some of my clients still working, they may only keep one year in reserves, for others retired they make prefer to keep five years [of expenses] in reserves. This is a personal decision and we come to this conclusion through a dialogue – it’s collaborative.

Once reserves have been established and agreed upon, we then allocate the remainder to a diversified group of assets that will compound/grow over time. In this conversation, I often use my favorite Charlie Munger quote, “The first rule of compounding is to never interrupt it unnecessarily.” To abide by this rule, you need to (1) have sufficient reserves, and (2) you have to be willing to stare down a lion.

Setting Expectations

Now, let’s bring the conversation back to our original question:

I am concerned with everything going on in the world right now; don’t you think we should adjust my portfolio accordingly?

My answer is “No.” Again, the portfolio was designed with sufficient reserves and an expectation that there would be volatility. Volatility is… normal. Volatility is what we as investors endure, and is the reason that we are compensated with attractive long-term returns. This represents the classic finance relationship between risk and reward.

What’s another word for endurance? Often the bible will use the word “longsuffering” synonymously with endurance, depending on the translation you are reading. Perhaps this is a better word for us as investors to meditate on because we can fully understand that sometimes it will be a “long” time that we have to wait and the “suffering” will feel painful.

A History in Longsuffering

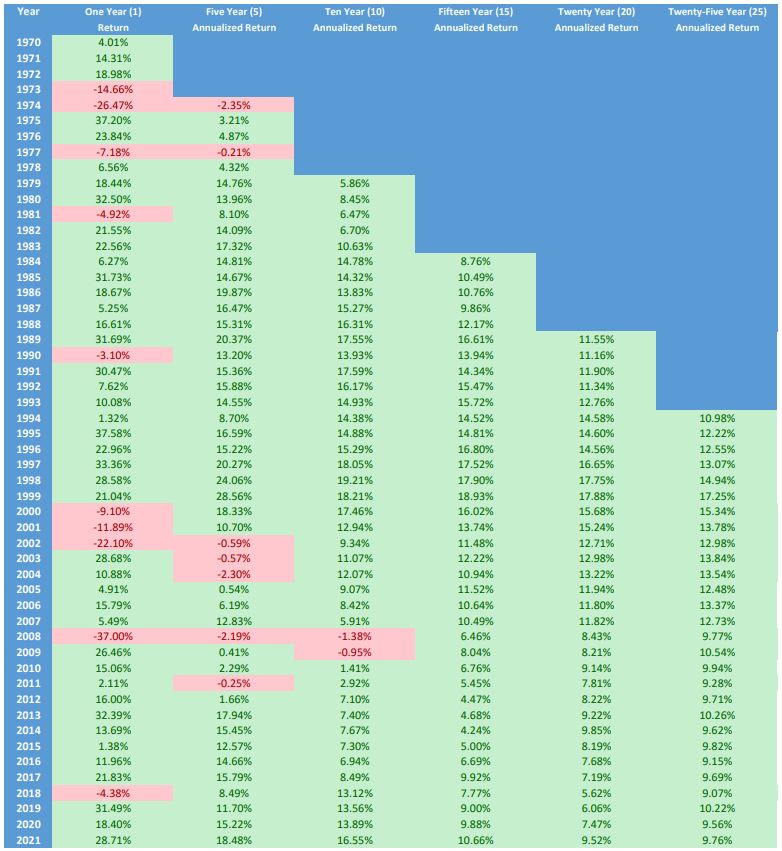

Source: Wikipedia

The table above captures a really simple truth. We see a basic recording of market returns (S&P 500) illustrated on a one-year basis all the way to a 25-year annualized basis. Negative outcomes (red) are present and common in the one-year or five-year terms, but non-existent in the fifteen-, twenty-, and twenty-five-year annualized measures. Here’s that simple truth, there is a benefit to be gleaned for the investor that is willing to exercise longsuffering.

Conclusion

Are you allowed to feel unsettled based on the current environment? Yes, you have my permission.

Should you ask your advisor about the design of your portfolio and affirm that it is appropriate for your situation? Absolutely.

Do you have to take action? No.

Again, don’t run from the lion, unless you believe you can outrun that lion. Be courageous and stand your ground.